Charles Schwab (SCHW) announced their first-quarter results on April 15, 2020. The following report is a summary of those results; no opinion will be offered, just the numbers. If you would like more in-depth detail, please refer to the quarterly report below:

Charles Schwab 10Q Report First Quarter 2020

All results discussed in this report will be in reference to the prior-year quarter of 2019.

Highlights from the First-Quarter 2020

- $73.2 Billion in Core Net New Assets

- 609,000 new brokerage accounts

- 1.5 million daily average trades

- All the above new records for the company

Selected Financial Metrics

- Market Cap – $40.88 billion

- Quarter End Market Price – $33.62

- P/E TTM – 12.4

- P/B – 1.74

- Return on Equity – 12.61%

- Return on Assets – 0.96%

- Net Interest Margin – 2.46%

- Debt to Equity – 0.32

Financial Overview

Charles Schwab reported net revenue of $2,617 million for the first quarter of 2020, down 4% from $2,723 million. Net income for the quarter was down 18 percent for a total of $795 million, from $964 of the previous quarter. Diluted earnings of $0.58 down 16 percent from $0.69 in the previous year’s quarter.

Net Interest Revenue

Net interest revenue was down 15 percent for a total of $1,708, with interest expense down 57% for a total of $(136) for the quarter. Asset and administrative fees were up 10 percent for a total of $827 million, up from $755 million.

Trading revenues were down 13% from a total of $188 million, with commissions leading the way down 31 percent for a total of $113 million from $163 million. Principal transactions were down 9 percent, and order flow revenue was up 72% for the quarter.

Interest-rate revenue was $1,671 for the quarter for a rate of 2.28 percent, down from $1,998, and a rate of 2.92% from the previous quarter. The average interest-earning assets increased to $292,273 from $273,603 in the previous quarter.

Funding resources were up in the quarter as well. Bank deposits, payables to brokerage clients, and long-term debt all rose for the quarter.

Schwab expects some margin compression in the coming quarters as the interest rate environment continues to be lowered by the Fed as the Coronavirus pandemic continues.

Asset Management and Administration Fees

Asset management and administrative fees increased by 10%, or $72 million compared to the previous quarter. The increase was a result of increased balances in purchased money market funds and advice solutions, all of which offset market declines in equities.

Trading revenues

In the first quarter, trading revenues declined 13 percent or $29 million, as a result of pricing actions. All of which more than significantly offset the increase in clients’ daily average trades and the higher-order flow.

Order flow revenue was $55 million, with an increase in order flow revenue because of a higher volume of trades.

Total Expenses Excluding Interest

Total compensation and benefits rose in the first quarter, 6 percent quarter, with a total of $897 million. Professional services increased by 7%, occupancy and equipment also rose 8%, and communication expenses rose 21% in the quarter, respectively.

Depreciation and amortization expenses increased in the quarter 13 percent for a total of $96 million.

Capital expenditures for the quarter were $250 million. Excluding any impact from the merger with TD Ameritrade, Schwab expects capital expenditures to be about 5 to 6 percent of revenues in 2021.

Taxes

Schwab’s taxes on income totaled $252 million for the quarter resulting in a tax rate of 24.1 percent, an increase from the previous year’s quarter.

Segment Information

Schwab divides the business into two segments: Investor Services and Advisor Services

Investors Services

Total net revenues for the segment decreased 2 percent for the quarter as a result of decreases in net interest revenue, and trading revenue. All of which were offset by increases in asset management and administrative fees.

Net interest revenue declined mostly because of Schwab’s pricing actions in 2019, which was offset by higher trading volume. Asset management and administrative fees rose as a result of increased balances in money market funds and advice solutions.

Schwab saw an increase in expenses, excluding interest of 9 percent in the quarter. All of which was primarily due to higher compensation and benefits, depreciation and amortization, and professional services. Compensation and benefits rose in the quarter as a result of annual merit increases and increased staffing.

Professional services rose during the quarter as a result of the pending acquisition of TD Ameritrade and other growth in the business. Depreciation and amortization also rose in the quarter because of increased depreciation and amortization of buildings and equipment related to campus expansion, and higher amortization costs associated with software acquisitions and upgrades.

Advisor Services

Total net revenues for Advisor Services fell 8% in the first quarter of 2020, as a result of decreases in the net interest revenue, trading revenue, and other revenue. All of which was offset by an increase in asset management and administrative fees. The net interest revenue declined because of lower average investment yields, which was offset partially by the growth of interest-bearing assets.

Trading revenues declined as a result of Schwab’s 2019 pricing actions, which was offset by the higher trading volume.

Expenses for Advisor Services increased in the quarter by 5 percent, compared to the first quarter of 2019. All of which was due to higher compensation and benefits as a result of annual merit increases and increased staffing. Expenses for depreciation and amortization increased as a result of higher depreciation of buildings and equipment for the expansion of Schwab’s campus. Amortization increased as a result of internally created software costs, and reinvestment in technology continues.

Capital Management

Schwab’s Tier One Leverage Ratio fell to 6.9 percent for the quarter from the 7.3 percent of the previous quarter, as a result of inflows of client cash in the quarter. The Tier One ratio falls within the stated goal of 6.5 to 7 percent that Schwab wishes to maintain.

Dividends

Schwab declared a 1 cent rise of the dividend or 6% in January 2020, which increases the quarterly dividend to $0.18. As of reporting the quarterly filing, there has been no notification of suspension of the dividend.

Share Repurchases

As of the reporting for the current filing, there have been no share repurchases executed in the first quarter of 2020 and no notices concerning any future repurchases as a result of Covid-19. Schwab has been authorized to repurchase up to $4 billion in common stock in 2019, and the company has $1.8 billion remaining from that agreement.

Valuation

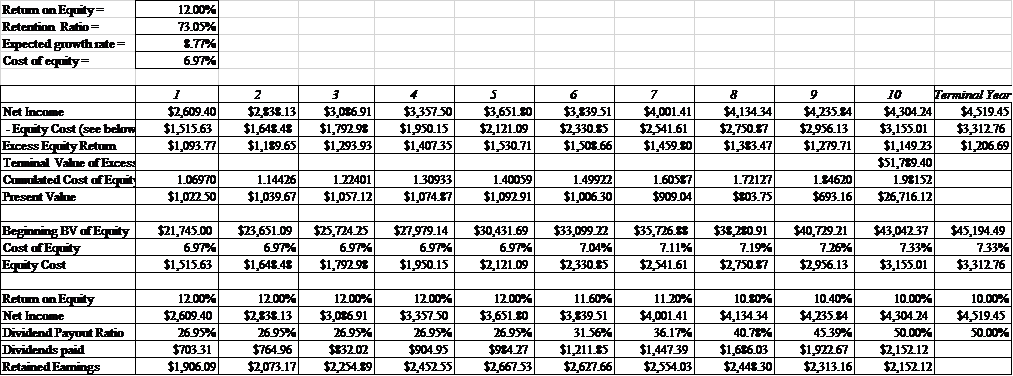

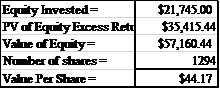

To calculate the intrinsic value of Schwab, I will be using an excess return valuation model. I will include the inputs that I use to give you an idea of where I think the value is coming from for the company. The model is not meant as investment advice, rather an opportunity to see a possible price target relative to the current market price.

Schwab’s estimated value per share equals $44.17 based on the data from above.

Final Thoughts

With that, we wrap up our quarterly summary of Schwab’s financial results for the first quarter of 2020. No opinion was offered, and the valuation is meant as a guide for finding the best price for you based on your research of this or any company. The report and valuation are not meant as investment advice, and please do your due diligence before buying or selling any shares of Charles Schwab.

As always, thank you for taking the time to read this report, and until next time.

Take care and be safe out there,

Dave

Related posts:

- Nike 10Q Summary Fourth-Quarter 2020 Nike (NKE) announced results for the fourth quarter of 2020 on May 31, 2020. The following report is a summary of those results for Nike...

- AT&T (T) 10Q Summary First Quarter 2020 AT&T 10Q Summary First Quarter 2020 AT&T Inc announced its first-quarter earnings on April 20, 2020. What follows is a summary you can read to...

- Verizon (VZ) 10Q Summary First Quarter 2020 Verizon released its first-quarter earnings on April 24, 2020. In this post, we will discuss a summary of those results. Financial Metrics: Market Cap –...

- Kontoor Brands (KTB) 10Q Summary for First Quarter 2020 Kontoor Brands (KTB) announced its first-quarter results on May 7, 2020. The following report will be a summary of those results for the first quarter....