When it comes to money, sometimes young adults don’t realize just how lucky they have it. By becoming a college investor rather than a “young professional” investor, a huge (life-changing) amount of money can be made.

Just because of the great compounding effects of a few years added by starting early.

Contributor Andy Shuler wants to show you just how powerful this early compounding can be, and how just a little hard work can make for truly life-changing results. The best part: anybody who is college-age can do it.

If you have ready any of my recent posts, you know that I have been on a bit of a Compound Interest kick lately, and it’s not going to stop with this post. In essence, the components of compound interest really consist of three things:

- Amount of money put into the account

- Interest Rate/Return

- Time

That’s it, really – and by no means are those listed in order of importance. In fact, the case can be made that they’re actually in the opposite order, but that’s neither here nor there.

The earlier you start investing, the greater amount of time that you have to take advantage of compound interest and maximize your financial gains.

That sentence is likely not a shocker to anyone reading, but exactly how much of an advantage is it to start early? Well, it can truly make or break your retirement – but we will get to that later.

The beauty of starting early is that it doesn’t take anything extra – it’s all effort.

What I mean is that it doesn’t take a higher income, or it doesn’t take you having to make sure that you’re picking the right stocks, or anything like that – it’s just the effort and self-restraint to not spend all of your money and instead invest it in the market.

The Importance of Hard Work

“But Andy, I’m a poor college kid. I can’t even afford a case of beer.”

First off – I doubt this is actually true – it’s much more likely that your priorities are just focused on other things…like beer. And I’m not going to be one to shame having fun in college, because I had more than my fair share, but there’s a way that you can do both.

Second – if you truly are having an issue with any extra money at the end of the month, then work more. A side hustle has never been easier than it is now with Lyft and Uber being so accessible.

I know that my advice of “work more” might sound harsh, but I was the kid that always worked 35+ hours when in college as a full-time student and in summers I worked three jobs – at a call center, a roller-skating rink and third shift at a waffle house, for a combined 70+ hours a week – to make sure that I could have fun and still be able to be financially prepared for life.

I worked three of the worst jobs possible (like, literally, the WORST jobs), at the same time, to set myself up for success – and you can too. An extra $150/month can go a really long way. How long? Well, let’s take a look.

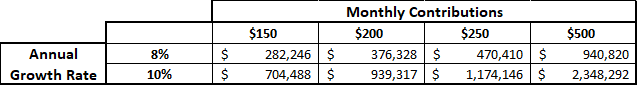

As you can see, $150/month at an 8% Compound Annual Growth Rate (CAGR Avg. since 1950 is 11%) would result in $282,246 by a retirement age of 65.

If you didn’t have to reread that sentence then maybe it didn’t set in, so let me say it again – $150/month, for only four years, for a grand total of $7200 of savings, can very easily turn into over $282,000 when you retire at age 65. Holy crap.

I mean, think about it – you’re talking that investing $200/month ($9600 total in four years) can result in over $376,000 at a very conservative return of 8%.

Even at the $500/month tier – that’s still only a total of $24,000 saving! I know that’s a lot for a college student turned college investor, but it definitely could be done if that was your goal.

Less Conservative College Investor Estimates

The numbers become even more staggering if either your monthly contributions can increase or if your Annual Growth Rate increases.

The numbers start to get really into the “life changing” category, in my opinion, once you get around $500,000 of benefit, which is either at the $250/month range for an 8% return or right off the bat at a $150/month and 10% range.

Yes, $500,000 in itself is absolutely not a life-changing amount of retirement, but I view this in a totally different way.

I am viewing this “college period” of investing to be 100% bonus on top of all other savings.

So, imagine this situation – you need $3,000,000 to retire and from your first day of work until your last, you accrue $3,000,000 in your retirement accounts – but then you have this additional $500,000 and change sitting there from these college investor years.

If you live another 35 years from age 65 to age 100, then that’s over $14,000 of extra money that you can have every year, assuming ZERO additional compounding. That would be if you literally took all of that cash out at age 65 and just sat on it.

And yes, $14,000/year in itself isn’t life-changing by any means, but $14,000 above and beyond all expenses and needs, is.

That’s a freaking amazing vacation every year for yourself and your spouse to Europe, or potentially even tuition for a grandchild.

Maybe you join the country club that you’ve been wanting to join, or you can now travel 4-5 times to Texas to see your family every year because they live there, and you live in Maine.

To me, those types of changes to your lifestyle certainly classify as life-changing.

I’ll be honest with you right now – I have two goals when writing this post:

- To get your butt off the couch and earn some more money

- To motivate you to save for your children

I already focused a bit on #1, so now I’m going to talk about #2.

Maybe your goal when you had children was to pay for their college but that’s not looking as realistic as you thought it was going to look. Maybe you can only pay for half, or maybe even none at all. But, maybe you can help pay for their retirement which can then in turn help them pay for their grandchildren’s college, so on and so forth.

This is your chance to setup your family for success, so they can continue to pay it forward within the family.

I very strongly encourage you to take a look at this and try to find a way to maybe squeak out that extra $150 of savings each month and invest it, either into a stock or into the S&P 500 ETF (SPY or IVV) so that you can start to reap the benefits of compound interest.

Start NOW for a HUGE Compounding Advantage

All in all, no matter your age, you can make a big difference by starting right now.

And if you’re a parent, why not talk to your children and show them these potential benefits of starting early?

If you can show them these values, maybe they will be motivated to take advantage of compound interest as a college-aged student, or potentially even earlier!

Related posts:

- 10 Reasons Why Compounding Interest is the 8th Wonder of the World The words compounding interest are two of the most powerful in the investing world. Today, I’m going to show you 10 reasons why. Albert Einstein...

- How the HSA and its Wonderful Triple Tax Advantage Builds Wealth If you don’t know what an HSA is then you have come to the right place. HSA stands for a Health Savings Account, but in...

- 5 Insane Compound Interest Examples to Keep You Motivated Compound Interest is one of the most amazing things in this world and is the reason that I got behind investing in the first place. ...

- How to Open an Investment Account for a Child I talk a lot about the power of compound interest and how time in the market is better than timing the market, and I feel...