Updated 12/12/2023

Did you know that Warren Buffett made $380,000 in 2020, of which $100,000 was his salary, and the balance was security protection for him and his family? He received zero in bonuses, stock options, and stock.

That’s right, one of the richest people in the world receives $100k a year, which is mind-boggling.

How do I know this?

We can learn many details about the company by reading the Def14A proxy statement. They include executives’ pay for a public company and their board of directors.

Part of the analysis of a company is learning as much about the management as possible. And one of the most underutilized methods is to read the Def14A statement, which each company has to distribute.

In today’s post, we will learn:

- What is a Def14A Statement?

- How to Find the DEF14A Statement

- How to Read the DEF14A Statement

- Example of a Def14A Statement

- Why Are DEF14A statements important for Investors?

Okay, let’s dive in and learn more about the Def14A statement.

What is a Def14A Statement?

Financials such as the 10-k or 10-q make sense when investors begin analyzing a company. However, the Def14A or proxy statement is just as revealing because it explores corporate officers’ business relationships, backgrounds, and compensation.

Is the Def14A the same as a proxy statement? The answer is yes!

The Def14A statement is a document that public companies must provide to their shareholders to help them understand how they can vote at shareholder meetings. Plus, it helps them make informed decisions on different proxy votes, such as electing board members or agreeing to a merger or acquisition.

Issues covered in a Def14A statement include:

- Proposals for a new board of director member

- Information regarding director’s salaries and bonuses

- Information on the bonus and option plans for said directors

- Proposed mergers and acquisitions

- Dividend payouts

- Goals and directions of the company

As shareholders, we are entitled to vote by proxy on any important issues that impact the financials, even if we can’t be there in person. That is one of the benefits of being a shareholder; we have a say in the company’s direction.

**Voting by proxy means that our vote counts as if we were there in person**

The Def14A statement provides details on the board members along with company executives. For example, you see what other boards a member sits on or whether they work for another company. We can also see how long the CEO has worked for the company and whether they “climbed” the ladder or are a hired gun.

The statement can also give us insights into how aligned management is with the shareholders. And whether their compensation benefits work toward the betterment of the company, shareholders, or executives.

We can also find potential conflicts of interest, such as related-party transactions that are not beneficial to the company.

How to Find the Def14A Statement

Investors can find the Def14A statement or proxy on a company’s investor relations website or via the SEC’s Edgar search tool. I also like to use Bamsec.com to read documents as well.

We will use Microsoft (MSFT) as our guinea pig.

Website

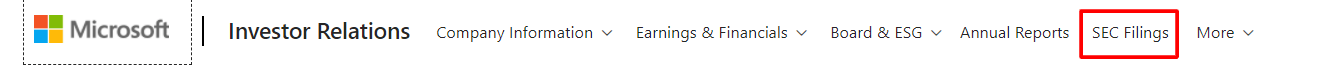

First, navigate to investor relations at Microsoft.com and look for the SEC filings to find the Def14A statement.

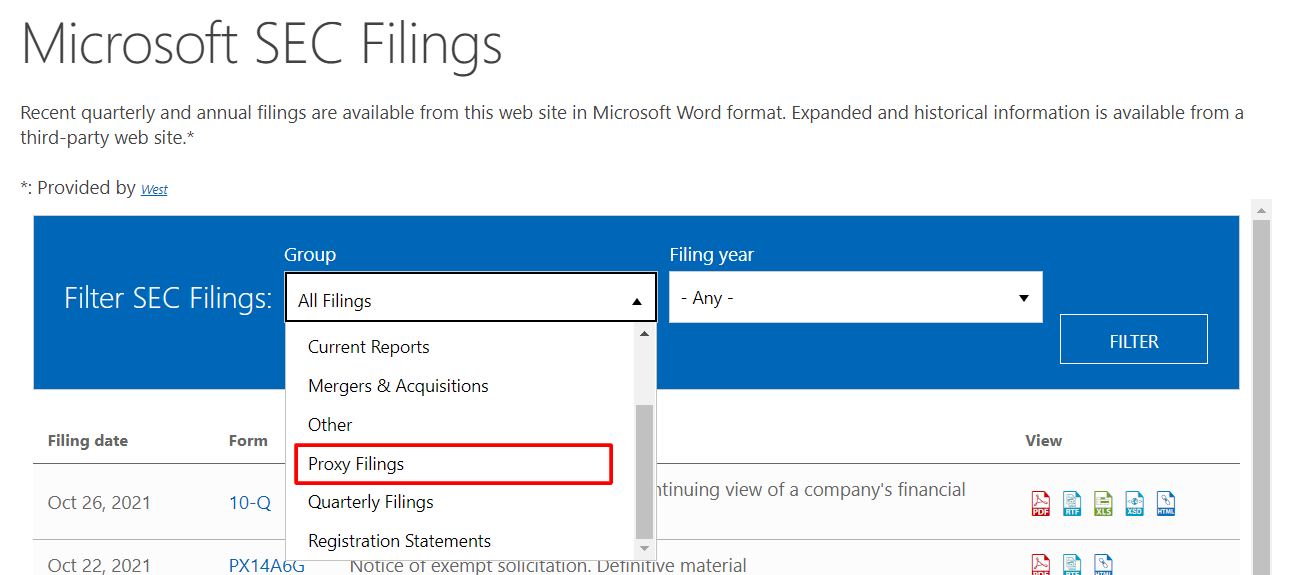

After clicking the above link, we can navigate the SEC filings by using the drop-down link below and choosing the current or past year to access the document.

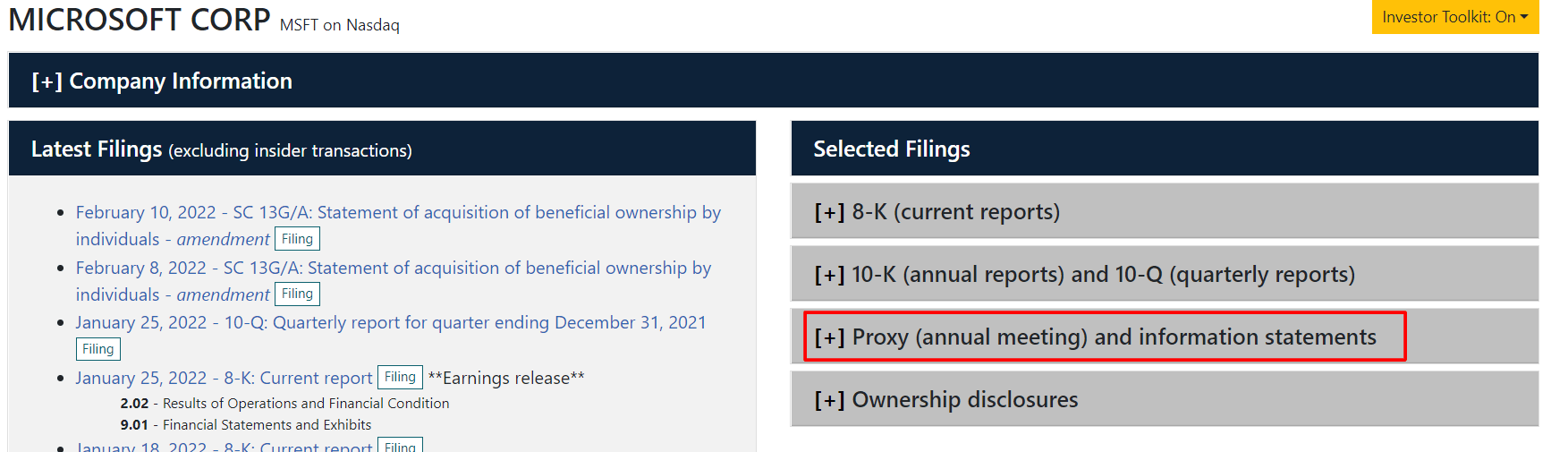

Once we click on the above link, we search for the Def14A dated October 14, 2021, which is the statement that contains the proxy information.

Sec Edgar

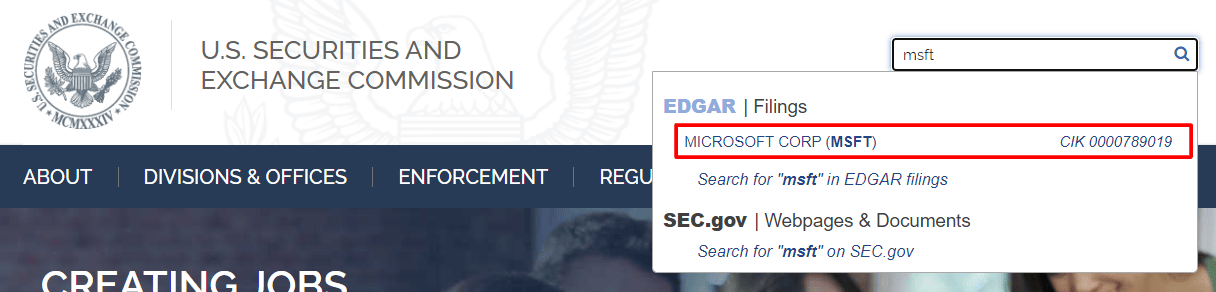

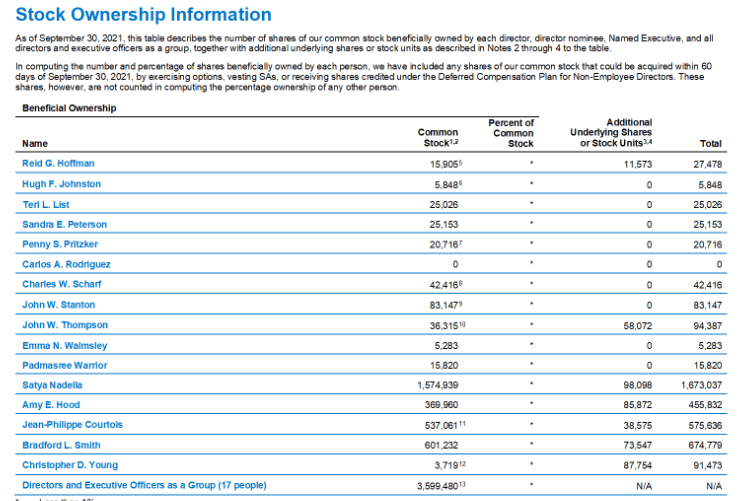

We navigate to Microsoft’s page using the government website and fill out the link.

On the next page, we will search for the proxy and information statements, leading us to the Def14A document.

Clicking on that link takes us to the next page to help us find the Def14A document.

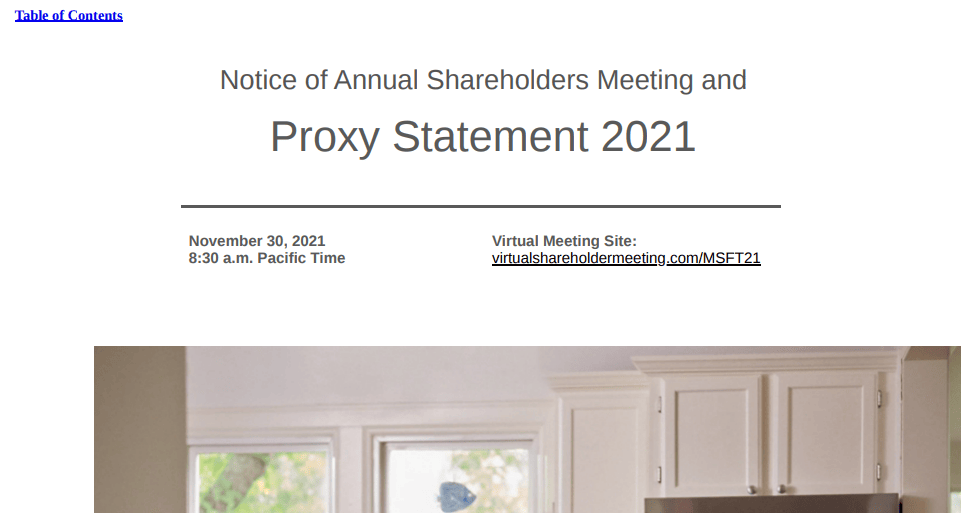

The above link takes us to the Def14A statement or proxy we found on Microsoft’s investor relations page.

Other options

Along with using the above sites, there are other options to find the Def14A statement, such as:

- Bamsec.com

- Tikr

- Koyfin

- Seeking Alpha

- Gurufocus

- Quickfs.net

- Many more

All of the above sites offer a way to navigate the company’s financial documents through their investor relations or the government website.

The bottom line is that there are tons of resources available for you to access the Def14A statement. Find a site that works best for you and use that to access these valuable company documents.

How to Read the Def14A Statement

Now that we have a company chosen to study let’s dive in and learn what the Def14A statement can tell us.

We can learn a plethora of details through this exercise, but the main focus for me is a few details. Here is a brief outline:

- Notice of Annual Meeting of Shareholders

- Ownership

- Election of Directors

- Board Structure, Organization, and Compensation

- Executive Compensation

The most important sections are compensation and the board of directors.

**Compensation drives company priorities and behaviors; incentives matter.**

If you read nothing else in the Def14A statement, read the sections concerning the pay for executives and board members. How and why they get paid and the composition of that pay, salary, or stock goes a long way toward telling us whether the company aligns with us.

Why is compensation so important?

Compensation is the most important concept to understand because it can separate the good from the bad or the dark from the light. Compensation is the battleground between the good and the bad.

A well-designed, functioning compensation with a focus on metrics that:

- Drive long-term alignment between shareholders and management

- Flows down the organization, helping drive behaviors

- It helps create long-term value for shareholders

Analyzing a company’s compensation structure, we can examine how it prioritizes capital allocation and long-term plans.

We also see what the Board prioritizes and how the Board rewards the team for accomplishing those goals.

Compensation is supposed to align with shareholder interests and drive company priorities, but self-interest can seep into any company. These self-interests become evident as you study more and more Def14A statements.

Here are six signs that a company has shareholders interests in mind when making decisions:

- Clearly articulating any capital allocation decisions, whether they are dividends, share buybacks, or reinvesting in the business

- Requiring management and board members to own stock in the business or have skin in the game

- The board of directors is putting shareholders ahead of executives

- The company requires equity and voting rights to be aligned

- Insisting on limited third-party transactions

- Paying reasonable stock options for executive compensation

Let’s explore these a little bit, shall we?

Capital Allocation

According to Warren Buffett, job number one allocates capital for any CEO.

When the company has a clear and defined capital allocation policy, it allows shareholders to hold themselves accountable and judge their performance.

For example, Microsoft awards management stock options based on the company’s total shareholder returns for shareholders. Part of that shareholder returns includes share buybacks and dividends.

2021, Microsoft returned $38 billion to shareholders in buybacks and dividends. Microsoft has earned 765.7% shareholder returns over the last seven years, compared to 183.7% for the S&P 500.

That kind of alignment with shareholders helps drive the capital allocation decisions for management. Over 70% of their stock options are included in shareholder returns; for a company like Microsoft, that is some serious coin.

Skin in the Game

Microsoft’s board of directors must hold three times their annual salary in stock to remain on the board. That equals $975 thousand at the minimum.

By forcing the board to maintain skin in the game, it helps ensure that they continue to think like owners.

The theory makes executives focus on the long-term, growing long-term profitability, and maintaining a strong balance sheet. The company will continue to gush cash for many, many years.

The same idea applies to executives when you find a company that makes the majority of their pay from stock and has a vested interest in its continued success. You will find strong, motivated management aligned with continuing financial success.

Board of Directors Putting Shareholders Ahead of Management

The board of directors’ primary job is to protect the interests of shareholders, not executive management.

How can we tell if this is happening?

- Independent directors hold meetings without management present to evaluate the performance.

- Board compensation is not unreasonable. If the board is constantly voting to give itself raises, that is a red flag.

- Perks are kept to a minimum. No private planes to fly your dog to Hawaii, or spending $100 thousand on solar panels for your vacation home

Having an independent board from the company is a good start to having a board aligned with shareholders. Each Def14A statement will have a breakdown of the board’s composition and the committees they advise.

It is important to have committees that avoid any possible influence from the company, especially the compensation committee. Be wary if you find a compensation committee with the CEO as the chair because that much power could be dangerous.

Example of the Def14A Statement

Okay, now that we understand the different sections and some items of importance to look for, let’s dive in and work through an actual Def14A to find some nuggets.

I want to use Microsoft’s latest Def14A statement or proxy for our guinea pig, dated November 30, 2021.

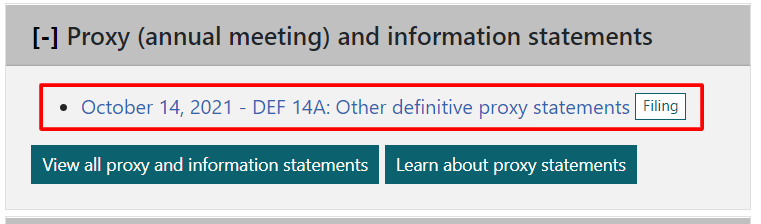

The first question I like to answer is: Who are the larger owners of Microsoft? Each proxy must disclose who has at least 5% ownership of a particular company. The disclosure can reveal who has “skin in the game.”

This tells us that Vanguard and BlackRock are the two largest investors. Interestingly, no insiders are among the larger shareholders, including the CEO and Bill Gates.

It is normal for most companies to see that the largest shareholders are financial institutions.

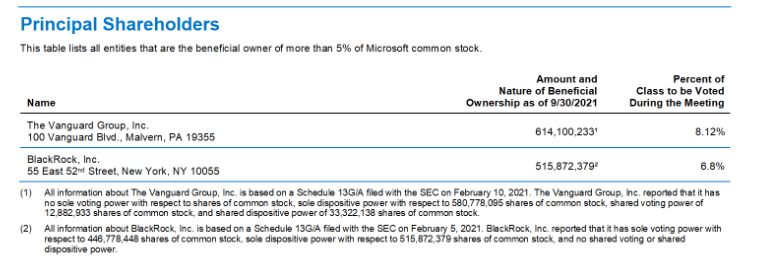

Next, we can look for the managers and directors to see what kind of “skin in the game” they possess, which we find under the section: stock ownership information.

Not much of a surprise here, but below that section, it outlines which directors and managers have “beneficial ownership” of shares, including exercisable options within 60 days of the filing date.

For example, Reid Hoffman, former CEO of LinkedIn and board member, owns 27,478 shares, of which 11,573 are exercisable after 60 days. Now, that doesn’t mean he will exercise them all, but if he does, he stands to earn, assuming a $300 share price, $3.4 million.

That is a big portion of “skin in the game,” but using stock options is common, which is not out of the ordinary for most companies. That is why board ownership is so lucrative and needs notation when studying companies. Remember that the more they pay directors, the less they have for shareholders or the company.

As for any compensation, board, or managers, we must compare to other companies to determine whether it is egregious or justified. We also need to exercise some judgment, but more experience will make it easier.

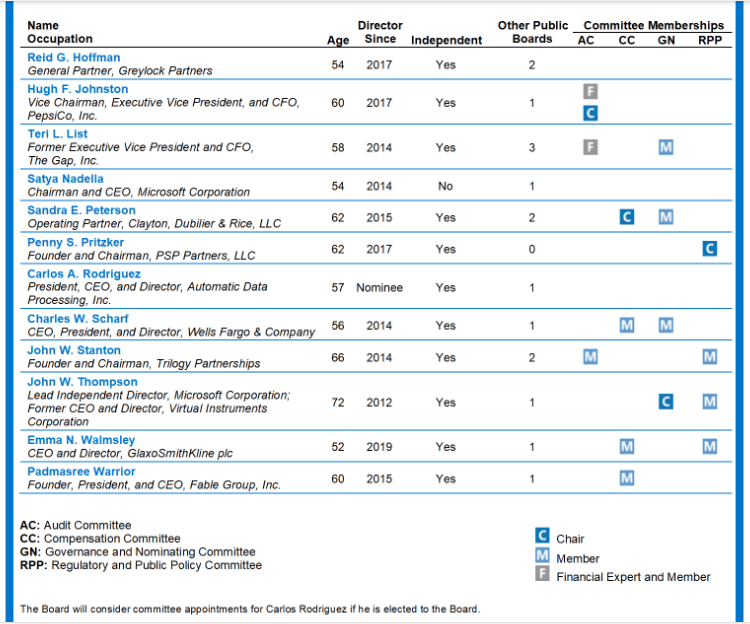

The next questions regard the board of directors, such as:

- How long do they serve?

- Who makes up the board?

- What committees do they serve?

- Are they independent?

- What is their base pay?

The picture below tells some stories; we can see who makes up Microsoft’s board, whether they are independent, and what committees they serve.

We can see that the only non-independent board member is Satya Nadella, the company’s CEO, and also, importantly, he is not a member of the compensation committee.

The compensation committee is the most important, and they control the incentives and pay for the company’s executives. It is important to understand who sits on what boards and the chair for each board.

If you see that the CEO or any other executive sits on that particular board, be wary of any increases in pay or benefits.

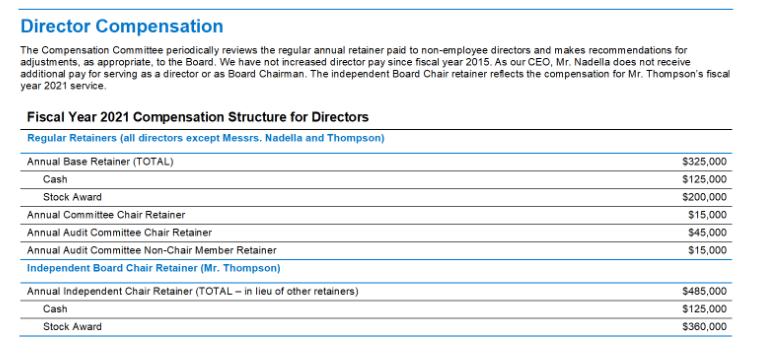

We find a chart outlining the pay for the board, which we see below.

At the beginning of the document, the company states that the board’s tenure averages ten years or less for the independent members.

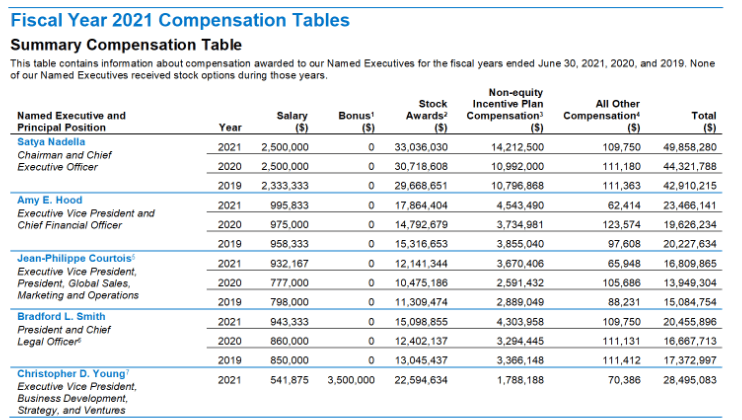

Now that we have answered all the questions regarding board members, let’s look at the pay for the executives.

A few questions that spring to mind are how much is their base salary, and what percentage of their pay is salary versus stock awards?

The table below will outline the compensation for the executives of the company. I will warn you: the numbers are big boy numbers; they are large, but Microsoft is a 1+ trillion market cap company, and it would be worthwhile to compare it to Apple, Google, and Facebook to see if they are egregious.

The Def14A statement will only include the upper-level management in the document; it doesn’t include any lower-level management.

The company sets the base salary compared to others in their sector to attract top-quality talent. And they base their incentives on metrics and other performance goals.

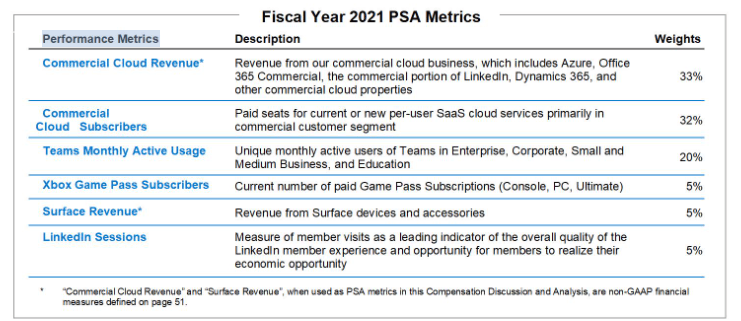

The company has structured the executives’ pay to be aligned with shareholders by tying it to total shareholder returns (TSR). They also tie it to cloud revenue growth, subscriptions, and other metrics.

Below is a chart the company uses, but it doesn’t define them specifically, which is frustrating.

Again, looking at the base salary and stock awards and comparing them to their peers will give you insight into whether they are egregious or align with shareholders.

For example, Tim Cook, CEO of Apple, is due for a base salary of $3 million, $12 million in incentives, and $82 million in stock awards. And Google CEO Sundar Pichai earned $2.02 million in salary and $5.4 million in stock awards. Remember that he had earned $276 million in stock awards the previous year.

It is good to look at the peer group and pay to understand the company operating in the relative ballpark.

Why Are the Def14A Statements Important for Investors?

There are two main reasons for the importance. One is the ability and right to vote on matters concerning the company. As shareholders, we have the right to vote, and in today’s world and level of technology, it is quite easy to do.

The second reason is that it gives insight into the board of directors and executives’ qualifications and compensation.

For example, if you discover that the board and executives of an underperforming company receive higher compensation than its performing peers, that could raise a red flag concerning excessive spending.

Investor Takeaway

In this post, we have highlighted the areas of a Def14A statement or proxy statement that investors should investigate and study carefully as part of their due diligence.

Using the Def14A statement as part of your annual review of companies you already own is a good process, along with using it as part of your screening process.

The Def14A statement is unquestioningly an underutilized tool to evaluate the board and executives. It can help you avoid problems in the future with poor management or board of directors.

As of right now, there isn’t any way to fully gauge the individuals who own and run the company we own. The best we can do is use the tools available to us to determine the honesty and integrity of the people running our investments.

And with that, we will wrap up our discussion on the Def14A statement.

As always, thank you for taking the time to read today’s post, and I hope you find some value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Assessing Executive Compensation While Analyzing a Company Evaluating management and how much they receive in pay go hand in hand. As investors, trying to assess a company’s management remains a challenge. We...

- Evaluating Management with a Simple Checklist for Investors “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that...

- How To Research Stocks (for Beginners) “Never invest in a business you don’t understand.” So you decided to invest in stocks but don’t know where to start? Think of researching stocks...

- What is Minority Interest and How Do I Find It? Acquisitions, as a part of growth, continue to play a role in the markets. Many companies use this strategy. Berkshire Hathaway, Google, and Constellation Software...