If you’ve ever listened to Andrew on the Investing for Beginners podcast then you know that he is the “DRIP King!” You might know this, but always wonder why. Well, let me show you the true power of having a high-performing dividend growth portfolio.

Click to jump to a section:

- What is DRIP?

- How to Set Up DRIP

- How to Find Future Dividend Aristocrats

- Dividend History Example

- How to Pick a Dividend Stock

What is DRIP?

In the past, I have written about the importance of a Dividend Reinvestment Plan, or DRIP, which gives you a good introduction to what DRIP is and its importance.

Essentially, DRIP is when you automatically reinvest dividends from a company back into the company. This is in the form of buying partial shares with your dividend. The alternative to DRIP is receiving the dividends as cash.

Since you own more of it, reinvesting dividends increases your stake in the company. Not only is this great if you believe in the company, but you also increase your future dividend payments.

Dividends are paid based on the number of shares held. If you earn more shares bought using dividends, you will receive even more dividends. Think of dividend reinvestment as additional compounding on top of the portfolio’s growth.

In my previous post, I walk through an example of where you invest $2,000. If you DRIP your investments, you could end up with over $235,000 in 50 years…from just $2000! But, if you didn’t DRIP your investments and held onto the cash, your value would be just under $160,000. Still an amazing investment, but a solid $75,000 less than the DRIP option.

How to Set Up DRIP

So, you’ve decided that you want to start to create your own DRIP portfolio – where do you start? Well, my #1 advice is to ensure you stay within your circle of confidence. Only invest in companies you know, or are interested in getting to know, especially when you’re starting off.

A Dividend Aristocrat is a stock that has been increasing their dividend every year for at least 25 years. This is a great sign for the underlying company, and assures you you will be getting a raise on your dividends for years to come.

Personally, I think Dividend Aristocrats are overrated. I like to find the future Dividend Aristocrats! Instead of finding that company that has already made its way to that prestigious Dividend Aristocrat title, start smaller.

Look for a company with many consecutive years of increasing dividend payments. Maybe they’re not quite in the S&P 500, or maybe they’re just not at the 25-year mark. Maybe they were a company that split from their parent company, but they’ve been increasing their dividend since before the split.

These are the types of things that I look for. I’m trying to find a company that is showing the promise of a Dividend Aristocrat but hasn’t had the time to reach that level.

How to Find Future Dividend Aristocrats

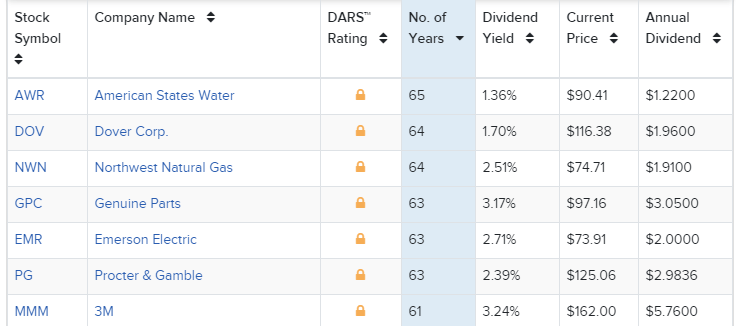

A great place to start is Dividend.Com. They have a good list of companies with their current share price, annual dividend, dividend yield, and the number of years that they have been paying that dividend. Unfortunately, if you want much more than that, you will have to pay for their subscription. But this is a great starting point for you to start taking a look at some of these potential fits for your portfolio.

The alternative is to dive into the history of the company yourself. You would have to track the dividend and ensure that it increases annually. This method takes a lot of time.

I recommend scrolling down to companies that have been distributing a dividend for less than 20 years. Then see if any catch your eye or you’re familiar with the company. The first name I saw that really stuck out to me was Costco. Costco has been distributing a dividend for 16 years, and its dividend yield is only .84%.

Personally, I prefer finding a company with a low dividend yield in this case. If I can get in on the ground floor, the company will only continue to increase its dividend year to year and eventually hit that Dividend Aristocrat status.

Dividend History Example: Costco

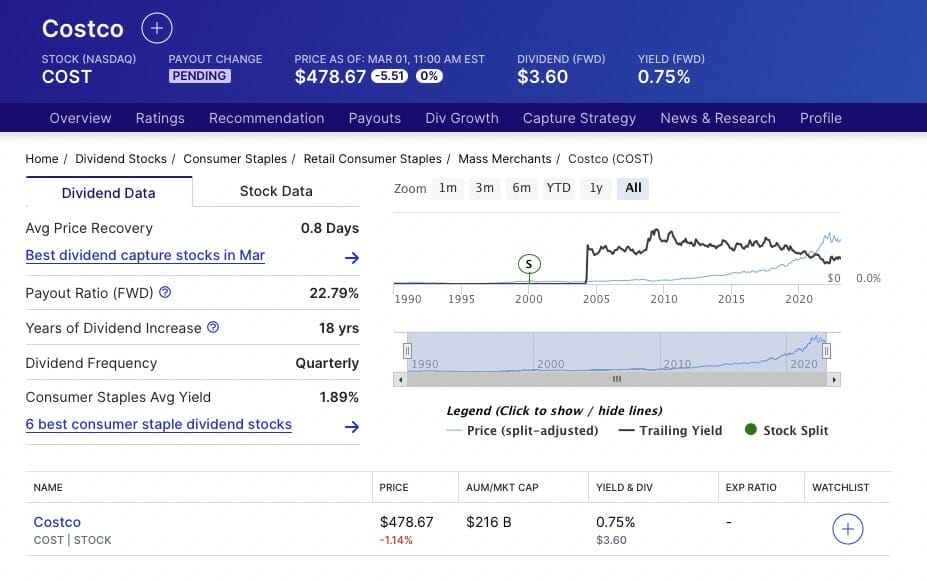

When I clicked on Costco, this screen came up:

It has some high-level dividend data, but if we really want to understand the company and its dividend better, we need to get to the meat and potatoes! If you scroll down more, you can see their Dividend History:

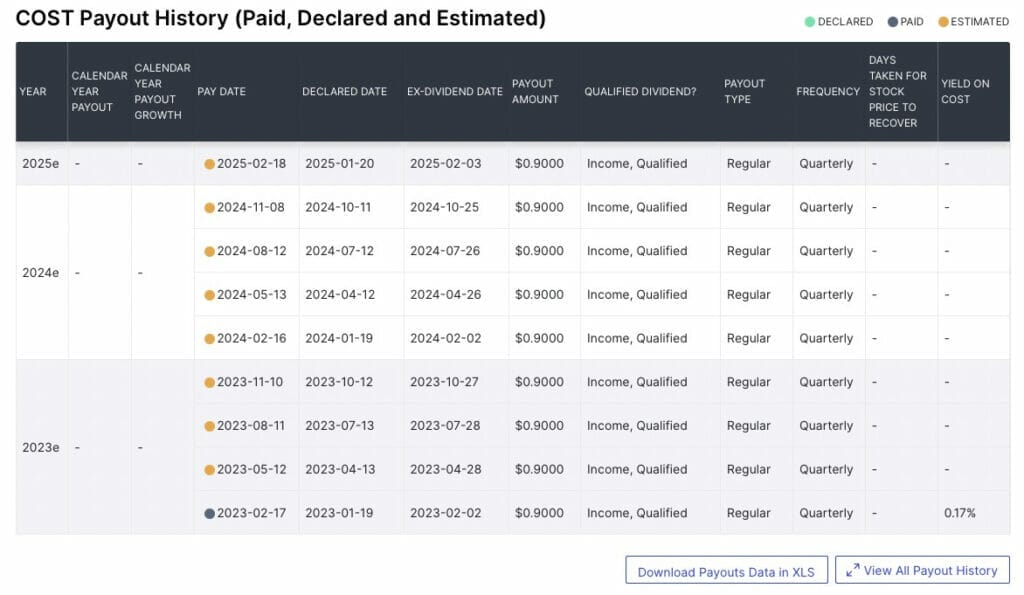

If you click on the ‘View All Payout History’ button, it goes all the way back to 2004 when they implemented their dividend. If you want to download the spreadsheet, then you’re going to have to become a paid subscriber. But guess what – just highlight the data, copy it and then paste it into an excel document.

It takes an extra 15 seconds but is completely free!

Once you do that, the process is very simple! Since each quarterly payment breaks down the dividend, you need to add together the first four dividend payments for year 1, then the next four for year 2, so on and so forth.

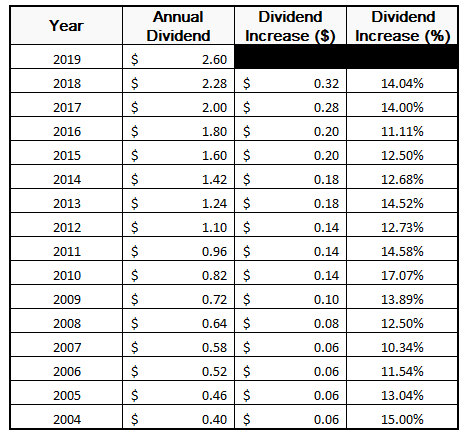

I have done that for you and then also included the increase over the year before as well as the percentage increase, shown below:

As you can see, Costco has met one of their most important requirements to be a dividend aristocrat. They have continued to increase their annual dividend each year, and they’re maintaining a 12 – 17% increase annually. That is a substantial increase annually.

I mean, if your entire portfolio grew at 12 – 17%, you would be pretty happy, wouldn’t you?

Now, you should go out and buy 100 shares of Costco right now, right?!

WRONG!

How to Pick a Dividend Stock

As with any investment, you need to look at the company as a whole and not just its dividend distribution. Take a look at their financials as a whole to try to get a good feel for whether the company is undervalued.

You should even consider whether a stock is a dividend or growth stock. Each have its pros and cons, and you should weigh your options carefully.

The best way that I can describe a dividend is to envision it as a side dish. While a side dish is essential for almost every meal, I would never pick one just because of the side dish. And if I get a meal without a side dish, the entrée better be pretty freaking good!

Understand better? Hopefully. If not, I bet you’re hungry at least.

The best way to efficiently run the numbers is to put the financials into the Value Trap Indicator that Andrew has created. Using the VTI not only ensures that you’re getting accurate financial ratios but also that you’re focusing on the correct ratios! I can’t tell you how much I struggled to know what ratios to focus on when I started investing. You have no gauge for how important each one is.

Lucky for us, the VTI does this for us.

At the end of the day, a dividend growth portfolio is a must-have. Few things are more exciting than getting a dividend payment and immediately seeing it put right back into that same company, knowing that that dividend will help you earn even more dividends the next time.

Don’t believe me? Try it. I bet you’ll get hooked on dividends.

Related posts:

- Dividend Aristocrats are OVERRATED! Check Out This Dividend Kings List! Chances are that you have heard of Dividend Aristocrats before and chances are that you have been told that they are the bees’ knees. Well,...

- Should I Own Exxon Solely for the XOM Dividend? If you’re a dividend lover like we are at Investing for Beginners, then chances are you’ve at least taken a peek at the XOM dividend...

- Dividend Ratios Pt. 2: How to Identify Sustainable Dividend Growth As we discussed in part 1 of this dividend mini-series, there is much focus on the past dividend growth of a stock– yet this doesn’t...

- Dividend Ratios Pt. 3: Measuring a Stock’s True Dividend Payout Ratio Measuring how much a company is growing in size, and how much it has grown its dividend, is only one part to finding great dividend...