Updated 1/15/2024

Have you been told that you can’t save money quickly with a low income? Are you tired of living paycheck to paycheck? Are you stressed that you will never find a job where you feel you’ll make enough money?

I have some good news for you if you answered yes to any (or all) of these questions. Just because you work a blue-collar job making an average hourly wage doesn’t mean you can’t save money. I have several ideas to show you how to save money fast on a low income.

Like anything in life, it certainly won’t be easy, but if you truly want to adjust your lifestyle and buckle down the hatches, there are ways to build your worth and minimize debt instantly.

I have four different topics to touch on, each one helping you better understand how to save money quickly, even with a low income.

Minimize Debt

Truthfully, if you have a lower income, you should already be mindful of your debt. There is a good chance the necessities of life are costing you enough, and extra monthly payments are just something you can’t afford, especially if you want to build up your savings.

There are all kinds of debt, some are good, a lot is bad, but debt is something that everyone is trying to reduce or pay off.

Bad Personal Debt

Bad personal debt is a term for a loan/debt that is costing you extra money because you can’t make the payment.

A few examples of this would be taking a cash advance that is costing you a percentage of your check, or a credit card bill where you are only making the minimum payment and adding anywhere from 15 to 25 percent interest on the remaining balance.

I would not consider an auto loan necessarily bad debt, but you must be careful not to get upside down on the loan (owing more than the vehicle is worth), or it can quickly become a bad personal debt.

No matter what type of income you have, getting rid of bad debt is the first thing you need to reduce to help save more money. At no point will it be possible to save any money if you are stuck paying off high-interest loans.

Good Personal Debt

I hate to call any amount of debt a good thing, but there are circumstances where some debt is necessary. The two easy ones that come to mind are your home and car.

Now, if you really want to save money on a low income, you should strongly consider finding a way to not have a car payment. I understand that having reliable transportation for work and/or family is extremely important, but cars depreciate faster than almost any asset you’ll ever buy. Even a low interest rate of 3-4 percent on an auto loan is a lot of wasted money.

A mortgage, on the other hand, is by far the best debt you can have, especially if there is some equity to go along with it.

Example – You have a mortgage on a $200,000 house, but you only owe $150,000. That means you have a debt of $150,000, but you also have equity of $50,000.

The rule holds for auto and home loans; you never want to get upside down on a mortgage. However, It is much more difficult to get upside down on a home mortgage than on an auto loan.

Trust me, having a mortgage compared to renting a house or apartment is already like saving money, and here is why.

Rent – You pay a $750 deposit and $1000/month rent for the next 12 months. At that time, you can move on to another option. You have spent $12,000 in rent for the year and you may get your $750 deposit back depending on how well you maintained the place.

Mortgage – You take a 30-year mortgage out on a $200,000 house. You can either come up with 20 percent ($40,000) for a down payment, or you can pay PMI (private mortgage insurance). Even with no money down, your monthly payment will likely be around $1,100/month (depending on taxes), with a good chunk in the beginning going towards taxes but more than $300/month going towards the principal.

In the scenario above, you could live in the house for three years and make $39,600 worth of payments while paying off over $12,000 in principal. If the house retains its value (which it should), you could sell it for $200,000 and pay yourself back $12,000 of what you paid for “rent” over the last three years.

I get it; not everyone can manage to buy a house for a host of reasons, but if your goal is to save large amounts of money on a low income, one of your first steps should be finding a way to purchase a home.

Additionally, every bit of debt that you can remove is another dollar in your pocket that you can put right into savings. One of the most effective strategies I recommend is matching dollar for dollar. That means for every dollar of debt you cut, you move it directly to your savings account.

Evaluate Necessities

This can be a very tough subject, but if you are serious about saving money fast on a low income, there will be some difficult cuts in your life. Depending on what stage you’re at in your life, your decisions may be completely different.

Food

The first easy topic to discuss is your food purchases. Obviously, food and water are a complete necessity to survive. I’m not saying you need to starve yourself, but I am saying you can control what and where you eat.

The easiest thing to cut is eating out. There is a ton of wasted money in paying for food at a restaurant vs. just eating at home. A family spending $300 a month eating out could quickly turn that into $100 at the grocery store or an extra $200 a month into your savings. $200 doesn’t sound like a lot, but that is almost $2,500 for the year, which is a big number, especially if you have a lower income.

If you are a single person or a couple that doesn’t have children, you can even take it to the next level and cheapen up the grocery bill. I remember eating frozen pizza, ramen noodles, and cereal daily as a college kid. All foods that are extremely cheap and can cut your grocery bill quickly. Just be careful so you don’t have to buy all new clothes from gaining weight.

Again, I’m not recommending that you stop buying fruits and vegetables. I’m just laying it out there that if you are serious about creating extra money to save, even on a low income, it can be done.

Others

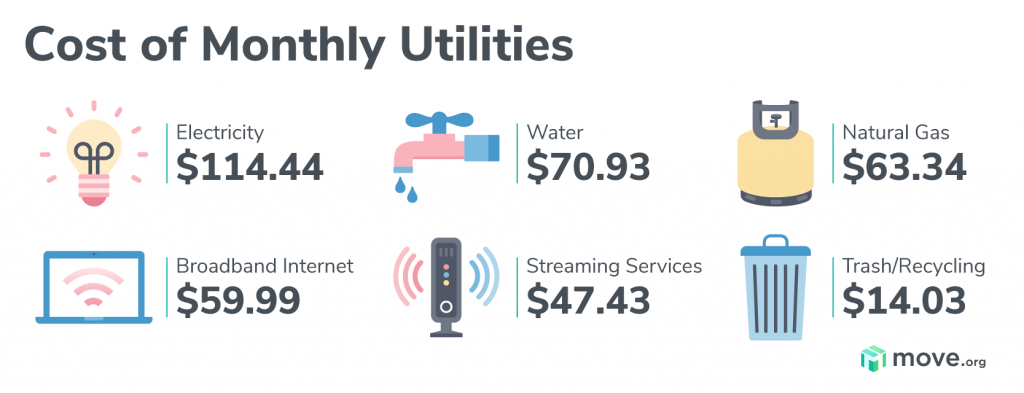

Other items that need to be evaluated are monthly utilities like heating and cooling, water usage, and especially cable and internet.

Again, going back to my college days, the heat was usually set at 64 degrees all winter, I tried to shower at the university as much as possible, and I streamed cable off my parents’ package for four years. These are not feasible options for everyone, but they helped me save a ton of money.

Sometimes, it’s easy to think that just because you don’t make a ton of money, it’s impossible to save money. Remember, you should already be naturally living somewhat within your means (hopefully), so there are always items you can go without to save money fast, even on a low income.

Reduce Costs

After evaluating all the necessities in life, it’s time to start slashing your monthly costs. Remember, saving money fast on a low income is completely different than someone on a higher income. You need to base your savings goal on a percentage. A target that I always tried to maintain is 10%, and that is a big amount that should help you save fairly quickly even with a low income.

That means if I’m making $30,000 a year and you are making $45,000 a year, our targets to save money are different. Saving 10% of any income is a huge feat that you should be extremely proud of.

What are the easiest costs to reduce if you are serious about this? Cable and rent. In today’s world, you can’t go without a cell phone, but you can go without watching TV in an unnecessarily expensive home.

Look at the figure below. Trimming down even just one or two of these can easily turn into significant monthly savings.

Vehicles

Another important area to consider in reducing costs is the car you drive. You may be driving an expensive car or truck you have decided is no longer necessary. You might have a $500 payment currently, but luckily, you have almost $12,000 worth of equity in the vehicle. You can go to the dealership and trade your car in for a $12,000 Honda Civic that runs like a champ. That instant $500 monthly savings should instantly go to your savings account.

Coupons or discounts for all your necessities that you can’t go without is another easy way to try and save some money that can go directly into your savings, no matter your income. Grocery stores are constantly battling for your business and have a ton of coupons available for consumers.

If you constantly check the ads, you can typically save $10-20 per week just on coupons, depending on how much you buy. For some willing to try new foods based on what’s on sale that week, you could save 10-15% on each trip.

Now that we have covered how to minimize your debt, evaluate your expenses, and cut costs to help save money quickly, I want to try and provide a few additional tips.

Tips on Execution

It’s easy to sit on a computer and type out how to cut costs and save more money, but it’s another to follow through with it. Trust me, I’ve been there. What’s the easiest trap to fall in, you might ask? For me, cutting costs in one area, and just adding it back in another category.

One thing that has worked well for me to save money faster is creating a completely separate savings account. It sounds silly when it’s so easy to move money from your checking to savings when it builds up, but that’s assuming you follow through.

My online banking is set up where I have a checking and savings account, and then the yearly savings account. That is where I constantly stash money throughout the year, and then I move it to my actual savings at the end of the year.

This makes a game for me, and I’m super competitive. So, every time I even find a quarter on the ground, I go to the bank and put it in that account (slight exaggeration). The best part about this for me is that I can easily see how much I saved for the entire year. You can then use your income and quickly figure out what percentage you saved.

Having this in a completely different account also makes it much easier for me not to touch it. I’m not saying there won’t ever be a circumstance where you must withdraw, but it makes it an absolute last option for me.

The easiest way to fail at saving money is by making the money too available. There should be friction between you and your savings.

Another big tip to help save money fast, even on lower income, is to set up a recurring deposit into that separate savings account. Most companies now offer you the ability to deposit a set amount or even a percentage of your check into a different account. Programing a weekly or monthly deposit directly from your check helps make it feel like you never really had the money to begin with.

Again, it doesn’t matter if this is only $5 weekly from your check. That still adds up to $260/year just from a simple little deduction you may never even miss.

Plus, if this process is automated, you’ll never forget to do it or put it off “just this week.”

I know a guy at work who used to eat out every day for lunch. Now, he packs twice weekly and puts the $15 he saves directly into his kid’s college savings account. That’s $60 a month or over $700 a year just on lunches!

The last tip I’ll give is to constantly challenge yourself and ask yourself the question of if you truly need something. Don’t get me wrong, the answer is sometimes yes, I need a new pair of jeans or shoes. But there are a lot of times if you really think about it, you can live without it.

I find myself now in a department store standing and staring for five minutes before I’ll put something in my cart. Trust me, this works, and it saves you against impulse buying which can be the worst type of spending.

As I mentioned in the beginning, saving money fast is no easy task even when you make plenty of money. On a lower income, it becomes even more difficult. The keyword is difficult, not impossible. If you follow these few easy steps, you can save money fast even with a lower income.

Related posts:

- Optimizing Home Savings with the Right Down Payment Options Have you started your home savings account and aren’t sure what to do with the funds? Do you feel like you’re not doing enough with...

- Key Things to Save up for as you Navigate Through Life No matter what stage of life you are in, there are always things to save up for. Here is a short list you should consider...

- How Much Should I Budget for a Car? At times you need to treat yourself, but always make sure to calculate how much you can spend on a car before you go crazy!...

- Hey Andy – How Much Should I Save a Month? Spend less than you earn. Simple words to live by but not really anything that’s truly that helpful, you know? Any person getting started on their...