Updated 8/7/2023

Companies expend more energy on mergers and acquisitions (M&A) than any other means of capital allocation. For many companies, such as Cisco and Intel, M&A is the most effective method for capital allocation and pursuing strategic goals. Even a company as powerful as Amazon pursued a merger and acquisition strategy to purchase Whole Foods to compete with Walmart in the grocery sector. That acquisition unquestionably impacted its financials, and in today’s post, we will see firsthand how it affected their performance.

In today’s tech-focused world, acquiring tech expertise or platforms is in many ways cheaper and easier than creating them themselves. That is the path that Cisco chooses, and back in the day, that was the policy Microsoft chose. Did you know; Excel started as something else until Microsoft bought the company that elevated it to the powerhouse it is today.

In today’s post, we will learn:

- A Brief Overview of Mergers and Acquisitions

- The Impact of M&A on the Stock Markets and Business Returns

- Amazon’s Purchase of Whole Foods

- M&A’s Impact on Amazon’s Financials

- Four Years Later, How Did They Do?

Okay, let’s dive in and learn more about Amazon’s purchase of Whole Foods and its impact on their financials.

A Brief Overview of Mergers and Acquisitions

Mergers and acquisitions are a method of either buying a company or combining two companies to improve the performance of both companies. In many cases, the acquiring company adds a technology or product they don’t have to fill out their portfolio to grow organically.

Or it might be a case of acquiring all of the competition to corner the market. In today’s growth-focused world, that is one of the strategies many companies employ.

There are five main types of mergers and acquisitions:

- Horizontal merger

- Vertical merger

- Market-extension merger

- Product-extension merger

- Conglomerate merger

For a more detailed explanation of each of the above M&A types, please check out the following post by Andy Shuler:

Recently, bigger mergers and acquisitions have rocked the market, such as T-Mobile’s merger with Sprint, which catapulted T-Mobile into the conversation of telecom leaders. The acquisition of Pixar by Disney helped Disney ramp up its animation and helped grow Disney’s media revenues.

So many mergers and acquisitions through the years altered the shape of business and the economy. For example, Norwest Banks purchased Wells Fargo but changed its name to Wells Fargo because it had better brand appeal. Wells then purchased Wachovia, which catapulted Wells Fargo into the largest systemic banks in the US conversation.

One of the impacts to consider when studying the M&A activity of a company is how they acquire or merge with the other company. There are three ways to complete the purchase:

- Cash

- Stock

- Combination of the two

We need to consider how the acquisition happens or how the company pays for the deal. Whichever method the company chooses can send a signal to the markets, and it also has a long-term impact on the company’s financial performance.

As with any purchase, the question remains whether the buyer gets more value than they pay for, with cash deals by far sending the best signal and moving towards more value.

For example, if the company pays too much of a premium for the deal, it might never make its investment back. Secondly, competition can replicate the benefits of a deal and improve its position while the acquiring company focuses on assimilation. Thirdly, an acquisition requires paying upfront for benefits down the road, which the market doesn’t always like. And the fourth reason, if the deal doesn’t work out, reversing the acquisition is costly. Consider Verizon’s recent sale of AOL and Yahoo for $5 billion after buying both for a combined $9.23 billion in 2015 and 2016.

The Impact of M&A on the Stock Markets and Business Returns

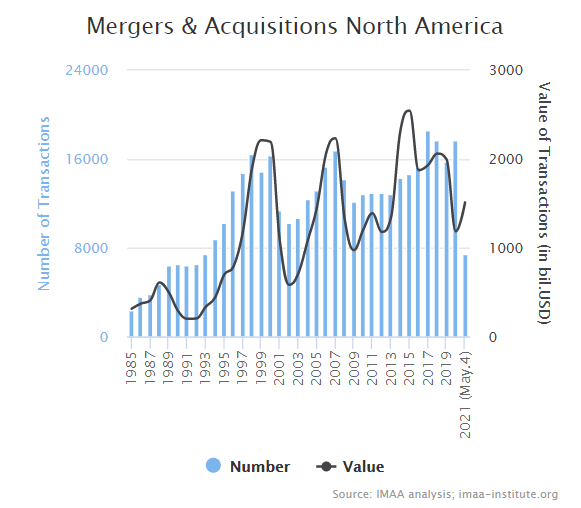

The dollar amount of M&A tends to follow the markets closely, and with more activity in the markets, the more M&A activity. The level of activity dropped recently, with all the uncertainty swirling because of the pandemic.

Chart courtesy of IMAA Analysis

Recently, AT&T announced they would merge WarnerMedia with Discovery for $43 billion after purchasing Time Warner for $79 billion in 2017. In the deal, AT&T will unwind its purchase of Time Warner to form a new media company with Discovery, which many analysts estimate could create a company worth $150 billion separate from AT&T.

When a company purchases another, it drives up the purchaser’s equity because much of the value comes initially from adding to its goodwill, and the increased revenues flow to its retained earnings.

Companies that act early in the M&A cycle tend to generate higher returns than those late to the game. For example, if a company started M&A activity right after the GFC in 2008 would likely benefit more than those that waited until 2012.

That is because cheap and accessible financing incentivizes action by buyers at the end of the cycle. Think of it like the bandwagon effect, companies see others doing it, and they think, why can’t I? Warren Buffett refers to this as the “institutional imperative.”

McKinsey did a study in 2010 that showed the overall returns for companies using M&A activity to grow were more likely to continue that strategy the larger the company. For example, a larger company such as Apple is unlikely to make a big acquisition because the hit rate is 50/50, where smaller bolt-on acquisitions tend to be far more successful and add more value in the long run.

A majority of the larger companies in the markets make smaller deals to add value to their companies, either with tech or products that enhance their current offerings. And the larger the company grows, the more likely it would continue to use the capital for M&A to continue that growth.

One of the best ways to measure the impact of those investments is the metric ROIC (return on invested capital) or ROIIC (return on incremental invested capital), which we will discuss in a few minutes. If you are not familiar with these metrics or how they work, please check out the following links before moving on with the case study.

- How to Calculate Invested Capital for ROIC (the right way)

- Investor’s Guide to Incremental Invested Capital (ROIIC)

Amazon’s Purchase of Whole Foods

Amazon announced its acquisition of Whole Foods on June 15, 2017, for $14 billion in cash ($42 per share for Whole Foods), roughly a 27% premium on the market price. In a desire to compete with Walmart in the grocery wars, Amazon purchased Whole Foods to beat Walmart at its game.

When Amazon announced the deal, it set off a tidal wave across the markets. Walmart and Target lost 5% that day; other grocers such as Kroger and Costco dropped 8% and 17%, respectively.

The market seemed to think something was up, and there was a change in the air, and Amazon would disrupt the traditional grocery business, despite Whole Foods only having less than 2% of the grocery market.

Whole Foods owned 456 stores at the time of purchase, and the stores were more of an upscale experience. Whole Foods stores were focused in dense urban areas, with many visualizing Amazon using these as centers for distribution by offering one-hour delivery.

Amazon is one of the leading companies in the world, but it didn’t start that way. In 1994, Jeff Bezos started the company that would become Amazon, originally known as Cadabra, Inc, as an online bookseller. Today, it is arguably the number one retailer globally, in addition to the powerhouse Amazon Web Services (AWS).

One of the principles that guide Bezos and Amazon is the obsession with customer satisfaction and the desire to be the one resource for customers. Amazon bets on convenience and being the offerer of the best price to drive its business. Bezos is also known for focusing on the long-term and trying to take long views on products and systems and understanding it takes time to work out the kinks and improve upon the first attempt.

That focus is apparent in the company’s focus on becoming the leader in delivery, by decreasing the delivery time window by locating several warehouses strategically around the US. Walmart initially struggled to keep up with Amazon because of this focus on improving delivery performance. Amazon had over four times the amount of warehouses around the US compared to Walmart’s.

Turning to Whole Foods, the company started with a merger of two small local stores in Austin, Texas, in 1980. From the beginning, the company differentiated itself by offering natural and organic food on a large scale. The company was one of the first to promote the farmer-friendly brand and was able to capitalize on the farm-to-table movement.

But not everything was rosy; the company acquired a reputation for being expensive, thus the nickname “whole paycheck,” which caused some damage to the brand and led to negativity on social media. Whole Foods also failed to keep up with changes in the grocery industry and struggled to keep up. The company jumped on the struggle bus in 2015 and showed no signs of getting off. With revenues flat or dropping, shareholders were starting to get nervous.

Enter Amazon, which desired to step up the grocery wars with Walmart. Amazon viewed Walmart as their main competition in the grocery market, understanding that Walmart’s success was one of the main drivers.

Walmart knew that groceries drew customers to the store, but they also knew they were spending more on clothing and other items because they were already there. I know I can’t go to Target without spending $50, even though I only went there to get some milk.

Amazon wanted to partake in those incremental add-ons. Bezos and the gang understood that adding groceries would escalate Amazon’s growth. And to Bezos, growth has always been the number one goal.

Amazon’s M&A activity has always operated on two levels: first, to reinforce its position in current markets and two, fill in gaps in its current offerings.

By purchasing Whole Foods, Amazon could get its foot into the $600 billion grocery market. Even though Whole Foods was only 2% of that market, the purchase allowed Amazon to get its foot in the door, allowing them to do Amazon things. Plus, it would give them some experience in something they didn’t have, offline retail.

In the early stages of the acquisition, some red flags popped up. First, Whole Foods stores were experiencing same-store revenue declines, and by comparison, were trending down to their peers. There was also some activism from Jana Partners, who were concerned about the company’s direction.

Before purchasing Whole Foods, Amazon sold seven tranches of debt for $16 billion to raise cash for possible acquisitions. Amazon paid $13.57 billion in cash, including Whole Food’s long-term debt and Amazon’s fee. The final total ended at $14.76 billion.

After the merger, Whole Foods operates under its name, with John McKay remaining the controlling CEO. Whole Foods became a subsidiary of Amazon, and operations continued as before.

Amazon stood to gain on multiple fronts with this acquisition:

- Entrance in the organic food industry

- Expansion of Amazon’s distribution channels

- Learning more about the “offline” behavior of customers

These inputs could help Amazon as it goes forward with both the grocery wars and future endeavors in the retail world. The company has designs to become the “one” store everyone needs, and Jeff Bezos has proven he is not afraid to take chances and push the envelope to improve the company.

M&A’s Impact on Amazon’s Financials

Now that we understand the reasons behind Amazon’s purchase of Whole Foods, let’s look at how it impacts its financials.

Amazon paid roughly $14 billion in cash for the company; let’s see what they bought.

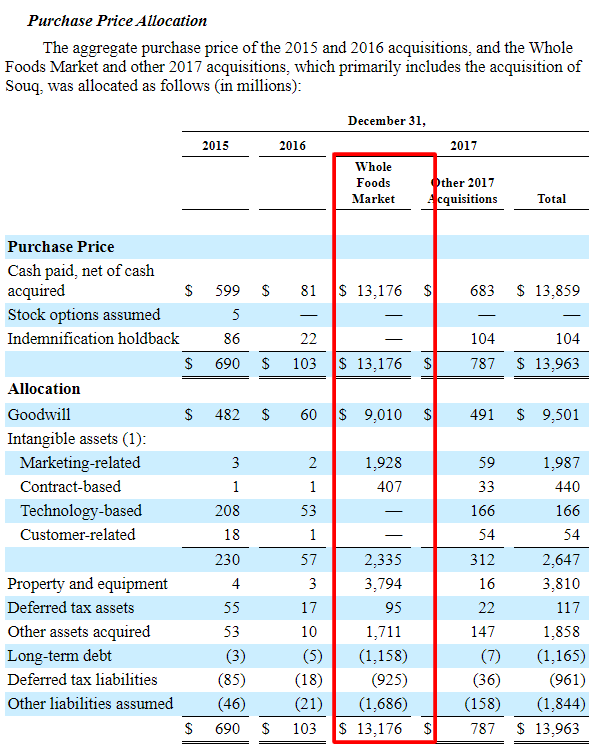

The first section to digest is the purchase and acquisition note in the 10-k from 2017. Below is the screenshot from the annual report, which highlights the price Amazon paid plus how it will affect its balance sheet. We can see that this is way above any acquisitions the company made in the last few years.

We can see that the company paid $13,176 million in cash for Whole Foods. In comparison, most of the acquisitions added $9,010 million to goodwill and $3,794 million in property and equipment, meaning that the majority of the additions added the company’s capital investments or increased the invested capital in our ROIC calculations.

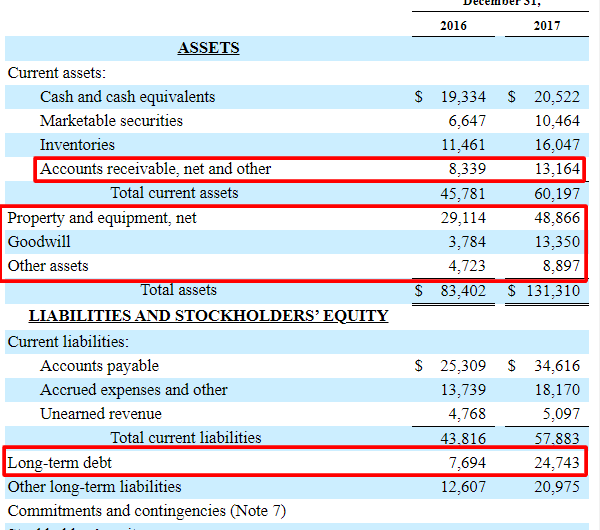

You can notice the large increases across the board in the assets sections of the balance sheet, particularly in the goodwill and property and equipment line items.

Also, notice the large increase in the long-term debt, $17 billion worth, that highlights the companies decision to add debt to purchase Whole Foods. Technically, they paid cash for the company, but Amazon chose to raise money by adding debt to its balance sheet to increase its cash hoard.

These decisions highlight how the company purchased Whole Foods and tells us how the company thinks about making acquisitions. The decision to add Whole Foods increased both the debt (liabilities) of the company as well as adding to the assets of the company, making it more valuable.

I want to point out by looking at this transaction is the impact it has on the company’s financials. In the case of Amazon, we see it increased the company’s value, but it also took on more debt, which in the hands of a lesser mortal could spell trouble. Amazon is such a free cash machine, the addition of debt is not a big concern. But it is important to highlight.

But the bigger question remains, how did it impact the growth of Amazon? It is hard to see in the short-term, but we can see that in a longer view.

Four Years Later, How Did Amazon Do?

So how has Amazon done since the addition of Whole Foods? We can look at a few areas to get a sense of the impact of the transaction. The biggest challenge when acquiring a company is enhancing the performance of the acquisition and adding growth to the acquirer. Bottom line, if it doesn’t grow revenues, the acquisition was a bad allocation of capital.

One challenge to assessing an acquisition like Whole Foods is that Amazon absorbed its operations into its financials without separating or segmenting their results. We can gather a few facts by looking at the top-line growth of the segment, including Whole Foods:

Item | 2018 | 2019 | 2020 |

Revenue | $141,366 | $170,733 | $236,282 |

We can see from the above snapshot; the company is experiencing incredible growth, to the tune of 18.68% CAGR over the three years.

Looking at the ROIC ratio from the year of purchase 2017 to the current levels.

- 2017 – 5.53%

- 2018 – 13.04%

- 2019 – 10.44%

- 2020 – 12.04%

- TTM – 13.47%

All of which gives us an average ROIC over the five years of 10.90%, but we can see the company recovered nicely from the lower reinvestment rate in 2017. We can also see from the WACC (weighted average cost of capital) over the same period that the company drove revenues during the period from its increases in the capital:

- 2017 – 10.27%

- 2018 – 13.39%

- 2019 – 11.34%

- 2020 – 7.71%

- TTM – 8.02%

The average cost of capital over the same period is 10.14%, which is slightly above the ROIC, which indicates the company is moving towards greater profitability. Keep in mind the cost of debt is higher than previous levels because of that additional $17 billion added to the debt load. That increase in debt load leads to a higher cost of capital and less reinvestment efficiency.

It also highlights some of Amazon’s low-cost producer models. With lower margins, especially in retail and grocery, the company carries lower profitability margins, similar to competitors Walmart and Target.

Another indication of the impact of Whole Foods’ purchase is the fact that Amazon is now pushing a new grocery initiative, the Amazon Fresh stores, which offer many of the same conveniences of competitors like Kroger and Walmart. The same low prices, delivery, pick-up, and wide variety of choices.

That choice was spurred by the desire to increase the percentage of Amazon Prime’s members spending on groceries, which can help increase the loyalty of the membership program. Amazon wants to increase sign-ups and increase retention, thereby driving more value and revenue for the company.

The Amazon Fresh stores drive towards a different clientele than Whole Foods; it is not a means of replacing those customers, increasing the attractiveness of another option for Prime members. The Fresh stores have lower prices and a wider choice of products than Whole Foods.

Amazon is hoping to drive more digitally reliant shoppers via the Fresh stores, as the Whole Foods customer is far more niche, and Amazon can’t build its base off those customers.

Investor Takeaway

In the classic method, acquisitions mean to increase the value and revenues of the acquiring company. Typically, the management pursues acquisition targets that can either add value to improving products or add revenue growth.

The increase in technology and the use of ordering online have changed the grocery game. Gone are the days where you have to go grocery shopping in the store. You can buy anything you want online and have it delivered or picked up, increasing the convenience and speed of shopping.

The question to as isk, can online completely displace in-store experiences?

It appears no, but time will tell on that idea.

When a company we own is looking to buy announces an acquisition, a good idea is to look through the acquisition details to see how that will impact your company’s performance.

Keep in mind management is going to spin everything in as positive a light as possible. But the reality is a little starker; not every acquisition will be a home run; many will fail miserably. You only need to look as far as Verizon’s purchase of AOL and Yahoo or AT&T’s purchase of Time Warner. All three acquisitions were meant to be transformative for each company, but they were spinning them off for far less than the purchase price a few years later.

Those examples highlight the big stakes game involved in acquiring and merging, and many companies are serial acquirers. It pays to study those acquisitions to assess how you think they will work and the downsides.

I hope our look at Amazon’s purchase of Whole Foods can help give you a guide to look at acquisitions and mergers. And with that, we will wrap up our discussion for today.

As always, thank you for taking the time to read this post, and I hope it helps you on your investing journey. If I can be of any additional assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Cash Vs. Stock Acquisitions: What’s Driving The Bus? Updated 7/24/2023 “If you aggregate all of our stock-only mergers (excluding those we did with two affiliated companies, Diversified Retailing and Blue Chip Stamps), you...

- Mergers and Acquisitions: Easy Basics for Beginners Updated 7/6/2023 Global mergers and acquisitions (M&A) volumes hit a record high in 2021, overtaking 2020’s deals. According to Refinitiv data, the total volume of...

- M&A As A Growth Strategy Updated 7/6/2023 Merger and acquisition activity drives much more growth than investors realize, and many companies practice mergers and acquisitions or M&A as their main...

- The 5 Types of Mergers and Acquisitions and Its Impact on Your Investments Have you ever had a stock jump massively after there was a merger and acquisition announced? Or, maybe the opposite happened and the share price...