Free cash flow remains the most important metric in finance. Beyond profit, free cash is money that the company can use in many ways to improve its position. Capital allocation remains one of the most important tasks a CEO faces in any company and goes a long way to increasing the company’s value. Defining those free cash flow uses and implementing them effectively signifies a fantastic capital allocator.

One of Warren Buffett’s secrets to success has been his ability to allocate the free cash Berkshire can generate yearly from its operations. Buffett’s ability to allocate the free cash flow has led to Berkshire becoming one of the most valuable companies in the world.

Buffett thinks so much of free cash flow that he created his method of measuring that free cash flow based on a company’s financials and how he interprets the flow of money through those financials. He refers to those free cash flows as “owners’ earnings.”

In today’s post, we will discuss:

- What is Free Cash Flow?

- What is the Formula for Free Cash Flow?

- What are the Five Uses of Free Cash Flow?

- Resources of Free Cash Flow

Let’s dive in and explore free cash flow uses and their impact.

What is Free Cash Flow?

According to Investopedia:

“Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet.”

Defining free cash flow can be confusing because there are different variations on the formula and what it means to different investors.

Interest payments on debt help define what type of cash flow investors commonly refer to. I mean, the interest payments remain excluded from calculations of free cash flow. The reason is there are different calculations for free cash, depending on how you consider the leverage or debt of the company.

Every company has different capital structures, and some investors prefer to calculate the free cash flow differently.

The more common definition begins with the free cash flow to the firm, and the other considers leverage as the free cash flow to equity.

My goal with today’s post is to define the uses of free cash flow. How can we measure those uses? Suppose you remain unfamiliar with free cash flow calculations and definitions, in which case, I will provide some resources to better understand the calculations and reasonings behind the logic. In the next section, I will briefly cover how I like to calculate free cash flow as a reference for the rest of this post.

For now, think of free cash flow as cash available for things such as dividends, share repurchases, debt repayment, or reinvesting in the company.

Free cash flow analysis also offers additional benefits, such as identifying problems in the income statement.

Some investors prefer free cash flow per share as a better measure of company performance rather than the far more basic earnings per share. This is mostly because free cash flow removes non-cash items from the calculations. Still, because the calculations for free cash flow include capital expenditures, those numbers can be uneven and lumpy over time.

An additional benefit of using free cash flow as a measure of profitability is that the calculations include working capital as a component.

The benefit of this inclusion is that it can provide insight into the profitability and health of the business. Including working capital can provide insights into items such as accounts receivables or accounts payable, which can indicate either collections of funds quicker or the building up of inventories—all of these point toward the profitability of a company, and items not included in the income statement.

Free cash flow is also valuable in determining whether a company will pay a dividend or the likelihood of continuing that payment. Likewise, if a company continues looking to borrow funds for expansion, examining the free cash flow would provide insight into the company’s ability to repay that loan.

Okay, now that we understand free cash flow and can see some benefits, let’s look at one way to calculate that free cash flow.

What is the Formula for Free Cash Flow?

Among the many different ways to calculate free cash flow, the one that I use the most comes from Professor Damodaran. The method he uses is known as the free cash flow to the firm. It involves items from both the income statement and the cash flow statement. For a far better description of this process, please see below:

Let’s dive in and explore this formula a little.

The formula for free cash to the firm, according to Professor Damodaran, is this:

- EBIT (Earnings before Interest and Taxes) – Taxes + Depreciation and amortization (+/-) Changes in Working Capital – Capex

All that looks like a mouthful, but it is not that bad.

We can find the number from the income statement under taxes paid and operating income, or EBIT.

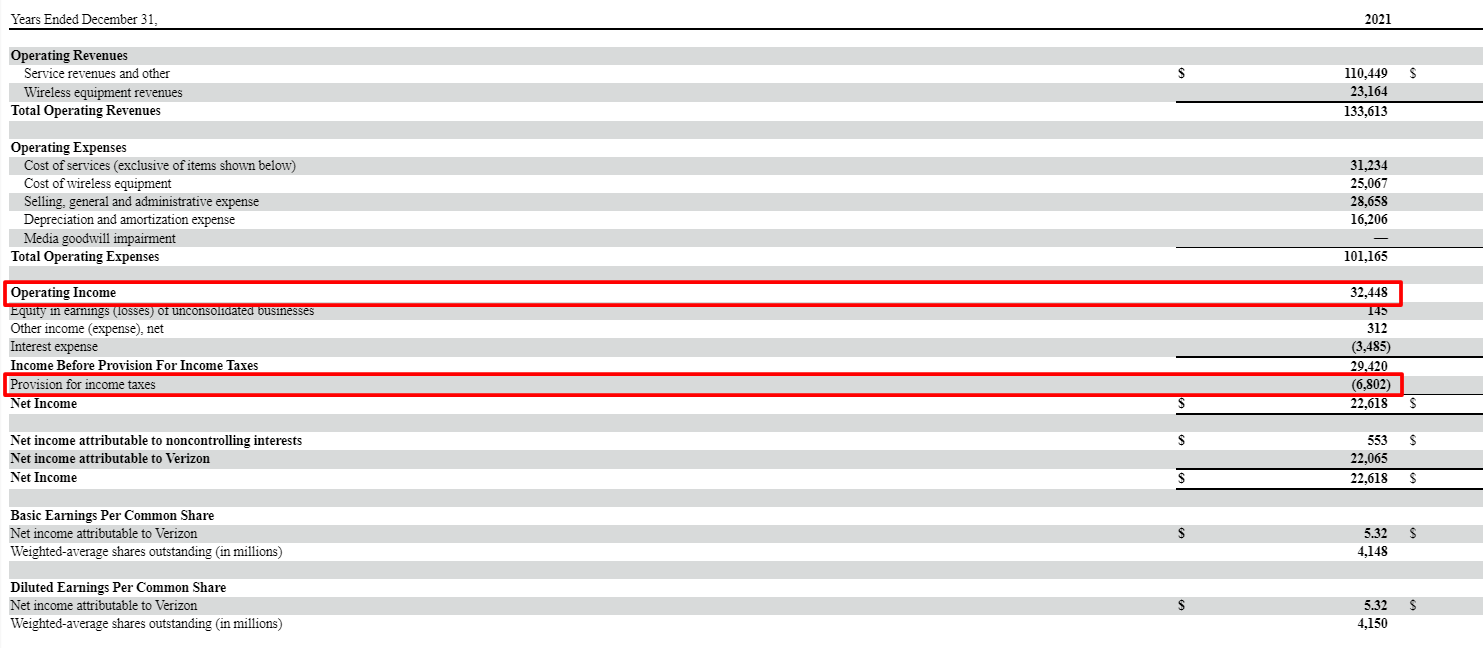

Let’s take at Verizon’s free cash flow, starting with the income statement.

We can see from the above income statement that we have:

- EBIT – $32,448

- Income taxes – $6,802

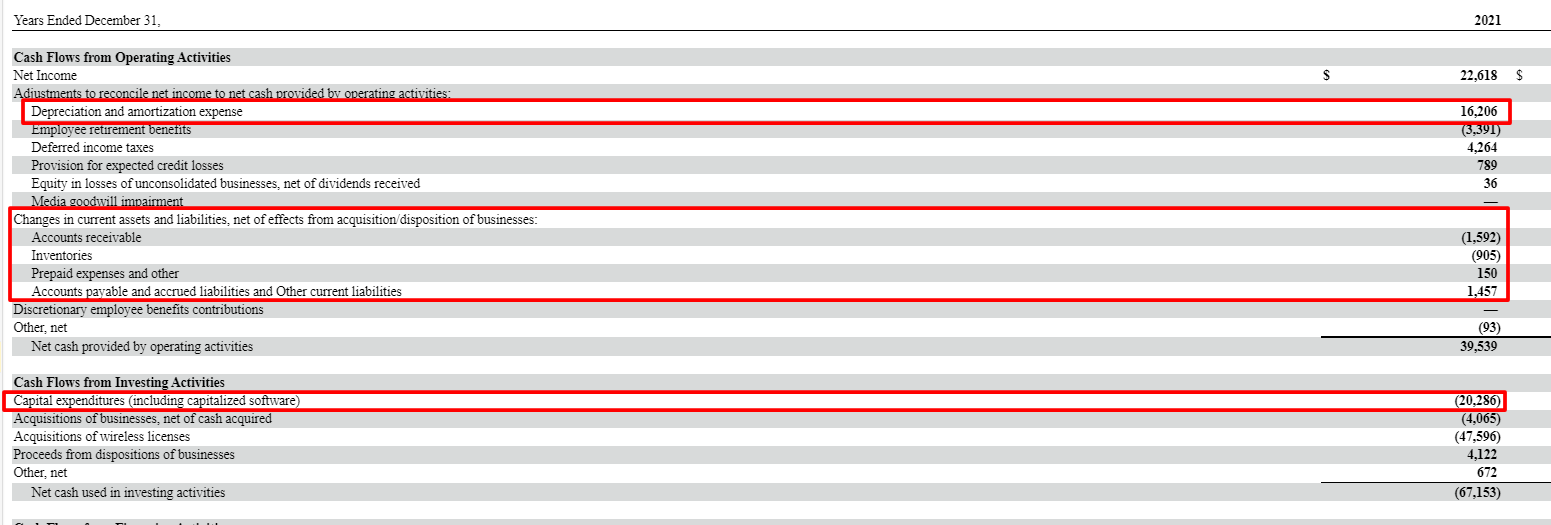

Now, let’s take a gander at the cash flow statement for Verizon to find our other numbers.

Okay, now we can pull out our numbers from the cash flow statement. Unfortunately, Verizon does not tell us directly what the change in working capital adds up to, so we will have to do a little math on our own.

- Depreciation and amortization expense – $16,206

- Capital Expenditures – ($20,286)

- Changes in working capital

- Accounts receivable – ($1,592)

- Inventories – ($905)

- Prepaid expenses and other – $150

- Accounts Payable – $1,457

Calculating the changes in working capital requires us to add the above numbers, which will give us our number.

Changes in working capital = (1592) + (905) + 150 + 1457

Changes in working capital = $(890)

Okay, now we can calculate the free cash flow to the firm for Verizon.

FCFF = $32,448 – $6,802 + $16,206 – $890 – $20,286

FCFF = $20,676 million

First, pretty easy, huh? Secondly, what the above numbers tell us is Verizon has $20,676 million available to either pay out a dividend, repurchase shares, or reinvest back into the business.

Using the above formula gives you a better idea of a company’s actual free cash flow after taking the operations and capital needs of the business into account.

One of the downsides of a formula like free cash to the firm is that it does not work well for financials such as banks and insurance companies because those cash flows don’t flow directly to the firm because of the amount of debt and liabilities they carry due to the nature of their businesses.

Don’t worry; I will provide some ideas on calculating free cash for financials later in this post, and it is a subject for another day.

Now that we know how to determine a company’s free cash flow, let’s discuss the possible uses of those funds.

What are the Five Uses of Free Cash Flow?

Once we know how to find a company’s free cash flow, we need to determine what we do with those funds. As the company’s CEO, we have multiple ways to go with these funds.

Our decisions with these funds remain critical to our business’s continued long-term success. The large capital allocations will determine how much free cash we have remaining and how consistently the company produces those cash flows.

Let’s look at the five ways we can allocate the free cash flow.

Dividends

Paying a cash dividend is one of the most obvious choices for allocating free cash flow.

Investors love dividends, which remain an important part of the investing process for most investors. Paying a growing dividend is also a fantastic way for a company to attract investors on a growing basis.

A company that pays a dividend indicates a shareholder-friendly company because it allocates those funds back to the investor that has entrusted the company with their hard-earned money.

One reason companies pay out a dividend is the company continues making enough profit to pay the dividend and uses the free cash for other items such as reinvestment, debt repayments, and others.

These factors must consider where the company is in its life cycle. Typically, younger companies cannot pay dividends and use their funds to reinvest for more growth or pay down debt. As the company matures, it may choose to start to pay a dividend to attract more investors or give back to those who have stayed loyal to them over time.

Paying a dividend is also a form of discipline for the company for several reasons. Once they start paying a dividend, it is incredibly important to continue down that path because investors and Wall Street HATE when a company cuts or stops paying a dividend.

Paying a dividend also reduces the temptation to go after riskier acquisitions or other plans as a means of growth.

Share repurchases

Share repurchases have become one of the most popular uses of free cash flow over the last twenty years. However, recently those choices have come under tremendous scrutiny, especially by some members of Congress.

Share repurchases function as a means of returning value to shareholders in the form of more value for their current shares. Once instituting a buyback, the shareholder sees their per-share value increase with fewer shares available for sale.

But buybacks also benefit the company as well. Repurchasing shares can help a company reduce its cost of capital, consolidate ownership, increase financial metrics, and, lastly, free up profits to pay executive bonuses.

The last two reasons above have led to much controversy regarding share repurchases; many companies, including Boeing, McDonald’s, and Caterpillar, have used repurchases to line the management’s pockets.

Paying Down Debt

Paying down debt has several benefits for the company. First, as the company pays the debt down over time, the interest expense will decrease, opening up more profit for the company to use for any capital needs.

Another benefit is the ability to borrow more money if the company feels it is a route they want to go. As the company pays the debt, it shows banks and other lenders that it has control over its capital and will be far more likely to loan to the company again.

Reinvesting in the Company

Using the free cash flow as a means of growth for the company is probably the greatest use. Reinvesting into the company is the best option, especially at an earlier stage.

Think of companies like Facebook, Amazon, Google, Apple, Netflix, Visa, etc. These companies have done a fantastic job of creating free cash flow and reinvesting into their companies. They’ve all spurred tremendous growth for both the company and shareholders.

Metrics such as return on invested capital (ROIC), return on capital (ROC), and Enterprise multiples are wonderful ways to track the success of that reinvestment.

Buffett waxes eloquently throughout his letters to shareholders on the importance of reinvestment and the ability to do so well as a means of growth for both the company and investors.

Acquisitions

Buying other companies with free cash flow is another example of a growth opportunity for many businesses. In fact, companies like Microsoft and Amazon have used this method to add to other components that accelerated their growth.

Many companies use cash to achieve these acquisitions, but others use their shares as a source of acquisition.

Using cash as a means of growth is common in the pharmaceutical world. Acquiring businesses that have created the latest breakthrough in pharma is one of the best ways for many businesses to grow their revenues and long-term profitability. In many cases, buying another company is far cheaper than creating the latest new drug.

Okay, now that we have identified the five ways companies can use their free cash flow, let’s look at ways we can measure effectiveness.

Resources for Free Cash Flow

Here are some great resources for calculating free cash flow and the uses of free cash flow.

Course on Valuation by Aswath Damodaran – video

All of the links above are great resources to learn more about free cash flow and the different ways to calculate it based on what type of company you are analyzing, as well as some of the various ways those flows can benefit both the company and the investor.

Finally, the class by Damodaran, which is free, helps you calculate free cash flows and how to use those flows to value a company.

All great stuff, and I highly recommend you give them a look-see.

Final Thoughts

Free cash flow is arguably the most important metric in finance, but it is not discussed among investors as much as it should be. It is likely because Wall Street analysts spend most of their time discussing earnings, revenues, and company growth.

While those ideas and metrics are important, what the company does with its cash flows after all of the operations are cared for is just as important to the company’s growth as well as returning value to shareholders.

However you determine to calculate free cash flow, we must understand the differences and, more importantly, how the company can use these free cash flows.

That is going to wrap up today’s discussion.

As always, thank you for taking the time to read this post, and I hope you find something of value for your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time.

Take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Free Cash Flow Yield – Finding Gushing Cash Flow for Future Growth Cash is king, and free cash flow acts as the engine’s oil. Determining free cash flow and its different uses remains a fantastic way to...

- Cash Flow Analysis Example Using Cash Flow Ratios Everyone Should Know Updated 4/4/2024 “There is a huge difference between the business that grows and requires lots of capital to do so and the business that grows...

- Levered Free Cash Flow Formula (FCFE) Explained Free cash flow and a DCF go hand-in-hand in estimating valuation. But should levered free cash flow (also called FCFE) be used in a DCF?...

- The 3 Important, Main Components of Debt Analysis (+Metrics) Updated 7/24/2023 “If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has.” John Maynard Keynes...