Updated 1/5/2024

Measuring investment returns continues to be something everyone looks to do when investing in the markets. The search for “alpha,” or market-beating investment returns, remains the goal of every investor.

Jensen’s Alpha method is one of the easiest ways to determine your investment return or alpha. This formula will enable investors to measure their returns versus their portfolio and the market.

Mohnish Pabrai has returned fantastic returns over his investing career; he remains one of my favorite investors, with a 16% return from 1995 to 2015.

The overall stock market returns, including dividends over the last 100 years, have returned over 10% annually, a great benchmark for long-term investors.

A tool like Jensen’s Alpha can help us determine our results against any benchmark.

In today’s post, we will learn:

- What is Jensen’s Alpha?

- Jensen’s Alpha vs. Sharpe Ratio

- What Does a Negative Jensen’s Alpha Mean?

- How to Calculate Jensen’s Alpha with Real-World Examples

Okay, let’s dive in and learn more about Jensen’s Alpha.

What is Jensen’s Alpha?

Jensen’s Alpha, also known as Jensen’s, is a risk-adjusted performance measure representing the average return on our portfolios or investments.

The Jensen’s Alpha formula was first introduced in 1968 by Michael Jensen, a well-renowned economist specializing in financial economics.

Jensen’s Alpha aims to determine the extra returns or investments, including stocks, bonds, or any other investment type.

The formula measures the investor’s return compared to the capital asset pricing or CAPM model. They use measures of the company’s beta and the average market return.

We could also look at this metric as simply alpha.

Let’s back up a moment to define alpha for those unfamiliar with that term.

Investment returns use Greek symbols to highlight different types of returns. Alpha measures the excess return compared to a particular benchmark. Beta measures risk, and Delta is used to track pricing changes in options.

For example, many investors use the S&P 500 as their benchmark to measure their returns. If an investor refers to beating their benchmark, they return alpha for their clients or themselves.

But, for our purposes, we are looking at our portfolio returns or Alpha. The good news is there is no need for statistics or higher algebra knowledge to determine our returns.

As investors, we use measures to check the success of our investments. This is because we need a benchmark to measure our progress as we buy and sell investments.

Looking at our investments in a vacuum doesn’t tell us much unless it is tied to another benchmark or related to those returns.

To accurately analyze our returns or investment manager’s returns. An investor must look at the total return and risk associated with those investments to determine if the returns compensate us for that implied risk.

A great example is when we look at two investments with 15% returns; any rational investor would invest in the investment with less risk.

We can use Jensen’s alpha formula to measure the investment’s return versus the risk level.

If Jensen’s alpha remains positive, the investment generates excess returns. A positive value tells us that our investment continues to “beat the market” with stock-picking skills. Yeah us!

Jensen’s Alpha vs. Sharpe Ratio

Measuring risk serves as an important part of the evaluation in investing. No risk-free investments or assets exist, and the ability to measure the risk of an investment represents the key to avoiding losing money.

Buffett’s rule number one is never losing money; measuring any investment risk helps you heed that rule.

Two of the more common methods of measuring those risks are Jensen’s alpha and the Sharpe ratio.

Both of these methods are useful in stocks and mutual funds or ETFs.

The Sharpe ratio, as well as Jensen’s alpha, help show historical volatility. This helps us investors pick which stocks or funds will fit our investment goals and the risks we could take to achieve those goals.

Modern Portfolio Theory tells us that risk is tied closely to returns; I believe risk is more associated with losing money.

Buffett believes, and I agree with this idea, that risk is closer to the risk of losing money.

The Sharpe ratio, developed by economist William Sharpe, is a risk-adjusted measurement of returns.

We calculate the Sharpe ratio by subtracting the risk-free return from the investment return rate, defined as a US Treasury bond. Then, divide that all by the standard deviation of return for that investment.

Sharpe Ratio = (Return Rate – Risk-Free Return) / Standard Deviation of Return

The Sharpe ratio highlights how an investment earns its returns, which is useful in comparing them with similar historical returns.

For example, if Walmart and Amazon have ten-year returns of 10%, and Walmart has a Sharpe ratio of 1.5, Amazon has a Sharpe ratio of 1.30.

As conservative investors, we would choose Walmart because Walmart would have higher risk-adjusted returns according to the higher Sharpe ratio.

Jensen’s alpha can compare returns on a risk-adjusted basis, but the alpha formula compares those returns concerning a benchmark.

For investors wishing to use benchmarks to measure returns, Jensen’s alpha is their choice if Walmart shows a 2% alpha, indicating it is beating its benchmark by 2%. So, the higher the alpha, the better.

According to the formula, the higher the alpha, the better stock-picking or fund-picking the investor or manager.

What Does a Negative Jensen’s Alpha Mean?

According to the various benchmarks, measuring alpha is a great way to determine if our investments are doing well.

A positive alpha indicates the investment is outperforming its benchmark and is earning excess returns. For example, if Walmart earns 2% alpha, it beats its benchmark by 2%. So, if you invest $100 in Walmart versus the benchmark of the S&P 500, then Walmart will earn 2% more returns than the S&P 500.

Example

Let’s put that in numbers to help illustrate.

If you invest $1000 in Walmart for five years and return 12% over the period, Walmart will return you $1762, or $762, on our $1000 investment.

On the other hand, if your investment of $1000 in the S&P 500 over five years, with a return of 10%, would return $1,611, or $611 on our $1000 investment.

The above example shows how we would earn an extra $151 over those five years with an alpha of 2%.

Now, what if the alpha was negative?

That would indicate that the investment is underperforming or earning less on our investment than the benchmark.

In our above example, Walmart earned 8% instead of 12%; now, the investment alpha is a negative 2%.

For our $1000 investment, we would earn $1,469 over the five years or $469 for our investment. I compared the return to the investment in the S&P 500, which yields $142 less than if we invested in the S&P 500 instead.

Negative alpha doesn’t always indicate our investment is losing money; as you can see from the above example, we still made money on the investment. The only issue is it didn’t beat the benchmark or generate alpha.

Do you sell the investment if it doesn’t generate alpha?

Negative alpha over a longer stretch might indicate an underlying weakness in the investment. Our thesis becomes incorrect; the market doesn’t recognize the potential of the investment, or we analyzed the company incorrectly, and the alpha doesn’t add up to as strong as we first thought.

Measuring our portfolio’s performance based on alpha is a great tool but remains one of our tools. And basing our decisions on one tool is not the best idea. Rather, it is better to use alpha as a guide and our goals to make decisions.

Measuring alpha is available for both individual investments and portfolio management.

Not every investment we buy will create alpha; remember that Warren Buffett doesn’t pick every winner; not all of his picks generate alpha.

No investor or manager will achieve alpha with every pick or portfolio creation. Instead, the goal is to achieve alpha, with increasing alpha to help raise all the ships.

Okay, let’s move on and determine how to measure alpha in our individual or portfolio investments.

How to Calculate Jensen’s Alpha with Real-World Examples

First, let’s look at the formula to calculate Jensen’s alpha below:

Where inputs for the formula are:

- Portfolio return = return on investment or portfolio

- Risk-free rate = risk-free rate of return

- Beta = beta of investment or portfolio during the measured period

- Market return = return of the benchmark, i.e., S&P 500

For example, let’s pick some stocks from Warren Buffett’s portfolio to see how those returns generate alpha.

I would like to look at Apple (AAPL) first. To find our inputs, I will use a combination of the following websites:

- Stratosphere Investing

- Beta

- Apple’s annual return

- S&P 500 return

- Treasury.gov

- 10-year Treasury note rate

Okay, now that we know where to go, I will pull together some numbers for us for Apple.

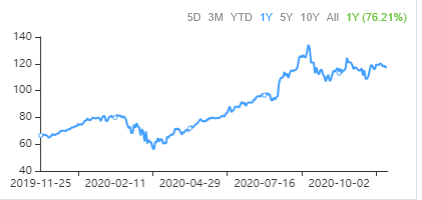

Apple

- Beta – 1.29

- Annual return – 76.21%

- S&P return – 13.48%

- Risk-free rate – 0.87%

Okay, now we can plug in our inputs to the formula.

Apple alpha = 76.21% – {0.87% + 1.29 * (13.48% – 0.87%)}

Apple alpha = 76.21% – 14.86% = 61.35%

So, the math tells us Apple has earned 61.35% alpha compared to the S&P 500 for the last year. It is an outstanding return.

Let’s look at another example, say Coca-Cola (KO).

Coke

- Beta – 0.58

- Annual return – (1.03)%

- S&P 500 annual return – 13.48%

- Risk-free rate – 0.87%

Now, we can plug all the above numbers into the formula.

Coke alpha = -1.03% – {0.87% + 0.58(13.48% – 0.87%)}

Coke alpha = -1.03% – 8.18% = -7.15

The formula above tells us Coke is losing alpha; compared to the S&P 500, Coke’s returns are less than the S&P 500 during the period.

Let’s try another one for giggles.

Wells Fargo (WFC) was battered during the pandemic and has not returned to pre-pandemic levels.

Wells Fargo

- Beta – 1.08

- Annual return – (52.98)%

- S&P 500 annual return – 13.48%

- Risk-free rate – 0.87%

Wells Fargo alpha = -52.98% – {0.87% + 1.08(13.48% + 0.87%)}

Wells Fargo alpha = -52.98% -( 14.48 = (38.5)%

The above formula tells us Wells Fargo is earning less than the benchmark and is losing money as an investment.

After looking at a company underperforming the benchmark, we must consider why Wells Fargo is underperforming. Then, decide whether those reasons merit selling the investment or holding it for a longer period.

If we analyze Buffett’s portfolio performance over the last three years, we see he has returned over 11.08%, compared to 14.89% of the S&P 500.

Assuming a beta of 1 and a risk-free rate of 2, we get an alpha of (3.81)% over that time. And if we look over a longer period, we see he is not generating alpha until 15 years out.

- 3-year – (3.81%

- 5-year – (1.37)%

- 10-year – (2.56)%

- 15-year – 1.23%

Analyzing another value investor, David Tepper, who runs the Appaloosa Investment portfolio, he has generated alpha, as shown below:

- 3-year – 3.17%

- 5-year – 1.91%

- 10-year – 12.49%

One of the great ways to track the different fund managers’ performances is to follow their returns via 13F filings, which you can find on SEC.gov or using a site like whale wisdom.

As our final tally, let’s look at an ETF fund to determine how much alpha it might generate. I would like to look at the Vanguard Total Stock Market fund (VTI).

The current market price equals $184.22, and the beta equals 1.01. The fund has total returns of 18.05% for the year versus S&P returns of 14.45%, which gives us an alpha of 3.47%.

Okay, after all those examples, I hope we have a handle on calculating alpha for our investments, whether individual picks or portfolios.

Final Thoughts

Investors strive to earn better returns by picking stocks, bonds, or ETFs. Whether a retail investor, investing independently, or a fund manager, generating alpha compared to a benchmark represents the goal.

Most investors use the big stock exchanges as their benchmarks, such as S&P 500, Dow Jones, or Nasdaq. But we can use other metrics as well, such as:

- Other guru’s portfolios, such as Buffett, Pabrai, or Dalio

- Other benchmarks, such as a 60/40 portfolio construction

- Or trying to outdo yourself

Measuring those returns using a simple formula such as Jensen’s alpha is a great way to measure your performance against those benchmarks.

Investors rate as a funny bunch; they all talk about generating great returns and beating a benchmark; it’s almost like looking to see who hits the longest home run.

Instead of focusing on the goal of beating another investor to gain bragging rights, focus on another goal, such as earning alpha for yourself.

The whole goal is to invest with the risk you are comfortable with and earn the returns you want compared to that risk.

Buffett talks a lot about sleeping well at night because he remains comfortable with the risk level in his portfolio. And the returns he has generated over his 50-plus investment career allow him that comfort.

We will wrap up our discussion today concerning measuring alpha with Jensen’s alpha formula.

Thank you for taking the time to read this post, and I hope you found something valuable on your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...

- The Information Ratio – CFA Level 2 An investor’s Information Ratio is a measure of the Active Return that is being achieved per unit of Active Risk. The Information Ratio is important...

- How to Use Return Attribution to Compare Portfolio Return Being able to attribute the sources of portfolio return is an important aspect in the decision making process surrounding portfolio management. The process of return...

- How Benchmarking Performance to an Index Keeps Investors Rational Have you ever heard the saying that “anyone can be a genius in a bull market?” Well, it’s true, if you’re not benchmarking performance of...