Realty Income Co (O) is a company that has a really strong focus on providing dividend value to their shareholders, and honestly, I see the stock mentioned all the time among dividend communities. So, it really made me think – what does the O dividend history really look like?

One of my biggest issues with dividend stocks is when people “chase yield”. For instance, they will buy in a company only because they have a high dividend yield. I will frequently see people invest in a company because of the dividend yield, or maybe they’re a dividend king and have a great track record of growing their dividend.

One of the companies that really bothers me is AT&T (T). Yes, they’re one of the most coveted Dividend Aristocrats, but does that mean they’re actually a good investment?

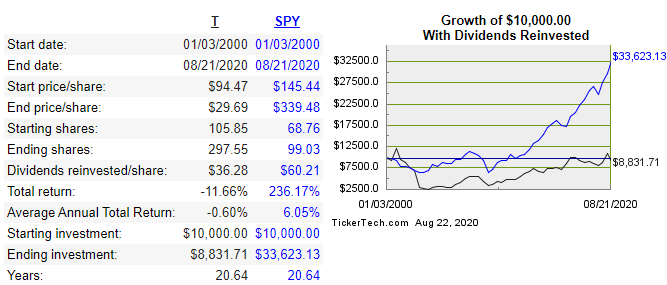

Well, if you invested $10K on 1/3/2000 and reinvested your dividends with DRIP, you would now have $8,831.71. At the same time, if you had chosen to put that money into an S&P 500 ETF like SPY, you would have $33,623.13:

So, one investment made you lose money, while the other gave you a total return of 236%!

But it has a great dividend yield, Andy! Nonsense. That’s why you need to look at the total yield, just as you need to do with the S&P 500.

I always will go look at historical drip calculators and Dividend Channel has my favorite one because it’s super easy to compare it to an index, and I think that benchmarking your performance to the index is the best way to actually measure your investing success.

The reason that I give all of this backstory is because when people talk about O, they mention how it pays a monthly dividend and that it has a strong yield. Immediately, before knowing anything about the company, it seems a bit gimmicky to me, but let’s dive in a bit further before making a final decision:

When I go to their website, it is evident just how important the dividend is, and I love that. They have an entire page dedicated to their Monthly Dividend Commitment where they say:

“Our founders, William and Joan Clark, started with a simple idea – to use the rent collected from commercial properties held under long-term leases to support monthly dividends to shareholders. Today, we continue to maintain that same commitment to the dividend.”

I think that makes a ton of sense – if the goal of the company is to create monthly rent, why not distribute those monthly earnings back to your shareholders?

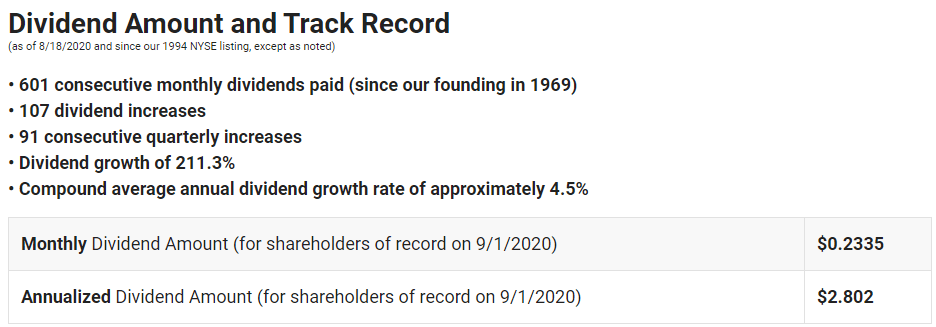

The website then goes on to talk about their amazing track record of increasing dividends throughout history:

I love that they’ve been increasing for so long and that is massive dividend growth rate over time!

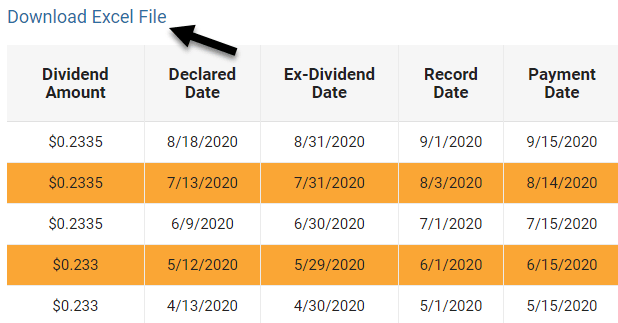

If you want to get into the weeds like I usually do, you can view their chart that shows all of the historical payouts.

Being an Excel and data nerd like I am, can you imagine the excitement that I had when there was a “download excel file” link? I honestly was geeking.

But then…

Womp womp lol.

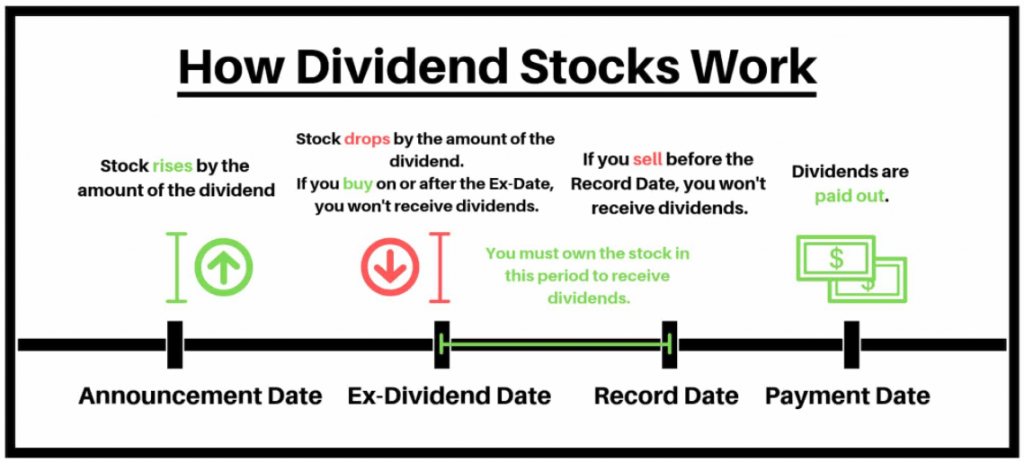

Oh well – either way, you can simply just highlight the data and then copy and paste it into Excel and it works just the same. I like this table a lot because it shows you the amount and 4 different dates, which are all extremely important to differentiate:

- Declared Date – the date that the amount of the dividend was declared

- Ex-Dividend Date – the date that you have to hold the stock by if you want to receive the dividend, so make sure you own it prior to this date.

- Record Date – the date that you must hold the stock through to receive the dividend

- Payment Date – the date that the dividend hits your account

Truthfully, I think that the chart below from Trade Options With Me is a great visual to understand the process:

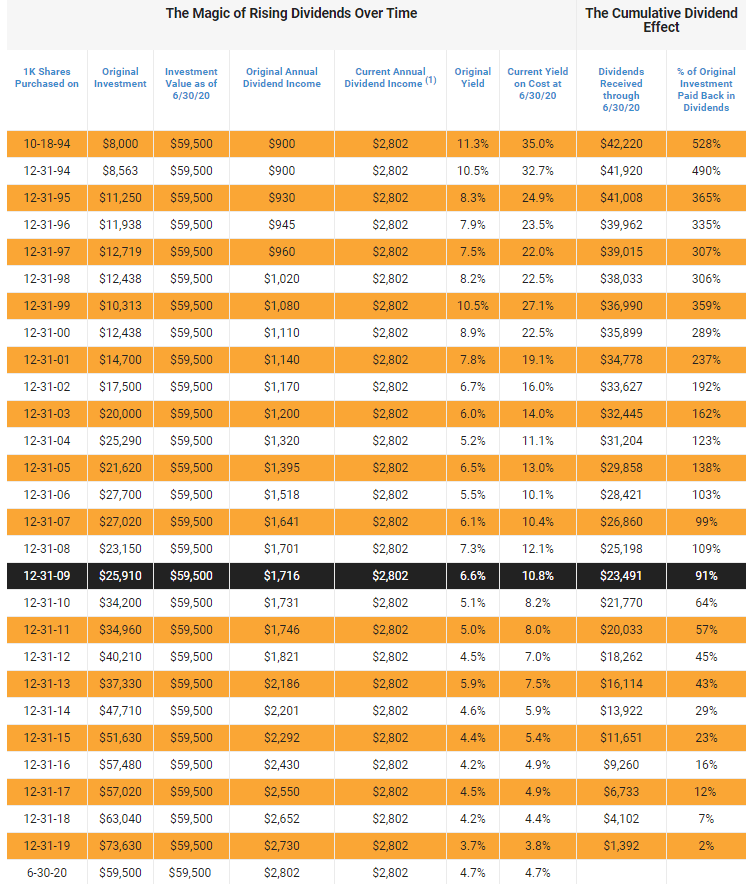

If you’re not a data nerd like I am, no worries! They also then go into a page where all they talk about is “The Magic of Rising Dividends” and show their YOY performance since 1994, which I must say, is very impressive:

The amount of years that they have continued to increase their dividend amount is super impressive to me and I love the amount of detail that O has put into really touting this performance.

It’s evident to me that they view the dividend as the most important value generator for shareholders and they don’t hide behind the thing that they are doing to continue to grow it.

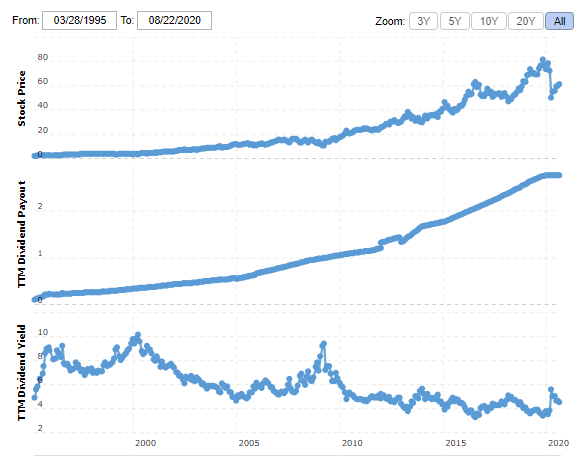

And of course, the last stop along the way for me is to go to ol’ faithful, Macrotrends and look at the dividend history. I love going to Macrotrends because it’s just a very simple graph to give you a general feel of how things have trended throughout time.

I know that the dividend has increased for many decades, so personally the thing that I get the most out of these charts are looking at the share price and the dividend yield. I like to make sure that the share price is actually increasing unlink AT&T, which many dividend investors have an infatuation with, and that the dividend yield is never getting blown way out of control.

In this case, both of these hold to be true, so those are positives in my book.

At the end of the day, from a purely dividend perspective, I think that O looks like a great company with a sustained track record of success. That being said, the dividend payment is only a very, very small portion of the entire company. If the company was to go to $0 then your 5% dividend yield wouldn’t mean squat.

So, as always, I urge you to do your own analysis and come to your own conclusion on the company, not just about the dividend itself but also about the future outlook. It’s imperative that you understand the total return projection for the company, so the share price appreciation AND the dividend payment, and not just one of those two.

If your passion for dividends is burning so strong, then I recommend that you check out JNJ or MMM, both of which are Dividend Kings meaning that they have an insane 50+ year track record of increased dividends!

Related posts:

- AOS: Dividend Aristocrat’s Phenomenal 25 Year Track Record In the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, they talked about some of the companies that have recently...

- A Look Through 3M (MMM) Dividend History If you’ve been following my posts at all, you probably see that I cover a lot of different topics, so it should be of absolutely...

- A Look Through Johnson & Johnson (JNJ) Dividend History Johnson & Johnson (JNJ) has been increasing their dividend for many, many years! In fact, that have increased it for 57 consecutive years, and as...

- A History of the HRL Dividend and Where it Could Go from Here Have you ever heard of Hormel (HRL) before? Hormel is very well known in the grocery store space, but they’re equally, and maybe even more...