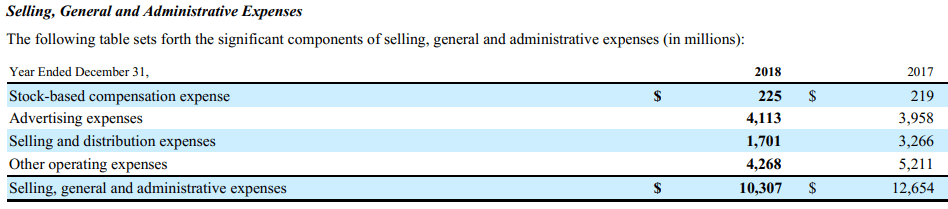

A company’s operating income is the profit associated with regular business operations before considering the financial leverage of the business, and its associated interest expense, as well as taxes. Operating income sits in the middle of the income statement, as seen below in a snapshot of Coke’s income statement. Operating income is the income left over after operating expenses have been subtracted from the company’s gross profit as can be seen in the formula below. This article will go over the details to know about operating income and expenses as well as what analysis can be learned from them.

Operating Income = Gross Profit – Operating Expenses

Sourced from Coca-Cola’s 2018 Annual Report

Operating Income is Similar to EBIT

As operating income is before interest expense, it is attributable to all contributors of capital to the business; both equity shareholders and debt lenders. Because of the items which operating income includes and excludes, the figure could also be the same as earnings before interest and taxes (EBIT) if the company does not report any non-operating income or expenses that sit further below on the income statement.

With this in mind, operating income can also be backed into by starting at net income and then adding back tax and interest expense as well as any other non-operating items of the business.

Just like with EBIT, if a new owner, or a new board of directors were considering relocating the business to a new tax regime and levering it up the way they like, operating income could be a good place to start the analysis!

Operating Income = Net Income + Tax Expense

+ Interest +/- Other Non-Operating Exp/Inc

What is Included in Operating Expenses?

Expenses which are NOT directly associated with the product a company produces, or the service it performs, are considered operating expenses. Operating expenses are support items which help the business operate successfully but they have little or nothing to do directly with the sales of the business.

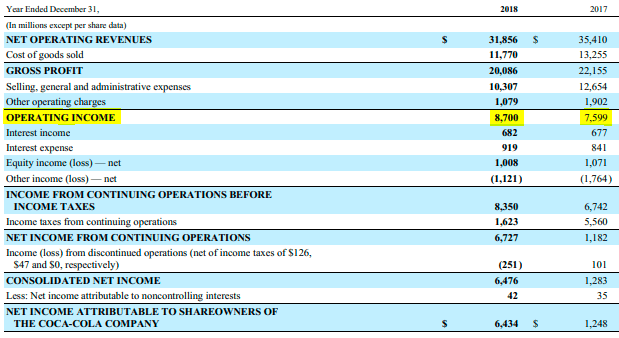

Selling, general, and administrative expenses (SG&A) is the most common item you will see as an operating expense on a company’s income statement. But hiding inside this single SG&A line item will be additional operating expense categories that are disclosed further in the notes to the financial statements. Below is a snapshot of this additional disclosure of SG&A from the notes of Coke’s financials statements:

Sourced from Coca-Cola’s 2018 Annual Report

As can be seen with Coke’s additional note disclosure, operating expenses can include items such as selling and distribution, research and development (R&D), advertising, depreciation and amortization, office rent, finance and accounting, risk management, human resources, and legal to name a few. As mentioned before, operating expenses are all support functions of a successful business but do not contribute directly to a specific sale.

Operating Expenses Should be Scalable

Unlike Cost of Goods Sold, which are variable depending on how many sales take place, operating expenses are mostly scalable. They can be described as scalable given that as sales increase, operating expenses will not increase at a 1-for-1 ratio but instead are able to be spread out over the higher sales figure to be less significant as a percent of sales.

Readers might have heard of a business being described as “fat” before. While, this all has to do with the business being bulky around the middle (of its income statement that is!).

This “fat” in the business is evident in operating expenses being higher than that of a comparable company in the same industry. The “fat” company is likely organizing its operations inefficiently, paying its management and employees too much, duplicating work, or performing unnecessary tasks.

This company could be a prime candidate for new management or an activist investor to shake things up, “trim the fat”, and get the business’s operations back in line with the competition.

What is Not Included in Operating Income?

Sitting further below the line of operating income are non-core income and expenses that have little or nothing to do with main operations of the business. Notably, operating income excludes items that are not part of the business’s regular operations.

As mentioned previously, one exclusion would be interest expense as this is a financing choice. There can also be income items that are not included such as interest income earned on idle cash and equivalents (unless the company is a bank) and investment income earned on idle cash that has been invested in marketable securities. Other items that will come up often are the gains or losses associated with the sale of property, plant, and equipment or other assets which the company is not in the business of selling.

Also noteworthy, and we will use Coke as an example again, equity accounted investments which the business owns a non-controlling stake in will be reported outside of operating income. For Coke, equity accounted investments consist of their ownership stakes in independent bottlers which provided $1,008M of income for 2018. However significant this amount may seem, the fact remains they are non-core assets which Coke does not operate themselves.

Related posts:

- Operating Leverage Formula: How to Calculate It with the Income Statement Updated 9/3/2023 “For a fundamental investor, anticipating revisions in expectations is the key to generating attractive returns. Sources of those revisions include fundamental outcomes (typically...

- Analyzing Intangible Assets and Their Impact To Assets and Operating Income The change in how companies invest their capital has grown exponentially, and accounting rules have not kept up. Intangible assets comprise a larger portion of...

- Interpreting the Statement of Cash Flows: Operating, Investing, and Financing A lot of critical information can be learned from the statement of cash flows. As cash flows to shareholders are what investing is all about,...

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...