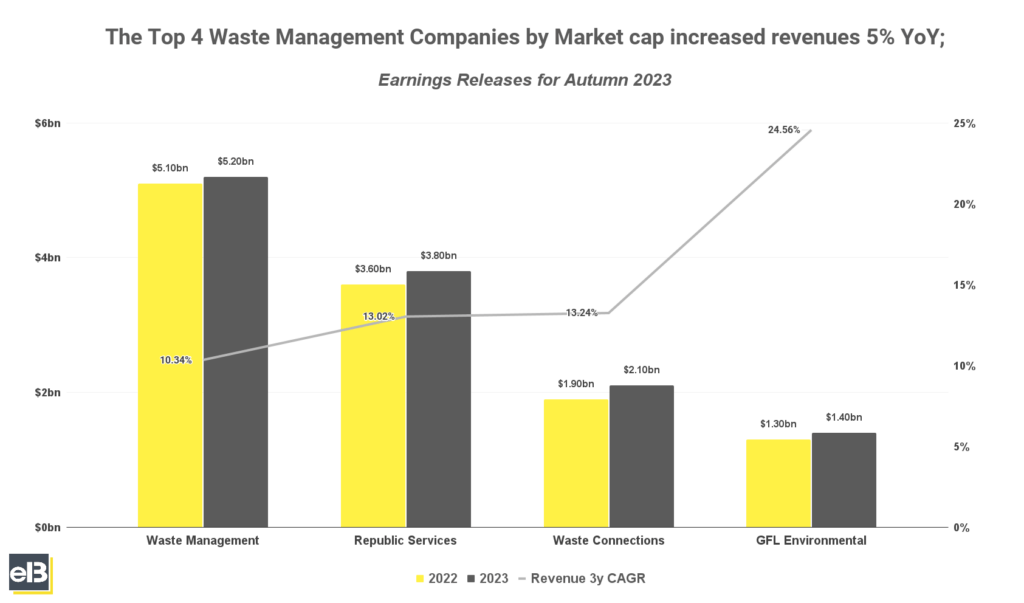

According to their latest earnings releases, the Autumn earnings results of the Top 4 Publicly Traded Waste Management companies by YoY revenues increased by 5% in the July-September quarter.

Of the publicly traded Waste Management companies that released Autumn 2023 earnings results, one leads the list and increased their YoY revenues by 9.8%, which is Waste Connections, Inc.

Waste Management, Inc. had the least increase in YoY revenues at 2.40% followed by GFL Environmental, Inc. at 3.20%.

The following sections are covered in this report [Click to Skip Ahead]:

- The Top 4 Waste Management Companies By Market Cap

- Biggest Publicly Traded Waste Management Companies by Market Share

- Top Waste Management Companies by Revenue Growth

- Top Waste Management Companies by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Waste Management, Inc. (WM) Stock Forecast

- Republic Services, Inc. (RSG) Stock Forecast

- Waste Connections, Inc. (WCN) Stock Forecast

- GFL Environmental, Inc. (GFL) Stock Forecast

The Top 4 Waste Management Companies By Market Cap

The list below only includes the top four Waste Management companies by market cap of >$10B. In the next section, all relevant >$1B market cap publicly traded waste management companies will be included.

| Company | Q3 2022 | Q3 2023 | YOY |

| Waste Management, Inc. | $5,075.00 | $5,198.00 | 2.40% |

| Republic Services, Inc. | $3,597.80 | $3,825.90 | 6.30% |

| Waste Connections, Inc. | $1,879.90 | $2,064.70 | 9.80% |

| GFL Environmental, Inc. | $1,325.80 | $1,391.50 | 3.20% |

Waste Management, Inc. reported a 2.40% increase YoY revenues in their latest Q3 2023, with a flat net income. During the recent quarter, however, reported total collection and disposal volumes increased by 1.4%. Management said it remains focused on continuing to drive operating leverage in the business, as shown by recent technology and automation upgrades in their recycling facilities and a seventh renewable natural gas facility expected to be in service in January 2024.

Republic Services, Inc. saw revenues increase by 6.3% YoY, which includes 4.6% organic growth and 1.7% growth from acquisitions. However, collection volume growth only increased by 0.1%. Management was pleased with their results and attributed the revenue growth to healthy pricing, positive organic volume growth, and above-average contribution from acquisitions.

Waste Connections, Inc. recorded a 9.8% YoY revenue increase while adjusted EBITDA was up 1.20% YoY. Management attributed the continued growth momentum to overcoming elevated levels of risk-related expenses and other lagging effects of higher employee turnover.

GFL Environmental, Inc. reported a 3.20% YoY increase in revenues, which includes the impact of divestitures. While excluding it, revenues increased by 10.30%. Solid waste pricing increase of 8.8% YoY has driven the revenue growth while environmental services contributed also, albeit slightly by 1.9% Management is optimistic and saw significant margin improvements during the quarter despite headwinds from M&A, commodity pricing and fuel.

Key Takeaway

The recent increase in quarterly revenues of waste management companies shows how resilient earnings are even in a boring waste collection, disposal, and recycling industry. The top 4 waste management companies continue to grow by M&A and healthy price increases tied to inflation and commodity and fuel prices.

It is worth noting that most of the top 4 continue investing heavily in RNG projects (renewable natural gas from landfill facilities) and are taking advantage of the increasing demand for biofuels in the energy industry.

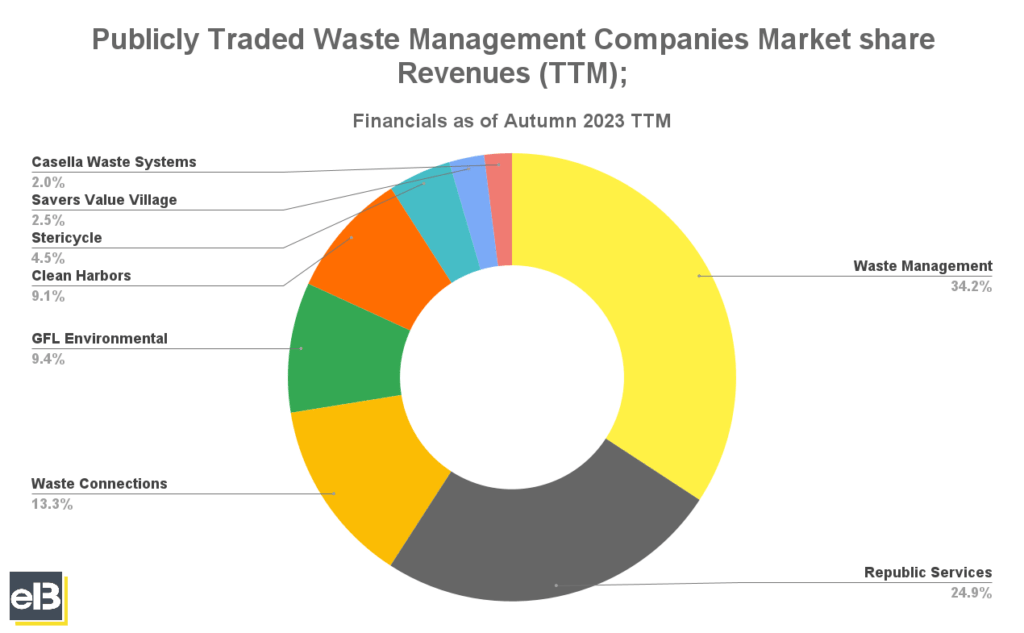

Biggest Publicly Traded Waste Management Companies by Market Share

The graph shown below comprises of >$1B market cap publicly traded waste management companies as of January 2024.

Leading the group is Waste Management with roughly 34.2% market share, followed by Republic Services with 24.9%, and behind is Waste Connections with 13.3% of Trailing Twelve Months (TTM) revenue share of all >$1B publicly traded waste management companies.

| Company | Revenues (TTM in Thousands) | Mkt Share |

| Waste Management, Inc. | $20,144,000 | 34.2% |

| Republic Services, Inc. | $14,662,700 | 24.9% |

| Waste Connections, Inc. | $7,855,643 | 13.3% |

| GFL Environmental, Inc. | $5,524,312 | 9.4% |

| Clean Harbors, Inc. | $5,349,081 | 9.1% |

| Stericycle, Inc. | $2,677,600 | 4.5% |

| Savers Value Village, Inc. | $1,484,286 | 2.5% |

| Casella Waste Systems, Inc. | $1,177,102 | 2.0% |

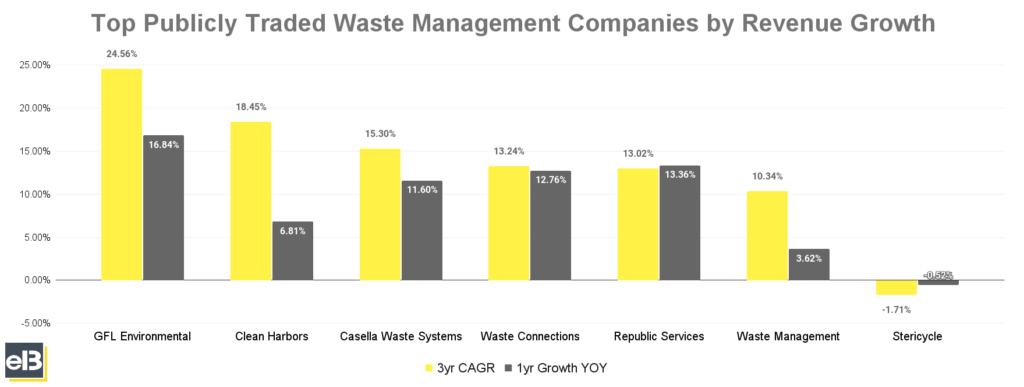

Top Waste Management Companies by Revenue Growth

In the previous three fiscal years, GFL Environmental led ahead among its peers in the waste management industry with a 24.56% CAGR in revenues.

Meanwhile, GFL Environmental still leads in boosting its year-over-year annual revenue growth of 16.84% from 2022-2023.

Clean Harbors takes the number two spot in 3yr revenue CAGR with 18.45%, while trailing behind is Casella Waste Systems and Waste Connections with 15.30% and 13.24% 3yr CAGR, respectively.

| Company | 3yr CAGR | 1yr Growth YOY |

| GFL Environmental, Inc. | 24.56% | 16.84% |

| Clean Harbors, Inc. | 18.45% | 6.81% |

| Casella Waste Systems, Inc. | 15.30% | 11.60% |

| Waste Connections, Inc. | 13.24% | 12.76% |

| Republic Services, Inc. | 13.02% | 13.36% |

| Waste Management, Inc. | 10.34% | 3.62% |

| Stericycle, Inc. | -1.71% | -0.52% |

Key Takeaway

The data above shows that the past three fiscal years have been resilient for waste management companies despite the rising fuel and labor costs. It shows a boring industry with pricing power in a relatively fragmented, low-barrier business. Operators have been efficiently managing costs, and it shows. Stericycle is an outlier; it is exposed mainly in medical waste and has the pandemic tailwind behind it.

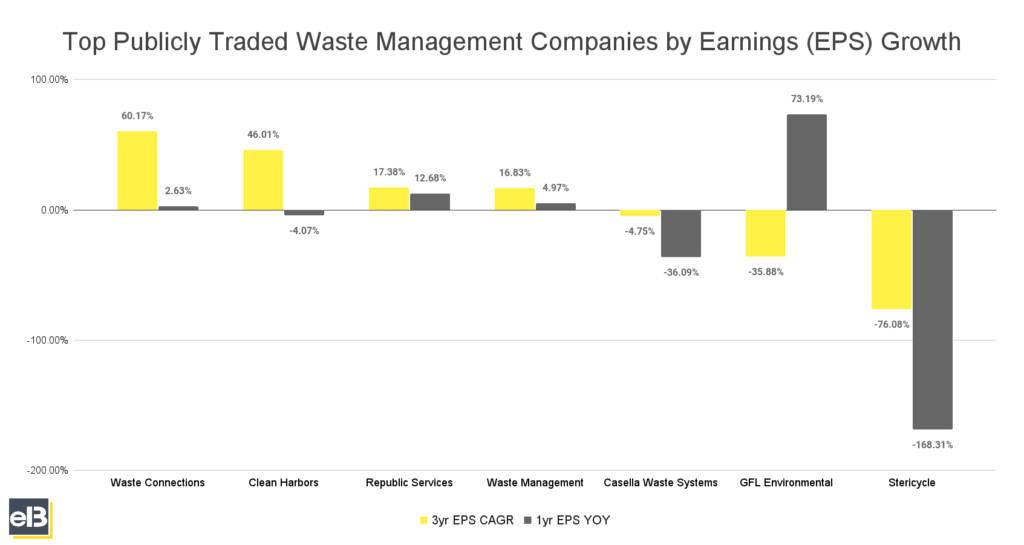

Top Waste Management Companies by Earnings (EPS) Growth

In the last three fiscal years, Waste Connections saw the highest 3 year annual compounded growth rate of 60.17% in earnings per share.

Results of the publicly traded waste management companies below are mixed, with some experiencing a sharp downturn in EPS while others steadily climb up.

Among the companies in the above graph, GFL Environmental had the highest 1-year EPS YOY growth rate of 73.19%

The list’s highest 3-year EPS CAGR companies are Waste Connections at 60.17%, Clean Harbors at 46.01%, and Republic Services at 17.38%.

| Company | 3yr EPS CAGR | 1yr EPS YOY |

| Waste Connections | 60.17% | 2.63% |

| Clean Harbors | 46.01% | -4.07% |

| Republic Services | 17.38% | 12.68% |

| Waste Management | 16.83% | 4.97% |

| Casella Waste Systems | -4.73% | -36.09% |

| GFL Environmental | -35.88% | 73.19% |

| Stericycle | -76.08% | -168.31% |

Waste Management Companies Revenue, Earnings and Stock Forecast (Quarter ending Q3 2023)

| Company | YOY EPS Forecast |

| Waste Management | 17.58% |

| Republic Services | 14.46% |

| Waste Connections | 22.18% |

| GFL Environmental | 155.55% |

Waste Management (WM) Revenue, Earnings, and Stock Forecast

Waste Management’s revenue over the latest Trailing Twelve Month period was $20.1 billion. Waste Management’s earnings (Net Income) over the latest Trailing Twelve Month period was $2.3 billion.

The Wall Street consensus for Waste Management’s EPS (earnings per share) projection for the next quarter is $1.53. The company’s TTM (trailing twelve months) Earnings Per Share was $5.70 as of the quarter ending September 30, 2023.

Waste Management is expected to see an expansion in earnings per share of 17.58% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Republic Services (RSG) Revenue, Earnings, and Stock Forecast

Republic Services’ revenue over the latest Trailing Twelve Month period was $14.7 billion. Republic Services’ earnings (Net Income) over the latest Trailing Twelve Month period was $1.6 billion.

The Wall Street consensus for Republic Services’ EPS (earnings per share) projection for the next quarter is $1.29. The company’s TTM (trailing twelve months) Earnings Per Share was $5.20 as of the quarter ending September 30, 2023.

Republic Services is expected to see an expansion in earnings per share of 14.46% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Waste Connections (WCN) Revenue, Earnings, and Stock Forecast

Waste Connections’ revenue over the latest Trailing Twelve Month period was $7.9 billion. Waste Connections’ earnings (Net Income) over the latest Trailing Twelve Month period was $0.8 billion.

The Wall Street consensus for Waste Connections’ EPS (earnings per share) projection for the next quarter is $1.09. The company’s TTM (trailing twelve months) Earnings Per Share was $3.20 as of the quarter ending September 30, 2023.

Waste Connections is expected to see an expansion in earnings per share of 22.18% YOY in the next quarter based on the consensus of stock market analyst forecasts.

GFL Environmental (GFL) Revenue, Earnings, and Stock Forecast

GFL Environmental’s revenue over the latest Trailing Twelve Month period was $5.5 billion. GFL Environmental’s earnings (Net Income) over the latest Trailing Twelve Month period was -$0.1 billion.

The Wall Street consensus for GFL Environmental’s EPS (earnings per share) projection for the next quarter is $0.21. The company’s TTM (trailing twelve months) Earnings Per Share was -$0.40 as of the quarter ending September 30, 2023.

GFL Environmental is expected to see an expansion in earnings per share of 155.55% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data mentioned in this article was sourced from publicly available filings and releases and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Waste Management Industry Report: Winter 2023 Results According to their latest earnings releases, the Winter earnings results of the Top 4 Publicly Traded Waste Management companies by YoY revenues increased by 7%...

- Publicly Traded Home Builders Report: Autumn 2023 Results Publicly available financial data collected by investment newsletter provider Sather Research, LLC showed that five Publicly Traded Home Builders by Market Cap grew Total Revenues on...

- Publicly Traded Truckload Freight Industry Report: Autumn 2023 Results Recent Autumn earnings results of the Top 5 Publicly Traded Truckload Freight companies by Q/Q Revenues decreased by -9% on average across the board in...

- Publicly Traded Logistics Companies Report: Winter 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Logistics Companies Grew Total Revenues Over 6% YOY in the October – December...