Are you new into investing and looking for a way to start investing your money? Well, look no further.

I go pretty in depth with this Stash Review, so you can understand the ins and outs of the app.

Personally, I think that Stash is a fantastic app for the beginning investor that really helps break things down in an easy to understand fashion. One of the main reasons that I think that this app will be very beneficial to a new investor is because of the platform.

The actual layout/appeal of the app is very sleek, and I think that in itself will make people more attracted to the app and more likely to use it. I know it sounds ridiculous, but I am more likely to use something that is very eye-appealing than something that looks clunky, so why wouldn’t that translate over to investing?

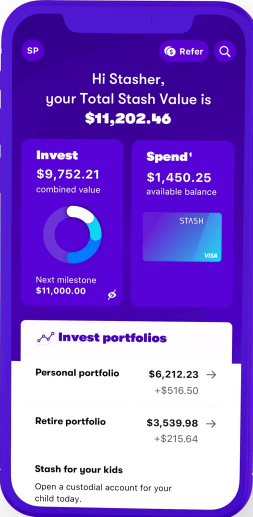

So, what does the app look like? When you first login, you fall onto the home screen where you can see what your total invested is as well as your total spend. Take a look below:

As you can see, the total investment is 9,752.21 but there are various different investment portfolios that you can have. The main three that you can invest for are:

- Personal

- Retire

- Custodial (investing for your kids)

One of the major downfalls of the Stash App, in my opinion, is that it costs money.

Don’t get me wrong, I am a very firm believer in that you get what you pay for, but in a world where things tend to be getting cheaper and cheaper with increased competition (i.e. Robinhood) I view this as a small downfall.

Now, that being said, I DO think you receive a ton of benefits with this app for the beginning investor, and I think that the fee is WORTH IT! Let’s take a look at the various plan options below:

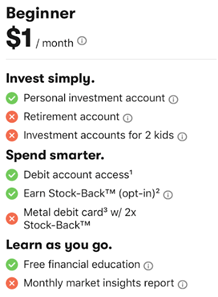

The Beginner plan is the most basic plan as you can imagine. It costs $1/month and gets you a lot of the basic options that you may need.

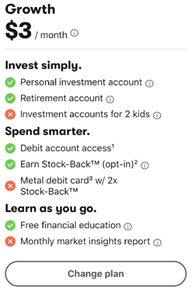

The next option is the Growth account which costs $3/month. This gets you everything in the Beginner account, as well as the ability to have a retirement account.

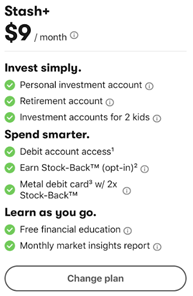

The last option is the Stash+ option. This includes everything in the Growth option, as well as the ability to have investment accounts for 2 kids, a debit card that you can use for your spending, and monthly market insight reports.

My personal opinion, because this is an HONEST review, is that the Growth plan is the one to go with.

I think that you’d be better off opening a 529 for your children so that you can still get all of the tax benefits, which the custodial plan does not offer.

The Custodial plan does offer a lot more flexibility, but it’s essentially just an investment account for your kids that they can use however they want – so it’s really just a personal preference of how you want to save and how you want that money to be spent that you saved for your kids.

18-year old Andy would’ve spent his money in a very immature way if he had the ability, but maybe that’s just me!

Now, let’s get to the fun part – the investments!

What types of things can you actually invest in?

Remember how I said that this app is great for the beginner investor? Let me show you why…

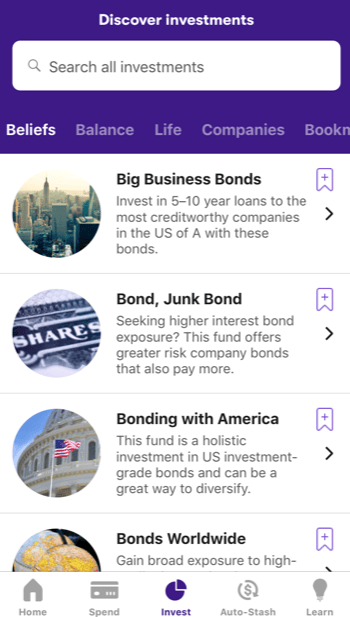

When on the invest tab, you fall onto this screen:

As you can see, there are a few different options, such as Beliefs, Balance, Life, Companies, and the last one is Bookmarks which is slightly cutoff in the screenshot.

- Beliefs – Beliefs is section that provides many ETFS that are more focused on the fundamentals, such as:

- Many various bond options

- “do the right thing”

- “inflation defense”

- “rate hike refuge”

- “women who lead”

- And many others

- Balance – this section is more so based on allowing you to have a balanced portfolio, with some of the options including ETFs such as:

- “Blue Chips”

- “Broad US Bonds”

- “Conservative Mix”

- “Corporate Cannabis”

- “Match the Market”

- “Slow and Steady”

- And many, many more

- Life – this only has three different funds that are all about your life, and include:

- “High Voltage”

- “Stocks Worldwide”

- “Young Money”

- I know this isn’t about Lil Wayne, but I’m going to pretend it is. I’m putting all of my money in this one ?

- Companies – if you want to scratch your itch of investing in individual companies, and we all think that you should scratch away, then do it here!

- You can pick from tons of companies here. They definitely don’t have every company, but a lot of the core S&P 500 companies look to be included.

I know that sometimes these reviews can be hard to follow, so let me try to recap this a bit…

In general, if you’re an entry level investor, I think Stash is a fantastic way to get into investing.

They have multiple ways that you can start to save so you can invest, as well as many great investment options. I am a very big believer in investing in individual companies, but I do also own some ETFs for some areas that I want some exposure to but want to be a bit more conservative.

I think that the ETF options are the #1 thing that makes Stash worth the monthly fee that they’re charging and notice that I said WORTH it.

If I was a brand-new investor, I would definitely utilize this platform.

And the fact that they allow you to buy individual stocks let’s you dip your toe into the water while still being safe with your other investments. As always, I highly encourage you to take a look at this yourself and see what conclusion you come to.

You can take a look online at https://www.stashinvest.com/ or simply just download the app. The worst thing that you can do as a beginning investor is to read this and completely disregard it.

Download the app and get started. Even if it isn’t exactly what you’re looking for, it’s still better than sitting on your hands, doing nothing.

Even if you take a step forward, and that step is somewhat crooked and isn’t exactly in the straight line of where you want to go, at least you’re closer than you were before.

Related posts:

- Stash vs. Acorns: Side-by-Side Investing Apps Comparison Not long ago, I wrote an article really breaking down everything that you might want to know about the Stash app . As I was...

- Upside Review: Easy Free Money, or Waste of Time Scam? You might’ve heard about the Upside app on the radio. Maybe you’re wondering if it’s worth the time. Contributor Andy Shuler took a try with...

- A Detailed Seated App Review Showing If You’ll Actually Save Money If you have read any of my other blog posts, such as one where I really outline some great frugal living tips you likely know...

- How the College Investor Has a HUGE Compounding Advantage!! When it comes to money, sometimes young adults don’t realize just how lucky they have it. By becoming a college investor rather than a “young...