There are two important sub-metrics for investors to understand on a balance sheet: tangible and intangible assets. Adding these up will sum to a company’s total assets.

The question here is twofold. Does it matter much if a high number of assets on a balance sheet come from tangible vs intangible assets? And is one preferable over another?

Let’s first define these terms.

At its most basic definition, an asset is something of value that (usually) produces an income stream. These are typically things like inventory and factory plants. I say usually because things like cash also count as an asset.

Now, assets on a balance sheet can be either tangible or intangible. A tangible asset refers to one that is physical. It’s the assets we typically think of, like the ones mentioned above.

Intangible Assets: Definition and Examples

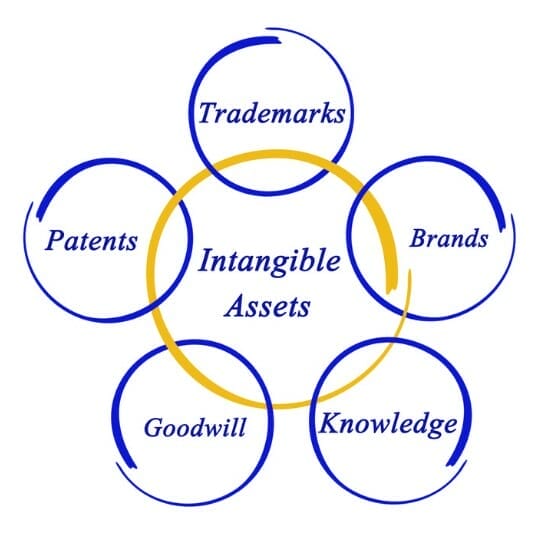

But there are also intangible assets. These are things a company owns that contribute to producing a revenue stream but aren’t physical or have a concrete value.

Examples of intangible assets are things like intellectual property, copyrights, and brand recognition.

Intellectual property can be very significant for cutting edge technology companies. Think of competitive advantages due to a certain methodology or patent/manufacturing advantage.

Copyrights are an example of important intangible assets for an entertainment/media company. The shows or movies don’t have a physical value but produce an income stream.

Brand recognition usually falls under the goodwill category on a balance sheet, which is an intangible asset metric. This can be significantly important for consumer goods companies who depend on brand loyalty.

The role of intangible assets varies for every company. It can depend on their unique business model or what industry they are in. So knowing this, does it really matter if a company’s assets are mostly tangible vs intangible?

Before answering that question, let’s go back to defining tangible assets.

Tangible Assets List (Examples)

Tangible assets are everything that are physical and either contribute to the income stream or have an obvious value.

In the balance sheet of a company’s 10-k, this includes things like:

- Cash & cash equivalents

- Short term investments

- Net receivables

- Inventory

- Long term investments

- Property, plant and equipment

Benefits of Tangible Assets

1. The problem with intangible assets is that because they aren’t physical and have a market value, their true value is debatable. While they may contribute to revenue, it’s not often clear to what extent they contribute to revenue. Because of this, the value of intangible assets must be estimated.

If you’ve ever experienced just one season of earnings reports, you’ll see that analysts estimates are rarely hit perfectly. Even with the wealth of information out there, these estimates are hard to come up with and be accurate.

The same difficulty applies to estimating intangible assets. You’ll never be able to definitely determine this number, yet it can contribute greatly to a company’s real intrinsic value.

2. The value of a company’s intangible assets isn’t likely to be consistent throughout the years. This becomes obvious as a company starts to fail. Lower sales means that a brand’s value may be decreasing, or the competitive edge of intellectual property may be closing.

As such, the value of a company’s intangible assets on a balance sheet may quickly fall.

And like mentioned earlier, this can be harder to estimate than some tangible assets, depending on the assets.

3. Intangible assets may or may not be able to be sold to another company in a bankruptcy case where a company is liquidated. Value investors like Benjamin Graham looked for stocks trading at a discount to liquidation value.

This means downside risk is greatly reduced. In the worst case, a company going bankrupt would still give the investor a positive ROI, from the sale of the company’s assets in relation to the price paid by the investor.

Tangible assets are generally considered to have higher liquidation values than intangible assets, at least depending on the company or industry. Regardless, it can be harder to estimate the liquidation value of intangible assets vs tangible assets, for all the reasons mentioned above.

Benefits of Intangible Assets

1. We talked about investors like Benjamin Graham who use a strategy such as net-net investing which depends on high tangible assets for success. In the same token, investors like Warren Buffett have historically looked for stocks with low tangible assets as part of an investing strategy.

Low tangible assets may actually be good for a company because it means their tangible assets are highly efficient. This means a company is less capital-intensive, and can compound faster and easier. When you need less capital to run a business, growth generally becomes easier.

You can find companies with low capital intensity using the ROIC formula.

This could mean that smart investments in workforce or marketing could have a greater impact than with other companies. And management’s ability to make these decisions could be considered another intangible asset.

2. The fluidity of the value of a company’s intangible assets may positively affect share price when a company is growing quickly.

This would depend on how much impact a company’s intangible assets has on increased growth. Again, this is hard to quantify but relevant to all investors regardless of strategy.

Which Type of Asset is Preferable?

We can’t just look at the above and say, well high tangible assets has 3 advantages and high intangible assets has 2… so it’s clearly the better choice. We can’t say that because the impact and weight of each advantage is debatable.

I solve this conundrum by refusing not to play. I’m not saying I’m sticking my head in the sand, but I’m solving it in other ways.

I think you want to start with a company’s cash flows, which over the long term determine the intrinsic value of a company. Starting by learning how a DCF Valuation works is an essential part of eventually understanding how to estimate intrinsic value.

Updated: 7/22/2022

Related posts:

- Is Price to Tangible Book Value Dead? A Full Guide to This Controversial Metric Warren Buffett and Ben Graham are the leading proponents of value investing. No fundamental analysis metric has a greater correlation to the company’s value than...

- How to Use Net Tangible Assets from a Company’s Balance Sheet Net tangible assets can be a very useful metric for evaluating a company’s future profitability, especially in capital intensive industries. In this blog post, I’ll...

- The Two Types of Undervalued Assets to Look For in a Balance Sheet Because of GAAP accounting rules, assets can be undervalued or even not recorded at all on a company’s balance sheet. This can be a source...

- Everything to Know on ROA, with Average ROA by Industry Data Post updated: 5/5/2023 The return on assets remains a useful measure for investors to understand. The formula offers a great way to measure the performance...