Warren Buffett and Ben Graham are the leading proponents of value investing. No fundamental analysis metric has a greater correlation to the company’s value than the price-to-book ratio. And, to a great extent, the price-to-tangible book ratio.

As value investors, we are more concerned with the value of a company and, more importantly, the book value of its assets than the earnings that Wall Street focuses the majority of its time on.

Understanding the book value of a company and how that company uses those assets to create value for the shareholders is the heartbeat of investing. A fantastic way to determine that value is the price of tangible book value.

In 2019, in the annual Letter to Shareholders, Buffett announced his use of book value as a measure of value for his company Berkshire Hathaway no longer had the same meaning it did years ago. He would no longer use the metric to value his company.

Wall Street, of course, jumped on the news and claimed book value was dead. Naturally, the assumption was wrong; Buffett was, referring to how he looked at his own company and how his assets had changed over time.

Throughout today’s post, we will see book value; tangible book value remains very much alive and can be a great tool to help you value a company’s assets.

In this post, we will learn the following:

- What is Tangible Book Value

- What is the Difference Between Book Value and Tangible Book Value

- How to Calculate Tangible Book Value with Real Companies

- How to Use Tangible Book Value to Value Companies

Ok, enough preamble; let’s dive in and learn more about the price to tangible book.

What is Price to Tangible Book?

So what is a price to tangible book? According to Investopedia:

“The price to tangible book value (PTBV) is a valuation ratio expressing the price of a security compared to its hard, or tangible, book value as reported in the company’s balance sheet. The tangible book value number is equal to the company’s total book value less than the value of any intangible assets. Intangible assets can be such items as patents, intellectual property, and goodwill.”

The easiest way to think about tangible book value per share is to remember that the number represents the amount of money we investors would receive if the company stopped functioning and liquidated all of its assets at its recorded values on the balance sheet.

Generally, if a stock trades at a higher price to tangible book per share multiple, it can leave investors with greater losses per share than companies trading at a lower ratio. This is because the tangible book value per share should reasonably be considered the lowest price at which the stock should trade.

In 2011, Buffett stated in one of his annual letters he would consider buying back any Berkshire stock when the company fell below 1.1 times its book value. Buffett indicates he feels the company trades below its fair value as its share price fell below the book value of its assets.

Price to tangible book value offers investors value, but not for every company. Notice above the explanation of what encompasses the formula, such as items like goodwill and intangible assets.

The ratio remains better suited to companies with hard assets, such as industrials, banks, insurance companies, and retailers. Price to tangible book value doesn’t offer much value in the tech world, as most of the assets are intellectual property, which remains near impossible to value; more on this in a little bit.

What is the Difference Between Book Value and Tangible Book Value?

When thinking of the differences between book value and tangible book value, consider book value as a broader overview of the value of a company’s assets.

Where tangible book value offers a more focused version of that metric, it strips out items such as goodwill and intangible assets because they can’t sell them at auction.

Book value is considered the value of assets, and hard assets are items you can sell and receive cash for them.

A good example would be if you owned a company that publishes books that you write. As you continue with your company, things continue going great, and you write several successful novels and print those books.

The money you pay for the printing presses, ink, paper, and other items for physically printing the books contains hard assets. Where the ideas, characters, and plots that capture the public’s imagination remain more intangible.

And what if your books suddenly fell out of favor, and you had to sell your company to pay off your debts. The hard assets of the printing press, paper, ink, and other items related to the printing would have value at a sale, whereas your plots, main character, or creative ideas would be much harder to place any value for sale.

Price to tangible book value would allow you to place a monetary value on your printing assets. In contrast, book value would allow you to place a monetary value on your overall business.

Let’s look at how we can calculate the price to tangible book value with a few companies.

How to Calculate Tangible Book Value with Real Companies

Before we look at a couple of examples, let’s outline the price-to-tangible book value calculation.

The formula for Price to Tangible Book Value:

P/TBV = Current Market Price / Tangible Book Value Per Share

Let’s break that down a little more.

Now, the current market price is one we can gather from any financial website. But finding the tangible book value per share will require a little sleuthing on our part, not hard sleuthing, mind you.

We have a choice of looking at the ratio either with annual numbers, or if you want a more up-to-date ratio, you can use the quarterly numbers. I will look at two examples, and we will use both methods to give you an example of how this can work.

Let’s break apart the tangible book value per share a little.

Tangible book value per share = Total Shareholders Equity – Preferred Stock – Intangible Assets / Shares Outstanding

Luckily, this formula concentrates on the balance sheet, so there won’t be much digging around other financial statements to find our data.

The first company I would like to dissect is Wells Fargo (WFC). Wells Fargo currently has a market cap of $100.7B and a current market price of $24.58.

We must look at Wells Fargo’s balance sheet to find our data.

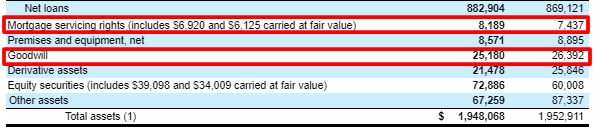

Before we go, let’s discuss intangible assets for a moment. Intangible assets are items with no hard monetary value and not always listed bunched together, so we might need to put on our Sherlock Holmes hat to find them. Luckily Wells Fargo lays it out in the notes section for us what they consider part of intangible assets.

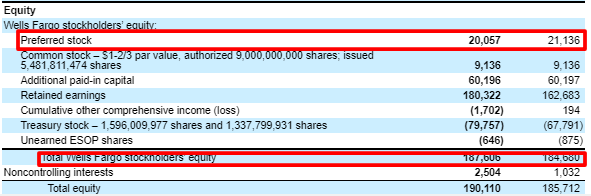

From the balance sheet, we can gather the following:

- Shareholders equity – $187,606 million

- Preferred Stock – $20,057 million

And from the intangible assets notes, we can gather our information to determine what constitutes intangible assets, according to Wells Fargo.

- Mortgage servicing rights (MSR) – $8,189 million

- Goodwill – $25,180 million

If we total all those items, we get a value of $33,369 million for intangible assets.

Again, items that are considered intangible are:

- Goodwill

- Amortization

- Trademarks

- MSR –refers to amortization or fair value assumptions of mortgage loans. In Wells Fargo’s case, they are the largest mortgage lender in the US, and amortization is an intangible asset.

Now that we have determined all the inputs for our formula let’s plug them all in and calculate.

- Current Price = $40.23

- Shareholders’ Equity – $187,606 million

- Preferred Stock – $20,057 million

- Intangible Assets – $33,369 million

- Shares Outstanding – 3936

P/TBV = 40.23 /( ( 187,606 – 20,057 – 33,369 ) / 3936 ))

P/TBV = 40.23 / 34.09

P/TBV = 1.18

Ok, that was pretty cool and not too hard, hopefully.

Let’s tackle another, shall we?

Next up, Prudential Financial (PRU) is an insurance company specializing in annuities and retirement products. Prudential currently has a market price of $90.84 and a market cap of $33.9 billion.

For Prudential, we will look at the annual numbers to calculate our price to tangible book value, pulling from the balance sheet.

Pulling the annual numbers together:

- Price ending 2022 – $90.84

- Shares Outstanding – 380

- Shareholders’ Equity – $62,608 million

- Preferred Stock – 0

- Intangible Assets – $1,804 million

- Goodwill – $1,804 million

- Amortization – $0

Now we can plug all the numbers into the formula.

P/TBV = 90.84 / (( 62,608 – 0 – 1,804) / 380 )

P/TBV = 90.84 / 160.01

P/TBV = 0.57

Ok, I think we are getting the hang of this. Now let’s take some of our calculations and analyze valuation.

Using Tangible Book Value to Value Companies

Now that we have calculated the price to tangible book of a few companies, let’s see how we can put this to use to value a company with this ratio.

We can use several methods, but one note of caution. Whenever calculating intrinsic value, remember that these are just estimates, and we need to do our due diligence along with these calculations to determine if the investment is right for us.

The first would be to take a longer view of the historical outlook of the price to tangible book value per share. I recommend at least five years to give you a good view of Prudential’s performance.

- 2018 = 0.73

- 2019 = 0.57

- 2020 = 0.47

- 2021 = 0.66

- TTM = 1.20

Now that exercise can give us a range of P/TBVPS; we can find the median over the last five years. We can also see the upward trend of the tangible book value over the period and the steady range of pricing.

The median price to tangible book value over the ten quarters is 0.66.

Now we can take that median range and multiply that by the tangible book value per share we calculate for the present quarter, which would be $159.64.

Intrinsic Value = Tangible Book Value per Share * Price per Tangible Book Value per Share

Intrinsic Value = $159.64 * 0.66

Intrinsic Value = $105.36

That would tell us what the tangible book value of the assets for Prudential would be worth in the market. The current market price of Prudential is $90.84, which would indicate that Prudential is undervalued compared to the tangible book value of its assets.

Suppose you wanted to shortcut the historical median. In that case, you could take the current tangible book value and multiply it by the price of tangible book value of the current quarter.

For Wells Fargo, that would be:

- Current Tangible Book Value per Share – $36.75

- Current Price to Tangible Book Value – 1.10

Intrinsic Value = $36.75 * 1.10

Intrinsic Value = $40.43

With Wells Fargo’s current market price of $40.34, it appears that the company remains fairly priced according to its tangible book value.

The other valuation opportunity with the multiple is the theory of multiple expansion.

For example, in our examples of Wells Fargo, which currently has a price-to-tangible book value of 1.10, the median for Wells Fargo is 1.32.

Then you could multiply the current market price by 1.32 and arrive at the price for Wells Fargo under “normal” market conditions for the bank.

The calculation price equals $48.51, in the range Wells Fargo traded at before the Coronavirus pandemic hit the world.

Using that type of valuation remains very simple and offers a quick way to see if the company trades at a discount and might warrant further study. In the case of Wells Fargo, the company has undergone some wounds of its own making, and the market continues beating up financials. All these ideas play in our minds when valuing a company.

These valuation techniques are simple and easy to execute, don’t require a lot of higher math, and can get you in the ballpark.

Remember what Warren and Charlie like to tell us; it is better to be approximately right than precisely wrong. Valuation remains an art and a science, and it doesn’t get caught up in finding that perfect number; rather, use these tools as a means to an end. Try to find the perfect investment for you and your risk appetite.

Final Thoughts

As we have seen, a company’s book value and tangible book per share don’t always reflect its true value. The assets may be on the balance sheets, but the book value includes items such as goodwill, amortization, and intangibles, which are difficult to assign a dollar amount. Book value may underestimate the true economic values of the assets. Still, it also may overestimate their true economic value because the assets such as real estate can become obsolete.

Financial companies such as banks, insurance companies, and investment banks typically report the current market value of the assets owned, such as loans or insurance premiums.

Generally, the book values of financial companies are a more accurate indicator of the company’s economic value, and tangible book values are an even more true indicator of the company’s value.

That will wrap up our discussion on the price to tangible book value. I hope you found something of value in this post, and thank you, as always, for taking the time to read it.

If you have any questions or if I can be of any further assistance, please don’t hesitate to reach out.

Until next time.

Take care and be safe out there,

Dave

Related posts:

- How to Use Net Tangible Assets from a Company’s Balance Sheet Net tangible assets can be a very useful metric for evaluating a company’s future profitability, especially in capital intensive industries. In this blog post, I’ll...

- Balance Sheet Debate: Tangible vs Intangible Assets– Which is Better? There are two important sub-metrics for investors to understand on a balance sheet: tangible and intangible assets. Adding these up will sum to a company’s...

- Beginner’s Guide to the Price to Book Ratio “Price is what you pay. Value is what you get.” –Warren Buffett The price-to-book ratio remains a top valuation metric for certain companies like banks,...

- BVPS: How Valuable is it to Know the True Value of a Stock? The book value per share (BVPS) ratio compares stockholders’ equity to the total number of outstanding shares. In other words, this calculates a company’s per-share...