In investing, understanding financial metrics is like having a roadmap in a complex landscape. For beginners, terms like EBT, EBIT, and EBITDA can sound like a confusing alphabet soup.

In this blog post, we’ll break down these crucial metrics in an easy-to-understand way. Whether you’re a budding investor or simply curious about financial analysis, this guide will help you grasp the essentials of EBT, EBIT, and EBITDA and why they matter in investing.

In today’s post, we will learn:

- What are EBT, EBIT, and EBIT?

- How is Each Metric Calculated?

- Key Differences Between EBT, EBIT, and EBITDA

- How Should Investors Interpret These Metrics While Assessing Investment Opportunities?

Okay, let’s dive in and learn more about EBT, EBIT, and EBITDA.

What are EBT, EBIT, and EBITDA?

Imagine you’re assessing a company’s financial health.

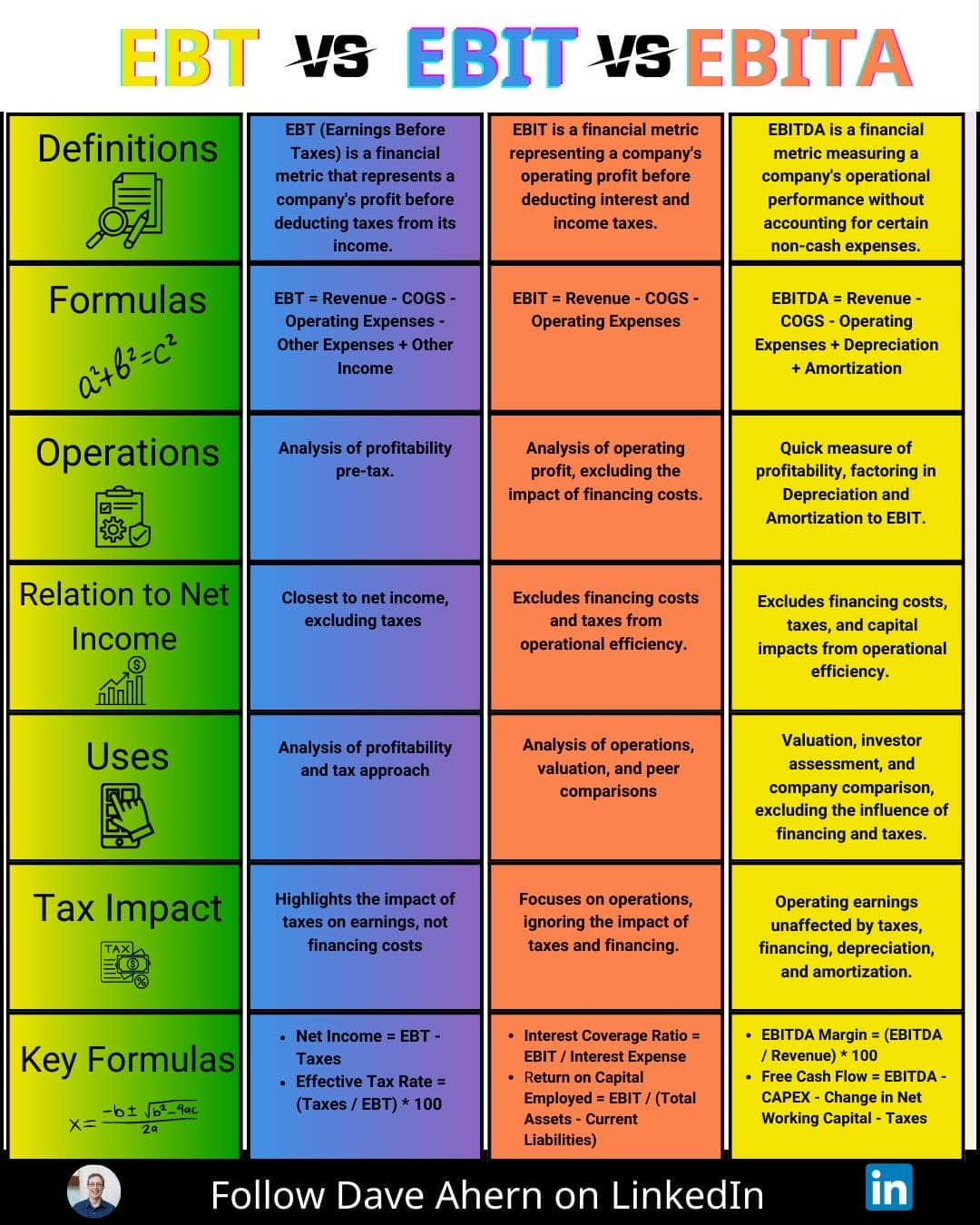

You’ll encounter various metrics, but three stand out: EBT (Earnings Before Tax), EBIT (Earnings Before Interest and Taxes), and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). These metrics magnify the company’s operational performance without certain accounting and financial influences.

1. EBT (Earnings Before Taxes):

- Definition: EBT stands for Earnings Before Taxes. It measures a company’s profitability and includes all expenses except taxes. It is calculated by subtracting all operating and non-operating expenses from revenue before deducting taxes.

- Importance for Investors: EBT is important because it provides a clear picture of a company’s operational efficiency without the impact of tax strategies and tax jurisdictions. This makes it easier to compare companies in different regions or countries where tax rates may vary.

2. EBIT (Earnings Before Interest and Taxes):

- Definition: EBIT stands for Earnings Before Interest and Taxes. It measures a company’s profitability based on its core business operations, excluding the effects of interest and taxes. It’s calculated by subtracting operating expenses (excluding interest and taxes) from revenue.

- Importance for Investors: EBIT is crucial for investors as it shows the profitability of a company’s core operations without being influenced by debt structure (interest expenses) and tax regimes. This allows for better comparisons between companies with different capital structures and tax situations.

3. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

- Definition: EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It provides a view of a company’s operational profitability by removing the effects of non-cash expenses like depreciation and amortization, as well as interest and taxes. It’s calculated by adding depreciation and amortization expenses back to EBIT.

- Importance for Investors: EBITDA is widely used by investors as it gives a clearer picture of a company’s operating performance and cash flow potential, independent of its financing, accounting decisions, and tax environments. It is especially useful in industries with large capital expenditures, as it shows the cash-generating ability of the company’s core operations.

Each metric strips away certain expenses or financial impacts to clarify a company’s financial health.

They remain particularly useful for comparing companies within the same industry, where we can assume similar operational structures and costs. Investors use these metrics to assess profitability and operational efficiency and to compare companies without the noise of tax, capital structure, and non-cash accounting figures like depreciation and amortization.

This gives investors a lens to view the company’s core profitability from its operations, free from the influence of accounting decisions and capital structure.

How is Each Metric Calculated?

To calculate EBT, EBIT, and EBITDA, you primarily use information from a company’s income statement.

Here’s a breakdown of how each metric is calculated and where you can find the necessary information:

1. EBT (Earnings Before Taxes):

- How to Calculate: We can calculate EBT by subtracting all operating and non-operating expenses (except taxes) from a company’s total revenues. The formula for EBT = Revenue – Operating Expenses – Non-Operating Expenses (excluding taxes).

- The income statement contains all the required data. It lists both revenues and expenses, with EBT often reported as a line item before the income tax expense.

- Example from Microsoft, all numbers in millions unless otherwise stated:

- Revenue = $211,915

- Operating expenses = $179,889

- Non-operating expenses = $1,527

- EBT = $211,915 – $179,889 – $1,527 = $30,499

2. EBIT (Earnings Before Interest and Taxes):

- How to Calculate: We can calculate EBIT by subtracting operating expenses from revenue before deducting interest and taxes. The formula for EBIT = Revenue – Operating Expenses – Non-Operating Expenses (excluding taxes), or EBIT = EBT + Interest Expense.

- Where to Find the Information: The income statement contains the necessary information. Revenue, operating expenses, and often EBIT itself have a listing. If EBIT doesn’t have a direct listing, you can calculate it by adding interest expenses to EBT.

- Using Microsoft again, same rules:

- Revenue = $211,915

- Cost of goods sold = $65,711

- Operating expenses = 56,729

- EBIT = $211,915 – $65,711 – $56,729 = $89,475

3. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

- How to Calculate: EBITDA is calculated by adding back depreciation and amortization expenses to EBIT. The formula is: EBITDA = EBIT + Depreciation Expense + Amortization Expense. Alternatively, it can be calculated directly from revenue by subtracting operating expenses (excluding depreciation and amortization) and adding back interest and taxes: EBITDA = Revenue – Operating Expenses (excluding D&A) + Interest + Taxes.

- Where to Find the Information: Information for calculating EBITDA is also primarily found on the income statement. Revenue, operating expenses, and EBIT are listed, along with depreciation and amortization expenses. Sometimes, these last two are included in operating expenses, and in such cases, they need to be added back to calculate EBITDA.

- Same as before with Microsoft:

- Revenue = $211,915

- Cost of goods sold = $65,711

- Operating expenses = $56,729

- Interest expense = $1,995

- Depreciation = $11,000

- Amortization = $2,500

- EBITDA = $211,915 – $65,711 – $56,729 + $1,995 + $11,000 + $2,500 = $104,970

The income statement is the key financial statement for calculating EBT, EBIT, and EBITDA.

These metrics provide insight into different aspects of a company’s profitability and operational efficiency, excluding certain expenses to focus on specific areas of financial performance. It’s important to note that while these calculations are standard, some variations might exist depending on the accounting policies of specific companies.

For example, some companies, such as Microsoft, don’t list depreciation and amortization as separate line items on the income statement. You must look at the cash flow statement to find the individual numbers. Others might not list the interest expense as separate items.

So, unfortunately, you might have to dig around a bit to find the necessary information.

Key Differences Between EBT, EBIT, and EBITDA

The key differences between EBT, EBIT, and EBITDA lie in what each metric includes or excludes from its calculation.

Each provides a different perspective on a company’s financial performance by progressively removing certain types of expenses:

1. EBT (Earnings Before Taxes):

- Focus: EBT focuses on a company’s profitability, including all operational and non-operational expenses, excluding taxes.

- Excludes: Only taxes are excluded in the calculation of EBT.

- Significance: EBT is valuable for assessing profitability without the influence of tax strategies, making it useful for comparing companies across different tax jurisdictions.

2. EBIT (Earnings Before Interest and Taxes):

- Focus: EBIT goes further by excluding interest expenses in addition to taxes. This focuses on the company’s operational profitability.

- Excludes: Both interest expenses and taxes are excluded in EBIT.

- Significance: EBIT remains useful for comparing companies with different capital structures and debt levels. By excluding interest, EBIT provides a clear view of a company’s operating performance irrespective of how they finance the operations.

3. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

- Focus: EBITDA excludes depreciation and amortization expenses, focusing on a company’s core operations’ cash-generating ability.

- Excludes: Interest, taxes, depreciation, and amortization are all excluded in EBITDA.

- Significance: EBITDA remains particularly helpful in industries where large investments in fixed assets are common. EBITDA provides insight into the company’s operational cash flow by removing non-cash expenses like depreciation and amortization.

In essence, as you move from EBT to EBIT to EBITDA, you progressively exclude more types of expenses:

- EBT gives the broadest measure of profitability, including all operational costs.

- EBIT provides a view of operational profitability irrespective of financing structure.

- EBITDA offers a closer look at operational cash flow and efficiency, removing the effects of financing, taxation, and accounting decisions on long-term assets.

Each metric serves a different purpose and offers useful information in different contexts, depending on what aspect of the company’s financial performance or efficiency an investor or analyst is interested in examining.

How Should Investors Interpret These Metrics While Assessing Investment Opportunities?

When investors analyze companies for investment purposes, it is crucial to understand and interpret metrics like EBT, EBIT, and EBITDA.

These metrics, each focusing on different aspects of a company’s financial performance, offer valuable insights but must be interpreted within the appropriate context.

EBT indicates a company’s profitability before the impact of tax policies.

It remains particularly useful for comparing companies across different tax jurisdictions. High EBT indicates strong profitability; however, investors should remain cautious as this metric does not account for the cost of debt (interest expenses). EBT might give an inflated sense of profitability in industries where companies have heavy leverage.

Thus, while EBT helps us analyze operational efficiency, we should use it with the company’s debt and interest expenses to understand the full picture.

EBIT takes the analysis a step further by excluding interest expenses and taxes.

This metric remains crucial for investors who wish to understand the profitability of a company’s core operations, irrespective of its financing structure. A high EBIT indicates profitable operational activities within a company. However, EBIT can mislead industries with significant debt, as the cost of servicing this debt is not considered.

Therefore, while EBIT is a strong indicator of operational profitability, investors should also look at the company’s debt levels and interest expenses to assess the sustainability of its profits.

EBITDA extends beyond EBIT by also excluding non-cash expenses like depreciation and amortization.

This metric is highly valuable in capital-intensive industries where significant investments in fixed assets can lead to substantial depreciation and amortization charges. EBITDA offers a clearer view of the company’s operational cash flow and efficiency. It indicates how much cash the company generates from its core operations. It is crucial to assess its ability to sustain and grow its operations, pay off debt, and fund new projects.

However, it’s important to note that by excluding depreciation and amortization, EBITDA can overstate the financial performance of companies with substantial fixed assets.

Hence, while EBITDA is a useful measure of cash flow, investors should not overlook long-term investment needs and asset depreciation.

When interpreting these metrics, investors should consider them about each other and in the context of the company’s industry. For instance, in industries like technology or services, where fixed assets and depreciation are less significant, EBIT and EBITDA may provide similar insights. In contrast, in manufacturing or telecommunications, where fixed assets play a crucial role, the difference between EBIT and EBITDA can be substantial and informative.

Additionally, these metrics should be used with other financial analyses, such as liquidity ratios, return on equity, and revenue growth rates, to develop a comprehensive understanding of a company’s financial health.

It is also important to consider non-financial factors such as market position, competitive advantage, management quality, and industry trends.

In conclusion, while EBT, EBIT, and EBITDA are powerful tools for evaluating a company’s financial performance, investors should use them judiciously and with a broader analysis.

Understanding the nuances of each metric and how they relate to a company’s operational, financial, and industry context is key to making informed investment decisions.

Investor Takeaway

Understanding EBT, EBIT, and EBITDA is like having a key to unlock a company’s real financial story.

Each metric offers a unique perspective, helping investors make more informed decisions. By mastering these concepts, you’re not just memorizing acronyms, but equipping yourself with crucial tools for smart investing. Keep these metrics in your analytical toolkit as you continue your investment journey, and watch how they illuminate your path to financial insights.

We will wrap up our discussions on understanding EBT, EBIT, and EBITDA.

Thank you for reading today’s post, and I hope you find something of value here.

If I can be of any further assistance, don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- How to Calculate NOPLAT for Operating ROIC Both NOPLAT and ROIC can be easily misinterpreted and misused in its applications to understanding a business. NOPLAT gets especially mishandled due to its more...

- Return on Capital Employed: Ratio for Profitability and Capital Efficiency Updated 2/7/2024 One of Terry Smith’s investing foundations’ main pillars is investing in good companies, which he defines as companies with high returns on capital...

- Invested Capital Formula: The Exact Balance Sheet Line Items to Use Updated: 5/22/2023 Invested capital is one of the main components of the popular Return on Invested Capital, or ROIC, metric. There are two main ways...

- Cash Return On Invested Capital: “Insider” Formula for Earnings Cash is king, and finding companies that are superior reinvestors of that cash is one of the trifectas of winning in investing. One of the...