Accounting scandals can be a death knell to investors of a public company. There’s various ways to sniff out accounting “shenanigans”, but one of the easiest ways is to scan the auditor’s report of the 10-k. Essentially, you want to determine whether there’s a qualified or unqualified audit opinion, by looking for a few keywords.

This post will:

- Define the basics (which at first sound counter-intuitive).

- Give examples directly from recent company 10-k’s.

- Shortcut for quickly sifting out the audit opinion when reading a 10-k.

The Basics of Audit Opinions

An unqualified audit opinion is a “clean report”. This means an auditor believes that all GAAP metrics and accounting policies seem to be fairly presented. The auditor doesn’t need to “qualify” the audit (make an exception for), it seems that the annual report is transparent and compliant.

On the contrary, a qualified audit opinion is one that needs further explanation or a disclaimer, not to say that the annual report is deceptive, but that there is an issue(s) with the representation. So a qualified report is not clean, and will outline exceptions or disagreements between the auditor and the report.

Audit Opinion: Sports Metaphor

Think of it this way—in a sports tournament, you might see a “qualifying” round. In qualifiers, a team needs to prove their worth, they are not allowed to play “as-is”.

So if the opposite of qualifying is “unqualifying”, then a team not in qualifiers doesn’t need to prove their worth to be in the tournament—like a financial statement that doesn’t need further “qualifying” (explanation) on why it is adequate.

Examples of Both Types of Audit Opinions

For the first example, I’ll show you a simple, pretty boilerplate unqualified auditor opinion. To follow along at home, pull up any 10-k on sec.gov and scroll down to REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, which can usually be found in Item 8: Financial Statements and Supplementary Data, usually right above the Consolidated Financial Statements.

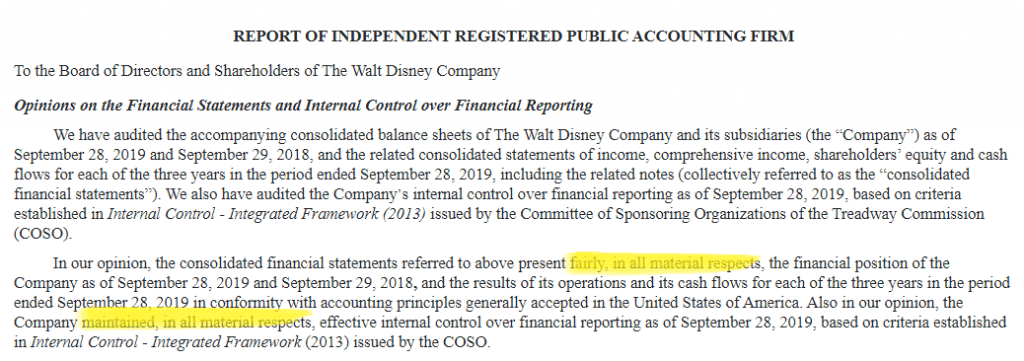

I’ll do that for a 10-k for Disney ($DIS) filed on 11/20/19. Here’s a screenshot:

Notice that the auditor never explicitly said that the report was an unqualified opinion, but you should be able to infer that based on the language they use in the notes containing their opinion.

I’ll also tend to look for the audit company’s signature in the annual report if I’m having trouble locating their opinion notes, as their opinion tends to be not too far above their signature. The signature could look something like this:

Now here’s an example of a qualified audit opinion in a real world setting. I remember this one vividly because it was a stock that burned me, before I knew the importance of checking for accounting transparency.

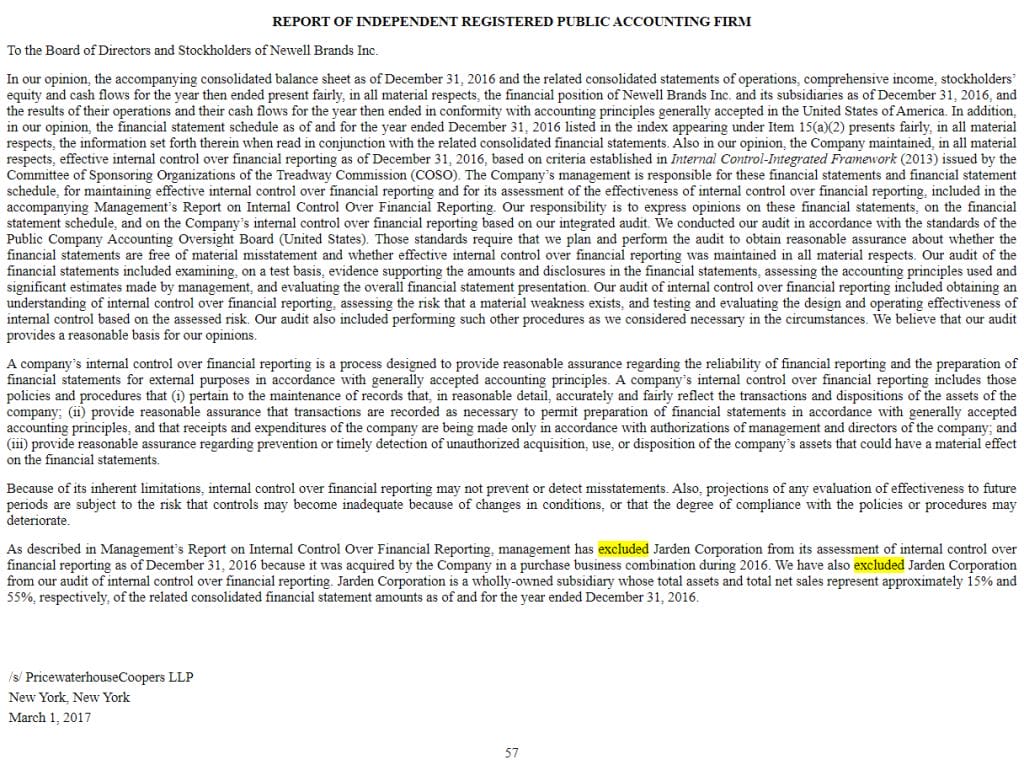

From the 10-k for Newell Brands ($NWL) filed on 3/1/17:

In this case it wasn’t the financial statements that carried a qualified audit opinion, but rather it was the financials from the company’s latest acquisition, Jarden Corporation, that were excluded from the auditor’s audit opinion analysis.

This had a major impact in one of the quarters to follow, where auditors and the company reported an $8.3B goodwill impairment to their earnings, which represented 96% of the stock’s market capitalization at the time.

So, not only do the financial statements need to be transparent, but also it’s reasonable for investors to expect financials from acquisitions to be transparent too, when possible.

If not—maybe it’s worth the wait to see when the impacts from an acquisition are audited with an unqualified opinion.

Note that most 10-k’s will have an unqualified audit opinion from the auditor.

It’s up to us to sniff out the rare qualified ones though.

How to Quickly Scan For a Qualified or Unqualified Audit Opinion

I found this trick from a 1st year hedge fund analyst in a discussion forum online, and thought it explains one of the best ways to sniff out a qualified audit opinion—generally meaning a company you might want to consider avoiding due to the inconsistency of its reporting and financial figures.

Basically, the analyst says to look for the following phrases “fairly, in all material respects” and “maintained, in all material respects” inside the annual report (Item 8 of the 10-k).

However, by checking for these phrases, “maintained, in all material respects” and “fairly, in all material respects”—you should be able to confirm that the audit opinion is in fact unqualified, with no need for additional clarification.

But if those phrases are not in Item 8 of the report, then this section should really be examined with a fine-tooth comb to sift out why the auditor chooses not to use the common phrases in their note.

If, while reading the 10-k, you find phrases like:

- “in our opinion, except for”

- “incorrect determination”

- “determined to be necessary had we been able to perform proper procedures”

- “we have also excluded”

Or any variation thereof.

But, as we saw with the Newell Brands example, those key phrases could be in there but still carry an exception later in the note, such as when it said “We have also excluded Jarden Corporation from our audit of internal control over financial reporting”.

So the shortcut is nice to use, but also be sure to scan for any “exceptions” as well.

Investor Takeaway

I hope that the importance of these two very different auditor opinions is made clear to you.

Those big stock crashes that you’ll see in stock prices often come from revelations on the Street that there’s some accounting chicanery happening in the financials, which is often spotted by auditors who in their work are examining numbers reported by management the most closely.

Think about it, these auditors will want to cover their back if they want to maintain any sort of credibility (which is so important with the vast number of firms they will serve), and making a qualified audit opinion is a great way to do this without sounding off the alarm bells and biting the hand that feeds, so to say.

Humans’ only chance against A.I. is words, not numbers

Of course, Item 8 of the annual report isn’t the only important section or footnote that’s easy to gloss over when you read the 10-k—which is increasingly more important in the days of AI and algorithmic trading based on financial data.

It’ll be hard for a machine to pick up on important adjustments to financial figures, and as such there’s huge opportunities for investors and analysts to find these discrepancies and apply them to their models.

And it’ll be hard for the human investor to compete with all of the new factor investing funds that use algorithms to buy stocks with great value metrics, which is why reading the words along with the numbers can give you that edge.

In this case of this 10-k section, the usefulness is in what stocks to exclude, rather than what stocks could provide alpha.

To continue in your investigation of the 10-k, I highly recommend the following blog posts covering more minute, critical details of the annual report:

- How to Test Goodwill & Intangibles for Possible Impairments

- Maintenance Capital Expenditures: The Easy Way to Calculate It

- Operating Leases Now in the Balance Sheet – GAAP Accounting Made Simple

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Financial Shenanigans: 6 Ways to Analyze Financial Reports for Fraud Question for you? Do you think companies practice to deceive investors by practicing financial shenanigans or intentionally set up financial statements to deceive investors? Unfortunately,...

- Explaining Management Discussion and Analysis (MD&A); 10-k Overview The Management Discussion and Analysis, or MD&A, portion of the 10-k is the meat and potatoes of a company’s annual report and one of the...

- GAAP Accounting Rules: The 4 Basic Principles Investors Should Know Most think of Accounting as this dry profession we only need to consider around tax time, but as an investor, understanding how accounting works on...

- How to Read the 10-k (Annual Report) If you want to learn more about a company or invest in a company, you can find a plethora of information on the company’s annual...