Anyone can become a good investor. You just need a little work, a little patience, and the desire to improve. Here are 25 investing tips specific to beginners, to help you on your way.

Updated: 10/17/2022

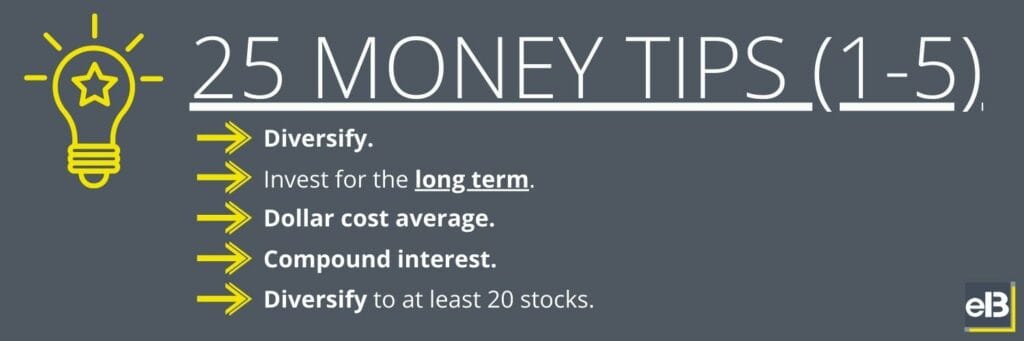

1. First and foremost… diversify

As a beginner, this first tip is the most important one you need to process. Yes, any investment carries with it some sort of risk, but much, if not all, of it dissolves if you diversify.

Don’t load up in company stock where you work. Remember the Enron’s of the world. The truth is, nobody knows what the future will hold. So be prepared, and diversify.

Most of your investments will probably go up over the long term. One or two bad investments won’t, and you can’t lose your future on one unlucky pick. A basket of investments, therefore, will almost certainly go up.

2. Long term plan is a winning plan

The market peaks and it crashes. This we know. But over the last 100 years, the stock market has averaged around 10% annual returns.

This is an encouraging fact. Investments in the stock market are like roller coasters. You won’t get hurt, as long as you don’t jump off during the ride.

A bear market, stock market crash, recession, and even depression aren’t new or unique circumstances. In fact, we have regularly seen recessions and recoveries dating back to 1600s.

3. If you want to be successful, dollar cost average

My investing mentor gave me the biggest tip for success in the stock market, and that was to dollar cost average.

Dollar cost averaging is simply investing the same amount of money consistently. I like to invest monthly. Of course, you can always add more, but dollar cost averaging keeps a minimum investment at all times.

This helps immensely in mitigating market timing, allowing me to profit no matter what the market is doing. It naturally helps you buy low, sell high. You’ll see this concept is also one of the most important with investing.

4. Compounding interest is your best friend

Albert Einstein also called it the “8th wonder of the world” and for good reason. Investing your money works so well because of compounding interest.

You can’t work as hard or as long as money can. Once you put money away, and start investing it… it makes you more money. If you reinvest that made money, you grow your pile of wealth. As the made money makes you more money, your wealth grows like a snowball.

Once you’ve been investing for many years, that snowball will grow exponentially. Just the sheer physics behind the numbers makes big numbers get bigger– thus the phenomenon of “the rich get richer.” It’s because of the math of compounding interest.

5. Diversify to at least 20 stocks

Various studies have shown that the best diversification for individual stocks is around 15-20, with 20 being ideal.

If you think about it, 20 stocks means that each position is only worth 5% of your portfolio. This means in the worst case scenario, if one company goes bankrupt, you are only down 5%.

Anything over 25 and the effects of diversification (for volatility) start to see a law of diminishing returns effect.

This tip is debatable, and if you’re interested in learning more, I recommend reading my rabbit hole on the myth of “overdiversification.”

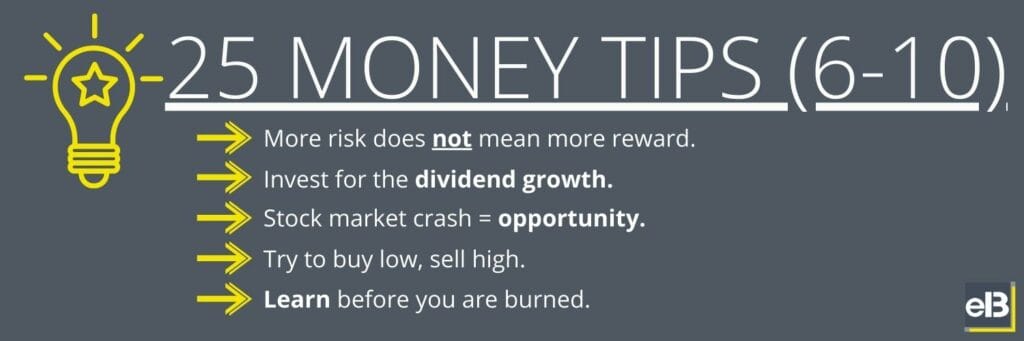

6. More risk does not mean more reward

Academics have done a good job of brainwashing investors into thinking that more reward can only come from more risk.

It’s just not true. If it was, then “buy low, sell high” wouldn’t work.

In fact, I argue that the stocks with less risk are also more susceptible to higher reward. It all depends on how you define risk, and the ones who do it correctly are bound to profit more than everyone else.

7. Invest for the dividend growth

Traditionally, investors bought stocks for the dividend payments. As the market became more gamified and overrun by greed, this basic fundamental has long been forgotten.

While a stock price going higher is a nice thing, it shouldn’t be the ultimate goal of an investment. Like for real estate, you should invest for the income stream so that you can make compounding interest.

Investors like companies that grow their earnings because this means more capital returned to shareholders in a dividend, at least that’s how the mindset should be if you want to be successful.

8. A stock market crash brings opportunity

Too often, people get caught up with what they have, instead of looking optimistically towards the future.

If the stock market has recently crashed, look at it as a great chance to pick up quality stocks at a discount. Forget that your own portfolio is down; you’ll only realize the losses if you sell right then and there.

Understand that the market has consistently recovered from every stock market crash. The only difference is the time required to see the recovery. But the market will recover, so take advantage.

9. Buy low, sell high

The chief adage of Wall Street. The reason why this strategy works is because of what was already previously shared. Markets toss and turn like the seasons.

Emotions run especially high in the stock market. Optimism is often exaggerated, and pessimism often overblown.

Fear and greed remain primal instincts for the human race, and it isn’t better showcased than on Wall Street. All this does is create opportunity for you.

10. Learn before you are burned

You can’t be a lazy investor. I’m sorry to say. Even if you want to pursue the most passive strategy of all like a mutual fund or index fund, you still need a basic understanding of investing concepts.

If you don’t, then you’ll end up selling at the very worst time, when stocks are at the bottom and everyone is selling. Of course, this is bad because stocks never stay at the bottom.

So, you must learn about the principles if you ever want to have your money work for you. You don’t have to quit your job and become a full time day trader, but you should at least read through this blog post.

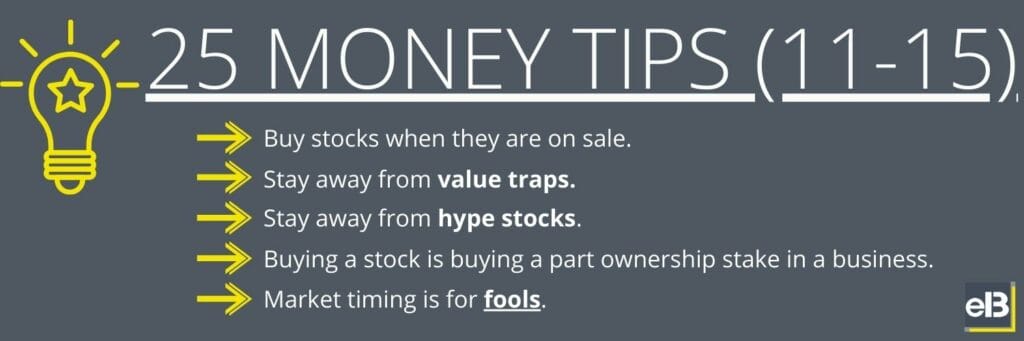

11. Stocks, like socks, are best bought on sale

Who was quoted as saying this? Why, only the greatest investor of all-time, Warren Buffett.

The idea of buying a stock trading at a discount to its intrinsic value has long been a primary cornerstone to the value investing philosophy. This is because it works.

Buying when stocks are on sale means going against the crowd and being a contrarian. It’s hard to do, and that’s why not everyone performs like Warren Buffett. But we can heed this valuable advice and apply it to our own investing to create better results.

12. Beware the value trap

You’ll get into trouble if you just buy every stock that is beaten up. Some stocks go down in value because they are really struggling business-wise.

It’s so important to learn how to identify the value trap so that you can avoid it. Unfortunately, it’s a step that many aspiring value investors skip over.

By understanding the worst case scenario, the bankruptcy of a company, an investor can identify future value traps and eliminate exposure to them.

13. Hype and popularity are NOT indicators of good business

If anything, hype in a stock is a good sign that it’s about to crash. Stocks turn into bubbles because of too much investor excitement. And what comes up must come down.

Hype isn’t good because it pushes the stock price higher than it should be. Sure, a business can be succeeding, but if there’s hype around it, chances are it isn’t living up to its reputation.

14. Investing in stocks is part ownership of a business

This is true because shares are part of a business by definition. An investor is really a business owner.

You’ll find success by selecting stocks where you’d buy the whole business if you had the money. Profit is the name of the game in business, and should be in investing too.

15. Market timing is for fools

Anybody who tells you that they can time the market is just as credible as someone who says they can foresee the future. Sure, there are patterns and trends, but they are as unpredictable as the next big viral video.

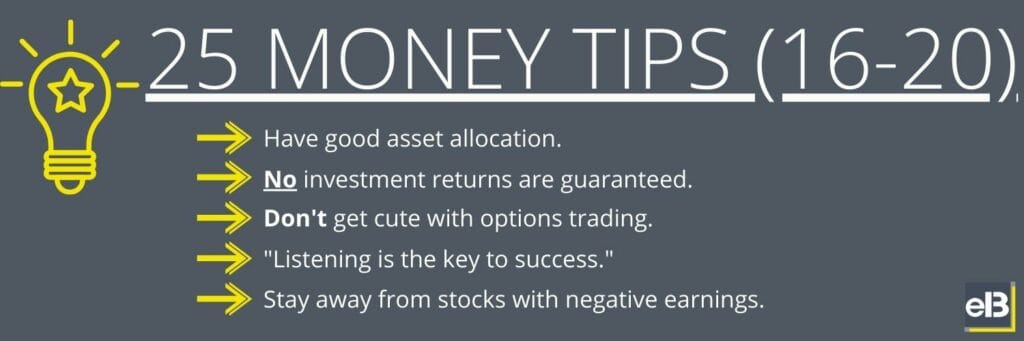

16. Practice good asset allocation

Most people should not have their complete net worth in stocks, if they can afford it. Try to buy a house, if you can, but at a price that is favorable.

Also, if you are close to retirement, have some money in bonds.

17. 18% “guaranteed” returns are never guaranteed

When anybody tells you an investment with them has a guaranteed return, they are about to steal all of your money. Not even Warren Buffett can guarantee any sort of return.

The biggest money and investing scams have all preyed on investor’s naivety and greed. Don’t let your greed blind you to the “opportunities” that are really too good to be true.

18. Don’t get cute with fancy options

Unless you have heavily researched the world of options, don’t be jumping in with a random options strategy you found on the internet. Options are particularly dangerous because they require investors to go on margin, which means investing with personal debt.

19. Listening is the key to success

I specifically remember being at a crossroads at my life where my financial future was extremely uncertain. I had steep financial obligations and little way of fulfilling them.

One simple message that I read on a fortune cookie simply said, “listening is the key to success.” For whatever reason, I took that advice to heart and began pursuing knowledge by listening to podcasts.

From that point on, I learned how to land an internship, which led me to an even better internship, which led me to my dream job.

Podcasts taught me how to make money, how to create money through a side business, and how to multiply that money with investments. I can give you this list of my top recommended podcasts, which could be the difference in your financial future too.

20. A stock with negative earnings is usually a cancer

Stock bankruptcies are trouble. A company with negative annual earnings is also in trouble, especially considering that earnings are the #1 goal of most businesses.

Of the 30 biggest bankruptcies in the last two decades, the greatest common factor was negative earnings. That should make you think twice about such a situation.

21. Learning financial statements can be very profitable

If the last tip went over your head, don’t fear. You don’t have to study accounting in order to become a good investor. A couple good books and an index fund will serve you well.

But for those of you that get fired up about numbers and money, individual stock picking could be right up your alley.

If you’re going to pursue that route, I highly recommend learning as much about accounting and financial statements if you can.

22. Everyone on Wall Street has an agenda

Much of their advice also shares a conflict of interest with your financial wellbeing. Understand that nothing presented as free is actually free.

You’re probably being sold to specific financial products, or are paying for financial services by way of commission of fees. Dave and I talked about this in-depth on one of our early podcast episodes.

There’s no free lunch on Wall Street.

23. Ideas and “hot tips” are a dime-a-dozen

If you didn’t read about the guy who lost $5,000 on a hot stock tip, go check it out.

The truth is, there’s always opportunity in the world. When someone tries to convince you that there’s just one chance, one limited opportunity, they are trying to sell you.

24. Too much company debt, like personal debt, is a ticking time bomb

Lehman Brothers, MF Global, Nortel. These were companies that carried way too much debt on their balance sheets, and then eventually paid the price.

Market crises don’t always mean that bankruptcies will happen. But they will show “who’s not wearing pants.”

A company with too much debt won’t be able to survive the next market crisis. If they do, it probably won’t be for long.

25. Try to imagine every possible situation, and mentally prepare for it

Play out the worst case scenario in your head with your investments. If the market takes a turn for the worst, do you have the fortitude to stay patient and disciplined?

Patience is a virtue. And it’s also a good strategy.

Related posts:

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...

- A Guide to Investing for Beginners— Your Path to Financial Freedom “Investing is the process of laying out money now to receive more money in the future.” Warren Buffett Most people think they need thousands or...

- Looking for New Investments? Beware of Biased Sell Side Research! When it comes to the sale and purchase of different securities, there really are two sides – sell side and buy side. The sell side...

- Beginner’s Guide to Value Investing and Intrinsic Value, From the Top Investors Updated – 12/6/23 Value investing is all about finding stocks trading at a discount to their intrinsic value. Investors have used this strategy for decades...