Updated 5/22/2023

We all pay for life, auto, or health insurance, but would you be surprised to learn that those same insurance companies take out insurance to cover any risks they might encounter?

It’s true, and reinsurers remain some of the largest insurance companies in the world. One of Warren Buffett’s greatest acquisitions for Berkshire Hathaway was General Re, a reinsurance company.

General Re and GEICO have allowed Berkshire to become the insurance giant and generate tons of cash for Buffett to put to work in the markets.

Reinsurance remains a less well-known aspect of the insurance industry, and not many focus on those companies, but they offer great returns and security to investors.

In today’s post, we will learn:

- What Is A Reinsurance Company?

- How Do Reinsurance Companies Work?

- Basics of the Reinsurance Model

- How Do Reinsurers Make Money?

- Samples of the Top Reinsurers

Okay, let’s dive in and learn more about reinsurance companies.

What Is A Reinsurance Company?

Reinsurance brings multiple insurance companies together to share risk by buying insurance policies from other insurers to limit their risk of total loss in the event of a disaster. The Reinsurance Association of America refers to it as insurance companies insurance. The idea is that no insurance has too much exposure to possible large events or disasters.

As insurance companies spread out the risks, they can take clients whose risk would be too great of a burden for a single insurer to handle.

Premiums paid by the insured are typically shared by the group of insurance companies involved in the reinsurance. In the U.S., regulations require that all reinsurance companies are financially solvent to guarantee they can meet their obligations.

A bit of history, the Reinsurance Association of America traces reinsurance roots back to the 14th century when people used reinsurance to cover marine and fire losses.

Since those early days, reinsurance has grown to cover every aspect of the current insurance industry, from hurricanes to snowmobiles.

Many companies, such as Munich Re, specialize in reinsurance, and others with reinsurance departments in U.S. insurance companies, such as Markel’s reinsurance segment. There are reinsurers outside of the U.S. that are not licensed to write premiums in the U.S.

It is important to remember that insurance companies cover the risk for their clients, and reinsurance companies protect the primary insurers from risk. Insurers such as Progressive manage their risk through a reinsurance company.

How Do Reinsurance Companies Work?

Remember that reinsurance companies provide insurance for insurance companies, but how exactly does it work?

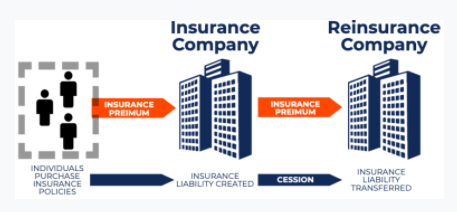

The primary insurance company transfers policies (insurance liabilities) to a reinsurer (reinsurance company) through cession. Cession refers to the portion of the liabilities transferred to the reinsurer.

Likewise, we pay insurance premiums to our life insurers; they pay insurance premiums to reinsurers to transfer insurance liabilities; below is the perfect diagram to illustrate the relationship.

Consider this idea; if one company assumes the risk on its own, in the event of a catastrophe, the costs could bankrupt the company, which would put at risk the ability of that company to pay out its premiums.

For example, what if a massive hurricane lands in Texas and causes billions in damages? If one company sold all the insurance to homeowners, its ability to cover all the losses would be farfetched. Instead, the retail homeowner insurer spreads part of the coverage to other insurance companies or reinsurers, thus spreading the risk to many other insurers.

There are four main reasons insurance companies purchase reinsurance:

- Risk transfer – companies can share or transfer part of the risk to other companies.

- Arbitrage – insurers can gain additional profits by buying insurance elsewhere for less than the premiums they collect from policyholders.

- Capital management – companies can lessen their risk by using reinsurance, which frees up additional capital without raising it.

- Solvency – purchasing surplus relief insurance allows companies to accept and take on new clients without raising new capital.

Regulations

Of course, with any insurance, there are regulations, and reinsurance is no different.

In the U.S., reinsurers regulate policies state-by-state, with the regulations designed to ensure solvency, rates, fair contract terms, fair market conduct, and to protect customers.

Primarily, regulations provide that the insurers remain financially solvent to ensure it meets their obligations to ceding customers.

Basics of the Reinsurance Business Model

Reinsurance companies offer two kinds of products:

- Treaty insurance – a type of contract where the insurer is obligated to accept all of the policies or an entire group of policies from the reinsured, including writing those not yet written.

- Facultative insurance – is a type of contract that is much more specific. These types of contracts can cover single insurance policies, such as the excess insurance on a large building like the Golden Gate Bridge. They may also cover different parts with different policies shared.

Along with these products, reinsurance can be considered proportional or not. Under proportional reinsurance, the reinsurer receives a prorated share of all policy premiums the insurer sells. The reinsurer bears a portion of the losses based on the prenegotiated percentage for a claim. The reinsurer also reimburses for additional costs such as:

- Processing

- Business acquisition

- Writing costs

With non-proportional reinsurance, the reinsurer is liable if the insurer’s losses exceed a specified amount, known as the priority or retention limit. Thus, the reinsurer doesn’t have a proportional share in the insurer’s premiums and losses.

The priority or retention limit is based on one type of risk or an entire risk category. Excess of loss insurance is a type of non-proportional coverage in which the reinsurer covers the losses exceeding the insurer’s retained limit. That type of contract is typically applied to catastrophic events and covers the insurer on a per-occurrence basis or for any cumulative losses over a set period.

Reinsurers deal with the most complex, hard-to-insure situations. They also deal with the biggest, most complex products to ensure catastrophic losses among the largest. These are the types of insurance most retail firms can’t touch or aren’t able to cover as a whole.

Because many of these difficult situations tend to be international, many companies have international exposure. Having that global presence allows the reinsurers to spread the risks globally.

When you see a catastrophe occur, such as a hurricane, the numbers the media throw out, like $50 million in damages, many different insurers, including reinsurers, cover those amounts.

Reinsurers don’t deal only with insurance companies; they also work with financial institutions such as banks or multinational corporations. But the majority of their business comes from insurance companies.

Like insurance companies, reinsurers write policies based on the insurance company’s risk profile, plus what kinds of promises there are to pay future claims. Reinsurance companies employ the same risk managers and use models to price their contracts.

Reinsurers target different customers than retail insurance companies, casting a much wider net and involving different or competing legal systems, nationally or internationally.

Reinsurance companies also operate in the dark or behind the scenes, as their nature insures other insurance companies. Retail insurers like GEICO are transparent, whereas the Reinsurance Group of America is far less transparent about its policies or target business.

How Do Reinsurers Make Money?

Reinsurance companies make money by reinsuring policies that they think are less speculative than expected.

Below is a great example of how a reinsurance company makes money:

“For example, an insurance company may require a yearly insurance premium payment of $1,000 to insure an individual. A reinsurance company may believe that insuring that individual is not as risky as determined by the original insurance company and, therefore, offer to take that insurance liability from the insurance company at a yearly insurance premium payment of $800. The insurance company would be willing to transfer that insurance liability, as they would net $200 yearly from receiving $1,000 to insure the individual and transferring the policy to the reinsurer for only $800. The reinsurer would accept this, as they believe the risk profile of the policy is not as high as determined by the original insurance company.”

Another way to generate income is by investing insurance premiums in the bond or stock markets. The reinsurer then liquidates the securities when they need to pay out claims. The perfect example of this done to perfection is Berkshire Hathaway and Warren Buffett using the “float” the company generates to create more profits.

The last revenue method comes from insurance companies offloading liabilities related to natural disasters to lower their exposure to greater losses.

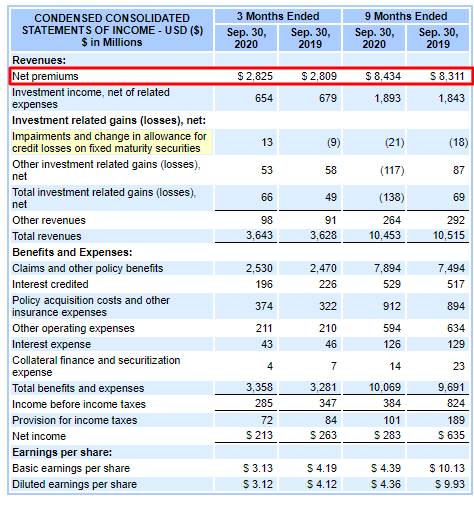

If we look at a reinsurer’s income statement, we see the same revenues and premiums as a retail insurer like Progressive.

The company also enjoys $950 million in reinsurance ceded receivables on its balance sheet. Alleghany Corp, another large reinsurer, carries $331.1 million of ceded receivables on its balance sheet and over $6 million in annual premiums.

Samples of Reinsurance Companies

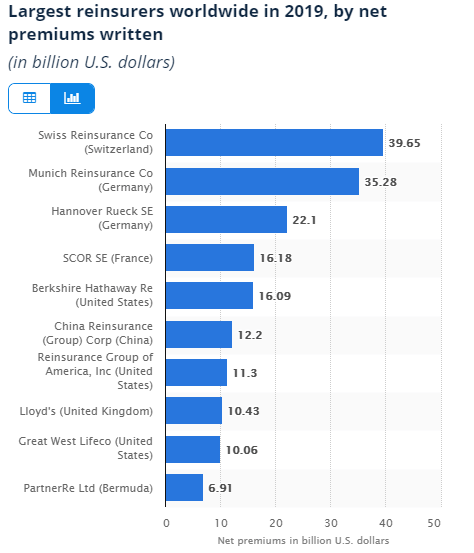

In this section, I would like to look at some of the larger reinsurers around the world, and in the U.S., below is a chart of the premiums written by the world’s largest reinsurers.

Swiss Re (SSREF)

Market Cap | $27.60B |

Revenue | $43.34B |

Net Income | ($878) million |

EPS | ($3.04) |

Price | $93.80 |

Munich Re (MURGF)

Market Cap | $41.13B |

Revenue | $67.86B |

Net Income | $1.43B |

EPS | $10.16 |

Price | $291.86 |

Hannover Re (HVRRF)

Market Cap | $20.84B |

Revenue | $26.75B |

Net Income | $1.11B |

EPS | $9.23 |

Price | $164.80 |

Scor SE (SZCRF)

Market Cap | $6.39B |

Revenue | $19.86B |

Net Income | $182.39M |

EPS | $0.98 |

Price | $33.92 |

Berkshire Hathaway (BRK.B)

Market Cap | $584.06B |

Revenue | $247.98B |

Net Income | $35.84B |

EPS | $22232.1 |

Price | $249.91 |

A note about the above charts shows that all the money is denominated in U.S. dollars to make comparisons equal. All the international players trade as pink sheets, which means here in the U.S., they trade over the counter (OTC) and not on major exchanges.

Next, look at a few of the bigger players in the U.S. market outside of Berkshire Hathaway, the largest reinsurer in the U.S., and take on the largest catastrophe risks as a reinsurer.

The companies we will look at are:

- Reinsurance Group of America – RGA

- RenaissanceRe Holdings – RNR

- Alleghany Corporation – Y

- Everest Re Group – RE

RGA | RNR | Y | RE | |

Market Cap | $8.66B | $8.37B | $9.12B | $9.7B |

Dividends | $2.80 | $1.44 | N/A | $6.20 |

P/E FWD | 11.39 | 11.39 | N/A | 9.34 |

P/B | 0.60 | 1.19 | 1.05 | 1.01 |

Rev Growth 5yr | 6.98% | 27.66% | 12.22% | 11.38% |

Gross Margin | 10.66% | 25.74% | 31.11% | 6.84% |

Net Income Margin | 2.84% | 14.81% | 1.14% | 5.36% |

ROE | 3.20% | 9.93% | 1.41% | 5.45% |

Cash from Operations | $3.32B | $1.99B | $1.04B | $2.87B |

Price | $127.39 | $164.95 | $652 | $224.72 |

The above idea is to look at different metrics and results to see how some of the larger reinsurers in the U.S. are performing. None of this is investment advice; rather, it attempts to show methods of thinning the herd when looking for investment ideas.

Charts like the above can help us find great investments or see how an industry stacks up.

Sometimes when analyzing a company in a vacuum, it is easy to get blinders on and think they remain the best, but when you line it up with other companies, maybe some performance stands out more than others.

For example, a company I have explored Alleghany a little, and I have found it interesting as they work on the same model that Berkshire Hathaway does—using the main reinsurance business as a method of creating float to invest in other great businesses, plus developing non-insurance businesses to expand its reach.

After putting together a chart like the one from above, it became clear that there might be other options in the reinsurance space.

Analyzing these types of businesses takes on the same approach you have with a property/casualty insurer. For example, we would use either a dividend discount or an excess return model for any intrinsic valuation.

Investor Takeaway

Reinsurance remains an important part of the insurance business, and it helps control costs for people looking for insurance in more complicated situations or products.

The reinsurance business operates in the shadows, not in a shady, dishonest way, but it operates far less in the public eye. Reinsurance has no cute geckos or crazy people like “Mayhem” advertising for reinsurance. But it remains important to the business, and many bigger insurers also carry a portion of reinsurance risk on their balance sheets.

For example, the opportunities to invest in reinsurers remain slightly more limited than in auto insurance. But these companies pay great dividends, have strong balance sheets, and have long track records of success through difficult periods. One of Berkshire Hathaway’s strengths is the diversification in the insurance business, with both GEICO and General Re. It enables them to profit from both aspects of the insurance business, property/casualty and reinsurance.

With that, we will wrap up our discussion on the reinsurance business.

As always, thank you for taking the time to read this post, and I hope you find something of value in your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- The Best Way to Invest in Insurance Companies: How to Analyze Their Stocks Insurance, one of the necessary evils of today’s world, right? We all have to have it in case of that one day you will need...

- Float: How Insurance Companies Can Leverage Buffett’s Secret to Wealth In the insurance industry, “other people’s money” is known as float. In a shareholder letter, Warren Buffett once said that float “had cost us nothing...

- Berkshire Hathaway 10Q Summary First Quarter 2020 Berkshire Hathaway reported its first-quarter earnings on May 2, 2020. This report is a summary of those first-quarter results and will not attempt any analysis...

- How 13F Filings Can Help Investors Evaluate Insurance Stocks How do insurance companies make money? We all think the monthly premiums we pay lead to how most insurance companies make money. Insurance companies make...