Updated 6/5/2024

I’m not lying—having a sinking fund is literally the best way to stay on budget. Sure, you could just make a billion dollars instead, but that’s not exactly a feasible path forward for most of us. So, what is a sinking fund?

Click to jump to a section:

- Why Have a Sinking Fund?

- What Is a Sinking Fund?

- The Power of a Sinking Fund

- Managing Your Sinking Fund(s)

- Emergency Funds

- Steps to Open a Sinking Fund

Why Have a Sinking Fund?

Before I get into the “what”, let me get into the “why”.

I have a sinking fund for protection. Sinking funds help protect me from the inevitable, largely unplanned, massive expenses that could occur at any point in time. Those massive expenses that might completely knock you off your budget and say “screw it” for the month are going to be completely avoided because you have a sinking fund in place.

Sounds enticing, right?

What Is a Sinking Fund?

A sinking fund is a savings account you have set aside for a specific purpose with the intent to spend. The “intent to spend” part is extremely important because this is not money you’re saving for your retirement that you must pull out for some reason. You have a true plan in mind for this spending when you start to save the money.

Examples of Sinking Funds

I have many sinking funds, one of which is a “Presents” sinking fund. Every time I am paid, a certain dollar amount comes directly from my paycheck and goes into this savings bucket for presents. For this post, let’s say that it’s $50.

When I get my paycheck, it’s immediately $50 less because now that money is in my Presents Sinking Fund. I do absolutely nothing with that money—nothing at all. It just sits there until I decide that it’s time to buy a present for someone.

It could be a birthday, wedding, Christmas, or “just because” present. At that point, I purchase the present and withdraw money from my sinking fund to cover it. So, if I buy a $25 present, I’ll take out $25 to pay for it and then leave the remainder in the sinking fund.

Then, two weeks later, when I get paid, another $50 goes in, and my balance is $75. Two more weeks, and it’s $125. That balance continues to grow until I make a purchase that requires me to withdraw from it.

Effectively, I’m forcing myself to save for presents, which can be a major expense around holidays or if you have many birthdays in your family close to one another. I’ve personally gone through many years without saving, and this just helps me get ahead of the game!

I’ve had years where I couldn’t buy people the presents I wanted because of money, and it was the worst feeling ever. Since I’ve had these sinking funds, that’s never been an issue for me!

I also have a sinking fund setup for “Car” purchases. Now, this sinking fund is set with two goals in mind:

- Protect us when we need car repairs

- Save for a new car

Truthfully, saving for a new car is way more fun than saving for car repairs, but car repairs are just a fact of life that will occur. Within the last week, I went to Midas and had over $1300 of repairs done on my car. Oil change, brakes, new tires, and a few other items.

I felt sick spending $1300 on a car that I don’t even like that much. And honestly, I almost didn’t. I was trying to talk myself out of spending the money because I just didn’t want to.

But guess what – I told myself that my tires were beyond repair, and they were. Literally, when I’d drive around a roundabout at a normal speed, and there are many roundabouts in Indianapolis, I could hear the tires squeal. And if there was rain, I could feel the tires give out a little bit.

Not safe. And that’s only the rain!

But guess what…do you know what happens when rain gets cold…yes, it turns into snow. And do you know what else? It’s October when I write this…

The Power of a Sinking Fund

I have a two-year-old son, and I’m freaking out about getting new tires when I clearly need them to help keep him safe during the winter, and I even have the money saved up to buy them.

If I didn’t have the money saved or had to dip into other savings that weren’t planned for that, I honestly don’t know if I would’ve made the purchase. Because I planned with a sinking fund, I was able to make the correct (and safe) decision.

But my family is safe for it. That’s worth way more.

And if we have some sort of unexpected issue with a car, such as I’m in an accident and must pay for repairs to hit our deductible, we’re taken care of. Because we’ve been planning for the unexpected with this sinking fund, it’s stress-free from a financial perspective.

Along with presents and cars, we have a “Vacation” sinking fund. It’s the same concept as the other two, but this is purely for vacations, as you’d expect. I love this because funding a vacation fund allows us to proactively save for those big vacations that we want to have and for the “unexpected” vacation.

Have you ever had that feeling where you’re like, “I just got to get away?” You can do that if you have a vacation sinking fund. My wife and I did that a week ago. We wanted to get away for a few nights before it got cold, so we booked an Airbnb and went away for a long weekend. Stress-free. Because we had been saving for months with this sinking fund.

Now, if you want to go on a crazy vacation like a Disney trip, overseas vacation, or a cruise, you will likely need to save a little more in addition to your normal sinking fund, but that just depends on the dollar amount you want to save. Saving even $50/paycheck, or say $1200/year, isn’t going to get you to Europe for quite a while, but when you decide to start planning that trip, maybe you’ve been saving for two years and have a $2400 head start.

Doesn’t sound too bad, right?

Managing Your Sinking Fund(s)

At first, I thought keeping track of all these different sinking funds would be an absolute nightmare…

I was wrong!

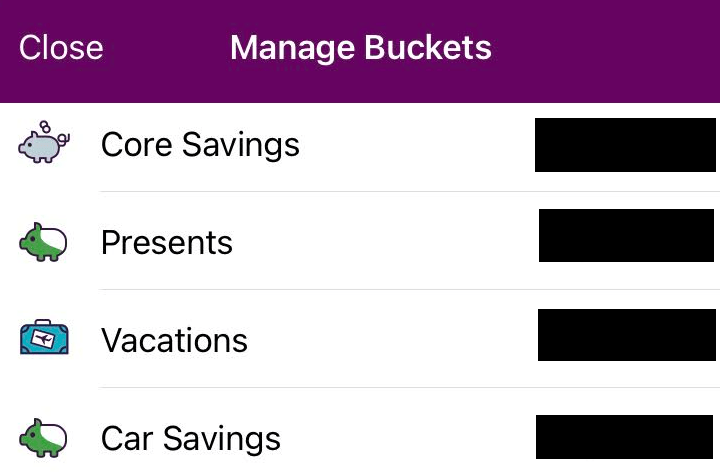

For this reason, I use Ally Bank as my high-yield savings account. They let you pick different “buckets” to group money into.

As you can see, I currently have vacations, presents and car setup for this savings as I’ve mentioned, but you’re not limited to these buckets:

Ally has a competitive interest rate of 4.2%. That’s literally 420x better than the .01 % I have with Fifth Third, so why not at least earn a little money while I’m filling up these sinking funds?

One of my favorite things to do with my sinking fund is not to use it. I know that sounds counterintuitive, and don’t hear what I’m not saying. I want you to go on vacations, repair/upgrade your car, and buy presents, but one of the best feelings is to be able to do these things and just pay for it out of your normal income.

For instance, when I had $1300 in car repairs, I only transferred $1000 from my sinking fund. I looked at my budget and said, “Andy, you can find a way to save $300 this month. Only transfer $1000 out of the sinking fund.”

I was just challenging myself to see if I could get “extra” frugal for a month and in turn, effectively save $300. You don’t have to spend your sinking fund just because you have it. At the end of the day, they’re somewhat like an emergency fund, right?

Emergency Funds

Think about it – an emergency fund is a sinking fund for…. wait…EMERGENCIES!

Sure, you might not be adding every paycheck, but you have saved some money with the intent to use it when crap hits the fan, right? That’s the point.

Everyone should have an emergency fund, and if you don’t have one, start here.

Not having anything saved for emergencies can ruin your finances, so please ensure you have one in order, even if it’s just a thousand bucks. You need some sort of buffer to help you out when needed.

Steps to Open a Sinking Fund

Ready to take the next steps to set up your sinking funds? GOOD! Here’s what I would do:

1 – Think about the sinking funds that need set up

It could be a car, a vacation, and presents like me. Maybe it’s also an emergency fund, where you add X to your account each paycheck. Maybe you love to go to sporting events, so you want to save $25/paycheck now to build up a good amount when that sports team’s season comes around.

It can be anything you will spend money on that might throw you off your budget. Plan for it now so you can spend worry-free in the future.

2 – Determine the amounts that you need

If you want to attend two NFL games each year and know they cost you $200/each, then you need $400. So, maybe aim to save $50/month from now until then so you have $600 saved for that season’s games. Then you have a nice $200 buffer in case your friends want to go to another game or maybe your team makes the playoffs, and you want to see them play.

Sure, a playoff game would likely cost more, say $300 instead of $200, but now you only need to come up with $100 because you saved an extra $200.

The same goes for your presents, car, or anything else. Think about what’s likely on the horizon for you. Christmas is coming up—how much do you normally spend? How are the tires on your car doing? If they’re bad, maybe inch up your savings number a bit faster. You can always ratchet it down later.

For instance, if you need new tires in 3 months, why not try to save $200/month to cover those? Then, once you buy them, go down to $50/month to fill up that sinking fund. It doesn’t have to be a “forever” amount…

3 – Set your money up to auto-transfer

This is huge because you likely won’t save money if you don’t do this. You’ll find a reason not to save it and, instead, blow it, and then come Christmas, or the time you need the new tires, or your team’s playoff game, you’re SOL. You don’t have any money, so you can either spend anyway and ruin the budget/go into debt or just miss out on the thing you want/need.

Both options are crappy, huh?

Instead, set up an auto transfer from your account each month or work with your employer payroll to have it automatically come out of your paycheck like I do. I like this the most so that every time I get paid, I have a lump sum in my Ally account and then divvy it between presents, vacations, and car, just as I’ve explained previously.

Honestly, it’s a pretty fool-proof system to implement that will help you a ton in the future.

At the end of the day, a sinking fund is nothing more than a dedicated savings account for a specific purchase, but the lack of one is a budget killer – I can speak from experience.

Determine what sinking funds you want, pick the amount, auto transfer that money, and plan it all out with your budget calendar, and bada boom bada bing – you just became a budget savant!

Related posts:

- What the Sinking Fund Formula Is – How it Can Help You Save Money Have you ever heard of the sinking fund formula before? To be honest, I hadn’t but it was something that I had used before without...

- 11 Surprising Ideas for How to Save Money On Vacation Easily How many times have you wanted to go on vacation, but felt like you didn’t have enough money to afford it? The reality is—you might...

- Simple Vehicle Maintenance Checklist to Save Your Budget Don’t get a nice car. Pay for your car outright. Maybe don’t even get a car if you can manage without one. If you’re into...

- Useful Tricks to Form Good Money Habits into Natural Decisions One thing is for certain, there are good money habits and there are bad. It seems like everyone has at least one bad habit (me...