Have you ever heard of the sinking fund formula before? To be honest, I hadn’t but it was something that I had used before without even knowing that it had an official name!

And if I was a guessing man, which I am, I am guessing that if you are even little bit as infatuated with personal finance as I am, then I am guessing you have used it before, too!

So, what is the Sinking Fund Formula?

WallStreetMojo defines it as

“a fund that is set up by the particular bond issuer in order to repurchase a definite portion of the bond issue or for the replenishment of a major asset or any other similar capital expenditure. As such, the bond issuer is required to contribute a certain amount of money to the sinking fund each period and the formula to calculate the sinking fund is as shown below.”

Per business-case-analysis.com, the term initially came from “Sinking the debt” back in the 15th century as people would pool together their funds to sink their debts. Nowadays, the primary usage for the sinking fund formula with business is when they’re setting aside capital to retire bonds.

In layman’s terms – the company is essentially saving money to pay off an upcoming debt or to retire bonds. They’re literally just planning ahead for the known future payment that is going to have to take place.

This might seem dry, or not applicable, but trust me – it is completely applicable to the common person in their everyday life!

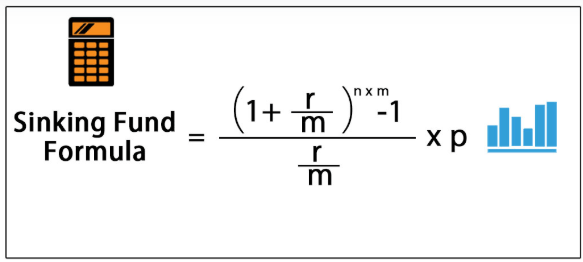

So, what is the formula?

I know, I know – you’re probably stressed out even looking at this but trust me – there is no need to be whatsoever. All that you need to know is the following information:

- Amount of Years

- Amount of Payments/Year

- APR

- Either the Periodic Contribution you plan to contribute OR the Sinking Fund Required to hit your goal

4 pieces of information – that’s it! And luckily for you, I might’ve even included a simple calculator that you can download to do the math for you…oh, I forgot – it’s completely free, too!

Let’s look at three different situations that you can utilize the Sinking Fund Formula in your personal finance journey:

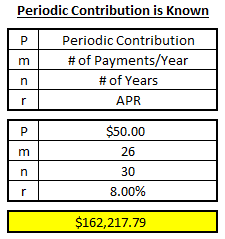

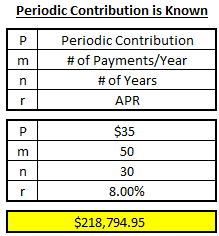

Situation 1 – You’re investing $50/paycheck, in which you get paid biweekly, and expect to get an 8% return over the next 30 years

All that you need to do is enter those four pieces of information into the excel calculator below to get your anticipated future value.

The Periodic Contribution is the $50, the # of payments/year is 26, the # of years is 30 and the APR is 8%. When you enter in these four pieces of information, you get a pretty outstanding result!

If you’ve ever played around with a compound interest calculator before then this might seem very familiar to you…and that’s because this is a compound interest calculator – just in excel version!

If you’re wondering why you can’t just go to a compound interest calculator online, there isn’t a good answer – you certainly can. But the beauty of doing your own calculations is two things:

- You learn better because you are physically learning how the formula works

- You can change the order of things to back into what you actually want to know

“What do you mean, Andy?”

Well, it’s cool to see that if you saved $50/paycheck over 30 years at an 8% return you would have over $162K, but who cares?

Have you ever entered into a 30-year plan to save $162K? No – that would be so ridiculous!

The more helpful usage of this calculator is to instead start with the Sinking Fund required to hit your goal and then back into what the monthly payments or contributions will need to be.

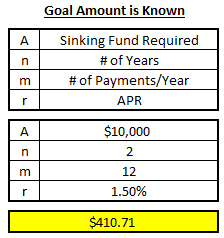

Situation 2 – you are planning to buy a car for $10K but you want to pay in cash. You want to buy the car in two years and will contribute monthly. You’re only going to put it into your high-yield savings account that earns 1.5% interest – how much do you need to save?

Easy! Just enter that information into this second calculator to get the amount that you’ll need to save:

As you can see, you’ll need to save $410.71/month to get to your goal of $10K in 2 years so that you can buy that new car!

Of course, I had to go ahead and save the most fun situation for last, so let’s get into it!

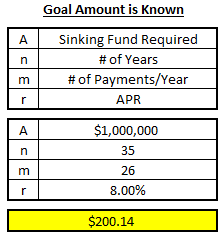

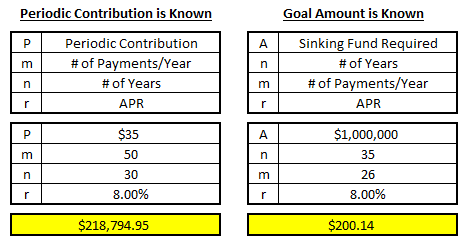

Situation 3 – By using the 4% rule, you have determined your retirement goal is $1 million. You are 25 and want to retire when you’re 60 and you expect the market to give you an 8% return on average.

How much of your biweekly paycheck do you need to contribute?

Since you know your Goal Amount, you will use the second calculator to back into what your contribution amount needs to be:

Four pieces of information is all that it takes! $200/paycheck seems like a pretty feasible amount to add, right? Honestly, I am surprised it was that low to get to $1 million in 35 years.

I think that the Sinking Fund Formula clearly has a very realistic usage for you in your everyday life as you can clearly see.

The Sinking Fund Formula can help you financially in so many ways:

1 – plan for major expenses that are upcoming, which is really the true usage of the Sinking Fund Formula

2 – plan your retirement goal, which after all, isn’t that why we’re even investing in the first place?

3 – just mess around and have fun! I frequently will find myself playing with compound interest calculators to see how changing a few variables can really change things.

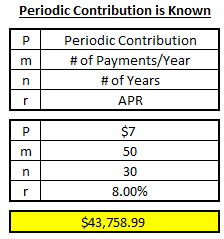

For instance, let’s pretend that I eat lunch out every single day of the week at work for an average of $10/lunch. Instead, I could pack my lunch for a cost of $3/day, therefore saving me $7. If I had 30 more years of work, and I worked 50 weeks/year (assuming 2 weeks of vacation), let’s see how much I could save, and of course, let’s assume that I invest this and earn my 8% in the stock market. And before you trash my 8% assumption, the stock market average since 1950 is 11%, so…

Ok, let’s see!

Packing 1 day/week

WOW! Packing only 1 day/week, so saving only $7/week over those 50 weeks, over 30 years, at an 8% return, would get you nearly $44K when you retired! That’s incredible! That makes me never want to buy lunch ever again. But what about if you were to pack more?

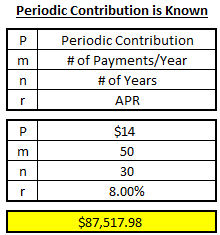

Packing 2 days/week

One extra day of packing in the week would double the amount that you would have been able to accumulate, which makes total sense, right?

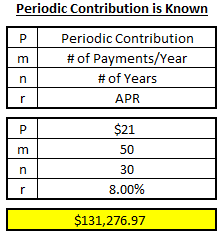

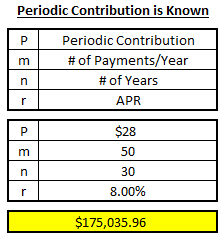

As expected, the accumulation amounts grow that much higher the more days that you’re willing to pack your lunch:

Packing 3 days/week

Packing 4 days/week

Packing 5 days/week

If you’re sitting here thinking to yourself that you don’t want to not allow yourself to go out to eat at all for your entire career because you’ll miss out on many things, I don’t blame you! Going out to eat can lead to new work opportunities, networking, and just a great chance to get away.

So, if going out is more important to you, then do it! You should be willing to spend money on the things that are important to you and then cut out the things that don’t matter.

That’s the #1 thing, in my eyes, about the importance of tracking your expenses. Tracking your expenses in a budget can tell you where you’re spending, and if you’re spending money on things you don’t care about, you will then have a new awareness to it and have the opportunity to fix it.

If you’re spending your money all on things that you love and need, then keep going! You’re all set. But guess what – most of us are blowing money on something stupid. I know that I am.

Personally, I don’t like going out to eat that much, for a few reasons:

- I am very busy, so I prefer to work through lunch. If I have to work 10 hours, I’d rather work 30 minutes of that through lunch than going to lunch and then having to stay 30 minutes later

- I am a tracking freak, and that includes calorie counting. Cooking my own food gives me the ability to prepare my own food and know exactly what I am eating.

- I love to cook! Packing my own lunch allows me to do something that I love doing and also save money while doing it…win-win.

- If I want to eat with someone, I propose to eat with them in the café or to grab a meeting room and eat…or go outside if it’s nice. Be creative. Eating lunch with people doesn’t mean that I have to pay for it, just as packing doesn’t mean I can’t eat with people.

- If I want to go out, I do it! I let myself have a treat if I want it. The key, again, is that as you can see above, I actually prefer to pack my lunch AND it saves money – those are the types of situations that I encourage you to try to find.

Maybe packing your lunch doesn’t apply to you. Maybe it’s buying new clothes a lot when you actually don’t care about clothes. Or buying a nice car when you don’t even drive much. Or maybe you only drive your car to work, but you love to bike and never have time to do it, so instead you could just bike to work and avoid gas, and more importantly, maybe a car payment!

In summary – think about what you spend money on mindlessly and ask yourself if it actually makes you happy. If it does, keep doing it. If it doesn’t, plug it into the Sinking Fund Calculator and see how much you could save by avoiding that activity!

The screenshots above were taken directly from the Sinking Fund Calculator, so you know what it looks like already:

As you can see, it’s super simple. There are two different charts with the one on the left being if you know what you are going to contribute and the one on the right is if you know your goal.

Do yourself a favor and download it. It’s 100% free and you might be able to learn a thing or two.

Compound interest is the #1 thing that got me into investing and it’s a super freaking addicting thing to look at. I mean, I just sit here and think about stupid things, like how getting a car with better gas mileage could save me a ton of money. Or, if I want to retire with a certain amount, save a certain amount for a new house, or just anything – what do I need to start saving now?

It would really suck to be saving $150/month if my goal required $250, wouldn’t it? Not only would you be saving $100 less, but you would be missing out on that extra time for your money to take advantage of compound interest.

Personal finance is really nothing more than planning and acting. If you act without planning, you’re screwed. If you plan without acing, you guessed it, also screwed.

Both of these calculators can get you to your goal in the fastest, most efficient way possible.

My favorite way to use the Sinking Fund Calculator is in tandem with Doctor Budget. I will try to find every possible way that I can squeeze money out of other budget categories that I have, such as food or gas or a car payment like I mentioned above, and then see how my balance will look if I were to simply invest that money.

If you want to go down a rabbit hole, you should try it. You will get addicted to saving money.

The only feeling better than saving money at the end of the month is using that same money to invest and set yourself up for a future that you otherwise couldn’t have.

Don’t think about it – be about it.

Related posts:

- What Is a Sinking Fund? Only the BEST Way to Stay On Budget! I’m not lying – having a sinking fund is literally the best way that you can stay on budget. I mean, sure – you could...

- Easy Ways to Save Money on a Tight Budget If you find yourself scrambling for money each month, try these easy ways to save money on a tight budget. You’ll learn some good habits...

- Don’t Think You Can’t Save Money Quickly With a Low Income? Updated 1/15/2024 Have you been told that you can’t save money quickly with a low income? Are you tired of living paycheck to paycheck? Are...

- Handy Andy’s Lessons: How to Save $5,000 In a Year! Saving money might seem like an impossible task, but I promise you, it’s not. Anyone can do it with a solid plan and the correct...