Have you ever heard of a budget calendar? Personally, I use one nearly every single day of the week and it saves me a ton of time and money, as well as keeping me on track with my budget without physically having to go in and track my expenses every single day.

And not only does it save me time, but there’s a pretty cool trick with using one that increases my annual savings at a pretty drastic rate, but don’t worry, I’ll show you that too!

I think that the most important task for a budget to accomplish is to make it find the perfect blend of being simplistic and forcing you to track your expenses. Personally, I feel that tracking your expenses is the best way to make sure that you truly understand where your money is being spent and then you’ll be able to effectively analyze if that money is being spent on needs or wants. If you’re not tracking it yourself, then you’re not getting enough into the details to be able to really make any real changes.

But at the same time, your budget needs to be simplistic enough so that you actually use it. If it takes hours and hours, you will simply stop using it altogether then that’s a complete waste of time, effort and money.

So, it’s all about finding that perfect blend – and that’s why I created Doctor Budget! Doctor Budget causes you to track, but in the way that you can truly input all of your spending for an entire month in less than 15 minutes. But even with tracking being so quick and easy to do, it still requires a little bit of time and effort, so that’s why I created this budget calendar as an “add on” tab that will be included in Doctor Budget, and sent out to all of you current Doctor Spreadsheet users as well!

So, what exactly even is a budget calendar, and why is it useful?

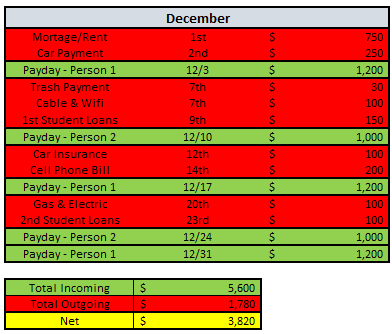

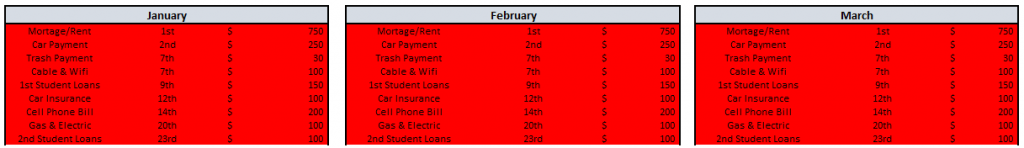

A budget calendar is not some super profound thought or some very complex formula or anything like that – it’s simply planning out when you’re going to get paid, when your bills need to be paid, and then providing you some sort of planning. For instance, I took the budget calendar that my wife and I used and made it very generic, and listed it below:

As you can see, it’s nothing that is overly mind-blowing. All this is showing me is when more money will be coming into my account, when money will be going out of my account, and providing me a great backbone for me to plan.

I have all of my expenses highlighted in red, the income is listed in green, and then I have a net section simply to show the difference of the income and the expenses for the month.

As you likely can tell, these are all fixed expenses that occur each month, on the same date, and for the same amount. Essentially, once I have my income and expenses outlined, I think that it gives me a much better ability to plan for my expenses for the month. Let me give you an example:

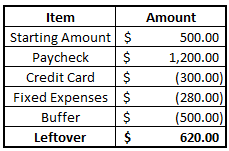

We just received income on 12/3 and have $1200 sitting in my account. From now until the next time that my family receives income, I have to pay for our trash removal, our cable & Wi-Fi, and then we will owe for the student loan payment. All of those payments, in total, will cost $280. For the purposes of this situation, lets also pretend that I owed $300 on my credit card, had $500 in the bank currently, and that I always like to keep a $500 buffer.

With all of those points, I would essentially create a simple math equation like this:

I just put the income as a positive and the money outgoing as negatives, so in this case I have $1700 total in income between what was currently there and the paycheck, and I have $1080 as expenses between the $300 on the credit card, $280 for fixed expenses and then the $500 buffer that I like to keep in there. So, all in all, I have $620 leftover.

Sweet!

Now what do I do?

Well, this is the fun part!! I will do one of a few things:

- Save that money/increase my buffer if I have a big purchase coming up that month or think there might be a need to keep a little extra cash on hand. In essence, the buffer is like a “weekly emergency fund”

- Pay extra down on debt. I won’t typically do this, but sometimes if I have a high interest debt then I might pay some of it down, but that’s solely dictated on the interest rate.

- INVEST! Ah, that’s by far my favorite option. I will take that extra money and invest it into the market. It’s that extra incentive to keep me motivated to keep putting the money into the market because I can do it on a weekly basis!

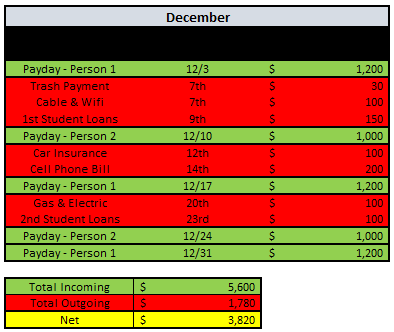

Like I said before, I love this budget schedule so much and almost use it daily. Once one of these items have already occurred, I will black it out completely so that I know it already occurred:

It’s nothing crazy, but I think that this gives me that satisfaction that I get from a checklist as these expenses come off my schedule. So, what are some of the other benefits of this budget schedule?

- Fast Tracking – I can track my spending in 30 seconds, on a daily basis, simply by looking at three things:

- My bank account and seeing how much money is left

- My budget schedule to see what else is left to be paid

- My credit card to see what I need to pay off the next time I receive income

- Frequent Credit Card Payoff – I am paying my credit card off every single time I get paid. This allows me to make sure that I am NEVER missing a payment which is so incredibly important. And if I am spending more that time on my credit card, I will know sooner than month end and ideally save up more to pay it off during the week.

- Also, a quick tip is that your credit card company might let you pay over what you actually owe. For instance, every single time I pay off my card, I pay the max amount which is usually about $100 what I actually owe. In a way, I am then making Chase owe me. Sure, I will blow through that $100 extremely fast, but it’s nice to have even more of a buffer.

- Motivation – I am looking at my expenses every single day in less than 1-minute total. By doing this in the morning, this starts me off on the right mindset that day and will keep me very motivated for keeping my spending in check and maximizing my side hustle!

- Adaptability – If you’re overspending you have the chance to adapt and make edits to your spending during the month rather than waiting until the end of the month! This can help you eliminate any potential issues of overspending that you might have before those issues even occur. Budgeting is great, but if you’re always waiting until the end of the month, then you will likely always overspend.

- Dollar Cost Averaging – If you’re like me and you’ll take any leftover money at the end of each pay period and invest it, then you’re now dollar cost averaging on an even more frequent basis. As we all know, the stock market is extremely volatile, and by even going from monthly investments to weekly, or bimonthly investments can really help smooth out some of that volatility!

- Mindset – having this budget calendar will allow you to keep the mindset right. This is similar to motivation but think bigger picture – eventually you’re going to instantly think about your budget and spending without having to look at a budget calendar or even Doctor Budget on a frequent basis. The goal of a budget is to make sure that we’re living within our means, but I think that everyone’s goal would be eventually to get to a point where we can do that automatically without having to create a budget and a budget calendar, right? Maybe you only need to pull high-level numbers like spending and income and then you can get enough of a big picture. That’s likely far down the road, but I’m sure it’s absolutely a goal for us all, right?!

- Organization – simply put, your entire financial life will be more organized by utilizing this simple tool. No lie – it totally changed how I look at my finances and plan my savings and investing!

So how do you create a budget calendar? Well, it’s very simple. I created mine in Excel and as I mentioned, it is available to all Doctor Budget members as well, but what I do is this:

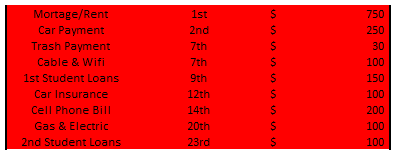

1 – I will create a list of all of the bills that I have for a month, along with the dates that they are due and the amount that I need to pay, and then format it into the budget calendar format that I want to follow, such as below:

2 – After that, it’s really simple – simply put create headers for every month, like ‘January’, and then copy these expenses into each month, shown below:

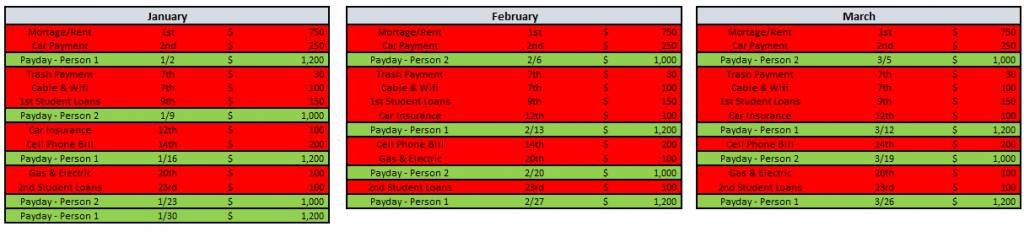

3 – The second to last step is simply to input your income. Let’s pretend that you get paid biweekly and another member of your household also gets paid biweekly, both of you getting paid every Thursday. All that you need to do is input your household income into the chart. So, the first paycheck would be 1/2, then 1/9, then 1/16, so on and so forth:

As you can see, it’s pretty simple. All that I am trying to do is breakup the different sections between money coming in and money going out so I can focus on weekly/biweekly periods, depending on how often you get paid. I find that the smaller the window, the more likely you are to stick to it and get addicted to those small wins!

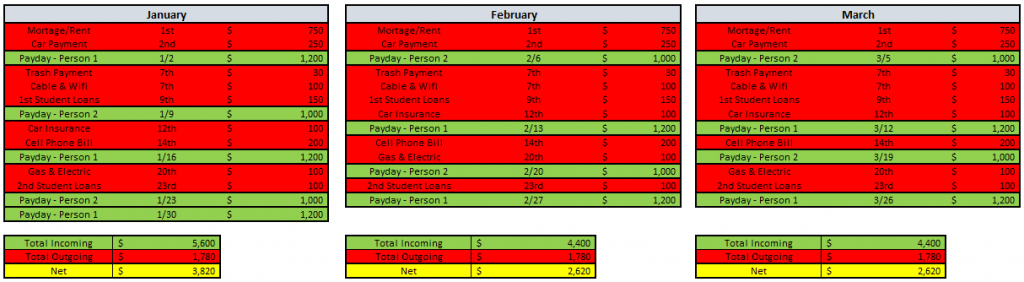

4 – The last step is simply totaling up the fixed expenses, total income and the net difference between the two for each month:

It’s nothing more complex than a simply ‘Sum’ function and selecting the right cells and then subtracting the ‘Total Outgoing’ from the ‘Total Incoming’.

But that’s really it! It’s that simple. Having something like this to plan around will help you just be that much more prepared every day of the year rather than just looking at your budget at the beginning and the end of the month! I’m here to help get you on the path to financial autonomy and that means starting at the ground floor with the basics and implementing simple things to get you focused on your goal.

You might notice in January that Person 1 will receive one extra paycheck that month compared to February and January. If you’re getting paid biweekly, two months out of the year you’re going to get three paychecks as compared to getting two for the other 10 months. My suggestion to you, and this is what I do, is I plan my budget off of two paychecks/month. Then, when I get to January and I have three paychecks, that means that I have an extra $1200 to spend in this hypothetical example. So, then I have all of this extra cash, twice a year, that almost feels like a bonus or a small money windfall.

I personally always try to save that money or pay off some high interest debt, or do something along those lines because if I can use that money to put me closer to my financial autonomy goal, then that means that I am saving 7.7% of my annual income BEFORE saving any other money at all.

This is exactly what I mean when I say that financial planning is about having the right mindset AND the right tools. You need both to succeed but it starts with the mindset. By doing something as simple setting up your budget on a two paycheck/month system, you’re already forcing yourself to save. It’s simple tricks like this that will pay dividends in the long run.

Obviously, you’re sold on the idea of a budget calendar…but now that you have this big surplus of income or your “extra paycheck month”, what do you do now? Let me show you!

Related posts:

- How to Use the Doctor Budget Tool to Set Your Finances Straight Recently, I was fortunate to be invited on the Investing for Beginners Podcast and talk about my personal finance experiences and introduce Doctor Budget to...

- Apps? Excel? NO – I need a PRINTABLE Budget Planner! Let’s be real – Mint is a great app for budgeting but does it actually help you budget? Personally, I got way more from being...

- Yes, Acorns Found Money for My Friend, But I Have a Better Solution! I recently had a friend tell me that Acorns found money for them and it really made me think about if it makes sense to...

- If You Forget These Personal Budget Categories, Your Budget WILL FAIL! The easiest way to fail on your personal budget is to not plan. That’s it – that’s how to fail. Or, maybe you plan but...