Updated 5/23/2024

If you’re a dividend lover like we are at Investing for Beginners, chances are you’ve at least glanced at the XOM dividend before. I certainly have, given its impressive track record, but does that alone make it enticing enough to invest in the company solely for the dividend?

If you’re brand new to the concept of dividends, then I recommend you start here with the basics, but in essence, a dividend is when the company decides to give a certain amount of its profits back to shareholders.

Click to jump to a section:

- The Importance of Dividends

- Viewing Dividends Like Paying Down Debt

- XOM Dividend Hype

- Pros of XOM Dividends

- Cons of XOM Dividends

When a company makes money, it has 5 choices for what it can do with that money:

The Importance of Dividends

A lot of investors are attracted to the idea of dividends for obvious reasons – they get that cold-hard cash in their pocket! I can’t blame them at all because a dividend is a guaranteed return compared to an unrealized gain that you would have from a stock appreciating in value.

Many people will argue that stocks that pay a significant amount are typically more established and less likely to experience major growth and share appreciation, and I agree with that, but that doesn’t mean that you should completely pass up a dividend-paying stock.

Sure, a growth stock might achieve 15% annual gains on average, but that 15% could be 50% gains in one year and then a 17% loss the following year. If you held that stock for all two years, you’d be up 30%, but what if you bought in when it was up 50%? Now you’re just down 17%. That doesn’t sound ideal.

On the other hand, a steady dividend stock might only increase 6% annually, but it’s also paying a 3% dividend, meaning once you get paid that 3%, you’re locking those gains in for good.

Viewing Dividends Like Paying Down Debt

In essence, I view it very similar to paying off debt.

Paying down debt is an guaranteed way to save money in the future. Similarly, dividends are a guaranteed payment that you can do anything with, as opposed to stock returns that are less certain.

When you have extra money at the end of the month, you have two choices (other than spending it): Invest it in some fashion or pay down debt.

Sure, the stock market will give you 8-10% on average each year, but it could be a negative return year or a 30% return year – you never know. Paying off a 7% debt is a locked-in, guaranteed 7% return on your money. On average, paying off the 7% debt would be a loser vs. the 8-10% returns, but it’s all about the guaranteed peace of mind. Not to mention, doing a little bit of both would be a great way to diversify your returns!

Think of it this way: If you invested $1000 in a company that traded at $50/share and paid you a 3% dividend annually, you’d get $30 in guaranteed dividends every year (assuming the stock’s share price did not grow). After 10 years, you’d have $300, or 30% of your initial investment.

You can use that cash to do anything – invest back in the company using Dividend Reinvestment Plan (one of my favorites), invest in a different company, take the money out and pay down debt, spend it, or do anything else with that money. The thing is you got locked-in, guaranteed return, and there’s something to be said for that.

So while you might be thinking, “Andy, why does this matter?” The answer is that even though a dividend stock like XOM might not be one that’s going to become a ten-bagger (10x growth) in two years, that doesn’t mean there’s no room for it in your portfolio.

XOM Dividend Hype

So, what exactly is all the hype about the XOM dividend?

Well, for one, XOM is a Dividend Aristocrat, meaning it has increased its annual dividend for 25+ consecutive years.

Think about that for a second. If you had bought shares of XOM 25 years ago, you’d literally still be getting paid for owning those shares. You’d be getting paid a ton!

If you had bought one share of XOM back on 1/1/95, you would’ve paid $17.85 for that share, and received $47.96 in dividends. In other words, you’d have tripled your money in only dividends on that one share – that’s bonkers!

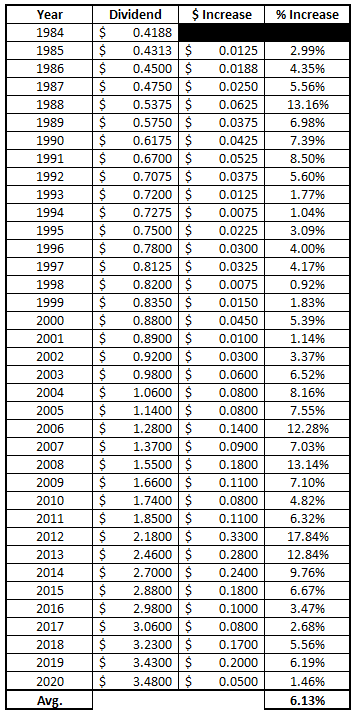

When breaking it down on an annual basis, you can see that the dividend increased every year since 1984 at an average clip of 6.13% each year:

Now, there are some pros and cons to this sort of performance that’s worth thinking about:

Pros of XOM Dividends

When you’re paid that cash, those gains are locked in, and you can never lose them.

I really don’t think that this point can be overstated enough because the value of being paid a dividend and locking in that return is so important when you’re investing. You always will hear people talk about the value of having cash now over waiting later and chances are you’ve even seen this in your daily life.

Literally yesterday my wife came home from the chiropractor and they want to put her on an annual plan where she goes X times/week and it gradually slows down, but they gave us two options:

1 – Pay 100% of the bill each month

2 – Pay the entire balance upfront and save about 9%

What would you do in this situation? The chiropractor is literally saying that they value the cash now so they’re willing to take less in exchange for having the money in hand right away.

Dividends are no different. Once you get that dividend in hand, you can choose to reinvest in the company or do literally anything else with it. If you had bought that single share for $17.85 back in 1995 like I mentioned, you’d have earned enough dividends by 2011 to have completely paid off that share and essentially be playing with house money.

The compounding of dividends is very evident

The compounding of dividends is really mind-blowing. In the first year of XOM’s Dividend Aristocrat journey, they paid out a total of $.4188. In 2021, every single quarter XOM paid out a dividend of $.87, more than double the annual dividend in 1984!

That 8x dividend performance is absolutely insane. Inflation during that same time period was 265%, so you’re still up around 550% as a real value.

The beauty of dividend investing is that when you’ve paid that dividend, you can reinvest that dividend right back into the same company through a process called DRIP, or Dividend Reinvestment Plan. Essentially, when you receive that dividend it’s just automatically rolled right back into the company that you own shares in.

For example, look below at one of my companies in my Roth IRA, Docusign. They don’t currently pay a dividend but if they do, I have set my account to reinvest those dividends right back into the stock and buy more shares rather than just dumping the cash into my account.

Dividend Aristocrats have a lot of security

When you invest in a Dividend Aristocrat like XOM, JNJ or MMM, you will see these companies do whatever they can to continue to grow their dividend and keep their Dividend King/Aristocrat status.

When companies place such a strong emphasis on the dividend and returning that value to their shareholders, they’ll do everything in their power to ensure that the dividend increases every single year.

I mean, even in 2020 when oil companies were going through massive turmoil from insane market dynamics and people not traveling at all due to COVID-19, XOM still put a massive emphasis on growing their dividend and not letting their streak be ruined.

Cons of XOM Dividends

Worse Stock Performance

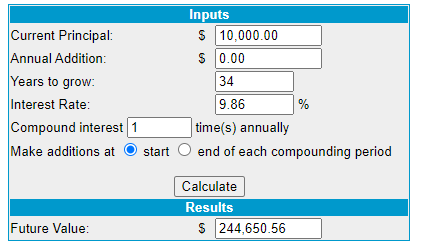

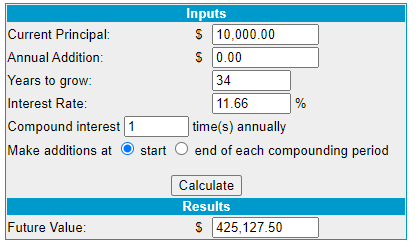

If you had invested in the S&P 500 instead of in XOM, you would’ve returned 11.66% annually vs. 9.86% for investing in XOM. That might seem like a narrow outperformance of a mere 1.8%, but the difference is massive.

Suppose you invested $10,000 in XOM 36 years ago in 1984 – you’d be sitting at $244,650. Not a bad return at all:

But, if you had invested that same $10K into the S&P 500 and received 11.66 returns annually, you’d be sitting at $4251,127!

That is a massive underperformance of XOM vs. the S&P 500. A few decisions like that and you could very well find yourself needing to work longer than anticipated and not being able to retire when you had dreamed.

Companies with Dividend King/Aristocrat statuses might get blinded by the importance of the dividend

I 100% understand the importance of the dividend and the impact that losing status could have on the share price of a Dividend King or aristocrat, but I also think that companies shouldn’t go to all lengths to keep that dividend intact.

Remember how I applauded XOM’s ability to continue growing its dividend through the extremely tough year of 2020? Well, that didn’t come without any bumps and bruises.

One thing that Exxon did was cut their 401k employer match for a year for their employees. I know it was an extremely tough decision to cut the employer match to retain the dividend, but I think the mere fact that a company was in a decision where they felt that they had to do one of these two things is not a great spot to be in at all.

I worked in the oil industry for seven years for a major competitor of XOM and I can confidently say that they definitely were not alone in the struggles that they experienced. When XOM cut their 401k employer match, there was a genuine fear among oil employees that all options were now on the table, once you see a behemoth like that make that type of decision.

At the end of the day, I feel like XOM chose its shareholders over its employees. Maybe that was the right decision, but it’s one that has lasting effects, as employee morale must’ve suffered during that time.

When XOM reinstated their employer match in October 2021, just a year later, there weren’t any catchup contributions or anything like that to help make those employees whole and reward them for sticking with the company. That’s just something that hits home a little bit for me since so much of what I do is talking about personal finance and retirement. Losing that 401k match can be killer and, unfortunately, is the only retirement that many people have!

Additionally, XOM went through a cutting of their workforce. It was reported by Yahoo Finance that XOM cut 8% of their low-performing workforce compared to the 3% that they typically will reduce.

To me, I read that XOM was cutting more people for budgetary reasons and used the low performers as the barometer of who to cut, which completely makes sense.

I’m not here to bash XOM by any means because the entire oil industry was absolutely crushed in 2020 and they did what they felt they needed to do, but I just don’t personally like investing in a company that chose shareholders over a massive employee benefit.

Summary

Overall, XOM is a solid, stable company that is a mecca in the oil industry. Their dividend track record speaks for itself and it will likely continue to grow for years and years as we’ve seen the dedication that management has shown.

But should you invest in XOM? That’s a decision that only you can make. I recommend taking a deeper dive into the true performance of the company with the Value Trap Indicator or maybe even looking for some other companies that have a great, growing dividend history.

Want to know where you can find those? I got you covered → check it out!

Related posts:

- Building a Dividend Growth Portfolio with Tomorrow’s Dividend Aristocrats If you’ve ever listened to Andrew on the Investing for Beginners podcast then you know that he is the “DRIP King!” You might know this,...

- Dividend Aristocrats are OVERRATED! Check Out This Dividend Kings List! Chances are that you have heard of Dividend Aristocrats before and chances are that you have been told that they are the bees’ knees. Well,...

- Dividend Ratios Pt. 2: How to Identify Sustainable Dividend Growth As we discussed in part 1 of this dividend mini-series, there is much focus on the past dividend growth of a stock– yet this doesn’t...

- What is a Good Dividend Yield? Dividend (and dividend growth) investors have long debated what is a good dividend yield. How little yield is too little, and is a high yield...