If you’re finding yourself struggling with getting your mindset right and can’t seem to get motivated and focused on personal finance, you have come to the right place. This chapter in ‘The Richest Man in Babylon’ really talks about the history of Babylon Money and how you can learn from the history to develop your own personal finance journey.

The chapter starts off by talking about Dabasir, a wise man that was once a major fool. You see, Dabasir never was able to stick to the #1 cure of a lean purse, which was to save 10% of your income…at least!

You see, Dabasir made saddles for a living, falling into the same business as his father. He made pretty good money and was able to provide for his family, but he quickly fell into the trap of not only spending all of his money but also borrowing from others!

Borrowing money is fine, in certain circumstances, if you pay it back – but not paying it back is an absolute no-no!

This process continued over and over again until it got so bad that Dabasir finally decided it was time to leave town and try to start over. He owed so many people so much money that he would rather start over than just fix his problems. That is so depressing.

After a few years in his new town, he fell into a crowd of robbers and eventually decided that was how he was going to make his living. The first robbery was very successful but after the second attempt, they were then attacked by a group of people that captured them and eventually made him become a slave.

Dabasir wasn’t like a slave, though. He came from a different background and had different values that he could fall back on. He didn’t bond with them and oftentimes was just spending time with himself.

One day his owner asked him why he was always on his own and he responded that he wasn’t like the other slaves. He didn’t want to be a slave anymore and in response to that, his owner told him to stop acting like a slave.

She told him that the way he needed to do this was if he was to go back to Babylon and pay off his debts, but he needed to have the right mindset. If he didn’t truly want to do this then he was never actually going to be successful.

To me, this is one of the most important lessons that you can learn, and I honestly didn’t even fully comprehend it until I was writing this blog post. If you’re in debt, and you keep adding to that debt, and all you’re doing is working to pay off the debt and never getting ahead, then you are a SLAVE!

You are 100% a slave. You’re busting your butt just to pay off the things you already have. You’re not making your future life better at all. You’re just maintaining the status quo, at best. You’re likely even getting worse off.

To me, debt isn’t really a description of the financial situation that you find yourself in. Debt is a mindset. If you don’t have a handle on your debt then your debt is going to handle you.

I’ll be honest – Dave Ramsey is not someone that I agree with for the most part. Dave teaches very basic rules such as “pay off all debt” and “pay off the smallest debt first.” For me, personally, I hate these pieces of advice, but I get why he has this stance.

I have a mindset that is deadest focused on achieving financial autonomy as early and efficiently as I can. For me, eliminating all debt is not the most efficient thing that I can do. The stock market has historically returned 11% since 1950 so why would I pay off a 3% loan instead of investing? I mean, the S&P 500 returned over 30% in 2019.

I would’ve really regretted paying off my mortgage if I had chosen that option.

But if you’re someone that is in debt over your eyeballs and you’re simply just searching for a piece of advice to help get you started and on the right path, then I think that Dave Ramsey’s advice can absolutely be great for you.

You see – the thing about personal finance is that it’s completely personal. You need to find what works for you, what motivates you, and make it work for you in the most efficient and effective way possible.

For Dabasir, when he was able to convince his slave owners that he was truly changing his mindset about paying back his creditors that he owed money to, he was freed. He immediately went back to Babylon and spoke with each of his creditors, apologized for leaving them and for borrowing without paying them back, and then told them of his plan to get them his money.

You’re probably thinking it was some super elaborate plan, so I’m really sorry for disappointing you, but here it is:

- Set Aside 10% of Income

- 70% is used for a home, clothes, food and extra spending

- 20% will be paid to those I owe money to

Man, that’s incredible. What an earth-shattering type of plan.

I recently was listening to the Stacking Benjamin’s Podcast and OG (Other Guy) had said that personal finance is meant to be boring and if it’s not, then you’re probably doing it wrong. I agree with him with one exception – it can also be fun if you’re doing it right and maybe you’re just a really big nerd like I am!

To get out of debt and achieve financial freedom doesn’t require you to be the most financially savvy person or have the most creative, insane plan to maximize all of your funds and inspire you to work a thousand jobs.

It’s really simple:

1 – Spend less than you make

2 – Make more than you spend

3 – Pay off debt/invest

End of list.

You’re probably reading the first two and thinking that they’re basically me writing the same thing twice, but oh you are so wrong!

Spending less than you make applies to managing your expenses, and the best way to do that is to find a budget that you’re actually going to use. I am the BIGGEST proponent of budgets that there is. I mean, I literally call myself Doctor Budget lol.

I think that using a budget and tracking your expenses is the most important step to financial freedom, by far. It’s not necessarily that this is where you’re going to see the biggest gains, per se, but this is where you lay your foundation.

To take a lesson from the Stacking Benjamin’s Podcast again – nobody looks at the bottom of a pyramid and compliments how amazing it is. People look at the top, but guess what, if you don’t have the bottom then you’ll never have that same top – plain and simple.

You have to start with a great foundation if you want to make monumental strides. Understand the basics, such as where you’re actually spending your money, and it will pay you back tenfold.

Now, make more than you spend – it’s oh so different!

You see, if you make $50,000, then there’s a limit to how much less you can spend than you can make. It’s $50,000. But making more than you spend – there is no limit! You could go make a million buckaroos next year!

Is that a hyperbole? Heck yeah it is, but it also could be true if you focused hard enough and had a great idea.

I have a great job that pays pretty well and we really, really watch our spending but guess what – there’s just only so much that we can cut without sacrificing the quality of life and the things that we want to do. So, what do I do? I make more money!

There’s a million ways you can make more money nowadays such as Uber, delivering food with Grubhub, walking other people’s dogs (yes, you get paid to play with a pup – the dream), selling random things around the house or even looking at things at a discount store and reselling, or even blogging!

I started blogging for Andrew Sather last year because I loved teaching people about Financial Independence, but the money didn’t hurt either. I’m proud to say that we’ve been able to save 100% of the money earned and invest it into the market.

The goal was to get ahead by bringing on this second income source, not to increase our quality of life. My life at age 29 is just fine – I want to improve my life at age 50!

So, I followed Dabasir’s third step and started to invest as much money as I can and pay off all “bad” debt that I had. Essentially, any debt that was over 6% we tried to pay off faster than required and then I also would invest a lot, too. Anything under 6% got the minimum payment because I assumed that I can outperform that in the market, and as I mentioned, 2019 was 30% returns….so yeah….

But the way that I was able to accomplish all of this was by making more money and increasing my savings rate that way.

I really encourage you to sit down and find the point in these three steps where you’re lacking. Maybe you’re great at budgeting and investing your money but would love to find something to just be able to bring in an extra few hundred dollars each month.

Or maybe it’s the flip – you work two jobs but just can’t get a handle on your spending at all. Take some time, sit down and just track your expenses. Tracking is by far the best way to actually get a grip on your spending and if you never know what is going out then you can’t ever slow down the money leak! I know I’m biased, but that’s why I love Doctor Budget because you have to track your expenses but it doesn’t take hours to do each month – in fact, you can update in less than 15 minutes!

It might not seem like a lot, but $300 each month, either from extra income or from cutting out unnecessary expenses can add up extremely quickly!

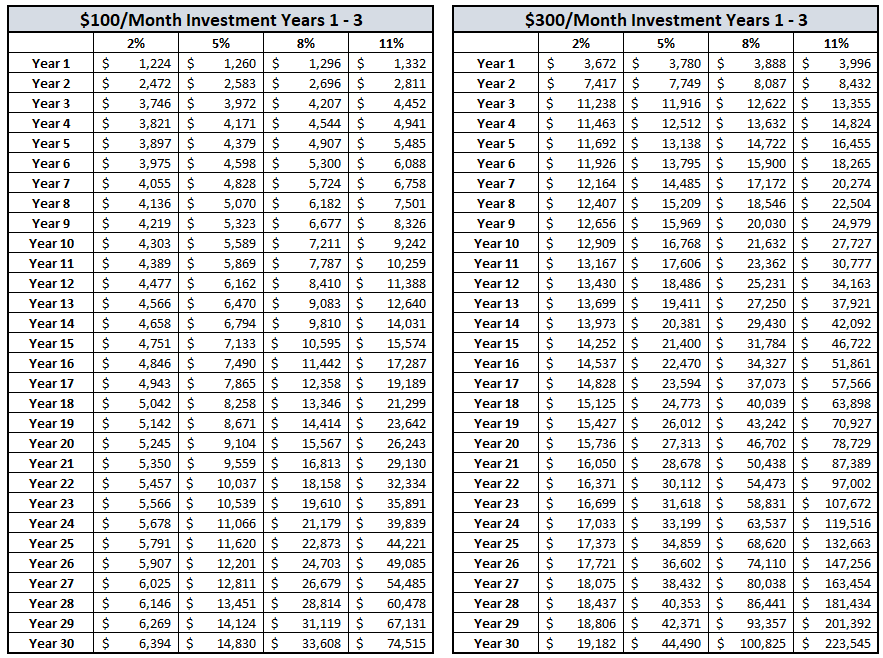

Take a look below at a few different scenarios. I am showing if you could just create a surplus at the end of each money and invest it into the stock market it can drastically change your life for the better in the future. The scenarios are:

1 – If you invest $100/month for ONLY 3 years and then you let that money just compound for 30 years. Your total investment is $3600 over 3 years.

2 – If you invest $300/month for ONLY 3 years and then you let that money just compound for 30 years. Your total investment is $10,800 over 3 years.

As you can see, if you invest only $100/month, you can have nearly $75K in 30 years if you were to obtain a return that’s consistent with the S&P 500 record since 1950. If you can up your game to $300/month then your new amount is nearly $224K. Those are some eye-opening numbers.

There’s 0% that this happens, but if the 2019 returns happened every year for 30 years, your $360/month for three years would turn into $22.3 MILLION! Like I said, 0% chance this happens…but dang!

The reason that I like to show these charts is to show that small things can make a huge difference. Cutting out some expenses each month, learning to grow your income, and learning how to have your money make money are all lessons that we have learned in the History of Babylon.

This is how you will get ahead in life. By finding ways to achieve small wins and then properly putting that money to work, you can set yourself up for success both now and in the future!

Just as Dabasir was able to teach us – if you can simply get a plan of action and act on that plan, you’re going to be all-set in life.

Do not be a slave to your debt.

You own your debt, not the other way around. Now start acting like it!

Related posts:

- 7 Cures for a Lean Purse: Money Secrets from the Ancients Unfortunately, we live in a country where many people do not have a lean purpose, and in all actuality that have an absolutely ton of...

- How Long Will My Money Last with the 4% Rule? (Based on History) If you’ve ever listened to even 5 minutes of a Financial Independence podcast, then you’ve likely heard something about the 4% rule. The 4% rule...

- Easy Steps to Implement the 5 Laws of Gold from ‘The Richest Man in Babylon’ One of the things that I hated the most when I was first starting my financial freedom journey was that there was soooo much information,...

- Handy Andy’s Lessons: 3 Methods to Save Money from Your Salary I often hear that people can’t save money because they have none. For many people, this likely isn’t true. Instead, they likely don’t have the proper...