Updated 5/1/2024

Cash is king, and finding companies that generate cash from their activities is the holy grail of investing. The basic cash flow statement provides answers to the question: Does this company generate free cash flow?

Today, we will dive into the basic cash flow statement in our ongoing series of learning basic accounting as a new language.

Interesting tidbit: The cash flow statement didn’t come into existence until 1987! Wrap your brain around that, as some of the great investors we look up to didn’t have this statement to help them determine how companies used their cash.

Investors such as Buffett, Munger, Lynch, and Graham didn’t have that statement available to analyze many of the great companies they analyzed. Referred to as “flow of funds,” the accrual basis we love and know today wasn’t available then.

In today’s post, we will learn:

- What is a Cash Flow Statement

- Components of the Cash Flow Statement

- Cash Flows From Operations (CFO)

- Cash Flows from Investing Activities

- Cash From Financing Activities

- How Cash Flow is Calculated and Other Metrics Used to Analyze the Cash Flow Statement

Let’s dive in and learn more about the basic cash flow statement.

What is a Cash Flow Statement

As defined by Investopedia:

“The statement of cash flows, or the cash flow statement, is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company.”

The cash flow statement measures a company’s effectiveness in managing its cash. That means how well a company generates cash to pay its debt and fund the business’s operations.

The cash flow statement is the third of the required financial statements for all public companies, the others being the income statement and balance sheet. All have been mandatory since 1987.

In today’s article, we will break down some of the parts of the cash flow statement and how we can use them to our advantage as investors.

The cash flow statement is the last of the three financial statements, which ties together the income statement and balance sheet. As we will see, they are all tied together, and it helps explain the other statements and their impacts. It helps bridge the gap between the income statement and balance sheet by showing how money moves in and out of the business.

The cash flow statement is probably the least read and understood of the financial statements, but I would argue that, aside from the balance sheet, it is one of the most important statements, as it highlights the company’s profitability.

Companies that cannot create cash flow or free cash flow must rely on other forms of financing their activities. After all, money is needed to pay for salaries, inventories, dividends, and more.

Methods of Creating Cash Flow Statement

There are two methods for creating a basic cash flow statement.

- Direct method

- Indirect method

It is the norm for companies to report their cash activities on an indirect method. The direct method or cash method records activities as they occur, whereas the indirect method reconciles accounting entries on a cash-in and cash-out basis.

Let’s move on to the structure of the basic cash flow statement.

Components of the Cash Flow Statement

The basic structure of a cash flow statement contains three sections:

- Operating Activities

- Investing Activities

- Financing Activities

We will break those sections down a little more in the upcoming sections.

It is important to understand that the cash flow statement differs from the income statement and balance sheet because the cash flow statement doesn’t deal with future incoming and outgoing cash on a credit basis, as do the income statement and balance sheet.

That difference means that cash is not the same as net income, which on the income statement and balance sheet includes cash sales and sales from credit.

The cash flow statement gives us a detailed picture of what happened to the company’s cash from a specific period, usually quarterly or annually.

The cash flow statement tells us how profitable a company is and how well it operates the business in the short term and long term, as evidenced by the amount of cash flowing in and out of the business.

Okay, let’s move on to the three separate sections of the basic cash flow statement. Remember, as we move from each section, we can read it from top to bottom; in other words, the cash flows from section to section until we reach the bottom of the statement.

Cash Flows From Operations (CFO)

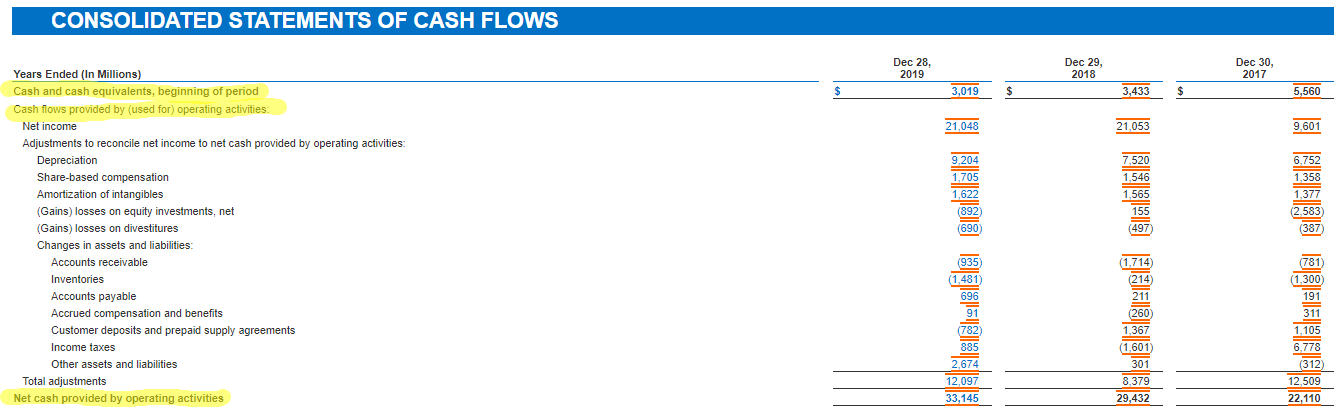

For reference today, we will use Intel’s (INTC) statement of cash flows from its 2019 annual report.

The cash flow from operations is probably the most important component of the cash flow statement. It helps tie together the income statement and the use of cash for Intel operations, for example.

If you look at the last line of the income statement, you will see the net income, and as you look at the first line of the cash flow statement, you will notice the same number from the income statement.

As we work through the cash flow statement, you might have questions about the different line items that I mentioned, if you would like deeper definitions of each item, please check this post from Cameron Smith below:

Interpreting the Statement of Cash Flows

The basic structure of the cash from operations is the following:

- Net Income

- Depreciation

- Amortization

- Impairment Expense

- Stock-Based Compensation

- Change in Working Capital

- Accounts receivable

- Accounts payable

- Inventory

- Change in Provisions

- Interest Tax

- Tax

- Operating Cash Flow

As you work down the cash flow from operations, you can see how Intel spends money from the net income the company created from the income statement.

It is not unusual to see negative numbers as we walk down through the section; those negative numbers we see in Intel’s statement tell us about cash outflows, and the positive numbers indicate a cash inflow.

Start with the net income and then add or subtract each item as you work through the statement.

The easiest way to think about the cash flow from operations is like your personal checking account. As money comes in, you pay it out for the bills you owe.

If you arrive at the bottom line and that figure is negative, that indicates Intel is not creating enough income to fund the basic operations of the business. As you move down to other sections, you will see additional funds added as additional debt or selling equity or shares to raise cash.

Important notes on several line items, such as depreciation, are needed.

Deductions such as depreciation are considered expenses and deducted from profit in the income statement, but they do not impact the company’s cash flow as depreciation is a non-cash expense. As such, we add depreciation back to the cash flow statement, as you can observe in Intel’s statement.

Other items you will see in the cash flow from operations section include:

- Rent payments

- Salary and wage payments to employees

In the case of investment companies such as brokerages, you will find items like receipts from the sale of loans, debt, or equity. From banks, you might see items like provisions for credit losses, changes in the fair value of marketable securities, and net changes in debt and equity securities.

As always, companies such as banks, insurance agencies, and brokerages speak a different accounting language; to understand them, you must understand their language. For today’s purposes, we will avoid those types of businesses to avoid additional confusion.

An important note: To calculate free cash flow or cash flow from equity, you will calculate both line items from the cash flow from operations.

Many companies outline how they calculate free cash flow and highlight those figures in the notes section of their financials.

For now, numbers to keep an eye on for those calculations:

- Depreciation / Amortization

- Change in working capital

- Net Cash from operations

Ok, let’s move on to the next section of the basic cash flow statement.

Cash Flows from Investing Activities

The next section on the cash flow statement is the cash flows from investing activities. The investing activities section includes any sources and uses of investing cash from the company.

Items such as:

- purchase or sale of an asset

- Loans to vendors

- Payments for mergers or acquisition

- Additions to property, plant, and equipment

The old PP&E is an old friend and part of any free cash flow calculations. They are also known as expenditures on cap-ex, or investments in computers, chairs, printer paper, or anything related to business operations and creating revenue.

PP&E is the actual cash spent on items known as cap ex, which can consist of maintenance cap-ex, monies spent on equipment repairs, or monies spent to continue operations.

The financing section connects with the long-term assets on the balance sheet, which are investments; thus, they flow through a different section of the cash flow statement.

Usually, cash flows from investing are cash outflows or “cash out.” That is because cash is used to purchase new equipment, buildings, or marketable securities. But when a company divests or sells an asset, the transaction is a cash inflow.

Cash flows from investments will usually be negative because, at this stage of the cash flow statement, the company uses cash to sustain the business, either with capex purchases or buying or selling investments to create more income.

Again, if the cash from operations is a negative number, then all these transactions will need funding from other sources other than the company’s operations. This helps illustrate a company’s positivity, which can generate cash flow from operations.

Cash From Financing Activities

Cash from financing activities is a fun section; here, we will discover how much money the company pays out in dividends, share repurchases, debt payments, or taking on more debt.

Changes in cash in the financing section are cash inflows when raising capital from activities such as selling company shares or taking on more debt. Likewise, they are cash outflows when a company pays out such items as dividends or share repurchases.

For example, if Intel issues a bond offering to the public, the company would receive cash inflows with the sale of each bond. On the other hand, the bond’s interest payments are a cash outflow, with the interest payments due to the customers’ purchasing the bonds.

In this section, it is not uncommon to see cash as a positive number, as in the case of Intel, which took on additional bond financing during the fiscal year 2019.

As we come to the end of the three components of the cash flow statement, you will see, at the bottom line, the term cash and cash equivalents.

To arrive at this number, you simply add all three components together. In Intel’s case, we arrive at cash and cash equivalents of $8,736 million. If you take a quick peek at the balance sheet, you will see the very same number at the top. This perfectly illustrates how the cash flow statement ties together the income statement and balance sheet.

If you will, the basic flow is the net income that comes into the cash flow statement; the company pays for all the bills required to generate that net income while also creating more cash by liquidating assets and paying down liabilities. Finally, we arrive at the end, which equals the cash and cash equivalents.

How Cash Flow is Calculated and Other Metrics to Analyze the Cash Flow Statement

As we arrive at the end of the cash flow statement, the next activity needs to be analyzing the statement, and the easiest way to do this is through metrics such as:

A widely discussed metric is free cash flow, which is simple to calculate. You take the cash flow from operations, add back the depreciation/amortization line items, and then subtract the CapEx or PP&E from the cash from the investing section.

Example: Intel

A quick example from Intel.

Free Cash Flow = Cash From Operations + Depreciation/Amortization – PP&E

From Intel’s cash flow statement:

- Net Cash from Operations – $17,315 million

- Depreciation – $5,248 million

- Additions to property, plant, and equipment – ($6,676)

Plugging in the numbers to our formula

Free Cash Flow = 17,315 + 5,248 – 6,676

Free Cash Flow = $15,887

If you want to learn more about the above formula and other methods to analyze the business’s free cash flow and the ratios to help you analyze your company, please follow the links above.

Final Thoughts

As discussed in our ongoing series on learning the different financial statements, the language of business is accounting. We must understand accounting to understand how to analyze companies both from a financial aspect and an operational basis.

Learning any language takes practice and repetition of the activities; as I attempt to learn Portuguese, I am learning that in spades.

However, I have found that the best way to learn anything is to put what I have learned into practice. And I think learning accounting falls into that category as well. Only by reading through the financial statements will you learn accounting and how that company works.

Understanding the basic cash flow statement will help you learn how profitable a company like Intel, Amazon, or Apple is. Still, it will also give you insight into how the company generates that profitability.

That will wrap up our discussion on the basic cash flow statement today.

As always, thank you for taking the time to read this post, and I hope you find something of value on your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Depreciation Expense: How to Decode Updated 8/7/2023 Depreciation is an accounting term that has a big impact on a company’s future profitability. It is a controversial topic because, as Warren...

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...

- Depreciation and Amortization – A Complete Financial Statements Guide Updated 8/7/2023 Buying businesses and equipment for operations is a part of business, and using depreciation and amortization is how companies account for those purchases....

- Interpreting the Statement of Cash Flows: Operating, Investing, and Financing A lot of critical information can be learned from the statement of cash flows. As cash flows to shareholders are what investing is all about,...