One of the most common things that I hear from people is, “I don’t have any money.” The advice from most personal finance people is “just budget.” But there are countless “budgeting for beginners” templates that are anything but for beginners. A complicated spreadsheet isn’t helpful to someone just starting out.

So I’ve written this guide. This is how I personally manage a budget and recommend that many beginners budget and start on their personal finance journey.

Click to jump to a section:

- Why Most People Struggle to Save

- Setting Priorities

- 1. Understand the reason why you want to start budgeting

- 2. Confront your fears

- 3. Analyze your spending

- 4. Assign appropriate dollar values

- 5. Track, Monitor, and Update

- Closing Thoughts

Why Most People Struggle to Save

So, if we really examine why most people have any money, let’s make some observations…

I oftentimes see my friends blow money mindlessly. Then, when it comes time for them to do something to benefit themselves, they claim not to have money. I know people that will go out and spend hundreds of dollars at restaurants, bars, sporting events, video games, and other unnecessary items. Then claim that they are not able to save money each paycheck.

When it comes down to it, this is nothing more than an excuse. I used to be one of these people. I was in awful credit card debt in college, but I did the best thing anyone could do.

Stop. Spending. Money. Mindlessly.

I sat down, confronted my fears, and wrote down everything I was spending money on. You know that person I described earlier? That was me. Nowadays I have different priorities.

Setting Priorities

Before my money even touches my checking account, I have already had part of my check direct deposited into my savings account, my 401K, my Roth IRA, and my brokerage account.

Those four accounts are never touched as all my bills and “fun money” are used from the remaining funds in my checking account. A number one way that I was able to grab control of my finances was to begin budgeting.

I tried many ways and failed, but it’s not how many times you fail; it’s that you continue to get back up and keep trying. Consistency is the key to finding success where most fail.

I finally found a method that works for me, and I think it will work for you too. Below are five beginner steps that I followed that really helped me get a hold of my spending habits:

1. Understand the reason why you want to start budgeting

What is causing this change in your life that makes you want to grab your finances by the horns and take charge? Is it just that you want to “grow up”? Do you want to save more? Do you have something you’re saving for, like an engagement ring or a wedding? Maybe you want to go to the Final Four and need to save $1,000 for tickets!

It could be anything – the point is, you need to know your reason. This will drive you to stay focused and dedicated.

2. Confront your fears

You are probably scared to look at your finances and where all your money is going. I know I was. But this is the only way that you can get better.

Some of you might prefer to use the app Mint, or write them down, but I prefer to track mine in Excel. When I first started, I went back and downloaded the last three months of spending from my checking account/credit cards and exported the transactions into a CSV file. This allowed me to look at where my money was going and find ways to cut out unnecessary spending.

There’s no better way to predict the future than to look at the past, so this is the first place to start. I have an example below of how I did this:

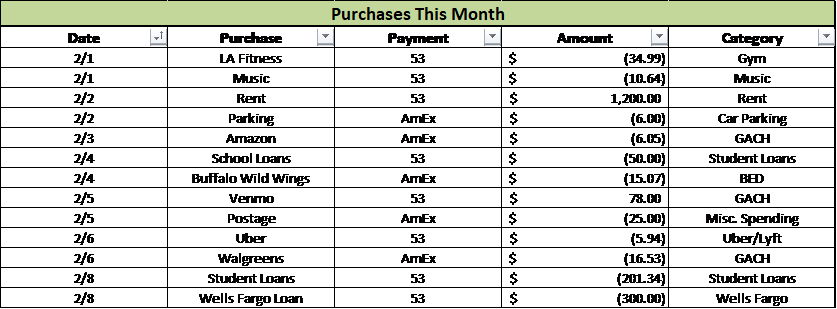

As you can see, each transaction has a date, the purchase/company, the payment method (53 stands for Fifth Third Bank, which I use for my checking), the amount, and the category.

The purchase and the category are similar as the category can encompass many types of purchases that fall into it. Once you’ve listed out all your purchases, group them into categories as I did.

Note that for the first line item, the purchase is LA Fitness for my gym, and the category is the gym. I do this because I might have other purchases that can go under the “gym” category, such as renting a bike, doing a drop-in class at a different gym, etc.

I also code things in acronyms a lot; as you can see I have “BED” listed. BED stands for Bars, Eating Out, and Dinners for me as a catch-all for those types of items. I do this to give myself some extra flexibility if I want a nicer dinner and don’t want to spend money going to bars with friends.

I also use GACH as an acronym which stands for Groceries, Animals, Cleaning, House. This is also a fitting acronym because it’s often a very large portion of my monthly spending.

GACH encompasses a lot but really is focused on my purchases at the grocery store and Amazon each month. Again, it makes it easier to group things together, and I view these all as needs rather than wants. I strongly encourage you to only group needs with needs and wants with wants. Otherwise, things can become skewed, and wants might overpower needs. Some common groups that I have are:

- Income – Include all income. This is the most important as you need a starting point. Don’t forget any side income or bonuses.

- Fixed Expenses – These are the same each month and never change. Popular items include Rent/Mortgage, Personal loans, Credit Card loans, cable, cell phone, gym, parking, car payment, car insurance, and electric.

- Variable Expenses – Groceries or “GACH,” “BED,” presents for people, travel expenses, gas for your car, Uber/Lyft, haircuts, laundry, workout supplements, clothes, medicine, music, car maintenance, miscellaneous spending.

- Savings – Many people choose to include this as a line item in their budget. Personally, I prefer to set up automatic payments from my checking, so I don’t have to worry about it. Then, I simply use my income number – savings amount. For instance, if I get paid bimonthly at $1,500/check and want to save $300/month into my savings, use $2,700 as your monthly income. That $300 is automatically transferred and is “Untouchable Income,” as I like to call it.

3. Analyze your spending

Now that everything I spent money on the last three months was grouped, I quickly realized that I was spending wayyyy too much out with friends and at restaurants. I always felt that was the case, but I never really put any pen to paper and noticed how bad it was.

Not only that, but I was spending money on Hulu, Netflix AND cable each month. Why did I need all three? The answer: I didn’t. I barely used Hulu.

Not a ton of money, but $8/month is nearly $100/year. Won’t make or break your budget, but if someone offered you a $96 check each December when you’re Christmas shopping, I’m guessing you wouldn’t turn it down.

4. Assign appropriate dollar values

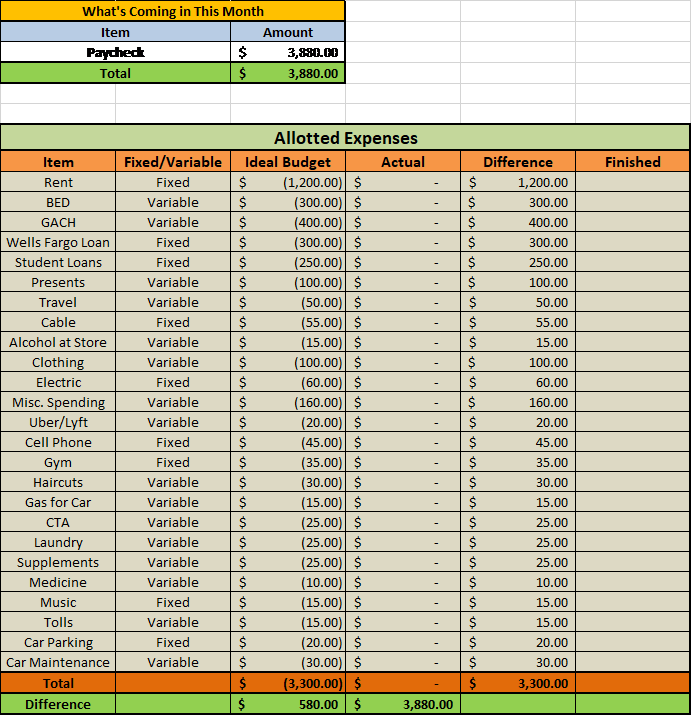

Now that you’ve grouped your purchases into categories and inputted your income, the next step is to find appropriate dollar values to associate with each one.

Obviously, at the end of the day, you want your income to be higher than your spending totals.

The more you can increase that difference between income and spending, the better off you are – but you need to be careful. A budget is just a budget. It’s an app, spreadsheet, piece of paper, etc. – and nothing more. A budget is just a plan.

Anyone can put in their budget that they’re only going to spend $50 on eating out in a month, but when you take your partner out to a steak dinner and spend $200, what do you do?

The point I’m getting at is yes, try to spend low and constrict expenses, but also be realistic. Nothing says you can’t treat your partner to a $200 steak dinner to celebrate a birthday, but make sure you have room to do so.

If you don’t, you need to make sure you’re prepared to sacrifice something else to save money to spend on that dinner.

If you’re unwilling to make these sacrifices and tough decisions, you will fail before you start. I have included an example of my budgeting format that beginners can use, which is below:

5. Track, Monitor, and Update

I recommend that you analyze your purchases at least twice per month. When I first started, I input purchases every few days to ensure I stayed on top of it.

Not to mention, it was exhilarating when I went a few days without spending a lot! It was motivating! And especially addicting.

I loved seeing the days go by and still having a lot left to spend (or even better, not spend, and then use to save once I got to the end of the month).

It’s important to remember that from month to month, your purchasing will change. Your budget should change as well.

If you know you have to change your oil or replace your tires, put that in your budget.

If you decide to grow your hair out and don’t want a haircut, eliminate the spending allotted for that category! A budget is a living, breathing, flexible item, just as your life is very fluid and changes constantly.

Closing Thoughts

Hopefully these five steps will help you get control of your spending so you can start saving!

The key is to stay focused and up to date on your budget. Even if you fall off the horse for a weekend or two, confront your fears, track that spending, and get back at it.

Ultimately, you’re in control of your destiny, and a budget is just a tool that can help guide you to financial freedom!

Related posts:

- What is the True Cost of a Home Gym? Many of us right now are stuck at home, quarantined due to the coronavirus, and the only way that we can workout is if we...

- How to Use the Doctor Budget Tool to Set Your Finances Straight Recently, I was fortunate to be invited on the Investing for Beginners Podcast and talk about my personal finance experiences and introduce Doctor Budget to...

- Stop Bleeding Money with Activity Based Budgeting! Updated: 6/7/22 Many of you know me as Doctor Budget, which I absolutely love, but I personally think one of the most important things for...

- Apps? Excel? NO – I need a PRINTABLE Budget Planner! Let’s be real – Mint is a great app for budgeting but does it actually help you budget? Personally, I got way more from being...