Buffett created a test every investor can use to find wonderful companies.

Most refer to the test as “Buffett’s One Dollar Test,” which helps us find companies that generate continuing value creation.

In today’s post, we will learn:

- What is Warren Buffett’s One Dollar Test?

- Buffett’s Approach to Analyzing Retained Earnings

- Case Studies of the Retained Earnings One Dollar Test

- Limitations of the Test

- Applying the One Dollar Test

Okay, let’s dive in and learn more about Buffett’s One Dollar Test.

What is Warren Buffett’s One Dollar Test?

The “$1 Retained Earnings Test” is a straightforward yet powerful concept introduced by Warren Buffett, one of the most successful investors of our time.

“Unrestricted earnings should be retained only when there is a reasonable prospect – backed preferably by historical evidence or, when appropriate, by a thoughtful analysis of the future – that for every dollar retained by the corporation, at least one dollar of market value will be created for owners. This will happen only if the capital retained produces incremental earnings equal to, or above, those generally available to investors.”

–Warren Buffett, 1984 Shareholder Letter

This test is a valuable tool for investors to assess the effectiveness of a company’s retained earnings — the profits a company keeps rather than distributes to shareholders in the form of dividends.

At its core, the “$1 Retained Earnings Test” is a simple idea. If a company can generate more than one dollar of market value for every dollar it retains, it is considered a positive indicator.

We can calculate the test in the following manner:

- Add up five years of retained earnings from the balance sheet.

- Compare the market cap in year 5 to the current year and determine the change in market cap.

- Divide the change in market cap by the sum of retained earnings.

- The company passes the test if the ratio is greater than or equal to $1.

I will include a calculator to run these calculations yourself later in the post.

In other words, the goal is for retained earnings to create value that exceeds the original amount retained.

Buffett often emphasizes evaluating how well a company utilizes its retained earnings to generate shareholder wealth.

Buffett’s approach to evaluating retained earnings reflects his belief in the compounding power of money over time. He asserts that a company should retain and reinvest earnings only if it can achieve a return greater than that obtained by distributing those earnings to shareholders.

This perspective aligns with the “$1 Retained Earnings Test,” where the benchmark sits at creating a dollar or more in market value for every dollar retained.

The simplicity of this test is one of its key strengths. It cuts through complex financial metrics and provides a clear metric for investors to gauge the effectiveness of a company’s capital allocation decisions. Investors can quickly assess a company’s long-term potential by focusing on whether retained earnings contribute to shareholder value.

Warren Buffett’s shareholder letters are a treasure trove of wisdom, and in one of them, he highlighted the significance of retained earnings.

He stated, “The best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

This encapsulates the essence of the “$1 Retained Earnings Test” — the idea a company can retain earnings in a way that enhances the company’s value for shareholders.

The effectiveness of this test lies in its adaptability to various industries and business models.

Whether a company is in technology, manufacturing, or services, the principle remains the same: retained earnings should work diligently to create value. It’s not merely about the amount of retained earnings but how efficiently they are employed to generate returns.

While the “$1 Retained Earnings Test” provides a valuable lens for investors, it’s crucial to acknowledge its limitations.

Every metric has its blind spots, and this test is no exception.

In certain situations, a company may have legitimate reasons for retaining earnings even if they do not immediately meet the “$1 Test” criteria. Understanding the context and industry dynamics is essential when applying this test. More on this later.

Buffett’s Approach to Analyzing Retained Earnings

Warren Buffett has a distinctive approach to evaluating retained earnings — those profits a company keeps rather than distributing to shareholders.

For Buffett, the quality of retained earnings is paramount, and his method focuses on the return generated from these retained funds.

Buffett’s assessment of retained earnings begins with a fundamental question: How effectively is a company utilizing the funds it chooses to retain?

He emphasizes that merely retaining earnings is not enough; what truly matters is the return on those retained earnings. In essence, he wants to see companies putting retained capital to work in ways that generate substantial returns for shareholders.

The return on retained earnings is a crucial metric for Buffett, reflecting his belief in the principle of compounding. When a company retains earnings, it reinvests those funds into the business.

The key question then becomes whether the reinvestment generates a return that exceeds the cost of capital. Buffett asserts companies should deploy retained earnings to enhance the company’s overall value for its shareholders.

One of the ways Buffett gauges the quality of retained earnings is by evaluating a company’s return on equity (ROE). ROE measures how efficiently a company utilizes its equity to generate profits. Buffett considers a consistent and high ROE as an indicator of effective capital allocation. A company with a high return on equity suggests that it is adept at using retained earnings to create shareholder value.

Moreover, Buffett’s emphasis on return on retained earnings extends beyond simple profitability metrics.

He looks for companies that not only generate profits but also reinvest those profits wisely.

Buffett often underscores the importance of effectively assessing management’s ability to allocate capital in his shareholder letters. He seeks companies with management teams that make strategic decisions, ensuring that every retained dollar contributes to the company’s growth and shareholder wealth.

Buffett’s approach contrasts with a mere accumulation of earnings without a clear plan for their utilization.

He recognizes that merely retaining earnings does not guarantee success; the intelligent deployment of those funds truly matters. He prefers businesses that have a history of turning retained earnings into profitable ventures, driving sustained growth over the long term.

In conclusion, Warren Buffett’s evaluation of retained earnings revolves around the principle of return on investment.

According to Buffett, retained earnings should not just sit idly on a company’s balance sheet; they should actively employ them to generate returns that outpace the cost of capital.

By emphasizing the importance of the return on retained earnings, Buffett provides investors with a valuable framework for assessing a company’s financial health and long-term potential.

For him, the story behind the numbers matters, and a company’s ability to smartly reinvest its retained earnings speaks volumes about its management’s strategic vision and commitment to shareholder value.

Case Studies of the Retained Earnings One Dollar Test

Examining real-world examples can shed light on the practical application and success of Warren Buffett’s “$1 Retained Earnings Test.”

Several companies have stood the test of time by effectively deploying their retained earnings, leading to positive outcomes for the companies and their shareholders.

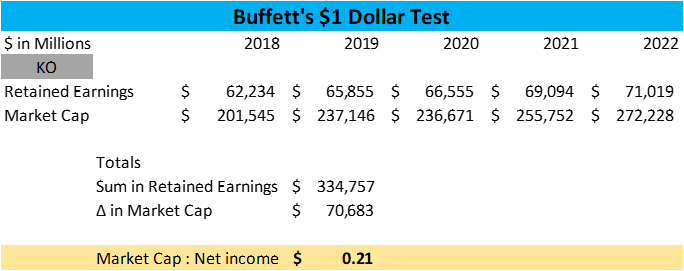

One notable example is Coca-Cola, which has long been a cornerstone of Buffett’s investment portfolio.

Coca-Cola has consistently passed Buffett’s “$1 Test” by intelligently reinvesting its profits into brand-building, global expansion, and innovative marketing strategies. The result has been a continuous increase in the company’s market value, outpacing the retained earnings.

Coca-Cola’s success demonstrates the power of compounding returns on retained earnings. By strategically allocating funds to strengthen its brand and expand its product reach, Coca-Cola has created enduring value for shareholders.

Most of Coke’s success resides in the past. The company doesn’t pass the test if we look at the current retained earnings ratio compared to the market cap.

But at this stage of Coke’s lifecycle, they offer bigger returns via dividends and buybacks.

The company’s positive outcomes underscore the effectiveness of the “$1 Retained Earnings Test” in identifying businesses that contribute to long-term shareholder wealth.

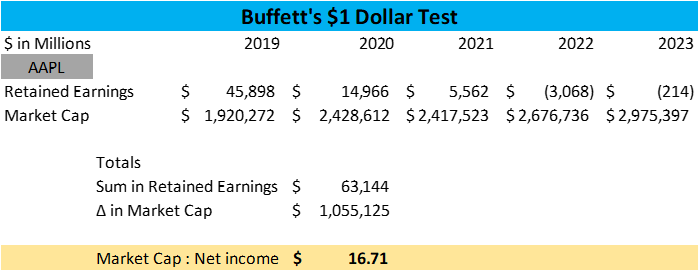

Another example is Apple Inc., which has experienced phenomenal growth and consistently passed Buffett’s test.

Apple’s strategic use of retained earnings for research and development, product innovation, and global expansion has propelled the company to new heights.

The introduction of groundbreaking products like the iPhone and iPad has boosted Apple’s market value and translated into substantial returns for shareholders.

Apple’s success story aligns with Buffett’s emphasis on the quality of retained earnings, proving that it’s not merely about accumulating profits but about making wise investment decisions as well. The company’s ability to convert retained earnings into innovative products and services showcases the correlation between effective capital allocation and sustained shareholder value.

Moreover, Buffett’s investment in See’s Candies provides another insightful case study. See’s Candies, a confectionery company, has consistently passed the “$1 Test” by reinvesting its earnings to enhance product quality, expand market reach, and invest in customer satisfaction.

This strategic approach has boosted See’s Candies’ brand value and contributed to the company’s ability to generate returns surpassing retained capital.

The Coca-Cola, Apple, and See’s Candies case studies collectively illustrate companies’ enduring success that aligns with Buffett’s philosophy on retained earnings. These companies prioritize intelligent capital allocation, ensuring that every dollar retained contributes meaningfully to the company’s growth and, consequently, to the wealth of its shareholders.

Positive outcomes for shareholders in these cases don’t stem from the accumulation of earnings but from the strategic and effective utilization of those retained funds.

The “$1 Retained Earnings Test” serves as a guiding principle for investors, directing their attention to companies that not only retain earnings but also employ them judiciously to create long-term value.

Limitations of the Test

While Warren Buffett’s “$1 Retained Earnings Test” provides a valuable lens for investors, it’s essential to acknowledge its simplified nature and recognize potential pitfalls and limitations.

The simplicity that makes the test accessible also implies that it might not capture the intricacies of every company’s financial dynamics.

One notable limitation is that the “$1 Test” does not account for industry-specific variations. Different sectors may have distinct capital requirements, growth patterns, and risk profiles.

Therefore, a one-size-fits-all approach may not be suitable, as what works well for a technology company might not apply to a manufacturing business. Investors should consider the unique characteristics of each industry when applying this metric.

Additionally, the test might not fully capture the timing of investments and returns. A company making substantial investments in a particular period may not immediately reflect positive results in terms of market value.

The lag between investment and return could potentially obscure the true effectiveness of the retained earnings.

Furthermore, external factors such as economic downturns, regulatory changes, or unexpected market shifts can influence a company’s performance, irrespective of its success in the “$1 Test.”

Lastly, unforeseen circumstances may impact a company’s ability to convert retained earnings into tangible market value, making it challenging for investors to rely solely on this metric.

Applying the One Dollar Test

Implementing Warren Buffett’s “$1 Retained Earnings Test” in your investment analysis can be valuable, but it’s crucial to approach it with a thoughtful and comprehensive strategy.

Calculator for you to put this all into practice:

Here are practical steps for investors to apply this test and enhance their financial analysis:

1. Understand the Company’s Business Model: Start by deeply understanding the company’s business model. Different industries have varying capital requirements and growth trajectories, influencing how they utilize retained earnings. Recognize the industry’s nuances better to interpret the “$1 Test” results.

2. Evaluate Historical Performance: Examine the company’s historical financial statements to assess how well it has utilized retained earnings. Look for patterns of consistent returns and positive outcomes for shareholders. Companies with a track record of intelligent capital allocation are more likely to pass Buffett’s test.

3. Calculate Return on Retained Earnings: Determine the return on retained earnings by comparing the market value increase to the retained earnings amount. This calculation quantitatively measures how effectively the company converts retained funds into shareholder value. A consistent positive result is indicative of successful capital allocation.

4. Consider Timing and Context: Recognize that the impact of retained earnings may not be immediate. Consider the timing of investments and the company’s strategic plans. A forward-looking analysis incorporating the company’s growth projections can provide a more holistic view of its potential.

5. Supplement with Additional Metrics: While the “$1 Test” is insightful, it should not be the sole metric guiding investment decisions. Supplement your analysis with additional financial metrics such as return on equity (ROE), price-to-earnings ratio (P/E), and debt-to-equity ratio. These metrics offer a broader perspective on a company’s financial health and risk profile.

6. Stay Informed about Industry Trends: Keep abreast of industry trends, market conditions, and economic factors that may impact the company’s performance. External influences can play a significant role, and being aware of these factors enhances your ability to interpret the “$1 Test” results accurately.

Investor Takeaway

Warren Buffett’s “$1 Retained Earnings Test” emerges as a powerful yet simple tool for investors seeking to evaluate a company’s financial prowess.

This test hinges on the premise that retained earnings should not merely accumulate on a balance sheet, but a company must wisely reinvest them to generate returns exceeding the cost of capital.

Examining real-world cases, including stalwarts like Coca-Cola and Apple, reinforces the correlation between effective capital allocation and sustained shareholder value.

While using the “$1 Test,” investors must remain mindful of its limitations, especially regarding industry-specific variations and the potential time lag between investment and visible returns. A nuanced understanding of a company’s business model, historical performance, and industry trends is imperative.

Additionally, savvy investors should complement the “$1 Test” with broader financial metrics like ROE, P/E ratio, and debt-to-equity ratio for a more comprehensive analysis.

In investment analysis, Buffett’s retained earnings philosophy remains a guiding principle, emphasizing that the real value lies in accumulating profits and deploying them strategically to fuel sustained growth and deliver substantial returns for shareholders over time.

As investors navigate the intricate landscape of financial decisions, the “$1 Retained Earnings Test” serves as a beacon, directing them towards businesses that prioritize intelligent capital allocation and have the potential for long-term success.

Related posts:

- What We Can Learn From Warren Buffett’s Four Pillars of Investing Warren Buffett has covered every aspect of investing over the years. Whether in one of his letters to shareholders, an interview, or an essay, a...

- Unlocking Financial Insights: How the 3 Key Financial Statements Interconnect “Accounting is the language of business.” Warren Buffett This brief quote underscores Buffett’s belief that a deep understanding of financials and accounting remains essential for...

- How Buffett’s Purchase of National Indemnity Propelled Berkshire Hathaway Studying Warren Buffett’s past investments remains a great way to learn. Over the years, Buffett’s investments have changed, but not a ton. He still looks...

- Evaluating Management with a Simple Checklist for Investors “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that...