Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT)

Updated 12/19/2023 Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large mix of marketable securities? Did you know that Microsoft owns over $120 billion in short-term investments, over 70% of its current assets, and over 39% of its total assets? That is […]

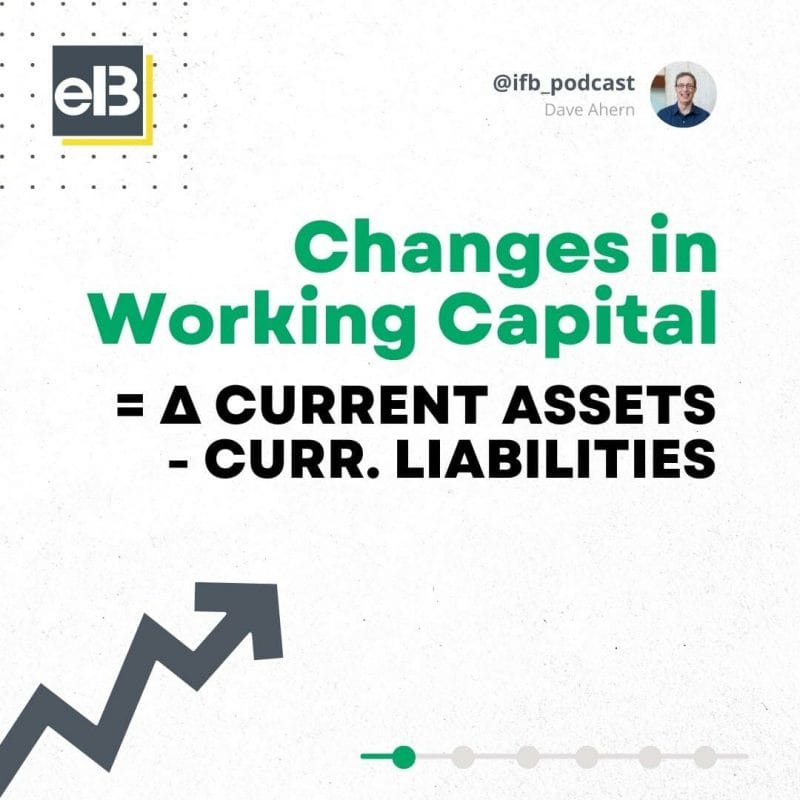

Changes in Working Capital: An Easy Walk Through

Updated 3/6/2024 Changes in working capital help explain how a company uses its assets to generate growth. Some companies build inventories, pay down liabilities, or extend their repayments to vendors to growt their cash flows. The better we understand how a company uses its assets and liabilities, the better we can predict changes in value. […]

SEC Form 4 Explained for Beginners

Updated 2/7/2024 One of the best ways to track how management feels about their company is to watch for insider buying or selling. Form 4 can help you determine any trades leadership makes regarding stock options. With the increase of pay for insiders (C-suite) in the way of stock options, tracking their moves can give […]

How to Calculate Days Sales Outstanding (DSO) – w. Real Examples

The DSO acronym in finance stands for average days sales outstanding, and is critical to understanding a company’s revenue and sales trends. The DSO calculation is simple, yet its usefulness should not be glossed over. Using the DSO formula can help a financial analyst spot when a company could be “stuffing the channel”, leading to […]

Return on Total Capital and How to Calculate it

Update 1/5/2023 “Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” Warren Buffett, 1992 Berkshire Hathaway Shareholder Letter All great businesses generate high returns on capital, and they do so regularly. Companies such […]

Run Rates: Key Metric for Quantifying Growth for Young Companies

Updated 4/28/2023 “Baby, we were born to run.” Bruce Springsteen, Born to Run lyrics With the booming stock market and the focus on exploding revenue growth, run rates and calculating them, plus their uses, is a timely metric to understand. Every quarter, companies hold earnings calls with analysts, which allow investors to hear from the […]

What a Good Debt to Asset Ratio Is and How to Calculate It

Updated 1/5/2024 Many businesses use debt to fuel their growth in today’s low-interest business world. Because debt costs are far lower than equity, many companies raise cash to grow by taking on larger amounts of debt. The debt-to-asset ratio measures that debt level and assesses how impactful that might be for any company. Debt can […]

Share Based Compensation Expense – How to Locate it in the 10-k

Today, share-based compensation issued to employees continues as one of the more disruptive finance topics, and some C-suite managers have abused their positions. Those behaviors have led many in Congress to believe that this type of compensation harms investors and employees. The idea of a “golden parachute” remains reviled and looked down on. In most […]

What is the Cost of Capital and How to Use It

Updated 12/12/2023 “I’ve never heard an intelligent discussion about ‘cost of capital.’” The value of any company or investment is the present value of future cash flows, whether Microsoft, our home, or a piece of art. Part of determining the present value of future cash flows is defining the discount rate or hurdle rate to […]

Understanding Provision for Income Taxes and International Taxes

Provision for Income Taxes is a line item in a company’s Income Statement which tells investors how much a company pays in taxes for a given Fiscal Year. By looking closer in a company’s Notes to Financials, the investor can get clarity on additional details of the Provision for Income Taxes—such as which amount is […]