Ben Graham, the father of value investing and the creator of security analysis, was a huge proponent of investing in bonds. His seminal book, The Intelligent Investor, recommends allocating anywhere from 25% to 75% of your portfolio to bonds.

Investing in bonds can be a great way to increase your margin of safety and protect your capital. Unfortunately, this area is not explored and largely ignored by the general investing public.

My goal with our continuing series about bonds is to help enlighten all about them and how they could help us.

Let’s talk about corporate bonds, shall we?

They are a bit scarier than treasury bonds, which we discussed in the last post. Corporate bonds have more moving parts and can be trickier to analyze. But that is why I am here. In today’s post, we will discuss the following:

- What are Corporate Bonds

- How to Analyze Bonds

- What are Bond Ratings

- Different Flavors of bonds: Investment grade and High-Yield

- How Do We Buy Corporate Bonds

All right, let’s get to it.

What are Corporate Bonds?

According to Investopedia:

“A corporate bond is a debt security issued by a corporation and sold to investors. The bond’s backing is usually the company’s payment ability, which is typically money to be earned from future operations. In some cases, the company’s physical assets may be used as collateral for bonds.”

Besides issuing shares to raise money, bank loans, or lines of credit, issuing bonds is another way for companies to raise capital for any project or initiative they may be working towards to increase its value.

Corporate bonds backing remains based on the company’s ability to pay back its debt. They can also use their physical assets; but think of the strength of their balance sheet as an indicator of the company’s ability to pay back its debt.

Interest rates for corporate bonds are generally higher than those of the treasury type, mainly because corporate bonds remain riskier. Treasuries have the backing of the US government, which has not defaulted on any debt, whereas corporations have defaulted from time to time.

Corporate bonds offer shares in blocks of $1000 in par value; what does par value mean? Each corporate bond’s value starts at $1000 for each bond, but the prices in the bond market will fluctuate above or below the par value.

Like treasuries, corporate bonds pay a coupon, typically every six months. We, as investors, would receive these coupon payments until our bond matures.

Corporate bonds can come with provisions that allow for early prepayment if interest rates change. We must avoid these types of bonds like the plague; they are not great for long-term bond investing.

One advantage of bonds over stocks is that if there were ever an issue with bankruptcy, it pays bondholders first before stockholders. Maybe this makes bonds safer than stocks, but we want to avoid this scenario if possible.

So how do we invest in bonds?

How do we Find an Investable Bond?

If we want to pick bonds like the pros, we need to find out what the pros are picking, especially as new investors to bonds. It is best to go straight to the source and determine what companies to best invest with themselves.

I would suggest we start by taking a look at some of the funds of the best bond fund managers out there; this is what I have done both for my stock portfolio, as well as my bond portfolio. Why not use their experience, wisdom, and knowledge to pick the best bonds for their funds to our advantage?

So, where do we find this information?

Probably the best website to use to help us find out what corporate bonds the best managers/funds are buying would be Morningstar.com. Morningstar is a freemium site that allows you to create an account for free, and you can use it to screen for different funds, or in our case, bond funds.

For your knowledge, let’s look at an example to get an idea of what I am talking about.

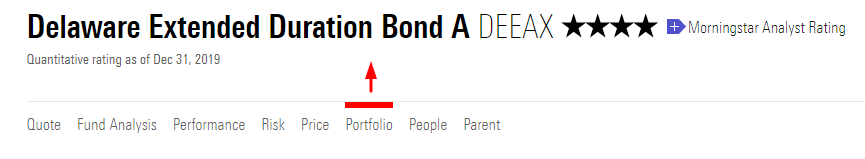

Once logged into Morningstar, we would look for a particular bond fund by screening for funds that are four to five-star rated for corporate bonds and then go from there. In this case, we will look for Delaware Extended Duration Bond A (DEEAX) bond fund.

Once we type in the above ticker, we will come to a screen that will list multiple links across the page; we want the link for a portfolio.

Once we click on that link, it will bring us to a page containing a plethora of information. We are looking for a breakdown of the portfolio as we are searching for individual corporate bonds to invest our money.

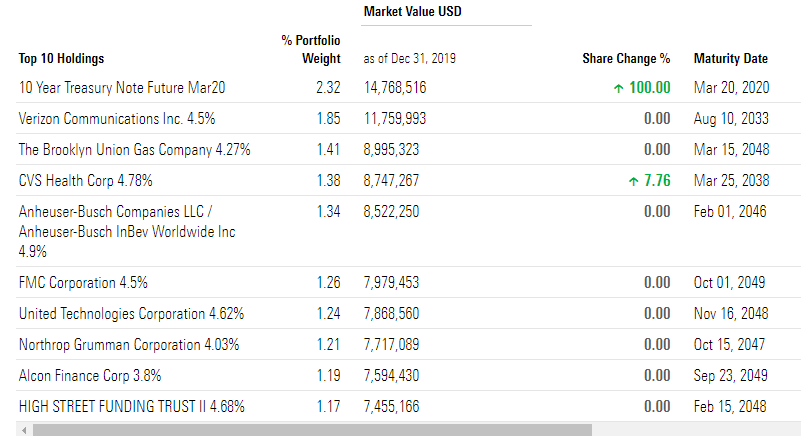

Toward the bottom of the page, there will be a breakdown of the largest holdings for this particular fund. Once there, you can see what corporate bonds this fund is holding.

In this particular fund, we can see that they are investing in Verizon (VZ), CVS, Anheuser-Busch, United Technologies, and so on.

The above list gives you a fantastic starting point to develop a portfolio of these particular companies.

Now that we have this info, what do we do? Do we buy these corporate bonds and go along on our merry way? Uh no!

We need to do additional research to investigate these companies to determine if their particular bonds are investment-worthy.

The good news is that now that we have a company we want to investigate, we can research that particular company just like we would if we were buying the equity versus the bond.

We would use many of the same techniques:

- Understand what it is the company does

- Looking at the quarterly and yearly data, looking for many of the same ideas, such as revenue growth, free cash flow, ROE, and ROIC, among just a few.

- Looking at the strength of the balance sheet

- Inspecting the long-term and short-term debt to ensure the company is not just taking on debt to pay dividends or to buy back shares, but to grow the company.

Once we are satisfied that we understand the company and feel like it is a strong, viable company, the likelihood of the default of its debt is remote. Then we can consider other factors when buying a corporate bond.

Another issue to consider would be making sure you are diversifying your corporate bonds across many different sectors. A mistake some beginning investors make when starting to invest is buying all tech stocks, financial or retail, for example.

The same rule applies when buying a corporate bond; it is also important to diversify when investing in bonds. Too much concentration in one sector could lead to more risk and potential harm to your portfolio.

It is best to spread your risk with corporate bonds among the many different sectors, trying to allocate no more than 15% across each sector.

There are many different sectors to consider, the most common being:

- Financials

- Auto

- Industrial

- Technology

Bond Ratings: What Are They and Can They Help?

Bond ratings are considered the most important measure of the strength of a bond. There are three major bond rating agencies: Moody’s, Standard and Poor’s, and Fitch.

These companies have tremendous sway in the bond market and can make or break a bond issuing.

Each company has a slightly different twist on its ratings, which rate the credit quality of each company and its bond issues.

Many different factors go into the ratings of a bond:

- Economic sensitivity – How sensitive a company is to the strength or weaknesses in the economy. Think about Walmart during the last recession and how it survived versus someone like Macy’s, which has struggled mightily since.

- Interest coverage ratios are critical to judging the company’s ability to cover its interest payments on bonds, given the various economic situations. These ratios indicate how risky a bond might be if its revenues decline or cash flow dries up.

- Seniority – Bonds that are paid before others if the company runs out of cash. Does the company pay us first, or are there other issues that preceded us? The seniority of our position can indicate the strength of our bond.

- Recoverability – If the unimaginable happens and our company, government, goes into default. Are there enough liquid assets to cover our bond? Think about a tech company like Apple because its debt is so small compared to its equity that, in the case of default, it would have enough equity to cover its debt.

Let’s look at a chart to give us an idea of the different bond ratings.

The best get the AAA ratings, and the worst get the C ratings. Bonds with higher ratings typically pay lower yields, whereas lower ratings pay higher yields. The difference in yields is one of the risks we must balance when investing in bonds.

These ratings can hugely impact bonds and the yields and prices they offer. Higher-rated bonds may offer a higher price on their face value and pay a lower yield than a bond that is not investment grade. Remember that price and yield remain inversely related in the bond market; as price goes up, yield goes down, and vice versa.

Ratings have come under great scrutiny over the last dozen years or so because of how they work and the companies that rate them. Remember the movie “The Big Short”? There is a scene in the movie where there is a discussion about the validity of some ratings given to a suspect company.

Companies can now pay rating agencies for higher ratings; this has been under review and will hopefully become more regulated to help eliminate unnecessary fraud in the system.

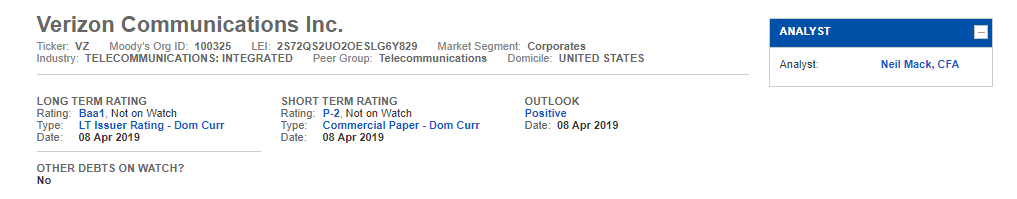

You can search for the company’s ratings on each rating agency’s website. You must have an account with them, which is free. I took the liberty of looking up the Verizon (VZ) rating on Moody’s to give you an idea of what it would look like on their website.

As you can see from the info above, Verizon has a Baa rating from Moody’s, an investment grade but on the border, which would bear watching in the case of investment. The rating can be a great way to test the strength of a company you are considering investing in its stock. The strength of their bond offerings can indicate a strength in their overall credit rating, which is a great thing.

Different Flavors of Corporate Bonds: Investment Grade versus High-Yield

The debate between investors will rage on which is better, investment grade versus high-yield. Let’s look at these ratings and how the bonds function to understand the potential risks and rewards better.

Let’s discuss high-yield bonds for a moment.

High-yield, formerly known as junk bonds, can offer investors many potential benefits, balanced by specific risks, mainly a higher risk of default.

Because of their lower ratings, the company’s bonds may have shakier credit ratings or suffer from a downturn in their business. They may also be a newer company with a shorter track record, thus less credit rating ability.

Some benefits they offer:

- Diversification – high-yield bonds typically have a very low correlation to investment-grade bonds, which means that adding high-yield bonds can add more diversification to a broad bond portfolio. Diversification doesn’t protect you from loss, but it can help decrease overall risk and improve the steadiness of the returns.

- Increase current income – to encourage investment, high-yield bonds offer a higher yield than investment-grade bonds. The higher yields can help increase the overall yield of our bond portfolio.

- Capital appreciation – An upturn in the company’s fortunes can greatly increase the price of a high-yield bond. This capital return can greatly enhance our portfolio in the long term. Of course, the inverse is true as well. If a downturn in the company’s financial health occurs, this could also drive down the price.

- Equity-like returns – There is a strong correlation between high-yield bonds and the stock market. The correlation can lead to similar returns over a credit cycle. However, returns on high-yield bonds tend to be less volatile than stocks because the income portion of the return is higher, providing great stability. The combination of enhanced yield and potential for capital appreciation means that high-yield bonds can offer stock-like returns over the long term. However, the returns are less than equities and come with a higher risk than investment-grade bonds.

Look at this chart from PIMCO.com, one of the leading bond fund providers in the world.

As you can see from the chart above, the potential for returns is enticing, especially for a bond portfolio. However, we must balance this potential against default risks and capital loss.

What are the risks involved with high-yield bonds?

Here is a list of some of the risks involved:

- Default risk – missing interest payments are greater for high-yield bonds versus investment-grade bonds.

- Downgrade risk – If the company’s financials deteriorate, there is a risk that its high-yield bond might get a downgrade, which would include a decline in the bond’s price.

- Interest rate risk – When interest rates rise, bond prices fall, and vice-versa. If interest rates fall, bond prices rise.

- Liquidity risk – This risk illustrates the possibility of difficulty in selling a bond quickly and at an optimal price. The lack of liquidity reflects in the bid-ask spread; as the spread increases, the ability to sell the bond quickly lessens.

The above is just a shortlist of the risks of investing in high-yield bonds.

For reference, according to Moody’s, the trailing twelve months (from 2019-2020) have seen a default rate of 3.4% of high-yield bonds among the B-rate bonds. As one would expect, this rate spikes during economic downturns, such as the Great Recession or dot com bubble meltdowns.

Compare this to the default rate of AAA-rated or AA-rated bonds over the last 30 years of 0.0% and 0.2%, respectively.

How Do We Buy Corporate Bonds?

Now that we have done our research, we are finally ready to purchase our first corporate bond.

Not so fast! There are a few more steps to work through before pulling the trigger.

Buying corporate bonds exists at two different levels.

- Primary market

- Secondary market or OTC

Let’s discuss primary markets first.

The primary market represents new bond issues. Think of these as IPOs for new corporate bonds. When a company decides to sell bonds to raise capital, it negotiates with investment bankers and large institutions to place its bonds in the markets, just like an IPO.

The pricing of these bonds is pretty straightforward to understand. When the bond is purchased, everyone pays the same price, known as the offering price.

The bad news about this market is that it is a closed loop for the small investor. We need special relationships to have access to buy any of these new bonds. Typically as a small investor, these primary market bonds are out of bounds.

The secondary market is where most buying and selling of bonds occurs after an initial offering or IPO. Small investors like us can buy in this market, but we must be cautious.

The secondary market occurs completely in the over-the-counter market. Most trades are in a closed system and conducted through a broker.

The trick with the secondary market is the pricing of bonds can be tricky to track and understand.

When buying in the secondary market, we must ensure that we are paying a “good” price. We must know the “mark up” or “spread” brokers will charge for selling us that bond.

The spread is the difference between what a broker paid for that bond versus what he wants to sell it to us for, considering it a commission. Unlike stocks, the spread builds into the price you would pay for that corporate bond, making it difficult to determine the spread or markup or how much profit the broker is making.

FINRA, a non-governmental regulatory agency, now offers the ability to track recent bond transactions through its TRACE system, which gives us some insight into spreads on recent bonds.

Before you buy a bond from a broker, use this system to look at recent quotes on bonds you are interested in. TRACE can give you an approximation of the spread your broker is charging.

Make sure you research your broker before you pull the trigger; recently, there have been some scandals concerning bond salespeople. Due to these scandals, there has been a greater degree of transparency in the bond market, but it still pays to do your due diligence before buying.

Bonds can be a great investment, but the corporate bond market requires a lot of due diligence and effort.

Final Thoughts

As we have discussed corporate bonds, we have discovered that there can be many benefits to using these vehicles to help grow our money.

Some risks can also be involved in corporate bonds, among them default risk.

Corporate bonds can be a great investment with safety not offered in the stock market. Bonds offer lower returns than the stock market, but the trade-off is the lower risk of capital loss.

Corporate bonds can be a great addition to your portfolio, depending on your risk profile and where you are in your investing journey. And if your risk appetite is greater, there are options to achieve equity-like returns with high-yield bonds, but you must be aware of the risks of investing in these bonds.

Also, keep in mind that playing in this market requires larger capital. Each bond requires at least $1000 to buy any one bond, with many requiring much more, say $5000 to $10,000 to invest in their bonds. Unless you have that amount of capital available to invest in corporate bonds, you might consider bond funds instead.

As always, thank you for taking the time to read this post; I hope you find it helpful and answers a few questions for you. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time.

Take care,

Dave

Post Updated: 12/14/2022

Related posts:

- How Bonds Are Rated – Your In-Depth Guide to Understanding Credit Risk Updated 6/7/2023 Have you ever tried to buy a car or home? If you have, you have gone through having your credit checked, which is...

- Bond Valuation Overview (With Formulas and Examples) Updated 6/15/2022 “An investment in knowledge pays the best interest.” Benjamin Franklin As investors learn more about our investments, we become better investors. One of...

- How to Find and Invest in Tax Free Municipal Bonds “I’m proud to be paying taxes in the United States. The only thing is – I could be just as proud for half the money.”...

- Corporate Bond Yield, Yield Curve, and its Impact in Fixed Income “Both from the standpoint of stocks and bonds, an investor wants to go where the growth is.” Bill Gross Considered the undisputed master of bond...