As you likely know, there are really two different ways for anyone to save money – you either have to cut your expenses of increase your income, and I’m ready to go in depth with ways to increase your income!

Of course, there are other ways like winning the lottery, receiving an inheritance, or robbing a bank – but if I were you, I wouldn’t bank on any of those… get it?!

Wait, sorry, but really quick – why did the banker fall asleep?

….

Because they lost INTEREST! HA!

Ok, sorry – I’ll stop with my lame jokes.

If you have read any of my previous posts, I am a huge advocate for decreasing your spending as a first step over increasing your income for a few different reasons:

1 – It’s Faster

You can literally stop spending money now. Like today. Delete your Amazon app. Stop ordering pizza and look through your pantry. Do you have green beans, rice and some frozen meat? There you go – that’s a dinner. You just used stuff you had instead of $20 on pizza.

Are you going to go out with friends tonight? Why not invite them over, grab a $8 6-pack of beer and play card games? $8 for a 6-pack instead of paying $4/beer + tip, plus an Uber there and back…easily looking at a $30 night at the minimum.

There are a ton of ways that you can just quickly stop this unnecessary spending if you really think about the ways that you’re simply just blowing cash.

2 – It’s Easier

This is similar to the examples I mentioned in the “It’s Faster” section, but a little different. Literally anyone can do any of these things with minimal effort. You can just stop spending. That simple.

I know it’s a mindset that is hard for a lot of people to get over, but there are ways to do it by simply just tracking your expenses. I think that tracking your expenses is the best way to get your spending under control and it’s the reason that I think that Doctor Budget is the best budget tool on the market.

It’s extremely simple to use, very customizable and forces you to just get a little bit in the weeds, which I think is crucial to actually understanding where your money is being spent.

You might think you know where you’re spending your money but I guarantee you don’t. I even find myself nowadays going, “wow, I can’t believe I spent that much on ____” when I review at the end of the month. That sort of insight allows me to be a more conscious spender for the next month, and it all started with the easy steps of looking at my spending.

3 – It’s the Most Important

Every now and then I’ll see an article that says something like, “This couple makes $500K/year and is still broke.”

…what?

First off, that’s ridiculous. Second, I don’t feel bad at all for them.

How can you make that much money and be “broke”? That is just ridiculous.

The answer is because they have absolutely no idea how to manage their spending. On the other hand, there are countless examples where people will be making a livable wage of $50K/year or less and are able to save more than half of their income.

Sure, they are likely implementing some sort of life decisions that some of us might not deem as “worth it”, such as no vacations, never going out to eat or eating only rice and beans, but the point is that there is always a happy medium that you can implement in your life.

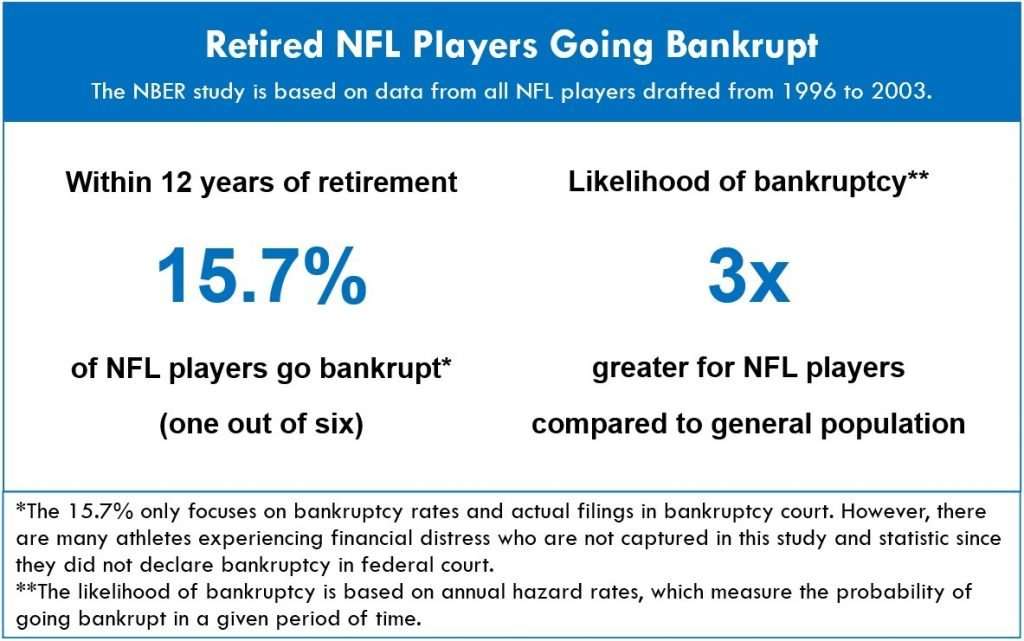

The point that I am trying to make is that no matter how much you make; you can always find a way to blow it. How frequent do you hear about professional athletes going broke not long after retiring from their sport?

The Azara Group did some research that I think is pretty interesting:

These sorts of stats are stunning. It really just shows me that just because you have a lot of money doesn’t mean that you’re going to be setup for life. If you cannot control your spending, then you’re never going to reach your financial goals, regardless of your income.

That being said, if you have a solid grip on your spending and don’t feel like you can, or want to, cut anything more out of your life – it might be time to look at seeing how you can increase your income limits!

That might sound like something that’s not fun, and it likely will mean extra work, but that doesn’t mean that it’s not worth it by any means. Below are some concrete steps that you can take to increase income:

1 – Ask for a Raise

I bet 99% of you are going, “Andy, I did that and my boss said ‘no’.” Well, why did they say no? Did you simply just go into their office and ask for a raise or did you have some sort of plan?

I am a really big fan of Ramit Sethi on the personal finance side of things and he talks about this extensively in his book, I Will Teach You to be Rich, which you can purchase on Amazon for under $9 – huge win!

In short, the steps that he recommends are:

- Find out what your boss wants

- Let them know that you want a raise

- Decide what you’re going to do & tell your boss how you’re going to do it

- Do it

- Show the results and ask for the raise

Seems simple, right? The book also has some exact scripts that you can follow to guide you through the conversation with your boss, but I think that even this simple format can help you tremendously.

Basically, you’re finding out what your boss is looking for in a successful employee. Then, you’re essentially telling them your expectation is to get a raise. Then, you’re telling your boss exactly what your plan is to achieve this goal. Next, you’re going to accomplish the goal and finally you will show the results to your boss and reintroduce the idea that you’re looking for a raise.

The process is simple and one that can be easily implemented by anyone. Chances are, you’ve already thought of many reasons why this won’t work for you. I know that I have!

- “My company is struggling right now.”

- “My company only gives annual raises.”

- “My company already pays me well.”

Those are not reasons – those are EXCUSES!

Even if you’re paid well, you can always make more. If you’re valued, the company will pay you more to stay with them and to be happy.

And guess what – the entire conversation started by you essentially asking your boss, “how can I help make your life easier?” Doing this just sets the conversation up the right way rather than going in and demanding more money for work that you’re currently doing.

You’re offering to do more in exchange for higher compensation – who would say no to that? That’s a win win!

It’s tough to get over the fear of being rejected when asking for a raise, but this is the quickest way to increase your income and often the path of least resistance – chances are, you’re the main barrier to getting that raise in the first place!

I know that’s true with myself, at least…

2 – Grab a “Traditional” Side Hustle

Of course, I have to include this in the list of ways increase your income and chances are, it’s the one that you’re most looking forward to reading!

There are many different ways to get a “Traditional” Side Hustle:

- Drive Uber/Lyft

- Deliver Groceries via Instacart or Shipt

- Deliver Food via DoorDash, Grubhub, etc.

- Walk dogs for people

All of these are some of the common ways that you might be used to people having a side hustle. The things that I like about all of these options are that you can work on your own schedule.

If you’re feeling super productive, you can wake up early one day and deliver groceries for people. Maybe you can drive Uber for a few hours instead of going out to a bar that night. Not only are you making money but you’re saving money as well by not going out – win win!

I have a coworker, that is compensated very well, that grocery shops for people on Instacart with her free time. Her significant other is a coach so when he is at games or practices at off hours, rather than watch TV nonstop, she will take a few hours and grocery shop for people.

It’s not a ton of money, but she said that it keeps her busy and gives her a little extra money that she can do with as she wants.

Another example is that when I lived in Chicago, I knew someone that had an hour commute home every day. If they didn’t have a huge rush to get home, they’d turn on their Uber app and try to pick up rides that moved them towards their home.

It could take an extra 30-60 minutes to get home, but in exchange for that, they were making $20+/hour for driving.

But check out this math – if you’re making $20/hour and it takes two hours, that’s $40. But, if it’s only one extra hour of driving, you made $40 in 1 hour. $40/hours * 2080 hours in 1 year = $83,200 in an annual salary.

Not bad, right?

3 – Monetize Your Hobbies

I guarantee that you can find a way to monetize your hobbies.

Like to work out a lot – maybe consider being a personal trainer!

Like to learn new things? Maybe you can become a tutor for the subjects that you’re knowledgeable on and actively learning.

Like to write? Try writing blogs!

Like to golf? Apply to a golf course and you likely will then get to golf for free!

Just be creative. You can find ways that you can put in a few hours of work for something that you absolutely love doing and in addition to making money, you’re doing something that you enjoy!

Nothing better than making money and having fun doing it!

4 – Become More Marketable

Find ways that you can become more marketable and bring more to the table with your current employer.

Does your current employer offer tuition reimbursement? Maybe you can go get that degree you always wanted or continue furthering your education.

Or, maybe instead of a degree, you can look at adding some certifications to your name to become a more marketable employee.

Do you do non-required tasks at your work and get involved in groups and networks that might open up more windows? Showing that you have skills that are not showcased in your current work or showing them off to people that you don’t directly work with, can open up a lot of opportunities at your current employer.

Have you ever attended networking events? Doing so can open up a ton of opportunities for you to potentially job hop, which leads me to my last point.

5 – Job Hop

Changing jobs is a great way for you to increase your income. Historically people have viewed this as a lack of loyalty but that’s just really not the way that the world works anymore.

Forbes wrote an article where the average annual raise for someone staying with their current employer is 3% while the typical raise when you switch employers is 10-20%.

Of course, there are a ton of reasons why you might not want to job hop around, but if you’re solely focused on the money and live in a city where there is a lot of potential options for you, this might be a good move for you.

Personally, I am extremely happy with my company and I actually have the ability to change jobs every 2-3 years within my company, so I feel like I have the stability with my current employer and also the benefit of jobs never being stagnant.

At the end of the day, it really just boils down to what’s the most important to you!

Summary

At the end of the day, any of these methods can be used to increase income to help you reach your financial independence goals. I recommend that you take a good, hard look at your current situation and try to see if any of these make sense in your daily life.

But, at the end of the day – increasing your income only works if your expenses are under control. If they’re not, you need to get that sorted out before you even think about anything else by getting your personal budget going with these 15 easily forgettable budget categories!

Related posts:

- No-Nonsense Financial Planning for Beginners (Pt2: Income) Ask anyone who’s gone from making a small income to making a lot—saving and investing becomes SO much easier when you have a higher income....

- 7 Simple Tips to Avoid Lifestyle Creep Have you ever found yourself being a victim to lifestyle creep? It might seem like a ridiculous thing but it’s most definitely not. Fortunately for...

- Retiring at 55? 9 Tangible Steps to Turn that Goal Into a Reality! Are you pumped for this blog post? I hope so! I know that I am extremely pumped to write it and show you all about...

- Make Sure You Find Companies with the Best 401K Match and Benefits Before Accepting a New Job When looking for a new job, it isn’t just about salary anymore. Companies with the best 401K match can be equally attractive as a strong...