Have you ever found yourself being a victim to lifestyle creep? It might seem like a ridiculous thing but it’s most definitely not. Fortunately for you, I have been through the ringer on this and am prepared to share some tips and tricks to prevent it from happening to you!

Lifestyle creep is also sometimes referred to lifestyle inflation and it’s essentially when your income rises, your expenses tend to rise as well. Basically, you start to earn more money so your tastes become “richer” and you start to spend extra money on those things.

It’s easy to sit there and say that you’ll never fall a victim to this because you didn’t need those things now so why would you need them later – but it’s not that easy. I can speak from experience.

My wife and I are very blessed to have great jobs but we still find ourselves to be frugal. We take a personal pride in seeing how much money we can save, invest and pay extra on debt to watch our net worth continually increase.

In fact, we love it so much that we actually hold frequent family finance meetings just to share our progress and motivate one another to keep on doing better. Some months things don’t change that much but other months we see monstrous gains – and seriously it’s the most motivating thing ever.

For perspective, some things that we do are:

- Use apps like Ibotta and the Meijer app to find coupons prior to grocery shopping

- Think extra, extra hard about things that we need, such as:

- Holding off on new work clothes since we’re not going in the office much

- Buying new socks until it’s literally a need

- Buying bulk items from Amazon instead of at the local store

- Having “cheap weeks” for meal prepping items

- Avoiding repainting our house which we want to do. Well, one of us wants to ?

We’re not cheap, but we just want to make sure we’re literally getting the most bang for our buck and using our money in the way that’s going to benefit ourselves the most, regardless of whether that’s now or in the future.

Fortunately for us, my wife recently just got a major promotion at work. She 100% deserved it and busted her butt to get this new job and it resulted in her getting an absolutely insane pay raise of nearly 50%! I couldn’t be prouder of her for getting that raise and it feels good to see her valued by her company with this sort of raise.

So, what do we do?

Well – we did all the wrong things:

- On the way home from work I bought a $70 bottle of champagne

- She bought new clothes

- I bought those socks that I wanted (lol)

- When we went grocery shopping, I didn’t use my coupon apps, we didn’t look at the advertisements, and we bought toilet paper and Kleenex from Meijer instead of Amazon

The horror!

You might think that it’s ridiculous that I am annoyed with myself for doing these things, and that’s fine, but that’s not the way that we intend to live our lives.

What if these decisions turned from 1-time decisions into habits? Not counting the 1-time purchase of champagne since that’s likely not going to repeat, we combined spent an extra $200 between the clothing and lack of grocery habits.

The grocery habits alone cost nearly $50 which is $2600 over a year or nearly half of an IRA! Just insane to think about by us not caring anymore, we might have just wasted $2600 because we got lazy and complacent about our habits.

Fortunately for us, we both have a lot of self-awareness about our spending and immediately knew that we were overextending ourselves. Most people likely don’t have self-awareness like this but I am also a mega-nerd when it comes to personal finance and listen to podcasts 24/7. Not only could we identify what was happening but we also understood our goals well enough to quickly identify ways to fix the issue, along with the monetary impact if we kept spending this way.

So, the real question is – what can you do to avoid lifestyle creep? There are fortunately a lot of things, both tangible and mindset related, so let’s stop wasting time and get into the details!

Tangible To-Do’s

1 – Be Prepared

Being prepared is by far the #1 thing that I think everyone should, and can, do well in advance of an awesome money windfall situation occurring. Now, I’m not saying that you should have some plan if you get a ton of excess cash, but you should have already been having family finance meetings where you and your family are onboard with what goals you have.

For instance, my wife and I had the goals this year to:

- Max out 401K Employer Match

- Max out our HSA

- Start to save 12 weeks of savings for my wife to take maternity leave in the distant future

- Max out both IRA’s

- Pay extra on a loan that’s 5.99% interest

Those were our main goals, and in order, of the priority that we were planning to attack them. So, when we got this amazing news that she was getting such a nice promotion, we immediately knew how we wanted to apply this extra money.

If you don’t have a plan in place, you’re much more likely to become a victim to lifestyle creep. Before you know it, you’re going to find yourself spending that extra income in ways that you quite frankly don’t need. You’re just wasting it.

Instead, we knew what goals we had and because our goals were very ambitious, there was a natural “gap” between what we could’ve likely accomplished on our current income.

We made them stretch goals to cause us to strive to be even better spenders and savers. So, when this opportunity came about – we were ready. We had planned.

There’s no reason you can’t be ready, too!

2 – Automatically Increase Your Savings

Automatically increasing your savings is not something that everyone can do but if you can, I highly recommend that you try it.

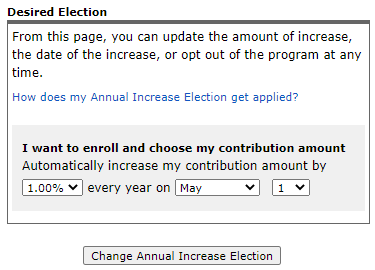

For instance, I have the option with Fidelity to automatically increase my 401K contributions every year. All that I have to do is set it one time and then I never need to worry about it again.

The screenshot below is from Fidelity showing just how easy the program actually is:

The company that I work for typically gives out annual raises that are generally 3%, give or take. I’ve only been with the company for 7 years but have received a raise each year so it is a pretty ratable thing although things can always change!

For me, it would make sense to use this program.

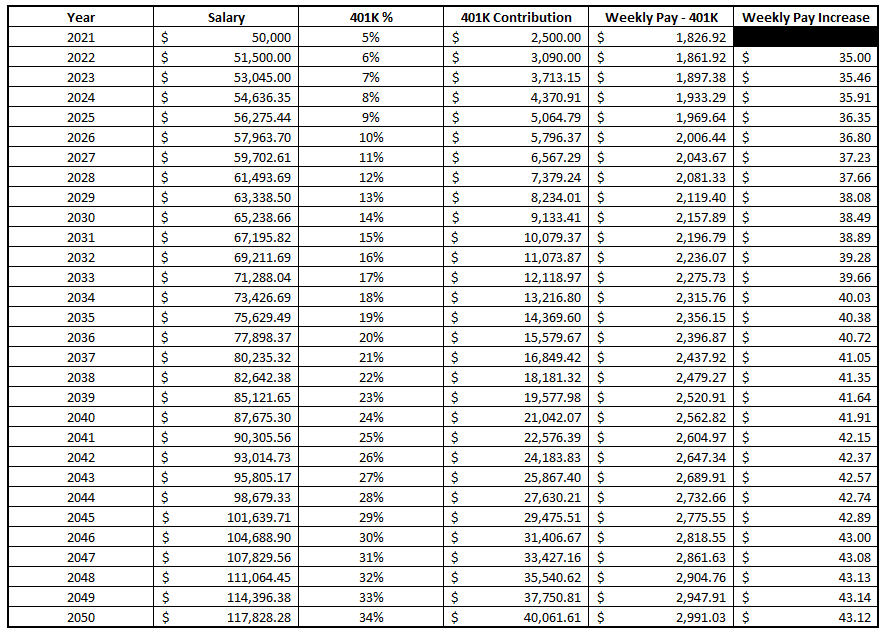

Let’s pretend this fake situation:

- Current Salary – $50K

- I get a 3% raise each year

- Current 401K Contribution – 5%

- I will increase my contributions 1% each year

If these things happen, then I am not only going to drastically grow my 401K contributions but also will increase my pay increase. Check out what happens over the next 30 years if I did this!

My 401K contributions grow by that same 1% each year which becomes more and more impactful as my salary increases, and I am still consistently bringing home about $40 on average more each paycheck, before taxes and all other things.

Pretty nice, right?

While this example is for a 401K, you can do a very similar type of transaction with your other accounts. It’s a little more manual but make a reminder on XXX date to go update your IRA contributions, savings, mortgage payments, or anything else.

Even if you don’t have a raise, just go in and do it. You’ll figure out how to make it work.

If you’re saving $250/month for your IRA then you’re at $3K each year – half of your annual max. Just go in and round that up to $300.

I promise you’ll naturally find a way to make it work. It’s how it always happens. And if you literally can’t, then it’s time for you to think about increasing your income!

3 – Create a Saving/Spending Plan

If you create a saving/spending plan then you can likely get away with skipping the first two tangible to-do list items, but I don’t recommend doing that.

This is such an easy thing to do and literally took me less than 5 minutes, but that’s only because we already had our goals established for what we wanted to achieve in 2021. It’s really not a hard process to do, but let me show you how to do it:

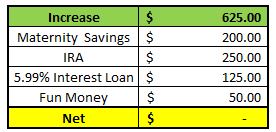

Let’s pretend that my fictitious $50,000 salary was increased to $60K – wow!

Now, I’m not going to get to take home all of that extra pay, but I will likely get around 75% of it, or $7500 extra dollars. You can either go in manually and try to calculate it in excel, a take-home pay calculator, or just wait for you to receive your first paycheck and then proceed with making your plan.

You know me – I chose excel ?

So, if you get an extra $7500 annually, that breaks down to $625/month. Assuming the same goals that I listed above; a potential breakdown might look like this:

- Max out 401K Employer Match – No changes. Already doing this.

- Max out our HSA – No changes. Already doing this.

- Start to save 12 weeks of savings for my wife to take maternity leave in the distant future – We were saving $200/month. Now we will bump this up to $400.

- Max out both IRA’s – We were contributing about $7500/month. Now we will contribute $1000 to max out the $12K limit in total between both of our IRA’s.

- Pay extra on a loan that’s 5.99% interest – currently not doing this as the IRA wasn’t maxed. Now we can put extra money down on this. How much can we put down? Well, theoretically you could put down the remainder of $175, but that takes me to my last tangible tip!

4 – Build in Leeway

Look, you just got a massive freaking raise because you busted your butt. I personally think it’s silly to just save 100% of that money and not allow for any sort of lifestyle creep at all.

If you plan it, it’s really not lifestyle creep. I’m not telling you to shell out a ton of money and just go waste it every day but give yourself something small that’s going to reward you. In the example that we have been walking through, maybe just give yourself $50/month to spend however you see fit.

It’s 8% of your total take-home pay and you’re setting up a plan to put the remaining 92% to an extremely good use. Trust me, I have seen that people that give themselves some leeway are wayyy more likely to succeed than those that follow an extremely stringent budget with 0 fun at all.

Ah – we’ve reached the end of the tangible list – time to go to the mindset-based to-do’s!

Mindset-Based To-Do’s

5 – Keep It Simple Stupid (KISS)

You got a raise. Save a large majority and then give yourself a very small amount to spend how you want.

That’s it.

Don’t overcomplicate it. Keep it Simple, Stupid.

Don’t spend days finding the most optimal strategy to spend every single dollar just to find out that you planned so precisely that when you overspend in a month, you immediately miss out on some of your other goals. Just keep doing what you had been doing and you’re going to be just fine.

6 – Treat Yourself

I think this one is really, really important. You just got a massive raise. You busted your butt. You were rewarded monetarily. Now you get to do something good for yourself and your family. DO IT!

Maybe instead of immediately putting these saving goals into action you decided to just postpone it a month or two. Take that extra $625 that we predicted you would receive and do something fun with it.

Go to an amusement park. Buy some new clothes. Get a really nice dinner. Hire an overnight babysitter and go on a trip with your spouse. Go to a sporting event. Anything!

If you have been absolutely living that minimalist lifestyle then you deserve to have something nice.

I am a HUGE proponent of saving as much and early as possible, but sometimes you need to recharge the batteries. You know how when it comes to fitness people actually say cheat meals are a good thing? It resets your body AND your mind to have that unhealthy meal and then you’re motivated to get right back on the healthy train.

Treating yourself is no different. Notice that I’m not telling you to go buy a new car. I’m telling you to go to a day trip or buy some nice new clothes.

There are different variations of “treating yourself”. Limit the “treat” to being something very reasonable…like less than two months (preferably one month) of your new raise.

7 – Screw the Jones’

And finally, one of my favorite ones – Screw the Jones’!

You are RICH! Time to upgrade the car, house, and everything else, right?!

NOOOOOOOOO!!!!

Keep living your same life that you have been living. All of the goals that you had, whatever they are, are now just going to happen earlier.

Sure, you can theoretically afford another $625 in monthly payments on crap that you don’t need, but wouldn’t you rather invest that money and retire early?

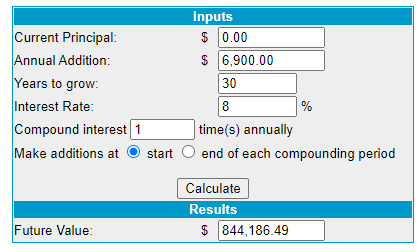

If you invest $575 and leave the rest for fun money then you would have over $844K in 30 years:

Not sure about you, but I’d rather have that $844K than a new car or a bigger house. Let the Jones’ buy their massive house and their Audi/BMW. They can have all of those tangible items, and debt, that they want.

When you’re 40 years old you’ll get to make decisions to questions like, “do we want to retire in a few years or buy a beach house? Do we want to work our current job or maybe just quit and do something we love doing instead? Do we want to move closer to our kids and take a lower paying job or stay here?”

Don’t those questions sound nice? Sure, you can buy that outrageous house now but you’re sacrificing flexibility and enjoyment in life in the future.

Stick to the plan. Live a minimalist life. Increase your income. Invest early and often.

If you do those things you’re going to be destined for success.

And oh yeah – CONGRATS ON YOUR RAISE!

Related posts:

- 17 Simple Minimalist Living Tips for a Maximum Life The Financial Independence, Retire Early (FIRE) community is all about cutting all expenses, maximize income, and retiring ASAP. While that in theory sounds great, I...

- Struggling to Save? Start with These 4 Simple Auto-Investments Updated 4/1/2024 One of the most challenging steps to becoming financially independent is getting that little snowball moving downhill by creating a gap between your...

- 5 Frugal Living Tips that Only Take Seconds to Implement Who says you can’t have fun AND save money? Here are some great frugal living tips that keep money in your wallet without killing your...

- 4 Tips to Strengthen Your Risk Appetite for Investing in the Stock Market Have you ever heard that the stock market is risky and that you’re going to lose all of your money? I know that I have...