Everyone knows that investing early can dramatically change your future. But how much can it actually change? The answer is a lot.

Click to jump to a section:

- Misconception About Investing

- The Magic of Compounding

- The Math Behind How Starting Early Affects Your Returns

- How Compounding Helps Your Family

- Don’t Wait

- How to Start Investing Early with $500

Misconception About Investing

I know a lot of people that don’t think they need to invest now. I frequently hear people say that they’re going to spend their 20s just spending money, not really saving anything, and then figure the rest out later.

And when I say that I hear people say this, I don’t just mean my friends. I mean younger people in the financial community. People who are self-proclaimed experts in finance.

That is the absolute opposite of the right move to make. The earlier you start, the better, plain and simple.

The Magic of Compounding

I mean, this is compounding 101. Let’s assume you make 10% on your investment every year, as is expected from the S&P 500. If you invest $1.00 in Year 1, you will have $1.10 in Year 2 (110%*$1.00). In Year 3, you will have $1.21 (110%*$1.10).

So, if you put your money in for only two years, you earned $.10, but in the third year, you earned $.11. That extra year was worth an additional $.01. I get it; that’s only a penny.

But you’re likely investing more than $1.

To keep this example going, if you did invest $1 this year and you earned 10% each year, do you know how much you would have in 2075? Guess. Seriously, take a second and guess.

You would have $207.97. Holy crap. From a $1 investment.

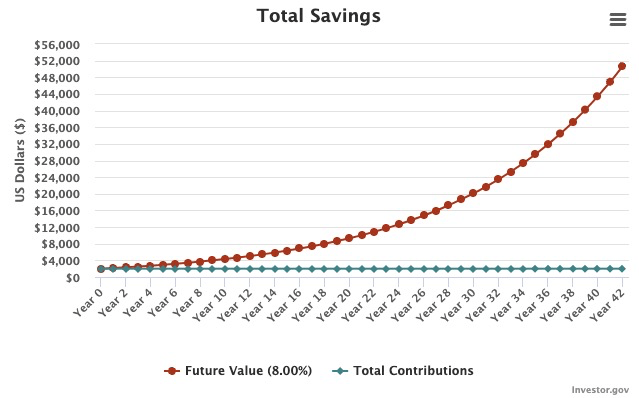

I’m no mathematician, but that’s a big freaking return. Now let’s imagine you decided to invest $2,000 right now and are going to retire by 2060, and on average, you receive an 8% return (CAGR since 1950 is 11%, so 8% is very conservative).

In 2060, that $2,000 would have turned into $34,491!

That’s pretty awesome!

Now, let’s imagine instead of investing this $2,000 in 2023, you decided to invest that same amount in 2018, just 5 years earlier. Your new retirement amount would be $50,678! That’s 47% more than you had if you started investing in 2023!

The Math Behind How Starting Early Affects Your Returns

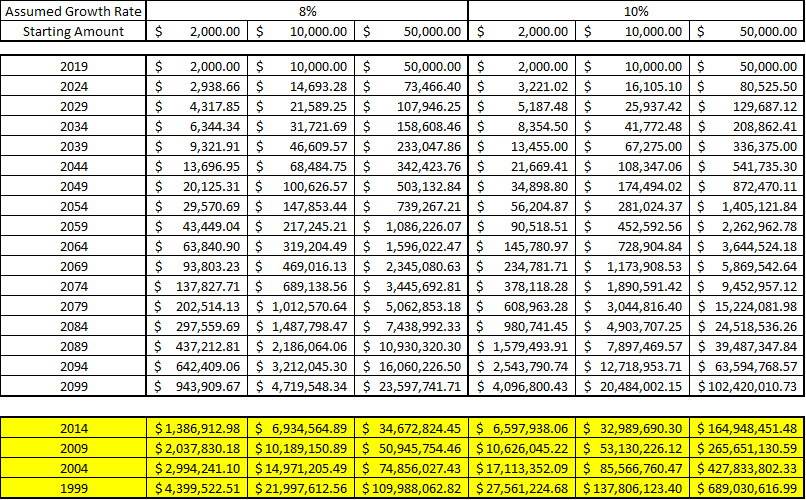

Below I’ve outlined a chart that will show you exactly what kind of impact starting early can have on your financial goals. What stands out to me is how drastically the money grows towards the end of the chart, and that’s the beauty of compound interest.

You’ll notice the yellow highlights at the bottom that show what your money would look like if you had started saving in either 2014, 2009, 2004, or 1999. Follow the columns to see the corresponding growth rate and starting amount.

Yes, if you invested $50,000 in 1999 and received a 10% growth rate each year, your total would be over $689 million in 100 years.

I know that nobody has $50,000 and can let it sit for 100 years (if so, you’d be the coolest baby ever), but this is truly a financial hyperbole to overstate how important starting early is.

How Compounding Helps Your Family

Just because you don’t have $50,000 that early doesn’t mean that you, as an adult, can’t put money aside for your children when they are born. That money can assist them in starting their life and covering emergencies, or even helping their children in the same way.

I’ve hit on this topic for a few posts in a row, but this really does stick out. Having the foresight and opportunity to set up generational wealth for your family is so powerful.

Imagine being the one to say, “I put $10,000 in a brokerage account, and if it gets 8% interest for 100 years, then that initial $10,000 will turn into nearly $22 million.

Now that’s how you set your family up for success!

Don’t Wait

It doesn’t have to be $10,000, but the thing to note is that a small sacrifice now can forever impact your family in indescribable ways. It can pave the way for them to be financially independent and continue to pay it forward to future generations.

The point that this article is really trying to make is no matter how much or how little you have, start as soon as you can because you’re missing out on valuable time for compounding.

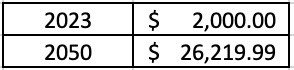

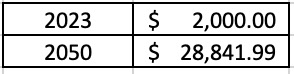

Your mindset shouldn’t be that every year you wait, you’re missing out on 10% of your initial investment. Rather, look at the difference when you want to retire. So, for instance, if you want to retire in 2050, this is what it would look like.

Your $2,000 invested in 2023 at 10% would give you a return of $26,219.99 by 2050.

But, if you had started just one year later, in 2024, you would’ve missed out on that entire year of compounding. So, you can’t think that you’re missing only $200 (10%*$2000), but instead, you’re missing out on much more than that.

As you can see, your actual opportunity cost is over $2,600. That is more than your entire initial investment simply due to waiting one year. Point being – get started as early as you can.

How to Start Investing Early with $500

I recently was asked by a friend what to do with their first $500. Their mindset was that they needed to save up thousands and thousands of dollars before they began to invest.

I don’t often agree with Jim Cramer, but he’s one to say that you should put your first $10,000 into the S&P 500 ETF (like SPY, IVV, etc.), just to make sure you’re really taking advantage of the market and then invest in individual stocks after that.

While I don’t necessarily agree with the dollar amount (it can be much lower), I do agree with the premise of getting your money into the market as soon as you can, even if not an individual stock.

If you want actionable steps to getting started investing, follow this checklist for beginner investors.

So, do me a favor, and more importantly, do a favor to yourself and your family, and start investing as early as you possibly can.

Related posts:

- Your ‘How To’ Guide for Creating Generational Wealth for Your Family Do you ever wish that you knew more about personal finance earlier in your life? If not, you are in the minority, my friend. So...

- The Key to Using the Rule of 25 to Plan Your Retirement Properly As a young teenager, all you can think about is moving out of your parent’s house. Then as you hit your early twenties, it turns...

- Hey Andy – Why Do People Invest? To someone that is not an investor in the stock market, beginning to invest can be absolutely terrifying, and guess what – I 100% understand....

- What Cashing out a 401K can cost you Need money now? Cashing out a 401K is an option, but not the first option you should consider when liquidating assets. All of us, at...