Investors can have strong views about mature stocks; the reality is there are tangible pros and cons to these kinds of investments.

In a nutshell, mature stocks refer to companies in the “maturation” phase of their life cycle with slower or saturated growth. Usually, they also have huge profits and size.

Mature stocks tend to pay higher dividends and tend to be priced at lower multiples due to their reduced growth potential.

Mature stocks are neither good or bad; rather they have pros and cons. And it’s important not to paint these companies with a broad brush—some mature stocks can have quite large growth potential while others could be paying unsustainable dividends.

The popularity of mature stocks cycles just like the stock market does.

Mature stocks don’t always outperform or underperform the market; in fact they are a “factor” just like any other stock market factor, whose performance cycles depending on what narrow time period you decide to look at.

To truly understand mature stocks and companies, you need the whole picture. We will discuss some of these pros and cons regarding mature stocks, including:

- Company Life Cycles and the “Mature” Stage

- How Mature Stocks Can Create Market Beating (or Losing) Returns

- Examples of Mature Stocks (Winners and Losers)

- Winning By Improving Profit Margins: $HD

- Losing By Maturing into a Decline: $HOG

- Investor Takeaway

Let’s start with the basics of company life cycles, and then use that to form our understanding of good and bad mature stocks.

Company Life Cycles and the “Mature” Stage

As Cameron Smith wrote about in his post on industry life cycles, there are 5 stages that both businesses and industries tend to follow over time:

- Embryonic

- Growth

- Shakeout

- Mature

- Decline

Each of these are generalized. There are no formal laws of business to say that industries or companies must follow this path exactly.

These are just the stages that tend to play out over many businesses and industries.

Investors tend to gravitate towards the growth or mature stages.

Growth investors look for companies in the embryonic, growth or shakeout stages. Value investors look for companies in the shakeout, mature, or decline stages.

Companies in either stage can provide market beating returns for investors. It all depends on when you are investing in particular companies, how long, where you got in, and where you got out. It can be a fierce debate; I recommend this article to learn more about growth vs value.

What does shakeout, mature, and decline mean?

In the shakeout phase, you tend to see an industry consolidating. All of the easy growth from a new innovation or technology may have saturated.

As growth of a market slows, companies fight more intensely for profits.

As a result, many companies might start doing M&A — basically, buying each other up as a way to inject more growth.

In the mature phase, the M&A from the shakeout phase has largely finished up. Now instead of a very fragmented industry, you’ll tend to see just a few very big companies.

These companies might find it easier to generate gobs of free cash flow since there isn’t as much competition to fight off.

Though the easy growth of the previous two stages has worn off, companies in the mature stage can still provide great returns for shareholders through various means.

In the decline phase, the demand for the products or services of the industry are fading away. Usually, a newer and better product or service has taken the place.

Companies which have progressed from mature to decline can be terrible investments.

Decline can become a self-reinforcing loop. Just as success begets success during growth, failure begets failure during decay.

The compounding of both growth and failure can be very powerful.

How Mature Stocks Can Create Market Beating (or Losing) Returns

Like I mentioned above, the easy growth for companies in the mature stage has usually worn off as they hit maturity.

Revenue growth can tend to slow down to match the economy’s growth, where before it might have been beating the economy. This is because in the mature stage, there is not much more market share to take (from their own competitors or other products and services).

But these companies can still generate market beating returns.

Companies that have matured can:

- Increase profit margins to boost free cash flow

- Use free cash flows to buyback lots of stock, which makes every share more valuable

- Use free cash flows to pay dividends, and multiply shareholder returns over time

- Become a reliable source of conservative free cash flow growth

- Take advantage of its steady free cash flows to lever up its balance sheet, and potentially create several years of market beating performance

Shareholders that own mature stocks can get great returns by:

- Buying mature stocks when they are cheap

- Holding shares of companies that buyback lots of shares at cheap prices

- Buying mature stocks of smaller industries that are being acquired by bigger industries

- Buying mature stocks that “turnaround” their business

Over time, in general, the best time to buy mature stocks is when nobody wants them. That’s usually during the tail end of a bull market, when growth investing propels to the spotlight.

As a market enters bear territory and an economy goes to recession, investors usually crave the stability of mature stocks. That can be some of the worst times to buy them, as they become no longer cheap and there is a great risk of overpaying.

Examples of Mature Stocks (Winners and Losers)

There was a great article written by Ben Reynolds for The Street which highlighted the best performing dividend stocks from the S&P 500 from 1990 – 2015. Many of these companies could’ve been considered on the “mature” side, with much of their cash flows being paid back to shareholders as dividends.

From the time of that article to 7 years later, that list of stocks performed about the same as the market (August 2015 – August 2022).

In aggregate, here were the annualized returns of each stock in that 7 year time period (with dividends reinvested):

- SHW: 16.4%

- VNO: -8.8%

- HOG: -3.6%

- LEN: 8.7%

- TROW: 10.2%

- GD: 8.6%

- NKE: 11.4%

- PSA: 11.0%

- HD: 17.4%

- LOW: 18.0%

- TJX: 10.1%

- SCHW: 11.8%

- PAYX: 19.0%

- UNH: 25.5%

One stock, FDO, was acquired. The S&P 500 returned 12.7% with dividends reinvested over the same time period.

Winning By Improving Profit Margins: $HD

Home Depot ($HD) was definitely already in the “mature” stage in 2015. By then, the home improvement retailer had already expanded across the United States. There wasn’t much room for the company to grow many more stores in their geographies without cannibalizing operations.

In fact, in 2015 the company had 2,274 locations.

Fast forward to 2021, and the company’s store count sat at 2,317. That’s a growth rate of only 1.9% in store count over 7 years—hardly a major driver of growth.

Despite that, $HD continued its torrid pace of share price growth.

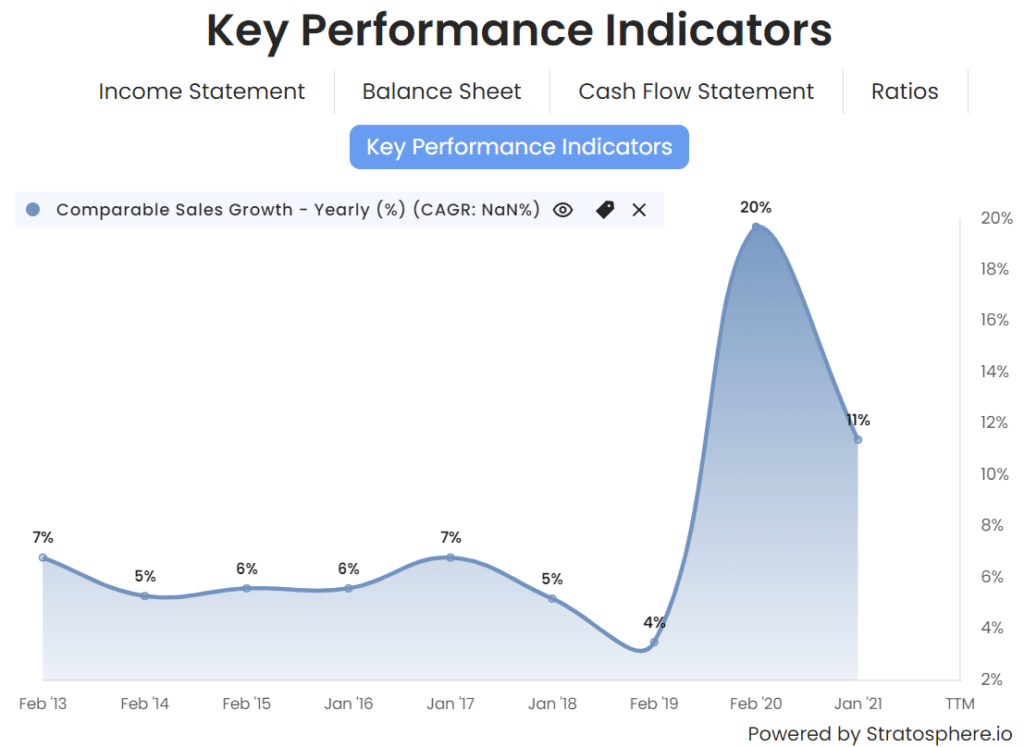

Home Depot was able to execute on market beating, 17.4% annualized returns over 7 years by leveraging its same-store sales and improving profit margins.

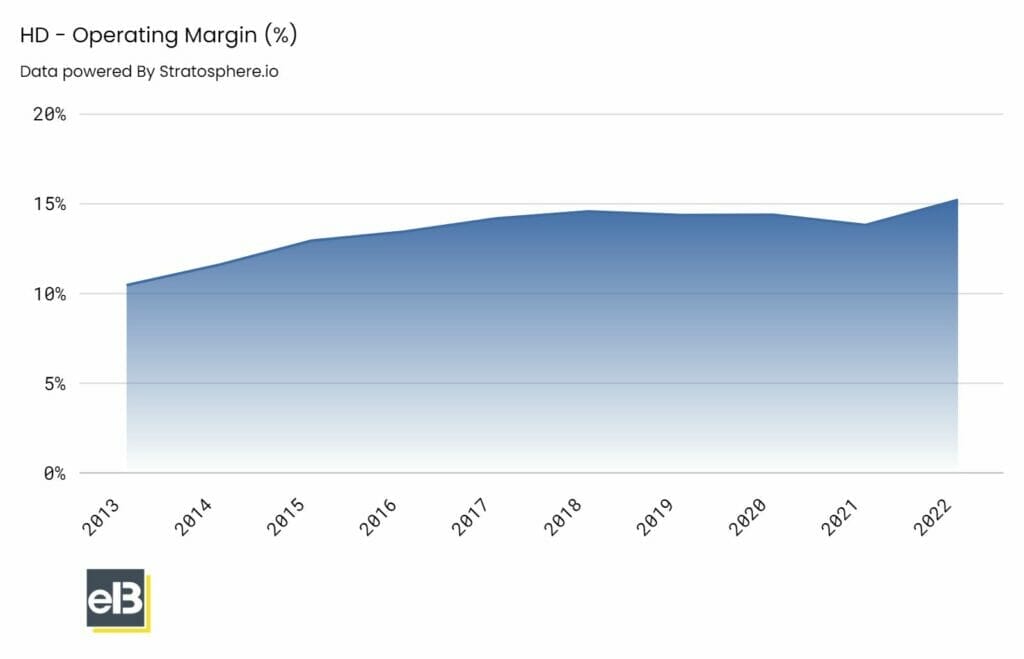

Here’s a chart from Stratosphere.io illustrating the improvement in operating margin:

Starting in 2015 going into 2018, Home Depot steadily improved its Operating Margin from 12.99% to 14.62%. That might not sound like much…

But that over one and a half percentage point of improvement represents a 12.5% increase in Operating Profits, even if revenues stay flat.

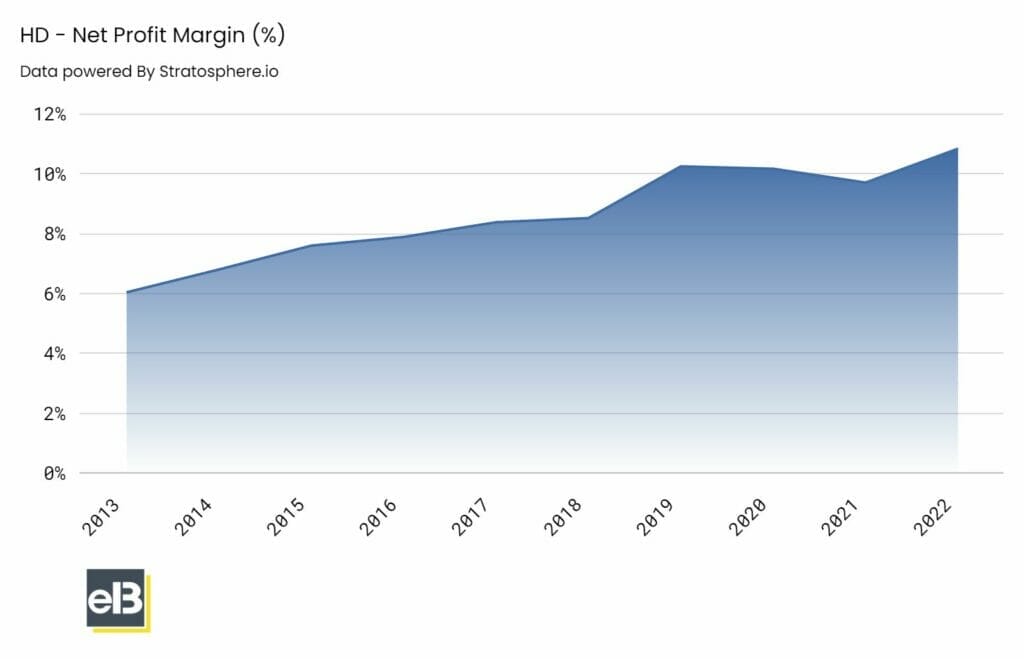

That, combined with the tax cuts act in 2017, helped propel Net Profit Margin to 10.87% in 2021, from 7.63% in 2015, which represents a 42% increase in profits even if revenues stayed flat (which they didn’t).

As we know, revenues increased steadily alongside their profit margins, which caused profit margins expansion to multiply earnings growth in an exponential fashion.

I’m not an expert in Home Depot’s 2015-2022 strategy, but it’s not hard to imagine that the company rode its brand’s popularity to effortlessly grow sales without needing to spend much for marketing. It’s further evidenced by looking at Gross Margins, which have been flat while Operating Margins have been improving.

$HD had no problem growing same store sales, which drove revenue growth in the absence of store location growth.

Home Depot provides inspiration of all sorts for many mature stocks investors, as they also leveraged their balance sheet to buyback lots of shares.

This all contributed to superior compounding for investors for over 7 years, even after recording top 15 growth in the 25 years prior.

It will remain to be seen whether this can continue, but this is an inspiring story of organic growth.

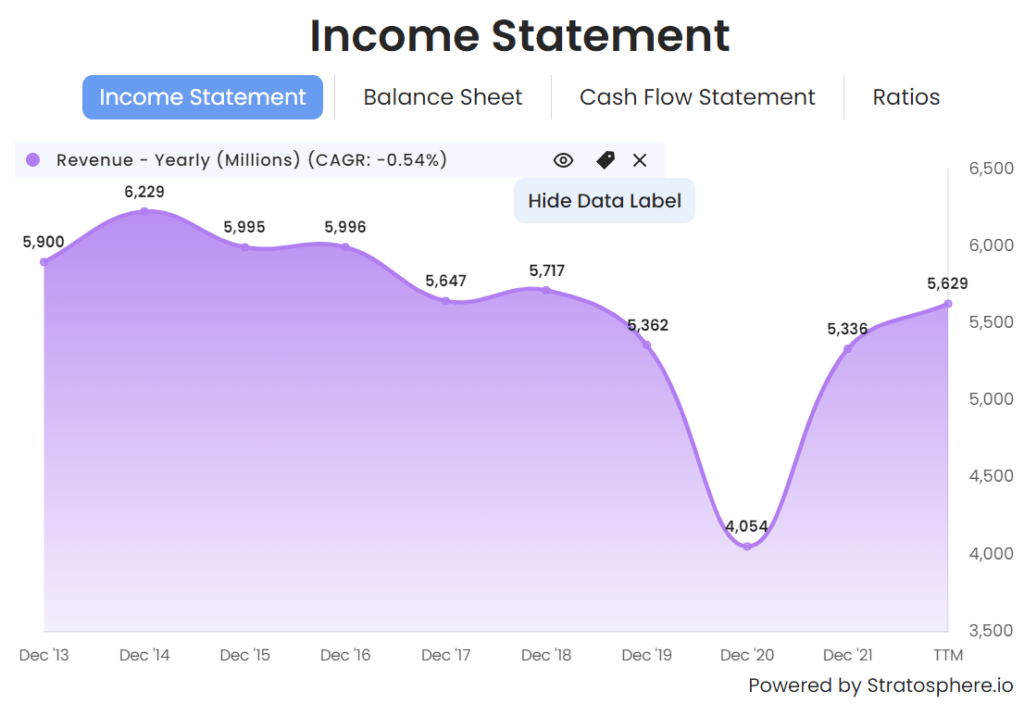

Losing By Maturing into a Decline: $HOG

On the other side of the top dividend growth winners of 1990-2015 is Harley Davidson ($HOG).

Over the next 7 years, $HOG shareholders saw the value of their shares decline by -3.6% annually while the S&P 500 returned 12.7%.

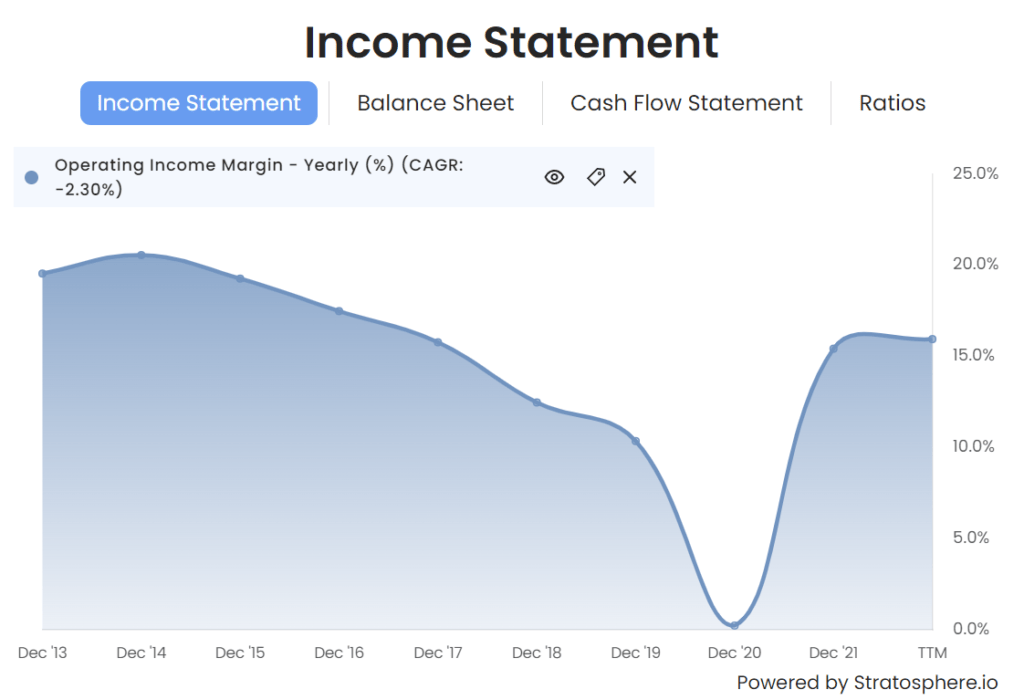

In all of the ways that Home Depot succeeded, Harley Davidson did the opposite.

Operating Margins declined from 19.39% in 2015 to 15.48% in 2021. That decrease of less than 5 percentage points represents a -20% decrease in profits all things equal. Tough to grow out of for any company.

Further compounding the problem, revenues over the same period also saw steady declines after 2015, with YOY reductions of -5.8%, -6.2%, and -24.4% among the worst offenders.

Even after buying back lots of shares (-10% to shares outstanding) over the time period, share prices are still down big.

As a company that sells discretionary products (motorcycles), $HOG provides some dangerous warnings about how quickly a company can decline if its products are no longer in high demand.

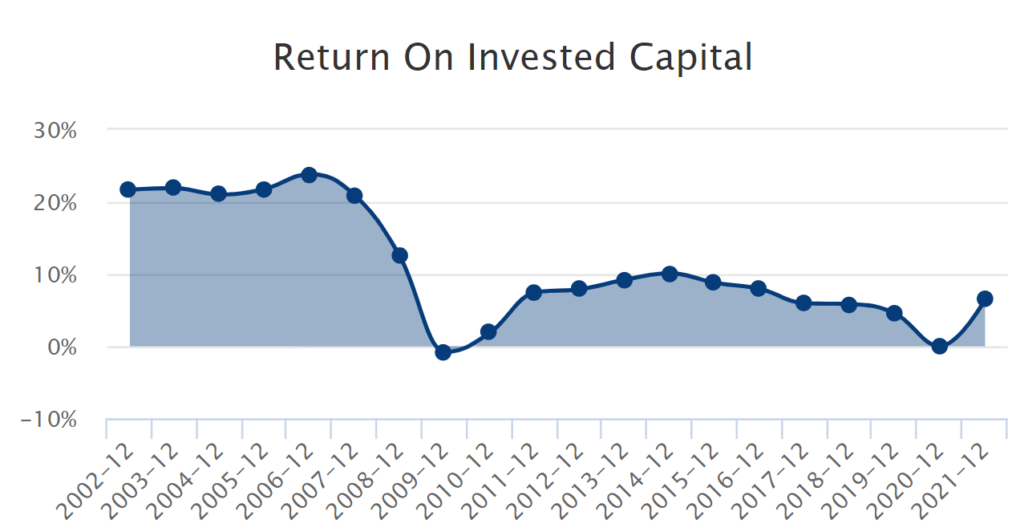

Looking at a historical chart of the company’s ROIC, we can see that they never really recovered much after the great financial crisis of 2008/’09. Profits again evaporated during the short, pandemic-driven recession in 2020.

Investors looking at mature stocks in consumer discretionary industries should heed these lessons.

It’s very hard for shareholders to earn great returns on a mature business with falling revenues, even if it continues to pay a growing dividend and repurchase lots of shares.

And falling revenues are usually related to a company with no growth prospects, or one being innovated against, or both.

Once the vicious cycle of decline starts, it’s very hard to come back from.

Lower profits means less capital to reinvest, which usually leads to less growth and greater market share stealing from competitors.

A company like $HOG could turn it around one day.

But that doesn’t erase the 7+ years of lost compounding for disappointed $HOG shareholders, who could’ve invested their capital for positive returns elsewhere during that time.

Investor Takeaway

Hopefully you’ve gleaned that mature stocks are neither good nor bad.

They are simply businesses at a certain age of their lifecycle, and could be a good or bad investment depending on which one you pick, and also at which time period you choose to buy and sell.

Some mature stocks can turn around their performance for a short time, leveraging their balance sheet or a savvy acquisition. Some can do it permanently through innovation, for outstanding long term gains.

Others still simply decline, at a rate which can be alarming for shareholders.

In all, it’s most important to evaluate each company independently. Start by reading its annual report. Learn if it has any competitive advantages. Analyze its financial data through fundamental analysis, to confirm any narratives you form about the company.

And then, decide whether to buy, sell or hold the company.

Remember that price matters, and can have a large impact to your overall returns from the investment.

Regardless of whatever you decide to do from here, please remember this: mature stocks, young companies, dividend stocks, growth stocks, value stocks—they ALWAYS go in-and-out of favor. Do not let that fact cloud your judgment about the underlying business underneath a stock.

Over the very long term, it’s the business that matters.

Related posts:

- Stock Buying Checklist: Essential Part of Evaluating Stocks (Example Checklist) The stock buying checklist is one of the essential tools to any investor, in my opinion, and to most, an underutilized tool. Using a checklist...

- What is a Quality Company and Why Should I Pay Up? “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” -Warren Buffett Many investors use...

- 100 Baggers: What Are They, Where Can I Find Them (With Examples) Updated 5/29/2023 Peter Lynch first used “10-bagger” to describe stocks multiplied in value tenfold, or 10 to 1. In his fantastic book, 100 Baggers, Christopher...

- Traditional Overdiversification Wisdom is Bunk. 15-20 Stocks= Not Enough. Everything you’ve ever heard about diversification, and overdiversification, is wrong! The conventional wisdom is that any portfolio over 20- 30 stocks is overdiversified. This is...