A negative book value means that a company has more total liabilities than total assets. The numbers simply say the company owes more than it owns.

But just because a company has negative book value, doesn’t mean it’s automatically a bad investment or even a company with a weak balance sheet. We’ll look at a company which boasts a high safety rating by Moody’s (A2), and yet has had years of negative book value.

However, there are very much so times where a company with a negative book value should be avoided at all costs. We’ll look at an example of that too.

In today’s post, we will cover the following sections:

- Strong Company with Negative Book Value Example

- Analyzing the Strength of a Company with Negative Book Value

- Weak Company with Negative Book Value Example

- Another Shortcut for Analyzing a Balance Sheet

- Investor Takeaway

First, let’s talk about a company where negative book value can actually be a source of strength, due to undervalued assets on the balance sheet.

Undervalued Assets

I wrote extensively about undervalued assets and how they occur due to current GAAP accounting standards. Take a look at that post in conjunction with this one.

In a nutshell, there are two primary reasons that assets can be under-represented:

- Land assets are carried (measured on the balance sheet) at cost only

- Brand names and other intangibles developed in-house have zero value

Both of these types of assets can make a company’s balance sheet appear much worse than it really is, strictly because of accounting.

In real-life, land (real estate) tends to appreciate over time. Also in real-life, brand names have value, and can be a reason a consumer picks one product over the other.

Yet the balance sheet misrepresents both of these type of assets, which misrepresents a company’s true book value since book value is Assets minus Liabilities.

And before you argue that a brand should be valued at zero because it’s not tangible, consider that accounting standards allow for brand names to have value on a balance sheet if a company acquires it from another company, but if it’s developed in-house, there’s no value.

That’s inconsistent, and thus why not all GAAP book values are the same.

Strong Co. with Negative Book Value [Example]

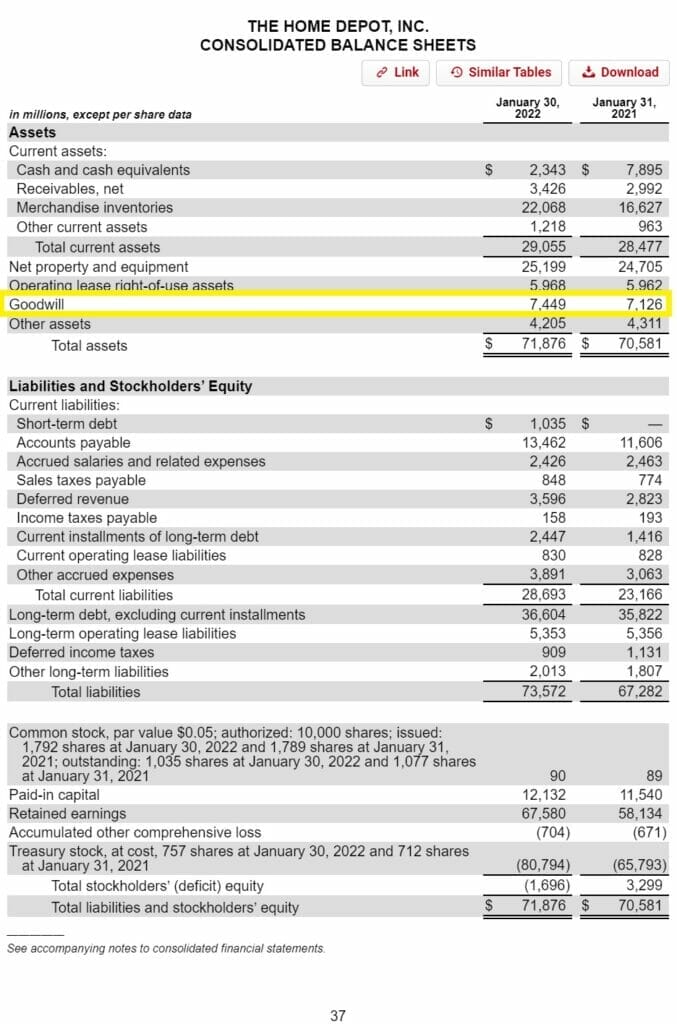

Let’s take a great example of this with Home Depot (ticker: HD). Sourcing a recent 10-K from the company, we see this screenshot of their balance sheet:

Note that the Goodwill line item, which where any brand name value would lie, is only recorded as worth $7.45 billion on the balance sheet.

Yet the company’s brand is undoubtedly worth more, especially when you consider that the company brings in over 57% more revenue than its closest competitor (Lowe’s) despite having a similar number of total stores.

It’s hard to argue that a company with the size of revenues like HD ($151B+) has a brand name worth only $7.45 billion.

Consider also that the company spent $25.4B in SG&A (which has marketing spend as a component) in fiscal 2021, so it’s hard to imagine they’d plow that much money into advertising each year and not be building a brand with a decent ROI.

If companies are gladly investing $100 million on an asset to get a 10% return ($10 million), you’d have to think that a company with $10B+ in profits has a brand name asset worth multiples of those earnings, and not worth a fraction of the actual ROI.

Next, let’s look at the second component of assets contributing to HD’s lower reported book value, and that’s its land assets.

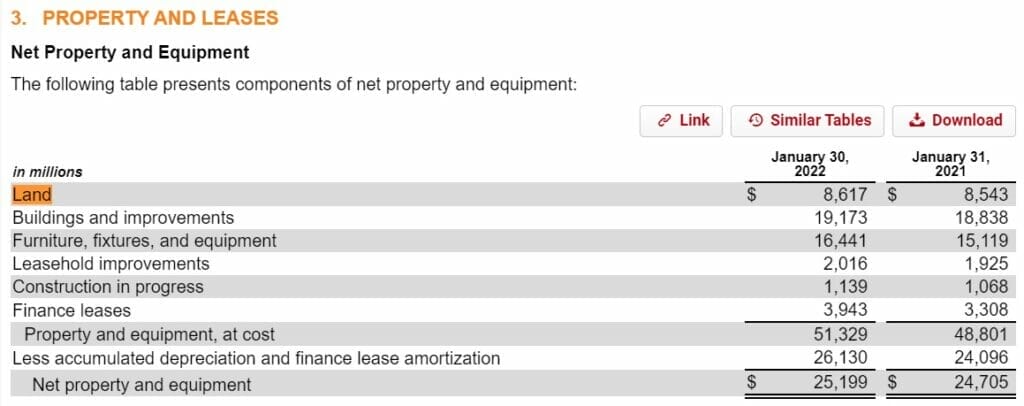

Land is usually found in the balance sheet under Property, Plant, and Equipment, which in HD’s case is on page 51 in the Notes to the Financials.

Within the Properties section of the 10-K, Home Depot reports that 89% of their stores are owned, and total store square footage is 240.5 million. That’s a significant amount of land.

Also, if you were to look at that change in reported value of the land assets over several years, you’ll see that lately those values haven’t changed much, while the value of the underlying land has probably increased significantly in the same time period.

Just because that land isn’t immediately liquid doesn’t mean it does not have value, and the fact that the company can sell their land for a significant profit into the future speaks to the resilience of their balance sheet and ability to secure financing in the future if needed. Even if the real estate market crashes and the land drops from current values, the total net from a future sale will probably still result in positive gains, especially the longer the company holds the land (and it appreciates).

Analyzing the Strength of a Company with Negative Book Value

If you go back to the most basic definition of valuation, you’ll recall that most of the value derives from expected future free cash flows earned by the asset over a period of time.

Even if a company has significant land assets and/or brand assets which seem under-represented, if the actual cash flow situation for either asset is in doubt, then so is the idea that the asset is undervalued.

In the case of Home Depot, we can assess the strength of its balance sheet based on the free cash flows from its assets (whether recorded or not) and its ability to pay on its future obligations.

From the company’s income statement, we can see that interest payments on its debt are around $1.5B per year.

Comparing that to $15-20B+ in operating income per year (from which interest expense is deducted), the company has a huge cushion to pay off its interest payments each year.

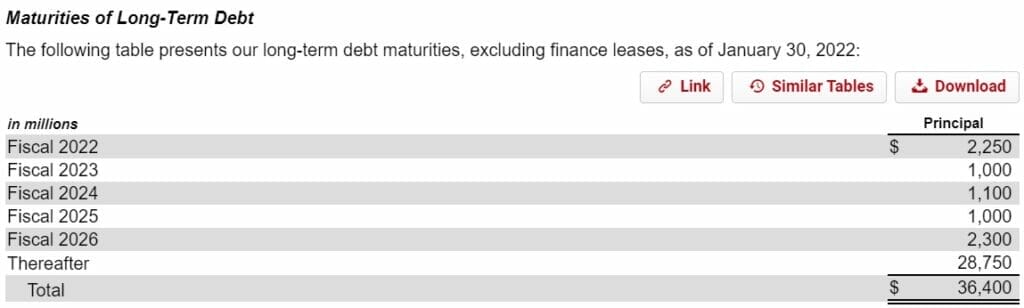

Moving on to the company’s debt principal, those are paid off from Free Cash Flow, which has totaled $10-15B+ in each of the last 3 years.

Principal payments are estimated around $1B-2B per year over the next 5 years, which leaves a lot of free cash flow left for shareholders to be reinvested in the business or distributed through dividends and buybacks.

Finally, you want to normalize a company’s earnings and free cash flows in order to simulate the earnings situation for a company when the economy is weak.

Looking back at the last recession and earnings trough (2009-2012 for HD), we see that the company took a pretty substantial haircut of about -40% to -60% of its previous earnings power.

Even in that case, the company would earn around $4B in free cash flow and still be able to make its debt payments and then some, even if it had no abilities to raise additional capital in any other way.

The bond rating agencies, which many bond purchasers will reference to determine the riskiness of issuing debt to a major public corporation, have also concluded that Home Depot’s credit quality is currently safe. Moody’s assigned HD with an A2 rating.

Essential Calculations for Evaluating Risk

These kinds of calculations can help you determine whether a company’s balance sheet is strong or not with its negative book value, without relying on more simple metrics like Debt to Equity (which rely on positive shareholders’ equity).

Whether you’re looking at a company with positive or negative book value, you should be considering the earnings power (or cash flow generation) of a company in the absolute. That’s because, as we discovered in this blog post and others, the values recorded on a balance sheet are not set in stone, and you only have to look at the massive write-downs that companies take during times of struggle for very tangible evidence of this.

For more on coverage ratios which are key to evaluating the strength of a company in relation to its debt and earnings, read this great article by Cameron Smith.

Weak Co. with Negative Book Value [Example]

Though there might be some diamonds in the rough when it comes to companies with undervalued assets, oftentimes (and probably the majority of the time) a company with negative book value is a massive red flag.

Companies who lever themselves up with mountains of debt will have to pay it back some day, and the higher the drag on cash flows and income that debt principal and interest becomes, the less cash which can both grow the business and be distributed to shareholders.

You can do the exact same type of analysis that we just did with Home Depot on any company with negative book value, and compare your findings with other competitors in its industry and the stock market as a whole to determine the riskiness of a company’s balance sheet.

Let’s look at American Airlines (ticker: AAL) as an example of a company teetering on the edge due to a global pandemic greatly reducing demand for its services.

Remember that when it comes to profits and losses, the numbers don’t care whether your struggles are your fault or due to outside forces. Debts and expenses need to be paid with few exceptions, and investment results do depend on these harsh realities.

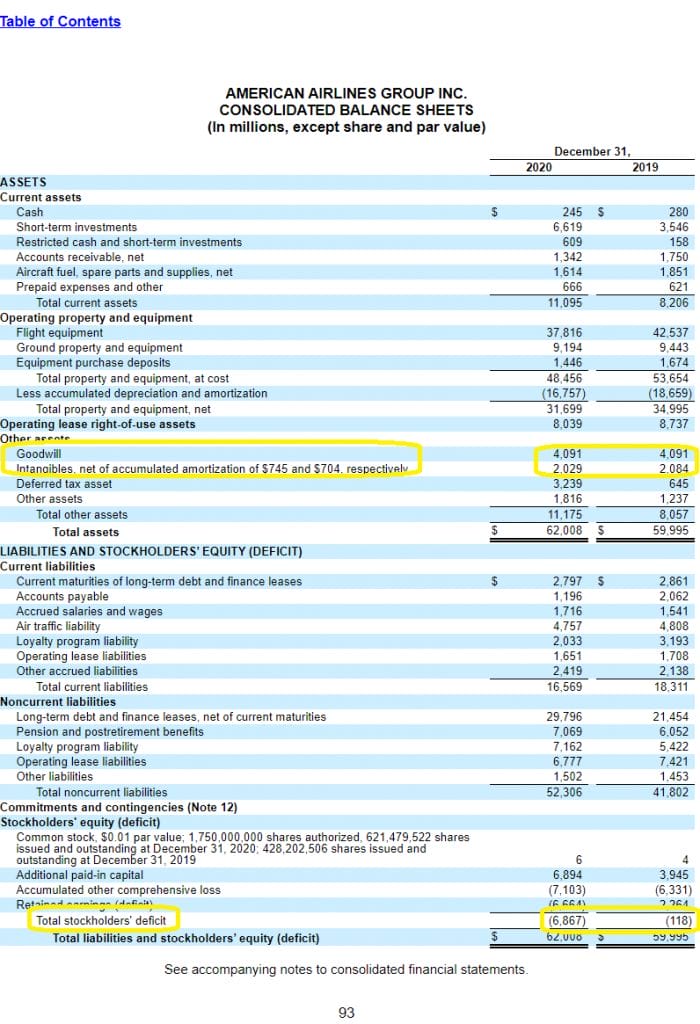

Taking the company’s recent 10-K, which has highlighted the bloodbath to the P&L during 2020, and looking at their balance sheet:

Here we see a balance sheet that has massively deteriorated in just one year, and driven a slight negative book value into a deep deficit in shareholders’ equity.

Note that Goodwill and Intangibles total $6B, which could have something to do with previous acquisitions rather than the American brand name itself.

But, if you look at the income statement for the company, you’ll see that Operating Income even before the pandemic was not that high, $3B and $2.6B, which makes you wonder if their brand recognition is that much of a profitable asset for the company. At least compared to Home Depot, it doesn’t appear to stack up.

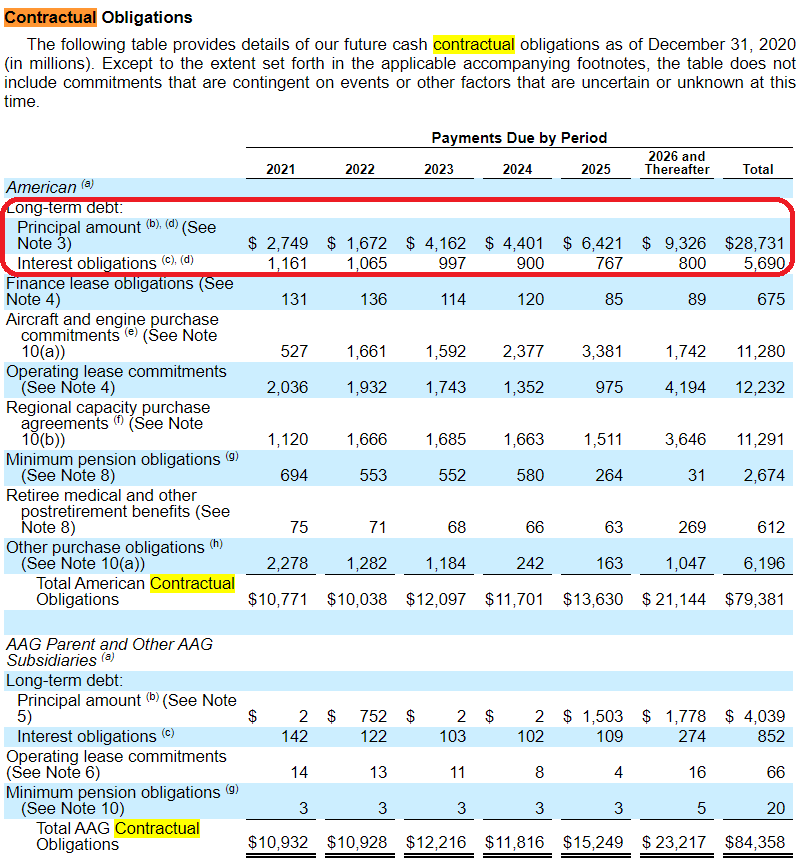

Next, we can look at their future contractual obligations, which showed interest payments of about $1B per year for the next 4 years.

That means that even if American Airlines could return to 2019 profit levels immediately, their interest coverage ratio would only be about 3x, leaving only ~$2B in profit before taxes.

Additionally, American had substantial principal debt due over the next 5 years which basically eliminates any future free cash flow the company would earn for quite a while. Sure, there are rules and stipulations with the debt, but it’s a pretty bleak future for a company with decreasing book value that’s deep into negative territory now.

Shareholders might not see the debilitating effect of that immediately, but there’s no way to avoid that reality and you have to think it will all come to roost eventually.

Another Shortcut for Analyzing a Balance Sheet

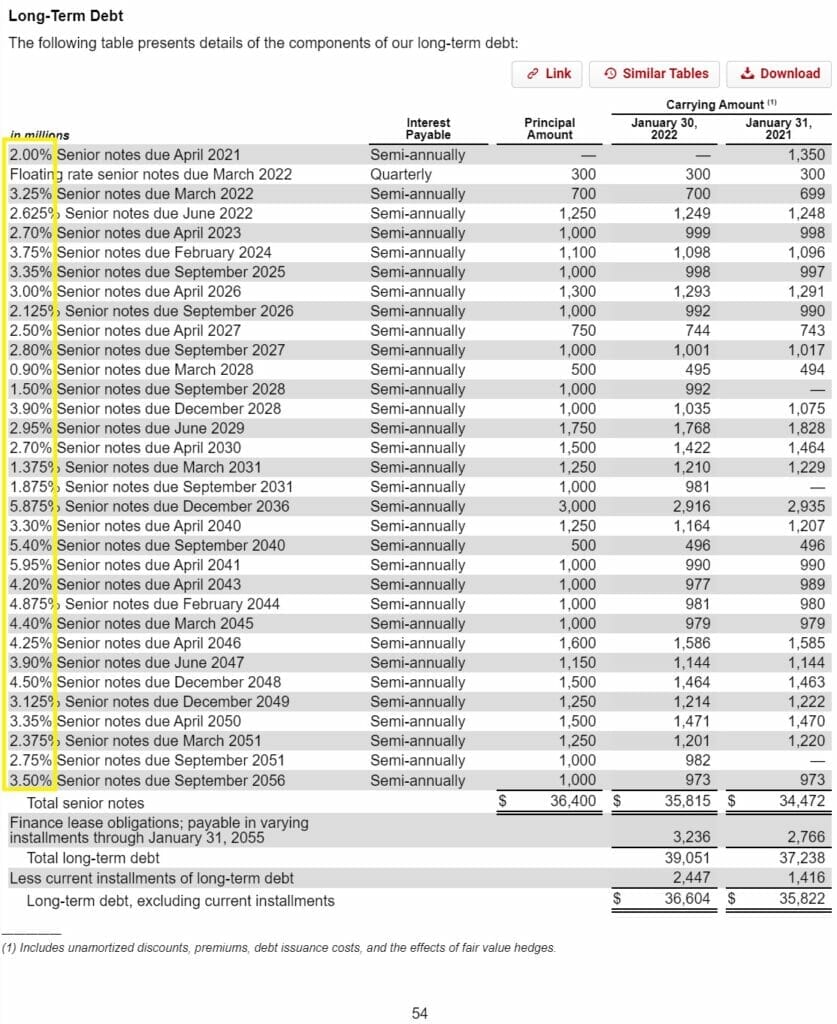

One last shortcut I like to use to get a surface-level check on a company’s balance sheet strength before going deeper is to look at the interest rates on a company’s current debt.

Bond investors are typically very conservative and much more rational than stock market investors. If a bond investor (often managing important pension funds or endowments) sees higher risks on a particular bond, you can be sure a higher yield (interest rate) will be required to buy the bond a company is issuing.

So you can often tell how risky a company’s balance sheet is perceived by the most conservative of investors by looking at the weighted average interest rate of the bonds it was successful in issuing.

Simply check the Debt section of a company’s Notes to Financials to visually get a picture of a company’s balance sheet quality, and then you can go deeper from there. In the case of Home Depot, interest rates on their debt have been generally low especially compared to their closest competitor, Lowe’s.

Of course, interest rates change from year to year, and so it’s not the absolute number but rather how it relates to other interest rates.

If interest rates are at 2%, for example, a strong company might be able to borrow at 3% while a weaker company might have to pay 5% or 6% or more.

Investor Takeaway

At the end of the day, you can’t look at any one single factor about a company or its financials and make a conclusion about its riskiness and prospects.

Business is tough, and as the pandemic showed, a single event can wipe out even a strong business. Investors should remember that diversification (and even global diversification) is key.

But at the same, we can mitigate a lot of the risk ourselves by knowing how to evaluate company strength, which often requires a deep dive.

As it relates to companies with negative book value, yes, I think most are probably bad investments.

But not all are, and you have to be smart about it if you want to uncover more investment opportunities.

Take Home Depot’s stock, which has increased 500%+ over the last 10 years.

It’s not in the most exciting industry– it’s constantly destroyed shareholders’ equity in order to buyback its stock, and yet it’s also maintained fantastic growth all along the way.

Maybe that’s the biggest takeaway in all of this.

As long as a company can maintain its growth and profitability, negative book value probably isn’t the worse thing in the world.

Updated: 12/15/2022

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- The Two Types of Undervalued Assets to Look For in a Balance Sheet Because of GAAP accounting rules, assets can be undervalued or even not recorded at all on a company’s balance sheet. This can be a source...

- How to Find Negative Retained Earnings in a 10-K – Does it Indicate Distress? Stockholders’ equity, also called book value, is the company’s assets minus its liabilities. We talk about tangible book value when we value investors discuss shareholders’...

- Is Price to Tangible Book Value Dead? A Full Guide to This Controversial Metric Warren Buffett and Ben Graham are the leading proponents of value investing. No fundamental analysis metric has a greater correlation to the company’s value than...

- What’s a Good Debt to Equity Ratio? The Ultimate Guide for Beginners The debt to equity ratio is a great formula for investors to use as a rule of thumb for determining the riskiness of a stock,...