According to their latest earnings releases, the Spring earnings results of the Top 5 Publicly Traded Insurance Retail Brokers by YoY revenues increased by 10.1% in the January-March quarter.

Of the publicly traded Insurance Retail Brokers that released Spring Q1 2024 earnings results, Arthur J. Gallagher & Co grew the highest quarterly YoY revenues by 19.90%

Willis Towers Watson plc had the least increase in YoY quarterly revenues at 4.30% followed by Aon plc at 5.10%.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Insurance Retail Brokers by Market Share

- Top Publicly Traded Insurance Retail Brokers by Revenue Growth

- Top Publicly Traded Insurance Retail Brokers by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Marsh & McLennan Companies, Inc. (MMC) Stock Forecast

- Aon plc (AON) Stock Forecast

- Arthur J. Gallagher & Co. (AJG) Stock Forecast

- Willis Towers Watson plc (WTW) Stock Forecast

- Brown & Brown, Inc. (BRO) Stock Forecast

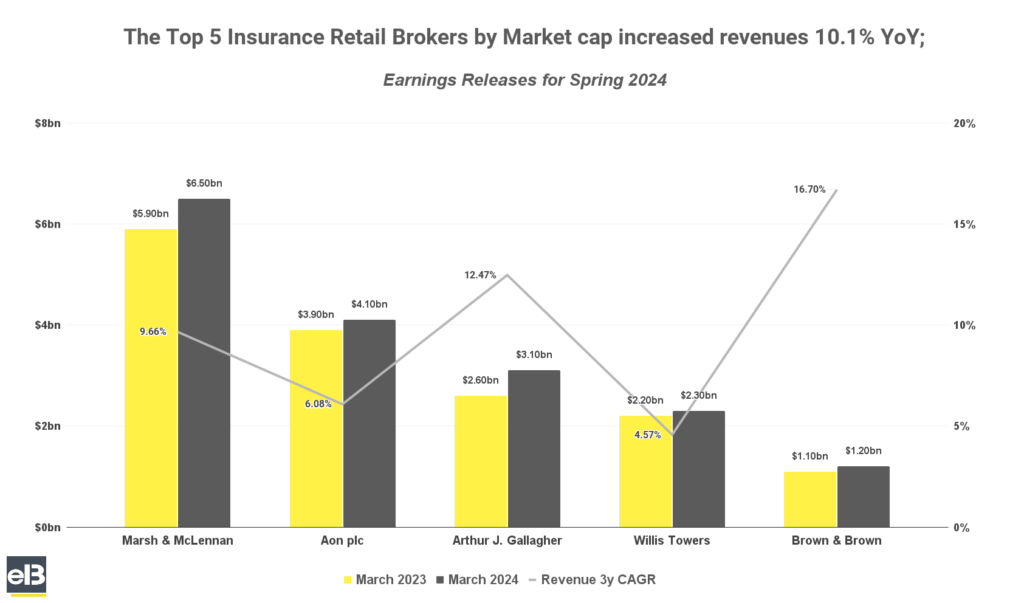

The list below includes the revenue of top 5 Insurance Retail Brokers by market capitalization of >$20Bn.

| Company | Q1 2023 | Q1 2024 | YOY |

| Marsh & McLennan | $5,924 | $6,473 | 9.30% |

| Aon plc | $3,871 | $4,070 | 5.10% |

| Arthur J. Gallagher | $2,606 | $3,124 | 19.90% |

| Willis Towers Watson plc | $2,244 | $2,341 | 4.30% |

| Brown & Brown | $1,108 | $1,237 | 11.80% |

Marsh & McLennan reported a 9.30% increase in YoY revenues compared to the first quarter of 2023 with the Risk & Insurance Services increasing also 9% to $4.3 billion. Management expects a strong year with continued economic growth in most of their major markets albeit inflation and interest rates remain elevated, labor markets are tight, the cost of risk is up and healthcare costs continue to rise.

Aon plc saw revenues increase by 5.10% YoY for Q1 2024, including 5% organic growth. Commercial risk solutions saw a 2% increase in YoY revenue growth with a 3% increase in organic revenue growth, reflecting growth among most major geographies driven by strong retention, management of the renewal book, and net new business generation.

Arthur J. Gallagher recorded a 19.90% YoY quarterly revenue increase with their core brokerage and risk management segments combined posting 20% revenue growth which includes 9.4% organic revenue growth. Management stipulates on their first quarter data showing solid customer business activity and mid-term policy endorsements, audits and cancellations combined were ahead of last year’s levels.

Willis Towers Watson plc reported a 4% YoY increase in revenues with organic growth posting a 5% increase for the latest quarter. Risk and Broking segment saw a 8% increase in revenues which was primarily driven by strong client retention across all geographies and higher levels of new business activity.

Brown & Brown saw a 11.80% increase in YoY quarterly topline growth with 8.6% being organic compared to the previous quarter. On M&A front, they completed six acquisitions and growth in markets they operate has not materially changed compared the previous quarter as consumer spending remained resilient. Wholesale brokerage delivered an organic revenue growth of 10.8% which was primarily driven by binding more net new business and rate increases.

Key Takeaway

The resilience of the insurance retail broker business continues despite current economic conditions. All the companies mentioned continue to grow their revenue over the past three years and yearly. Insurance retail broker companies continue to write business regardless of the market’s ups and downs, as the demand for insurance never abates. Premiums will only continue to rise as different economic risks continue to do so.

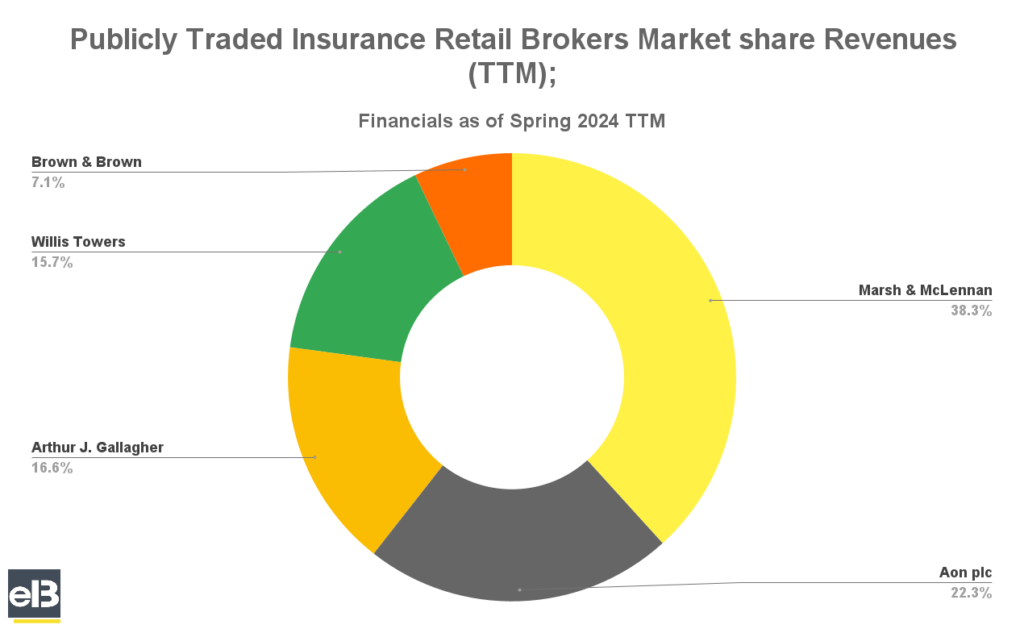

Biggest Publicly Traded Insurance Retail Brokers by Market Share

The graph shown below comprises of >$20Bn market cap publicly traded Insurance Retail Brokers as of May 2024.

Leading ahead is Marsh & McLennan with roughly 38.3% market share, followed by Aon plc with 22.3%, and behind is Arthur J. Gallagher with 16.6% of Trailing Twelve Months (TTM) revenue share of all >$20Bn publicly traded insurance retail brokers.

| Company | Revenues (TTM in Thousands USD) | Mkt Share |

| Marsh & McLennan | $23,285,000 | 38.3% |

| Aon plc | $13,575,000 | 22.3% |

| Arthur J. Gallagher | $10,077,400 | 16.6% |

| Willis Towers Watson plc | $9,580,000 | 15.7% |

| Brown & Brown | $4,328,400 | 7.1% |

Top Insurance Retail Brokers by Revenue Growth

In the last three fiscal years, Brown & Brown lead ahead among its peers in the insurance retail brokers industry with a 16.70% CAGR in revenues.

Meanwhile, Arthur J. Gallagher leads in boosting its year-over-year annual revenue growth of 18.67% from 2022-2023.

Arthur J. Gallagher takes the number two spot in 3yr revenue CAGR of 12.47%, while trailing behind is Marsh & McLennan and Aon plc with 9.66% and 6.08% 3yr CAGR, respectively.

| Company | 3yr CAGR | 1yr Growth YOY |

| Brown & Brown | 16.70% | 14.96% |

| Arthur J. Gallagher | 12.47% | 18.67% |

| Marsh & McLennan | 9.66% | 10.38% |

| Aon plc | 6.08% | 7.06% |

| Willis Towers Watson | 4.57% | 7.04% |

Key Takeaway

The table above shows the robustness and the pricing power of insurance retail brokers. They continue to collect fees across broad and multiple industries regardless if rates are down or up as most are broadly diversified and handle clients exposed to different kinds of risk.

Top Insurance Retail Brokers by Earnings (EPS) Growth

In the last three fiscal years, Marsh & McLennan saw the highest 3 year annual compounded growth rate of 21.65% in earnings per share.

Among the companies in the below graph, Brown & Brown had the highest 1-year EPS YOY growth rate of 33.39%

The list’s highest 3-year EPS CAGR companies are Marsh & McLennan at 21.65%, Brown & Brown at 20.70%, and Aon plc at 11.74%.

| Company | 3yr EPS CAGR | 1yr EPS YOY |

| Marsh & McLennan | 21.65% | 23.11% |

| Brown & Brown | 20.70% | 33.39% |

| Aon plc | 11.74% | 2.58% |

| Arthur J. Gallagher | 4.36% | -8.24% |

| Willis Towers Watson | -3.22% | -0.05% |

Insurance Retail Brokers Revenue, Earnings and Stock Forecast (Quarter ending Q1 2024)

| Company | YOY EPS Forecast |

| Marsh & McLennan | 8.77% |

| Aon plc | 11.87% |

| Arthur J. Gallagher | 18.86% |

| Willis Towers Watson | 13.31% |

| Brown & Brown | 27.47% |

Marsh & McLennan (MMC) Revenue, Earnings, and Stock Forecast

Marsh & McLennan’s revenue over the latest Trailing Twelve Month period was $23.3 billion. Marsh & McLennan’s earnings (Net Income) over the latest Trailing Twelve Month period was $3.9 billion.

The Wall Street consensus for Marsh & McLennan’s EPS (earnings per share) projection for the next quarter is $2.39. The company’s TTM (trailing twelve months) Earnings Per Share was $7.90 as of the quarter ending March 30, 2024.

Marsh & McLennan is expected to see an expansion in earnings per share of 8.77% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Aon plc (AON) Revenue, Earnings, and Stock Forecast

Aon plc’s revenue over the latest Trailing Twelve Month period was $13.6 billion. Aon plc’s earnings (Net Income) over the latest Trailing Twelve Month period was $2.6 billion.

The Wall Street consensus for Aon plc’s EPS (earnings per share) projection for the next quarter is $3.09. The company’s TTM (trailing twelve months) Earnings Per Share was $12.80. as of the quarter ending March 30, 2024.

According to the consensus of stock market analyst forecasts, Aon plc’s earnings per share are expected to expand 11.87% YOY in the next quarter.

Arthur J. Gallagher (AJG) Revenue, Earnings, and Stock Forecast

Arthur J. Gallagher’s revenue over the latest Trailing Twelve Month period was $10.1 billion. Arthur J. Gallagher’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.10 billion.

The Wall Street consensus for Arthur J. Gallagher’s EPS (earnings per share) projection for the next quarter is $2.26. The company’s TTM (trailing twelve months) Earnings Per Share was $5.10 as of the quarter ending March 30, 2024.

Based on the consensus of stock market analyst forecasts, Arthur J. Gallagher is expected to see an expansion in earnings per share of 18.86% YOY in the next quarter.

Willis Towers Watsons (WTW) Revenue, Earnings, and Stock Forecast

Willis Towers Watsons’ revenue over the latest Trailing Twelve Month period was $9.60 billion. Willis Towers Watsons’ earnings (Net Income) over the latest Trailing Twelve Month period was $1.0 billion.

The Wall Street consensus for Willis Towers Watsons’ EPS (earnings per share) projection for the next quarter is $2.32. The company’s TTM (trailing twelve months) Earnings Per Share was $10.0 as of the quarter ending March 30, 2024.

Based on the consensus of stock market analyst forecasts, Willis Towers Watsons is expected to expand earnings per share by 13.31% year over year in the next quarter.

Brown & Brown (BRO) Revenue, Earnings, and Stock Forecast

Brown & Brown’s revenue over the latest Trailing Twelve Month period was $4.30 billion. Brown & Brown’s earnings (Net Income) over the latest Trailing Twelve Month period was $0.9 billion.

The Wall Street consensus for Brown & Brown’s EPS (earnings per share) projection for the next quarter is $0.87. The company’s TTM (trailing twelve months) Earnings Per Share was $3.30 as of the quarter ending March 30, 2024.

Based on the consensus of stock market analyst forecasts, Brown & Brown is expected to see an expansion in earnings per share of 27.47% YOY in the next quarter.

Methodology

All data mentioned in this article was sourced from publicly available filings and releases and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Biggest Publicly Traded Spirits Industry Report 2023 Results Recent 2023 earnings results of the Top 6 Biggest Publicly Traded Spirits Industry companies increased LTM revenues by 7% on average across the board according...

- The Best Way to Invest in Insurance Companies: How to Analyze Their Stocks Insurance, one of the necessary evils of today’s world, right? We all have to have it in case of that one day you will need...

- Publicly Traded Waste Management Industry Report: Spring 2024 Results According to their latest earnings releases, the Spring earnings results of the Top 5 Publicly Traded Waste Management companies by YoY revenues increased by 5.7% in...

- Publicly Traded Truckload Freight Industry Report: Winter 2023 Results According to their latest earnings releases, the Recent Winter earnings results of the Top 5 Publicly Traded Truckload Freight companies by YoY Revenues decreased by...