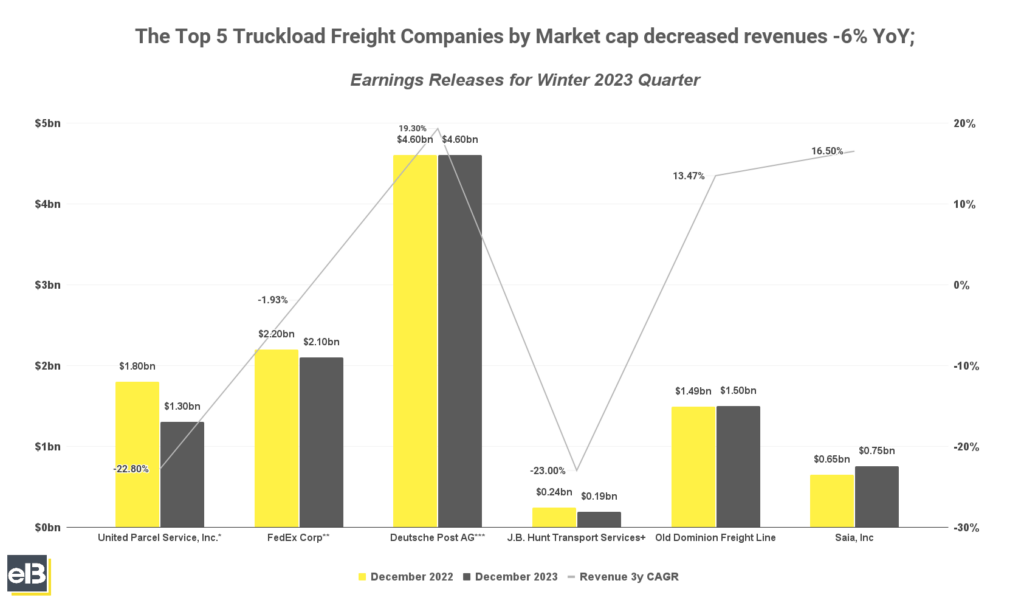

According to their latest earnings releases, the Recent Winter earnings results of the Top 5 Publicly Traded Truckload Freight companies by YoY Revenues decreased by -6% on average across the board in the October-December quarter.

Of the publicly traded Truckload Freight companies who released Winter 2023 earnings results, the following top 5 companies by market cap decreased revenues -6% YoY on average: United Parcel Service, FedEx Corp, Deutsche Post AG, J.B. Hunt Transport Services, and Old Dominion Freight Line.

The 6th company by market cap, Saia, Inc., stood out with an increase of 14.5% YoY of revenues.

**Only FedEx’s Freight revenue with its Winter quarter ended last February

*** Only DHL’s Supply Chain revenue

+ Only JBHT’s revenue include truckload segment

(Revenue 3yr CAGR of UPS, FDX, DHL and JBHT only include revenue segments mentioned above)

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Truckload Freight Companies by Market Share

- Top Truckload Freight Companies by Revenue Growth

- Top Truckload Freight Companies by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- United Parcel Services, Inc. (UPS) Stock Forecast

- FedEx (FDX) Stock Forecast

- Deutsche Post AG (DHL) Stock Forecast

- J.B. Hunt Transport Service (JBHT) Stock Forecast

- Old Dominion Freight Line (ODFL) Stock Forecast

Top 6 Truckload Freight Companies By Market Capitalization > $15Bn

The list below only includes the top 6 Truckload Freight companies by market capitalization of >$15Bn. The next section will include all >$5Bn market cap publicly traded truckload freight companies.

| Company | December 2022 | December 2023 | YOY |

| United Parcel Service, Inc. (Forwarding revenues) | $1,803 | $1,317 | -27.00% |

| FedEx Corp (Freight revenues) | $2,186 | $2,125 | -2.79% |

| Deutsche Post AG (Supply Chain revenues) | $4,655 | $4,653 | -0.04% |

| J.B. Hunt Transport Service, Inc. (Truckload revenues) | $242 | $195 | -20.00% |

| Old Dominion Freight Line | $1,491 | $1,495 | 0.03% |

| Saia, Inc. | $655 | $751 | 14.50% |

United Parcel Service, Inc. reported a -7.8% decrease YoY revenues in their latest Q4, 2023 while operating profit was $1.3 billion, or down -22.5% compared to last fourth quarter of 2022. Management pointed out in the call that the macroenvironment in the latest quarter showed improvements. However, the transportation and logistics sector conditions remained under pressure with fourth quarter average daily volume declining by -7.4% due to soft demand and overcapacity in the market.

FedEx Corp saw revenues decrease by -1.9% YoY, but operating income increased by 19% despite lower revenue which is primarily due to the execution of the company’s DRIVE program and the continued focus on revenue quality. However, the FedEx Freight segment operating results decreased due to lower fuel surcharges, reduced weight per shipment and lower shipments overall.

Deutsche Post AG recorded a -15% YoY decrease in revenues in Euro currency as B2B segment still has no meaningful recovery even from a continued support from B2C peak seasonal uplift. Supply chain segment revenue declined -2% YoY however, organic revenue growth grew by +4% YoY supported by new contracts signed.

J.B. Hunt Transport Service, Inc. reported a -9% YoY decrease in Q4, 2023 revenues citing the overall decline in volumes and revenue per load excluding fuel surcharges as the driver behind lower YoY revenues. The Truckload segment revenue is down -19% compared to the same period previous year. A -13% decline in revenue per load and -7% load volume is behind the lower Truckload revenues which was partially offset by a 13% increase in average length of haul.

Old Dominion Freight Line saw YoY revenues increase by 0.3%, which was primarily due to a 3.0% increase in Less-than-Truckload (LTL) revenue per hundredweight that more than offset the -2.0% decrease in LTL tons per day. Even with LTL tons per day decreasing the recent quarter, their LTL shipments per day and overall market share improved with an increase of operating ratio of 60 basis points to 71.8% for the latest quarter.

Saia, Inc. reported an increase of 14.5% in revenues last quarter compared to Q4, 2022 with operating income increasing $112.7 million, or a 21.5% increase. This was driven by an increase of 18.1% LTL shipments per workday and LTL revenue per hundredweight increase of 11.7%. Management commented on the ongoing soft environment of the economy but optimistic as the company just acquired and won the bid on Yellow’s terminal and assets which will accrue positively on the overall business moving forward.

Key Takeaway

The recent quarter earnings weakness in the Truckload Freight industry continues as volumes trend down with the overall soft macroeconomy the culprit most management in above businesses blame. Also, the continued lower fuel surcharges hit the biggest companies in the list as fuel prices normalize compared to last year.

However, some companies continued to operate excellently as shown by their growing efficiencies in the increasing operating ratios. Goes to show which operating model wins in such a tight competitive environment that is with the Truckload industry.

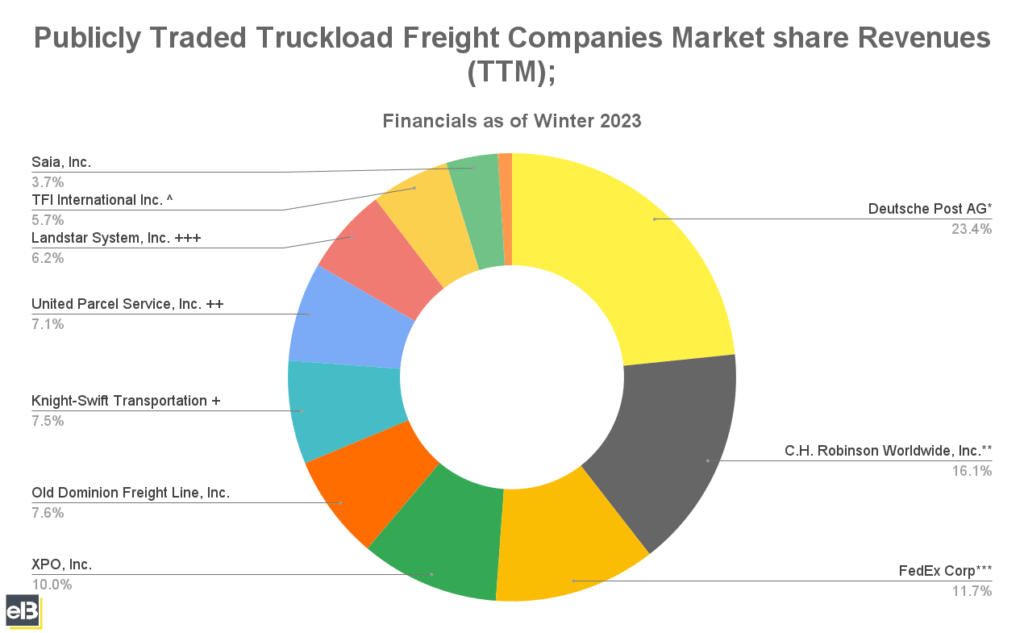

Biggest Publicly Traded Truckload Freight Companies by Market Share

The below chart shows the list of publicly traded Truckload Freight Companies with meaningful market caps of >$5Bn as of April 2024.

**Only CHRW’s TTM NAST revenue ^Only TFII’s TTM LTL and Truckload revenues

*** Only FDX’s TTM Freight revenue Note: All in US Dollars

+Only CHRW’s TTM NAST revenue

++Only UPS’s TTM Forwarding revenue

Leading the group is Deutsche Post AG with roughly 23.4% market share, followed C.H. Robinson Worldwide, Inc. with 16.1%, and just behind is FedEx Corp with 11.7% of Trailing Twelve Months (TTM) revenue share of all publicly traded truckload freight companies.

| Company | Revenues (TTM in thousands) | Mkt Share |

| Deutsche Post AG | $18,096,000 | 23.4% |

| C.H. Robinson Worldwide, Inc. | $12,471,000 | 16.1% |

| FedEx Corp | $9,045,000 | 11.7% |

| XPO, Inc. | $7,744,000 | 10.0% |

| Old Dominion Freight Line | $5,866,000 | 7.6% |

| Knight-Swift Transportation Holdings | $5,780,000 | 7.5% |

| United Parcel Service, Inc. | $5,534,000 | 7.1% |

| Landstar System, Inc. | $4,829,000 | 6.2% |

| TFI International, Inc. | $4,402,000 | 5.7% |

| Saia, Inc. | $2,881,000 | 3.7% |

| J.B. Hunt Transport Services* | $5,688,900 | 1.6% |

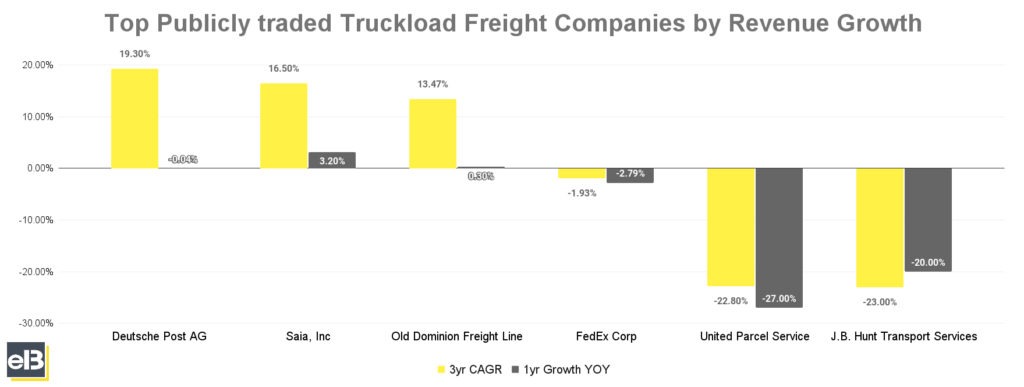

Top Truckload Freight Companies by Revenue Growth

In the previous three fiscal years, Deutsche Post AG lead ahead among its peers in the truckload freight industry with 19.30% CAGR.

On the other hand, Saia, Inc. is leading in boosting its year-over-year annual revenue growth of 3.20% from 2022-2023.

Saia, Inc. takes the number two spot in 3yr CAGR with 16.50%, while trailing behind is Old Dominion Freight Line and FedEx Corp with 13.47% and -1.93% 3yr CAGR, respectively.

| Company | 3yr CAGR | 1yr Growth YOY |

| Deutsche Post AG (Supply Chain revenues) | 19.30% | -0.04% |

| Saia, Inc. | 16.50% | 3.20% |

| Old Dominion Freight Line | 13.47% | 0.30% |

| FedEx Corp (Freight revenues) | -1.93% | -2.79% |

| United Parcel Service, Inc. (Forwarding revenues) | -22.80% | -27.00% |

| J.B. Hunt Transport Services (Truckload revenues) | -23.00% | -20.00% |

Key Takeaway

As the data above shows, most of the three fiscal years of growth in Truckload and LTL revenues are decelerating, with others showing negative one-year-over-year earnings growth. The continued lower volume of shipments and the reversal in fuel surcharges bogged down most freight earnings. However, operational excellence is key in the cyclical market of the truckload business, as seen with ODFL and SAIA, which have positive YoY earnings.

Uncertainties about the economic recovery still abound among Truckload freight companies, as volume recovery goes along with it. However, some management pointed out that the weight per shipment was stronger sequentially in the last quarter, which is an early indicator that the economy will start turning.

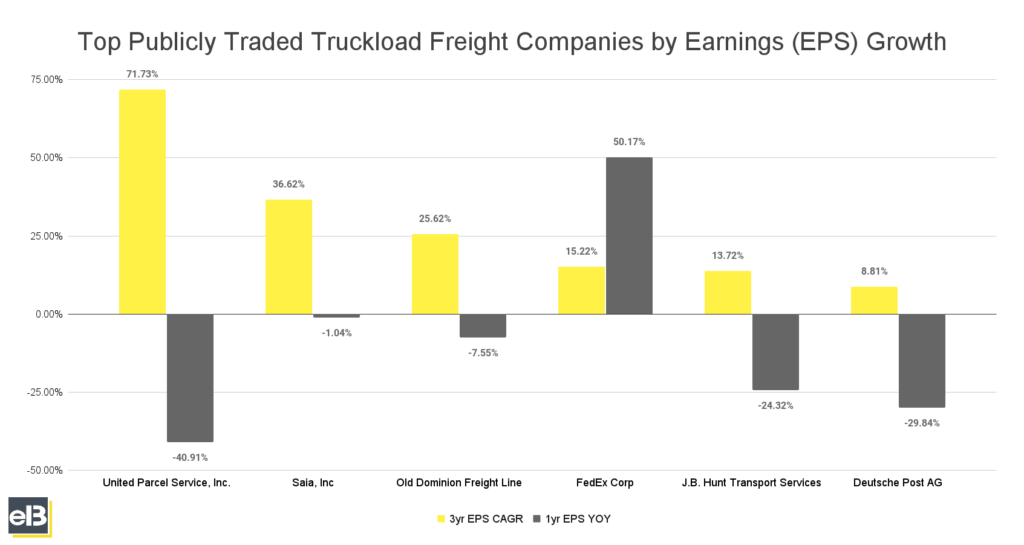

Top Truckload Freight Companies by Earnings (EPS) Growth

In the previous three fiscal years, United Parcel Service, Inc. saw the highest 3 year compounded annual growth of 71.73% in earnings per share.

Among the companies in the below graph, FedEx Corp had the highest 1-year EPS YOY growth rate of 50.17%.

The highest 3-year EPS CAGR companies in the list are United Parcel Service, Inc. at 71.73%, Saia, Inc at 36.62%, and Old Dominion Freight Line at 25.62%.

| Company | 3yr EPS CAGR | 1yr EPS YOY |

| United Parcel Service, Inc. | 71.73% | -40.91% |

| Saia, Inc. | 36.62% | -1.04% |

| Old Dominion Freight Line | 25.62% | -7.55% |

| FedEx Corp | 15.22% | 50.17% |

| J.B. Hunt Transport Services | 13.72% | -24.32% |

| Deutsche Post AG | 8.81% | -29.84% |

Truckload Freight Companies Revenue, Earnings and Stock Forecast (Quarter ending December 2023)

| Company | YOY EPS Forecast |

| United Parcel Service, Inc. | -37.74% |

| FedEx Corp | 8.98% |

| Deutsche Post AG | -19.51% |

| J.B. Hunt Transport Services, Inc. | -3.16% |

| Old Dominion Freight Line | 4.23% |

United Parcel Service, Inc. (UPS) Revenue, Earnings, and Stock Forecast

United Parcel Service, Inc’s revenue over the latest Trailing Twelve Month period was $91.0 billion. United Parcel Service, Inc’s earnings (Net Income) over the latest Trailing Twelve Month period was $6.7 billion.

The Wall Street consensus for United Parcel Service, Inc’s EPS (earnings per share) projection for the next quarter is $1.37. The company’s TTM (trailing twelve months) Earnings Per Share was $7.80 as of the quarter ending December 30, 2023.

United Parcel Service, Inc is expected to see a contraction in earnings per share of -37.74% YOY in the next quarter based on the consensus of stock market analyst forecasts.

FedEx Corp (FDX) Revenue, Earnings, and Stock Forecast

FedEx Corp’s revenue over the latest Trailing Twelve Month period was $87.5 billion. FedEx Corp’s earnings (Net Income) over the latest Trailing Twelve Month period was $4.4 billion.

The Wall Street consensus for FedEx Corp’s EPS (earnings per share) projection for the next quarter is $5.38. The company’s TTM (trailing twelve months) Earnings Per Share was $17.6 as of the quarter ending February 24, 2024.

FedEx Corp is expected to see an expansion in earnings per share of 8.98% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Deutsche Post AG (DHL) Revenue, Earnings, and Stock Forecast

Deutsche Post AG’s revenue over the latest Trailing Twelve Month period was $89.5 billion. Deutsche Post AG’s earnings (Net Income) over the latest Trailing Twelve Month period was $4.0 billion.

The Wall Street consensus for Deutsche Post AG’s EPS (earnings per share) projection for the next quarter is $0.67. The company’s TTM (trailing twelve months) Earnings Per Share was $3.40 as of the quarter ending December 30, 2023.

Deutsche Post AG is expected to see a contraction in earnings per share of -19.51% YOY in the next quarter based on the consensus of stock market analyst forecasts.

J.B. Hunt Transport Services (JBHT) Revenue, Earnings, and Stock Forecast

J.B. Hunt Transport Services’ revenue over the latest Trailing Twelve Month period was $12.8 billion. J.B. Hunt Transport Services’ earnings (Net Income) over the latest Trailing Twelve Month period was $0.7 billion.

The Wall Street consensus for J.B. Hunt Transport Services’ EPS (earnings per share) projection for the next quarter is $1.52. The company’s TTM (trailing twelve months) Earnings Per Share was $7.0 as of the quarter ending December 30, 2023.

J.B. Hunt Transport Services’ is expected to see a contraction in earnings per share of -3.16% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Old Dominion Freight Line (ODFL) Revenue, Earnings, and Stock Forecast

Old Dominion Freight Line’s revenue over the latest Trailing Twelve Month period was $5.9 billion. Old Dominion Freight Line’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.2 billion.

The Wall Street consensus for Old Dominion Freight Line’s EPS (earnings per share) projection for the next quarter is $1.34. The company’s TTM (trailing twelve months) Earnings Per Share was $5.70 as of the quarter ending December 30, 2023.

Old Dominion Freight Line is expected to see an expansion in earnings per share of 4.23% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data mentioned here in this article was sourced from publicly available filings and releases, and processed by investment newsletter provider, Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Truckload Freight Industry Report: Autumn 2023 Results Recent Autumn earnings results of the Top 5 Publicly Traded Truckload Freight companies by Q/Q Revenues decreased by -9% on average across the board in...

- Publicly Traded Logistics Companies Report: Winter 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Logistics Companies Grew Total Revenues Over 6% YOY in the October – December...

- Publicly Traded Home Builders Report: Winter 2023 Results Publicly available financial data collected by investment newsletter provider Sather Research, LLC showed that five Publicly Traded Home Builders by Market Cap grew Total Revenues on...

- Publicly Traded Home Builders Report: Autumn 2023 Results Publicly available financial data collected by investment newsletter provider Sather Research, LLC showed that five Publicly Traded Home Builders by Market Cap grew Total Revenues on...