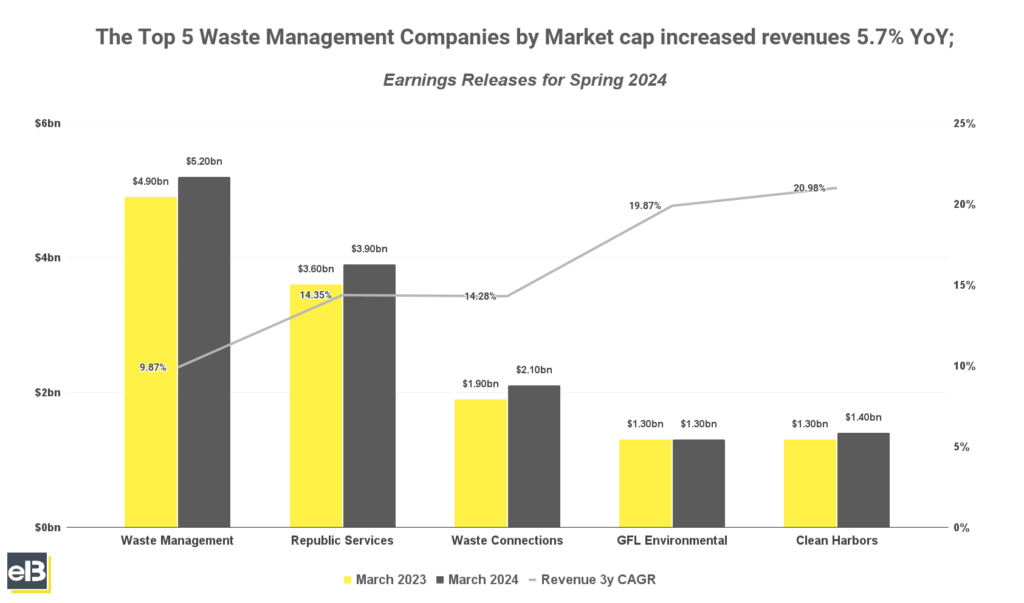

According to their latest earnings releases, the Spring earnings results of the Top 5 Publicly Traded Waste Management companies by YoY revenues increased by 5.7% in the January-March quarter.

Of the publicly traded Waste Management companies that released Spring Q1 2024 earnings results, Waste connections grew the highest quarterly YoY revenues by 9.10%

GFL Environmental had the least increase in YoY quarterly revenues which is flat followed by Clean Harbors at 5.30%.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Waste Management Companies by Market Share

- Top Waste Management Companies by Revenue Growth

- Top Waste Management Companies by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Waste Management, Inc. (WM) Stock Forecast

- Republic Services, Inc. (RSG) Stock Forecast

- Waste Connections, Inc. (WCN) Stock Forecast

- GFL Environmental, Inc. (GFL) Stock Forecast

The list below only includes the revenue of top 5 Waste Management companies by market capitalization of >$10Bn. The next section will include TTM revenues of all >$1Bn market cap publicly traded waste management companies.

| Company | Q1 2023 | Q1 2023 | YOY |

| Waste Management, Inc. | $4,892 | $5,159 | 5.50% |

| Republic Services, Inc. | $3,581 | $3,861 | 7.80% |

| Waste Connections, Inc. | $1,900 | $2,072 | 9.10% |

| GFL Environmental, Inc. | $1,331 | $1,330 | 0.10% |

| Clean Harbors | $1,307 | $1,376 | 5.30% |

Waste Management, Inc. reported a 5.50% increase YoY revenues in their latest quarter, driven primarily by core price increase of 7.2%. Collection and disposal yield continue to increase by 5.1% but volumes flat. However, softer temporary roll-off volumes and a lower outlook for energy surcharge continues to temper revenues as expected, management said.

Republic Services, Inc. saw revenues increase by 7.8% YoY for Q1 2024, which includes 4.1% organic growth and 3.7% growth from acquisitions. Core pricing increase of 7.0% drove revenue growth and another 6.0% revenue increase from average yield. But volume growth decreased -1.1% on revenue. However, management expressed optimism and was well-positioned to achieve their full-year goals.

Waste Connections, Inc. recorded a 9.10% YoY quarterly revenue increase while solid waste core pricing increased by 7.8%. However, the reported volume growth was -3.8%, which is in line with expectations, as management said in their latest conference call. Extreme weather events impacted reported volumes. Recycling revenues are up 50% YoY on the back of recycled commodity values rising 15% in the start of the year.

GFL Environmental, Inc. reported a 0.5% YoY increase in CAD revenues, which excludes the impact of divestitures. Solid waste pricing increased by 7.7% YoY however, solid waste volumes continued the trend down –3.0% and still significantly better than the company’s expectations. The unusually cold January weather impacted volumes as well.

Clean Harbors saw a 5% increase in YoY quarterly topline growth with volumes coming into their disposal and recycling network continue to increase. Average incineration pricing increased by 6% but incineration utilization was only 79% in the last quarter due to weather disruptions last January.

Key Takeaway

The trend continues to go up, albeit slowly, in quarterly revenues of waste management companies, even with negative volumes due to weather disruptions. This shows the pricing power waste management companies have, as it shows the core pricing increase of high single digits. Optionality in recycling revenues also helped soften the declining waste volumes, as recycled commodities have been up since the start of the year.

Biggest Publicly Traded Waste Management Companies by Market Share

The graph shown below comprises of >$1B market cap publicly traded waste management companies as of May 2024.

Leading ahead is Waste Management with roughly 34.1% market share, followed by Republic Services with 25.1%, and behind is Waste Connections with 13.5% of Trailing Twelve Months (TTM) revenue share of all >$1B publicly traded waste management companies.

| Company | Revenues (TTM in Thousands USD) | Mkt Share |

| Waste Management, Inc. | $20,693,000 | 35.0% |

| Republic Services, Inc. | $15,245,100 | 25.8% |

| Waste Connections, Inc. | $8,194,101 | 13.9% |

| GFL Environmental, Inc. | $5,550,076 | 9.4% |

| Clean Harbors, Inc. | $5,478,460 | 9.3% |

| Stericycle, Inc. | $2,639,900 | 4.5% |

| Casella Waste Systems, Inc. | $1,342,955 | 2.3% |

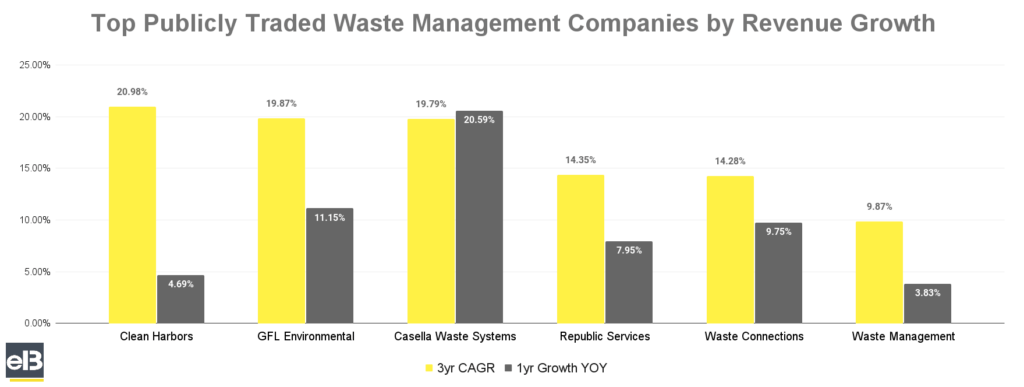

Top Waste Management Companies by Revenue Growth

In the last three fiscal years, Clean Harbors lead ahead among its peers in the waste management industry with a 20.98% CAGR in revenues.

Meanwhile, Casella Waste Systems leads in boosting its year-over-year annual revenue growth of 20.59% from 2022-2023.

GFL Environmental takes the number two spot in 3yr revenue CAGR of 19.87%, while trailing behind is Casella Waste Systems and Republic Services with 19.79% and 14.35% 3yr CAGR, respectively.

| Company | 3yr CAGR | 1yr Growth YOY |

| Clean Harbors, Inc. | 20.98% | 4.69% |

| GFL Environmental | 19.87% | 11.15% |

| Casella Waste Systems | 19.79% | 20.59% |

| Republic Services | 14.35% | 7.95% |

| Waste Connections | 14.28% | 9.75% |

| Waste Management | 9.87% | 3.83% |

Key Takeaway

The table above shows that the revenues of top waste management companies have remained robust over the past three fiscal years, albeit with some cyclicality. Size also matters, as you can see from the trend of lower revenue CAGRs, the bigger the company is. However, continuous core price increases, M&A, and cost optimizations have benefited these companies in a still fragmented industry. Volumes have been trending down the past quarters due to extreme weather conditions, but core price increases provided a buffer.

Top Waste Management Companies by Earnings (EPS) Growth

In the last three fiscal years, Waste Connections saw the highest 3 year annual compounded growth rate of 53.78% in earnings per share.

Among the companies in the below graph, Republic Services had the highest 1-year EPS YOY growth rate of 19.00%

The list’s highest 3-year EPS CAGR companies are Waste Connections at 55.96%, Clean Harbors at 42.14%, and Republic Services at 21.90%.

| Company | 3yr EPS CAGR | 1yr EPS YOY |

| Waste Connections | 53.78% | -7.52% |

| Clean Harbors | 38.42% | -8.07% |

| Republic Services | 21.48% | 19.00% |

| Waste Management | 18.62% | 11.85% |

| Casella Waste Systems | -45.17% | -69.23% |

| GFL Environmental | -56.41% | -112.04% |

Waste Management Companies Revenue, Earnings and Stock Forecast (Quarter ending Q1 2024)

| Company | YOY EPS Forecast |

| Waste Management | 20.29% |

| Republic Services | 8.21% |

| Waste Connections | 14.26% |

| GFL Environmental | -26.85% |

Waste Management (WM) Revenue, Earnings, and Stock Forecast

Waste Management’s revenue over the latest Trailing Twelve Month period was $20.7 billion. Waste Management’s earnings (Net Income) over the latest Trailing Twelve Month period was $2.5 billion.

The Wall Street consensus for Waste Management’s EPS (earnings per share) projection for the next quarter is $1.82. The company’s TTM (trailing twelve months) Earnings Per Share was $6.10 as of the quarter ending March 30, 2024.

Waste Management is expected to see an expansion in earnings per share of 20.29% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Republic Services (RSG) Revenue, Earnings, and Stock Forecast

Republic Services’ revenue over the latest Trailing Twelve Month period was $15.2 billion. Republic Services’ earnings (Net Income) over the latest Trailing Twelve Month period was $1.8 billion.

The Wall Street consensus for Republic Services’ EPS (earnings per share) projection for the next quarter is $1.53. The company’s TTM (trailing twelve months) Earnings Per Share was $5.70 as of the quarter ending March 30, 2024.

According to the consensus of stock market analyst forecasts, Republic Services’ earnings per share are expected to expand 8.21% YOY in the next quarter.

Waste Connections (WCN) Revenue, Earnings, and Stock Forecast

Waste Connections’ revenue over the latest Trailing Twelve Month period was $8.2 billion. Waste Connections’ earnings (Net Income) over the latest Trailing Twelve Month period was $0.795 billion.

The Wall Street consensus for Waste Connections’ EPS (earnings per share) projection for the next quarter is $1.17. The company’s TTM (trailing twelve months) Earnings Per Share was $3.10 as of the quarter ending March 30, 2024.

Waste Connections is expected to see an expansion in earnings per share of 14.26% YOY in the next quarter based on the consensus of stock market analyst forecasts.

GFL Environmental (GFL) Revenue, Earnings, and Stock Forecast

GFL Environmental’s revenue over the latest Trailing Twelve Month period was $5.55 billion USD. GFL Environmental’s earnings (Net Income) over the latest Trailing Twelve Month period was $0.067 billion USD.

The Wall Street consensus for GFL Environmental’s EPS (earnings per share) projection for the next quarter is $0.24. The company’s TTM (trailing twelve months) Earnings Per Share was $0.20 as of the quarter ending March 30, 2024.

Based on the consensus of stock market analyst forecasts, GFL Environmental is expected to see a contraction in earnings per share of -36.43% YOY in the next quarter.

Methodology

All data mentioned in this article was sourced from publicly available filings and releases and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Waste Management Industry Report: Autumn 2023 Results According to their latest earnings releases, the Autumn earnings results of the Top 4 Publicly Traded Waste Management companies by YoY revenues increased by 5%...

- Publicly Traded Waste Management Industry Report: Winter 2023 Results According to their latest earnings releases, the Winter earnings results of the Top 4 Publicly Traded Waste Management companies by YoY revenues increased by 7%...

- Publicly Traded Home Builders Report: Winter 2023 Results Publicly available financial data collected by investment newsletter provider Sather Research, LLC showed that five Publicly Traded Home Builders by Market Cap grew Total Revenues on...

- Publicly Traded Truckload Freight Industry Report: Winter 2023 Results According to their latest earnings releases, the Recent Winter earnings results of the Top 5 Publicly Traded Truckload Freight companies by YoY Revenues decreased by...