Do you like makin’ money? That’s what I thought! Yes, we all do! And guess what – the stock market has 100 years of history doing nothing but making money for people.

At the end of it all, that’s why any of us invest in the stock market. Sure, we might do it so that we can retire early, but the only reason that you can retire early is because you’re making money!

Maybe you’re investing your 529 money for your child’s education but again, you’re doing that so you have to save less.

At the end of the day – it’s about nothing more than makin’ money!

It took me awhile to really be able to comprehend what investing in the stock market even meant. I always used to think that people that invested in the stock market were super risky and that their money was being handled by immoral people…I couldn’t have been further from the truth!

There really were four things that were instrumental in getting me motivated to invest as much as humanly possible in the market:

1 – Understanding how Compound Interest Works

Of course, any sort of blog post trying to get people motivated to invest has to start with compound interest, and this is truly where my journey did start.

I felt like I could quite simply never get ahead no matter what I did, but once I truly understood why compound interest was so important, I was hooked.

If you invest $100 in Year 1 and make 10%, then you now have $110, meaning you made $10. But in Year 2, if you make another 10%, you now have $221, meaning you made $11!

How did you make $11? Well, remember that $10 you made in Year 1? Now you make another 10% on that $10, so you get an extra $1.

You do this for years on end and the gains are massive. It’s why getting your money to work in the market is so incredibly important rather than just sitting on your hands and doing nothing.

2 – Understanding the History of the Stock Market

This was probably the second most important thing for me and one that I intend to spend most of my time on today. You see, the stock market is undefeated – it always goes up.

Now I am not saying that everyday the stock market goes up. I’m not even saying that every year the stock market goes up. But what I am saying is that eventually, at the end of it all, the stock market is going to go up and it always has.

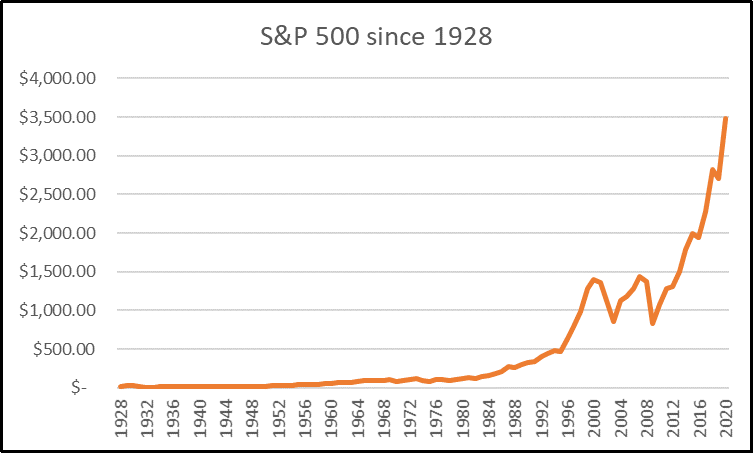

Below is a nice little graph to show exactly what I am talking about:

You see what I am saying? You can see the slow climb that occurred and then really gained steam as we get into the recent years. But a lot of that is skewed because the S&P just got so high that it’s hard to pick it up on the graph.

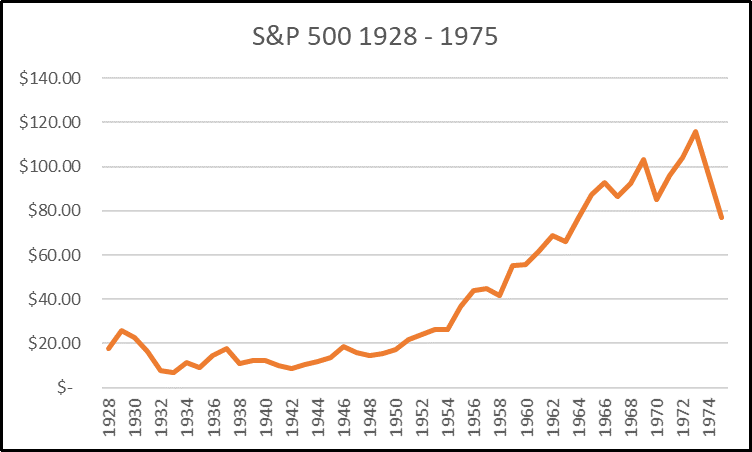

When we only look at 1928 – 1975, you can see that the same is still true:

“But Andy, you can clearly see that at the end of your chart, the stock market is crashing!”

Sure, you’re right. But how long do you think it takes for the market to rebound back to its high price of $116.03 in 1969? Not very long…

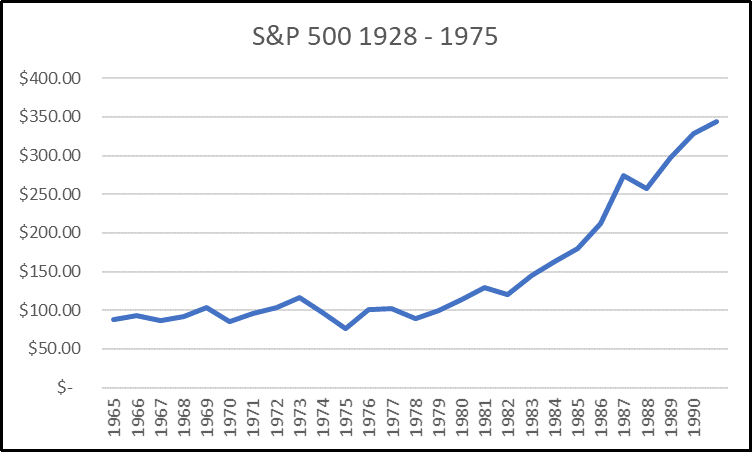

It reclaims that all-time high by 1980 and then by 1990 it is now sitting at $329.08, nearly triple the price in 1969.

So, if you were able to buy and hold some shares of the S&P 500 and just hold onto them for 21 years, you nearly tripled your money. That’s not to shabby if you ask me.

Looking at investing from this viewpoint is what really made me trust that things would be ok. It brings me peace when I invest because I trust that the market is going to do what it’s always done – go up!

This is why I benchmark myself to the S&P 500 at all times. I trust that the S&P is going to do its thing so I just try to focus on beating it. I find that having this mindset keeps me a rational investor both in the good times and the bad times.

If my portfolio gains 18% and the S&P 500 gains 20%, I don’t think that I am some sort of investing savant. If anything, I am questioning why I underperformed Joe Schmoe that bought SPY to mimic the stock market.

I’m not happy with an 18% return if the market gave me 20%.

And if the market declines by 10% and I lose 8%, then I’m happy! I outperformed the market even though I actually lost money. I trust that the market will rebound like it always has and continue to make those 10% gains. If I can just outperform the market by 2% every year then I am going to save years of saving!

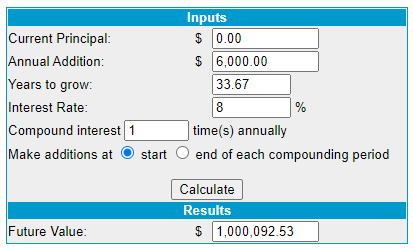

It might not seem like a lot, but do you know the difference between getting an 8% return and a 10% return?

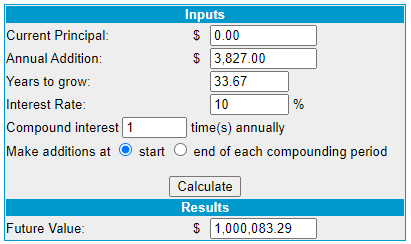

Well, if I maxed out a Traditional IRA and got an 8% average return, I would have $1 million in 33.67 years!

That doesn’t sound like some insanely impossible thing to accomplish, right? Just $500/month?

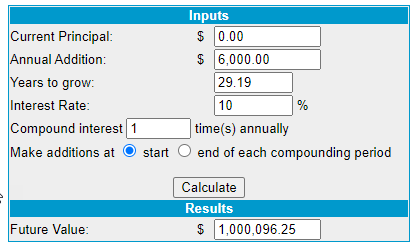

But what if I did the same exact thing and got 10% returns?

I get to that same goal of $1 million but now in just over 29 years:

So, that extra 2% just saved me about 4.5 years. Or, if you’re not in a major time rush to get to $1 million, you could simply just contribute $3,827/year instead of the $6K:

So, long story short, I trust that the market is going to go up (like always) while I focus on just trying to slightly outperform the market each year. I don’t have some crazy unattainable goals – I just am looking for small, realistic wins that I can accomplish.

I don’t care if my portfolio goes up 10% or down 10% – I focus on what I can control and let the market do the rest! I think it deserves a little bit of faith after this track record of 100 years of makin’ money in the stock market!

3 – Realizing that the Best Thing to do is Often Nothing

#2 leads me right into this point, and that’s that usually the best thing that you can do is nothing. It is so easy for us to want to get into our investments and play with things and try to “optimize” them a bit. I am a huge culprit of this.

The thing is that every time we play with our investments, we’re naturally going to make a mistake. We usually will let our runners run and cut our losses, but that’s the exact opposite of what value investors would do. Value investors buy low and sell high, and you’re letting your ‘high’ keep going and selling your ‘low’.

Now, this is a form of momentum investing which I am personally very fond of, but it’s also extremely speculative.

If you’re going to partake in momentum investing, I think that it should really be a small portion of your portfolio or maybe in an ETF like MTUM that actually has an extremely strong history of beating the S&P 500.

More often than not, simply letting your money ride is going to be the best thing that you can do, especially if you’re in ETFs that are meant for your to just keep dollar cost averaging and not look back.

If you’re in individual stocks, I highly recommend that you continue to monitor the company and look at their 10K’s and any news that comes out, and then always run the financials through the Value Trap Indicator to make sure the company is still looking strong, and then move forward from there.

As Warren Buffett says, “Buffett says if you don’t feel comfortable owning a stock for 10 years, you shouldn’t own it for 10 minutes.”

I think that really sums up what our mindset should be when investing.

4 – The Only Thing Keeping You from Making Money is YOU

If you’ve read through the first three points and you’re still on the fence then stop. Just stop. What else do you need to know?

There was a chapter in Rich Dad, Poor Dad where Robert Kiyosaki, author of the best-selling book, talked about some of the reasons that people basically create instead of taking their financial well-being into their own hands.

Fear, Cynicism, Laziness, Bad Habits and Arrogance are the things that can ruin people in this regard.

People like to create reasons not to take advantage of this amazing opportunity that they have in front of them to retire early and maybe even to create generational wealth for their family!

It drives me absolutely nuts!

The stock market has a 100-year history of producing great returns, so what else do you need? Don’t say that you’re not smart enough. Anyone can be smart enough. If you don’t want to find individual companies then just buy an ETF like SPY to take advantage of what the market is trying to give to you.

Too lazy?

So, let me get this straight – you’re too lazy to download an app on your phone and apply for a quick account? Then every time you get paid you just click on that ETF/Stock ticker and buy the exact amount that you want?

Instead of that 1 minute that it takes you every time you’re paid, you’d rather miss out on hundreds of thousands of dollars and then have to work harder or longer to have that same quality of life?

That’s not lazy – that’s idiotic.

You don’t have the stomach for the volatility and are fearful for investing? Get a financial advisor. Create a speed bump between yourself and your future financial prosperity so you can’t make impulse decisions that you might regret.

One of my favorite examples is I know people that sold their entire 401K in 2009 when the stock market crashed and they’ve been in cash ever since, probably earning 2% APR. Since it’s peak on 8/28/2008 at $1,300.68, the market then went on to crash to $676.53, a 48% decline from its high.

Do you know what the S&P 500 is at as of late 2020? $3,426.92.

If those people had simply just held their funds and not sold, they’d have 263% of their investment BEFORE the crash. If you compared it vs. the bottom in 2009, their money would’ve increased more than 5X.

If you think something fundamentally has changed in your investments, sure, feel free to take that money out. But if you’re just in an ETF then you need to make sure that that money stays in the market and isn’t taken out until you’re retired and plan to use it.

If the stock market really is crashing hard and going to $0 then guess what – I don’t think your money is going to matter anyways – we’re all going to have very different lives than what we currently do.

Once you are truly able to trust that the stock market is going to have another 100 years of successful returns, then you will be able to be a much more rational and confident investor.

In my eyes, I think the world just keeps getting more and more innovative and it’s creating more opportunities for amazing companies. I think about companies that are truly changing the world and making our lives better.

Just during COVID we have learned to basically shift our entire lives to being online in some capacity of another. Personally, I think that this is a trend that’s not going anywhere, but this is exactly what I mean when I talk about how companies are just continuing to become more competitive and robust, and that’s just going to keep strengthening the total stock market.

You know what companies that I think will benefit most from COVID-19? I really think it’s the cloud computing stocks. If you’re looking for some exposure and don’t know where to start, don’t fret – I got you covered!

Related posts:

- [S&P 500] Average Valuation Multiples by Industry: P/E, P/FCF, P/S, P/B, PEG There are many valuation multiples which investors use to compare stocks with their peers in an industry. This post displays the mostly commonly used valuation...

- 5 Historical Stock Market Facts That Can Help Boost Your Returns Investing is tough, right? Wrong! Investing is like anything else – it’s only tough if you don’t know what you’re doing. We’re here to help...

- Price to Sales is NOT Relevant When Margins Are High – 20Y [S&P 500 Data] The price to sales ratio (or the P/S ratio) has long been a reliable metric for uncovering value because (1) sales tend to be more...

- Comparing the P/E Ratio of Nifty 50 Companies with Today (7 Examples) The nifty 50 companies were the most popular stocks of their time in the 1960’s and 1970’s. These 50 companies were growing so fast that...