Updated 11/9/2023

In 2021, analysts estimated the subscription as a service (SaaS) market size to be around $145.5 billion in the U.S. alone, with expectations to grow to $171.9 billion in 2022. The SaaS market expects to grow as more organizations adopt SaaS solutions for various business functions.

Many of these solutions are some of the most popular market investment choices, such as customer resource management (CRM), eCommerce, web hosting, and enterprise platforms.

As we will see, barriers to entry in the subscription as a service or SaaS businesses are low, and many of the bigger names in the markets have adopted these as the primary business model or are in the process of changing their model to take advantage of these types of business models.

Companies such as Salesforce, Adobe, and Intuit are the biggest in the markets and control large portions of their particular segments. The recurring revenues and high margins guarantee continued long-term dominance as much as you can.

In today’s post, we will learn:

- What is a Subscription As A Service Business Model

- How Does a Subscription As A Service Business Model Work?

- Different Types of Subscription As a Service Companies

- Examples of Different SaaS Companies

Okay, let’s dive in and learn more about subscription as a service company.

What is a Subscription As A Service Business Model?

The subscription as a service business model, or as we will refer to it from now on, the SaaS business model, is based on the idea of selling a service or product on a recurring revenue model, with monthly or annual recurring subscriptions.

Companies like Netflix, Disney +, and Spotify are some poster children for SaaS companies. You can argue they occupy different segments like entertainment, but their revenues come from that monthly, recurring Netflix payment we gladly fork over every month.

Most SaaS companies focus on retention over customer acquisition; both are important, but maintaining that level of recurring revenue is the building block for future growth.

Subscription models concentrate on generating revenue so that each customer continues to pay for extended access to a good or service instead of a high upfront cost.

Much of our economy in the U.S. is moving towards these recurring revenue business models across a wide range of fields, from accounting, entertainment, data storage, and even medicine.

Concentrating on improving the customers’ experience and maintaining the service and experience they expect leads to continually growing the customer’s lifetime value (LTV).

What Is SaaS?

So, what is Saas?

From salesforce.com:

“Software as a service (or SaaS) is a way of delivering applications over the Internet—as a service. Instead of installing and maintaining software, you access it via the Internet, freeing yourself from complex software and hardware management.

SaaS applications are sometimes called Web-based software, on-demand software, or hosted software. Whatever the name, SaaS applications run on a SaaS provider’s servers. The provider manages access to the application, including security, availability, and performance.”

The SaaS business model is simple, and the payoff for the customers and company is optimal because there is no hardware or software to buy, install, and maintain. Access to the applications is easy; we need an internet connection.

From the company’s point of view, they don’t need to warehouse expensive hardware or maintain expensive storefronts with inventory or sales staff. All of which lead to much bigger margins and more profitability.

How Does a Subscription As A Business Model Work?

Subscription as a service company has been around for a long time; they were first introduced in the 1600s by newspaper and book publishers. A great example is your Wall Street Journal subscription years before Netflix came along.

With the rise of technology and SaaS products, many companies are moving from a business model where customers buy once to recurring revenues generated by subscriptions. The business model has proven resilient because customers are more than willing to continue to pay for their Spotify subscription to continue listening to their favorite music (blues) and their Wall Street Journal subscription.

A company like Netflix should highlight how powerful this business model is, how addicting some of these types of businesses are, and the power they hold. For example, look at the global spread of the Squid Game and how quickly and pervasively it spread throughout different cultures and age groups.

Let’s go back just a bit and, a few years ago, when you purchased your Microsoft Word or Office, you had to buy the physical disk and then upload that into your computer to access the different programs. But now, you can access the same programs through the cloud and pay a monthly subscription or a one-time licensing fee.

In the old days, Microsoft would handle all the implementation, infrastructure support, and inventory of their disks and hardware.

However, SaaS delivers those same products remotely from a server, along with management and access to those products. Most SaaS applications run in the cloud and don’t require users (you and me) to buy hardware, networking, or other expensive infrastructure to operate the product or service.

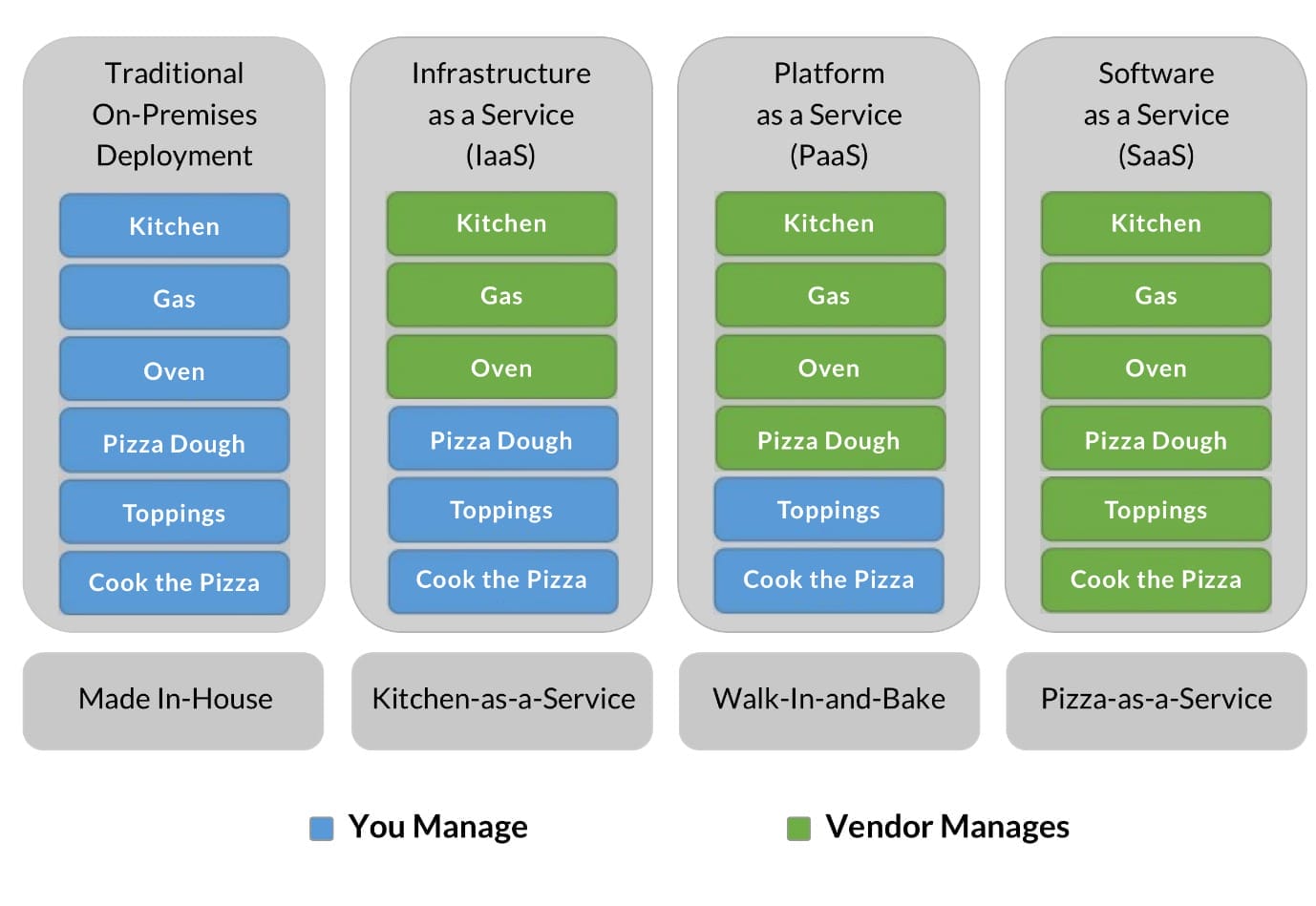

There are three principal models of cloud computing, of which SaaS is one of them:

- SaaS (subscription as a service)

- PaaS (Platform as a Service)

- IaaS (Infrastructure as a Service)

Below is an excellent infographic explaining how the different cloud services work, using my favorite food, pizza, as an example.

The SaaS business model is a lot like a bank, which protects each individual’s private information while allowing access to services to many individuals on a massive scale.

All SaaS companies have a multitenant architecture, meaning all users and applications have a centralized, common infrastructure that allows them access to service; think Netflix.

The centralized network allows Netflix to upload the Squid Game to its server, and customers around the globe can all access the same show.

SaaS architecture allows quick, easy customization for the provider, enabling them to easily update or add new features to the platform while providing access instantly.

Finally, the architecture allows the company access to a tremendous amount of data that it can use to innovate, update, or drive new features and services for the consumer. And it allows better access to managing privileges, monitoring fraud, and ensuring everyone can access the same service in real time.

The ultimate power of the SaaS business model is the ability to continue to harness the power of the web. As that power grows, SaaS companies will continue to thrive.

Different Types of Subscription A Service Companies

Subscription as a service business model can span a wide range and variety of companies and industries. Those industries can include:

- Websites

- Cable television

- Gyms

- Lawn care

- Storage units

- Newspapers

- Many more

As with every innovation, this model has adaptations, for example, the rise of subscription boxes. Subscription boxes include women’s clothing, snacks, meal delivery kits, and shaving equipment. Even big tech giants such as Apple and Google have gotten on the train with monthly subscriptions for extended cloud memory for pictures.

There are also different home care products that you can have shipped directly to your homes, such as Birchbox or Dollar Shave Club.

Other types of subscription services, like car subscription services, provide you with access to a car for a monthly subscription. There are other services out there that provide liability insurance, maintenance, registration, and roadside assistance for a recurring subscription. Unlike a car lease, which is often a two to four-year commitment, a car subscription service is a month-to-month, and you can swap out your car every month. Automakers like Porsche and Audi now offer this service, while others like Enterprise offer the same idea.

I know I would Like to drive a new Porsche every month! You can do it for only $1500 to $2600 a month.

Probably, the most common type of subscription as a service companies are the ones most popular to most investors, such as:

- Amazon Prime

- Costco

- Netflix

- Spotify

- Disney +/Hulu

But on the business side, multiple others offer more cloud access, such as:

- Microsoft Azure

- Amazon AWS

- Google Cloud

- Salesforce

The above are just a small smattering of the different types of SaaS solutions available; there are also:

- Enterprise resource planning (ERP)

- Accounting software

- Project management software

- Email marketing software

Examples of Subscription As A Service Companies

There are thousands of SaaS business models globally today, with more growing daily, explaining the growing market shown earlier. Despite that growth, over 93% of SaaS startups fail within the first three years due to a lack of market fit for their product, cash flow issues, or seeing more churn than growth.

SaaS Company Examples

Let’s look at a few examples of SaaS companies that have thrived.

Salseforce

Salesforce is one of the highly recognizable companies and was one of the true trailblazers in space. Salesforce began by Marc Benioff in 1999 and officed out of San Francisco. Their goal was to create business software applications in a new way that would allow delivery through the Internet.

That idea completely eliminated the huge upfront costs for most businesses and implementations that would take years, including continuous updates and maintenance. Salesforce would enable all of this through their software and delivery via the Internet.

Before the creation of Salesforce, Customer Relationship Management or CRM was hosted on the company’s server. That process was slow, took years to update and maintain, and cost millions.

But Salesforce took that idea and created a much lighter, more feasible solution by building cheap CRM software and distributing it entirely online as a service, with monthly subscriptions available for different menu options.

The power to deliver that software came from the cloud, which in 1999 was far different than today.

Salesforce’s success wasn’t entirely because of the massive upgrades in its software programs; instead, it built a better product at a fraction of the cost and removed the friction of lengthy installations by moving all of it to the cloud.

Salesforce upset the traditional business model by eliminating long-term contracts or expensive licensing deals by offering the same access to everybody for a $50-a-month subscription fee.

One of the benefits of using Salesforce to build an app to deliver your service or product is you concentrate on building the app instead of focusing on the infrastructure and tools to build the app. All of that saves businesses millions and years to get to market.

Think about it: Salesforce exists in the cloud, allowing anyone on the team to access the tools. The tools are easy to use, even for none programmers like me, and because they exist on the cloud, Salesforce has the tools to help your business scale up quickly.

As of early 2021, Salesforce has over 150,000 customers, and over 88% of the companies in the S&P 500 use Salesforce today. In the CRM market, Salesforce currently controls over 23% of the market compared to its nearest competitors:

- Oracle – 5.5%

- Microsoft – 5%

- SAP – 5%

- Adobe – 3.9%

Also, the company’s AppExchange features over 2,700 applications with 3 million downloads, and more than 70% of Salesforces customers use these apps.

Salesforce has grown from humble beginnings to one of the leading SaaS companies globally, with a market cap of $302 billion and annual revenues of $23.5 billion.

Netflix

The other SaaS company I would like to look at is Netflix.

Netflix began in 1997, founded by Reed Hastings and Marc Randolph. In 1999, the company began offering an online subscription service, allowing subscribers to choose movie and TV titles from Netflix’s website. The choices were then sent via mail in the form of DVDs, along with prepaid envelopes. Netflix orchestrated all of this from over 100 distribution centers.

Even though most subscribers rented movies for a flat fee for as many titles as they wished, the company limited their total DVDs according to their subscription plans. At that time, Netflix carried tens of thousands of movies in its catalog.

In 2007, Netflix began to switch to a streaming plan allowing subscribers to stream movies or shoes directly to their homes through the cloud. And by 2010, the company completed the pivot to streaming-only plans that offered unlimited streaming. By 2016, Netflix’s streaming service was available to over 190 countries.

Netflix’s catalog of entertainment titles became a must-have, which has given the company tremendous pricing power. Who out there doesn’t have a Netflix subscription is almost automatic at this point.

Netflix currently carries a market cap of $290.3 billion and annual revenues of $7.4 billion. It is also part of the infamous FAANG stocks, which comprise almost 50% of the S&P 500 returns at the time of writing.

Both Netflix and Salesforce are perfect examples of the power of the subscription as a service business model and illustrate how companies with great ideas can scale quickly and profitably because of the nature of SaaS businesses.

Investor Takeaway

Subscription-as-a-service companies such as Salesforce, Netflix, Spotify, and Adobe have given investors tremendous returns. The pandemic is only accelerating the move to cloud-based industries.

The rise of the dominance of Saas companies in the markets and economies is partly why many investors or economists believe that “this time it is different.”

But even though the way businesses operate and their ability to scale up is far quicker than in the recent past, the suspension of the laws of economics isn’t happening. That means that companies still need to create products and services that consumers want and crave, and those companies need to generate revenues exceeding their business costs.

In other words, they need to become profitable and generate shareholder value.

These are fantastic businesses with amazing profitability and revenues, and we can find many great investment opportunities. But it is good to understand the basics of the business models, a little history, and some differences between them.

And with that, we will wrap up our discussion on subscription as a service companies.

As always, thank you for taking the time to read today’s post, and I hope you find something of value. If you have any questions or if I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Dollar-Based Net Retention Ratio in SaaS Companies In the SaaS (software-as-a-service) world, we have many ways to measure the impact of customers churning or leaving the platform. In a recurring revenue model,...

- Business Breakdown: An In-Depth Netflix Stock Valuation The Netflix product is easy to understand for most investors. Doing an in-depth stock valuation can be much harder. In this post, I will show...

- Core Bank Processing: A Breakdown of the Sector Updated 10/12/2023 The history of banking and how we handle our money is a fascinating subject, and the evolution of how we bank has been...

- What is Banking As A Service (BaaS)? Finally the Future of Banking? Updated 4/4/2024 One of the hottest scenes in the market today is fintech, with $266 billion in new investments in the first half of 2021...