In the SaaS (software-as-a-service) world, we have many ways to measure the impact of customers churning or leaving the platform. In a recurring revenue model, we can use a dollar-based net revenue retention rate (DBNR), also known as net retention rate, to help us out.

These ratios are SaaS’s most commonly cited metrics to measure retention.

Revenue retention remains a crucial part of recurring revenue models. Because churn can damage a company’s revenue growth, we need to track how well it retains its customers.

Most publicly traded companies calculate the dollar-based retention rate themselves.

Even though they don’t provide us with the exact numbers, we can determine how well a company like Twilio grows without getting new customers.

In today’s post, we will learn:

- What is a Dollar-Based Net Retention Rate?

- How Do We Calculate a Dollar-Based Net Retention Rate?

- The Importance of a Dollar-Based Net Retention Rate

- Top Retention Rates for SaaS Companies

Let’s dive in and learn more about a dollar-based net retention rate.

What is a Dollar-Based Net Retention Rate?

SaaS uses dollar-based net retention or net retention to measure stickiness. They use these ratios to measure fluctuations in their revenue base. DBNR measures any changes in revenue over time.

The ratio measures any upgrades, downgrades, and churn.

Let’s define a couple of terms.

- Software-as-a-Service or SaaS equals recurring revenue style companies. Several examples include Crowdstrike, Twilio, and Salesforce.

- Dollar-based net retention rate equals the acronym DBNR, which we will use throughout this post.

- Churn equals the turnover of customers in a business. For example, Netflix tracks the churn of its customers. If you sign up and use the service for less than a year and then unsubscribe, that’s churn.

Dollar-based retention metric helps SaaS companies measure growth without acquiring new customers.

The metric is a non-GAAP measure, meaning they have zero standard definitions. Some SaaS companies report dollar-based retention, and others report net revenue retention.

The difference between some definitions is churn.

The DBNR calculations compare revenues from one set of customers to another group. Not every company will report the metrics necessary to calculate DBNR, but we can use our knowledge of the formula to understand the impact on the company.

The SaaS business model looks to onboard new customers and grow the revenue from those customers over time.

Twilio can grow by selling additional products or services to existing customers, or, they can increase product and service usage among those customers.

The dollar-based retention ratio can tell us how well Twilio expanded its business. We can infer from the ratio how Twilio sells extra services or products.

The DBNR ratio shows us how effectively Twilio grows revenues from existing customers.

Most companies use it to measure the effectiveness of upselling instead of churn. A DBNR above 100% tells us the company has succeeded in upselling additional products or services.

Companies will look at a ratio like DBNR to tell how well they grow revenue to compensate for churn.

For SaaS companies to succeed long term, they need to focus on retention, engagement, and the potential of their current customers.

In part, acquiring new customers is hard, expensive, and time-consuming. Leveraging existing customers can drive growth for both the company and the customer.

Data proves the point: according to Gartner, customers who receive value from a company are 82% more likely to renew their subscriptions, and 97% more likely to share their positive reaction by word-of-mouth.

The bottom line: great customer service can help unlock recurring revenue and customer loyalty.

How Do We Calculate a Dollar-Based Net Retention Rate?

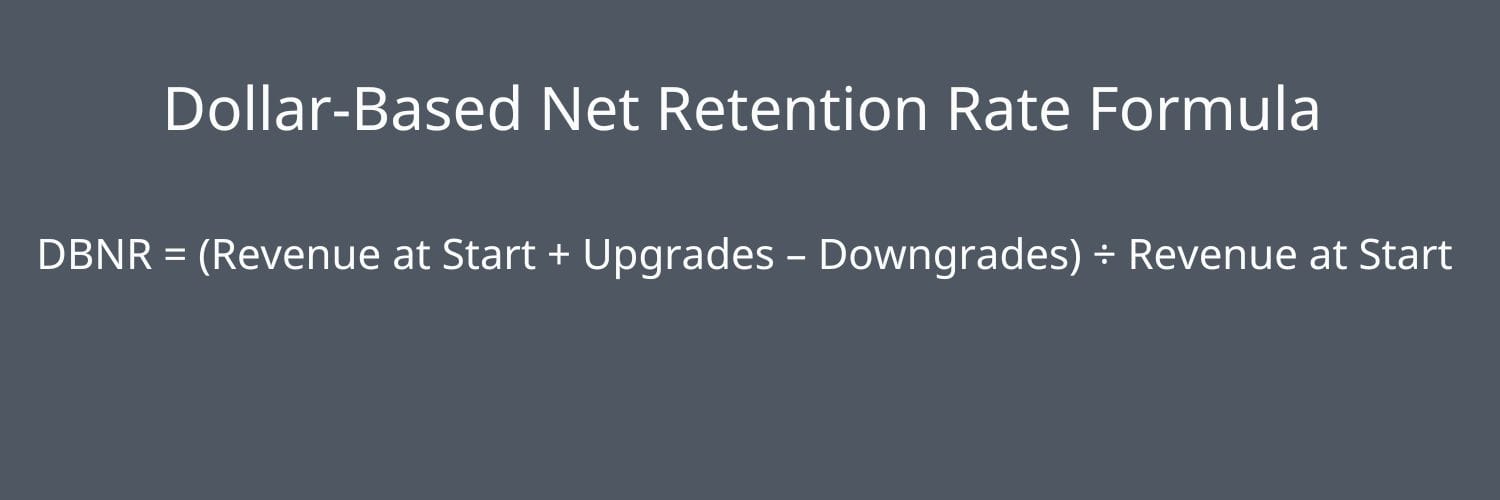

The math behind the dollar-based net retention rate equals:

We calculate Crowdstrike’s dollar-based net retention rate by comparing customer revenue at the start of one period. Then we compare period one to the same customers at the end of period two.

An important caveat: DBNR doesn’t measure customers who do not remain customers or churn off the platform.

But…..because the ratio is not a GAAP number, we have little consistency in the calculations across public companies.

The best way to ensure consistency is to read through the footnotes for each company. We can see from those footnotes how each company calculates this important metric.

For example, here’s the definition from Crowdstrike:

“Our dollar-based net retention rate compares our ARR from a set of subscription customers against the same metric for those subscription customers from the prior year. Our dollar-based net retention rate reflects customer renewals, expansion, contraction, and churn, and excludes revenue from our incident response and proactive services. We calculate our dollar-based net retention rate as of period end by starting with the ARR from all subscription customers as of 12 months prior to such period end, or Prior Period ARR.

We then calculate the ARR from these same subscription customers as of the current period end, or Current Period ARR. Current Period ARR includes any expansion and is net of contraction or churn over the trailing 12 months but excludes revenue from new subscription customers in the current period. We then divide the Current Period ARR by the Prior Period ARR to arrive at our dollar-based net retention rate.”

And then we have Fastly’s definition:

“We calculate Dollar-Based Net Expansion Rate by dividing the revenue for a given period from customers who remained customers as of the last day of the given period (the “current” period) by the revenue from the same customers for the same period measured one year prior (the “base” period). The revenue included in the current period excludes revenue from (i) customers that churned after the end of the base period and (ii) new customers that entered into a customer agreement after the end of the base period.”

As we can see, each company has similar definitions, but Crowdstrike includes churn, while Fastly doesn’t.

Again, remember that each company will determine the rate differently, but understand the logic behind it and what it tells us.

Let’s walk through an example to give us a sense of how this works:

|

Customer |

Revenue at the Start of Period |

Revenue at the end of the period (Scenario 1) |

Revenue at the end of the period (Scenario 2) |

|

A |

$2,000 |

$2,000 |

$3,000 |

|

B |

$3,000 |

$3,000 |

$3,500 |

|

C |

$4,000 |

$0 |

$0 |

|

D |

$5,000 |

$5,500 |

$5,500 |

At the beginning of the period, customers A, B, and D generated $10,000 in revenue for Twilio, with customer C dropping out and not included in any further calculations.

In scenario 1, Twilio generated $10,000 from customers A, B, and D at the end of the period. Therefore, our DBNR calculations equal 100%. DBNR equals $10,000 ÷ $10,000 = 100%

In scenario 2, Twilio generated $12,000 from the same customers at the end of the period, equaling a DBNR of 120%. (DBNR equals $12,000 ÷ $10,000 = 120%)

The above example helps us see how effectively Twilio might sell additional services to its customers.

The Importance of a Dollar-Based Net Retention Rate

For SaaS-based technology enterprises, DBNR is especially helpful. They can increase sales to current clients or bring in new ones to increase revenue. Many SaaS businesses strive to “land and grow” or acquire new clients while increasing their services.

SaaS organizations must grow sales to their current client base because it is typically more cost-effective to retain existing customers than to acquire new ones. If they can, customers are satisfied with the service and use the company’s products more frequently.

DBNR is a helpful indicator for determining how much existing consumers improve their use of a company’s goods and services over a specific time frame. A corporation’s dollar-based net expansion rate is not the same as the dollar-based net retention rate (DBNRR).

While DBNRR studies the entire customer cohort over time, DBNR looks at a specific subset of consumers. Both offer valuable information on the health of a subscription business and the degree of client engagement, but there are important distinctions. The difference between DBNRR and DBNR is how successfully a corporation “expands” the clients that it “lands.” DBNRR measures the proportion of revenue maintained over a while.

To compare like with like when using these metrics, it is crucial to comprehend how each company determines them. Some organizations use the DBNRR and DBNR interchangeably; therefore, it is important to carefully read any disclosures in corporate filings to ensure you know exactly what they monitor.

The lifetime value of each customer rises when they use a company’s goods and services more frequently. Due to the subscription-based business model used by SaaS enterprises, a high DBNR should increase recurring revenue.

The portion of a company’s revenue that it anticipates will continue in the future is recurring revenue. Businesses generate recurring income by granting continued access to their goods or services in exchange for recurring payments. One-time sales are less predictable and more unstable than recurring revenues. Recurring revenues are ones businesses can count on regularly with a high degree of certainty.

SaaS businesses aim to maximize their recurring income by increasing the quality of goods or services they offer to clients. Many SaaS companies have high valuations because of recurring revenue and rapid growth rates.

Recurring revenue multiples remain widely used to determine the worth of SaaS companies. These types of valuation remain different from techniques used to assess conventional businesses, such as analyzing previous sales of similar businesses or arriving at a present value using the discounted cash flow (DCF) method.

Customers of SaaS companies pay recurring or subscription fees, which makes their revenue more stable. They can potentially produce large revenues if they retain consumers over an extended period. In addition, many SaaS businesses are experiencing rapid growth as the SaaS model gains more acceptance.

SaaS providers do not levy the large upfront costs associated with conventional software sales strategies. However, if a business can raise the bar of goods or services it offers to its clients, the lifetime value of SaaS customers is frequently higher and can rise.

Long-term agreements with contented clients lower the volatility of earnings, increasing valuations. SaaS businesses profit from scalability as well. These businesses can draw a larger share of an expanding market as the use of cloud-based apps rises. SaaS businesses also frequently provide exclusive technology and have exclusive intellectual property, which raises their valuations.

The dollar-based net expansion rate can give important information about how successfully a business can expand the range of goods and services it provides to its current clients.

The remaining customers grow their spending if the DBNR exceeds 100% during the monitored period. The higher spending is a good sign, but it’s not the only factor to consider when determining if a business is worthy of buying.

However, when combined with other data, the dollar-based net expansion rate can offer important insights into a company’s performance.

Top Retention Rates for SaaS Companies

Some top SaaS companies have high DBNR rates while offering lower churn numbers. The average monthly churn in the SaaS world hovers between 3-8%.

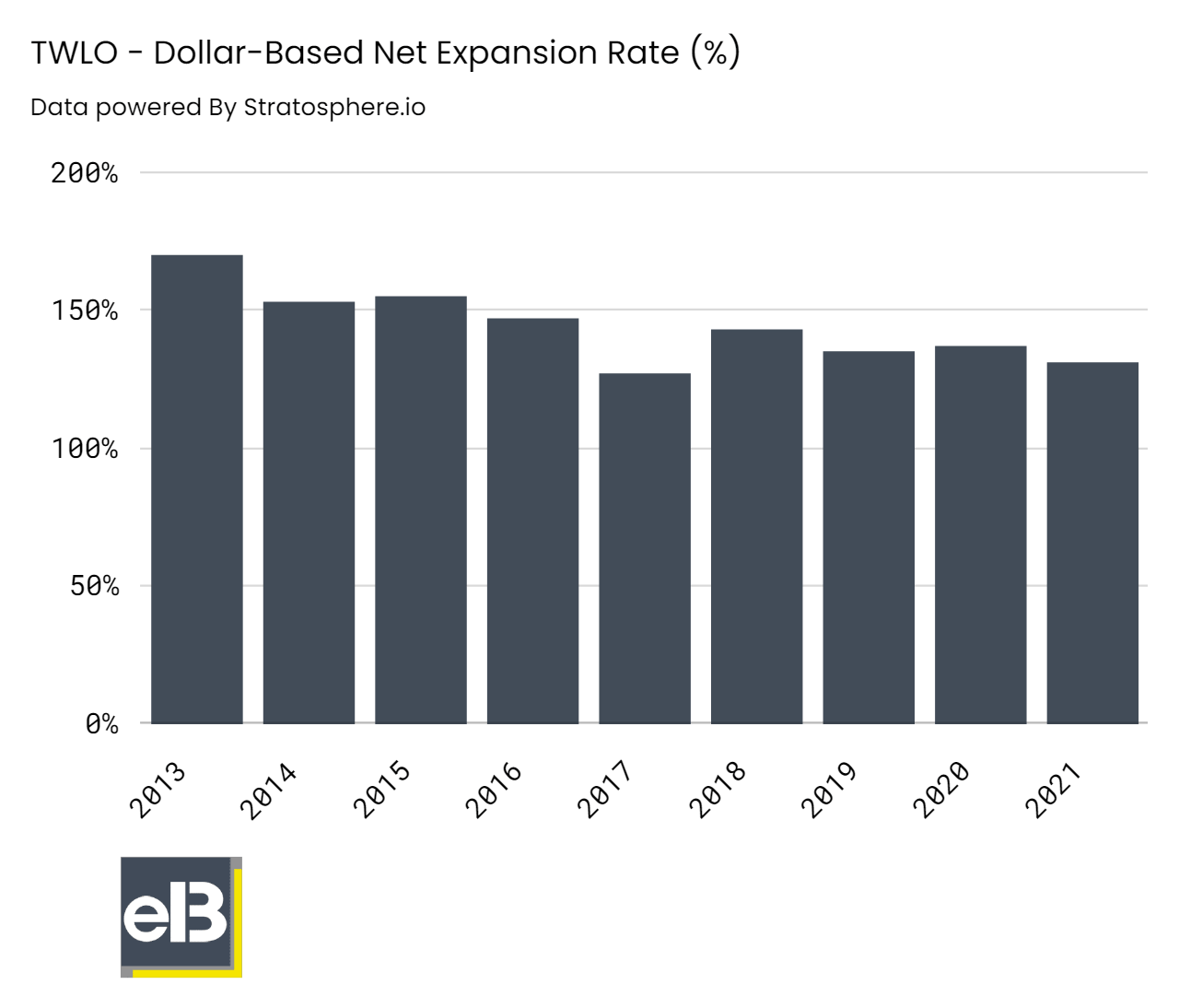

Chart courtesy of stratosphere.io

What is a good dollar-based net retention ratio?

Good question, and by and large, anything above 100% remains the standard. Consider that growing your DBNR by 5% increases your profit margin by 95%.

Here is a chart showing some of the top DNBR rates for some of the best names in SaaS

| Squarespace – 85% | Snowflake – 169% |

| Hubspot – 100% | Twilio – 155% |

| Surveymonkey – 100% | Datadog – 146% |

| Shopify – 110% | Slack – 143% |

| Okta – 123% | Zendesk – 112% |

| Qualtrics – 122% | Asana – 120% |

| Pagerduty – 122% | Fastly – 130% |

Consider that Snowflake grows its revenues by around 100% annually, with a DBNR of 169%. The company currently spends more on operating expenses than they generate in revenue, but those kinds of revenue growth, along with retention ratios this good, won’t continue for long.

Companies like Crowdstrike and Cloudflare continue to grow revenues at an impressive clip, 35-50%, while also sporting great DBNR rates of 123.9% and 124%, respectively.

One of the darlings of the pandemic, Twilio, grew revenues to $2.8 billion with a DBNR rate of 131%. But the company can’t control its expenses which contributes to increasing losses, which the markets haven’t liked.

Investor Takeaway

We shouldn’t consider any metric in isolation. DBNR works best when paired with statistics on revenue growth and customer-level turnover.

The latter, though, is frequently omitted by businesses. As a general rule, we anticipate best-in-class enterprise software companies to have dollar-based net retention rates of at least 110%. Larger land developers typically have lower DBNR numbers by definition. The ideal scenario would involve a strong DBNR, rapid revenue growth, and low customer turnover rates.

Investing in the SaaS industry comes with a new language, and understanding metrics can help us become better investors.

Top-performing SaaS companies generate DBNR ratios of 120%+, and the median remains 106%, so anything greater than 100% means your company operates on track. The higher the DBNR, the stickier the company’s platform, which is what we want to find.

And with that, we will wrap up our discussion regarding a dollar-based net retention ratio.

Thank you for reading today’s post; I hope you find something of value. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Saas Companies: Simple and Powerful Business Updated 11/9/2023 In 2021, analysts estimated the subscription as a service (SaaS) market size to be around $145.5 billion in the U.S. alone, with expectations...

- Business Breakdown: An In-Depth Netflix Stock Valuation The Netflix product is easy to understand for most investors. Doing an in-depth stock valuation can be much harder. In this post, I will show...

- What is Banking As A Service (BaaS)? Finally the Future of Banking? Updated 4/4/2024 One of the hottest scenes in the market today is fintech, with $266 billion in new investments in the first half of 2021...

- Core Bank Processing: A Breakdown of the Sector Updated 10/12/2023 The history of banking and how we handle our money is a fascinating subject, and the evolution of how we bank has been...