If you have learned basic stock analysis, odds are you have learned the price-to-earnings ratio (P/E). A simple equation you can build for any company, the P/E tells you what multiple a stock is trading at compared to its current earnings power. It gives you a quick snapshot of how investors are valuing a business.

But that’s all it is: a snapshot. The P/E is just one of many financial metrics. Sometimes, using it in isolation can lead investors astray. Many investors – myself included – will argue that the P/E ratio is actually overrated. Why? Well, we’re going to find out today.

If you want to take your investing game to the next level, it’s time to move beyond valuing stocks solely on the P/E ratio and start valuing them on cash flow projections. In this post, we are going to learn:

- How to Calculate a P/E ratio

- The Limitations of the P/E ratio

- Why Comparing P/E Ratios is Futile

- A Better Way to Value Stocks

How to Calculate a P/E Ratio

Feel free to skip this section if you already know what a P/E ratio is.

A price-to-earnings (P/E) ratio tells you where a stock trades compared to its trailing earnings. There are two common ways to calculate a P/E ratio. Both will get you the same answer.

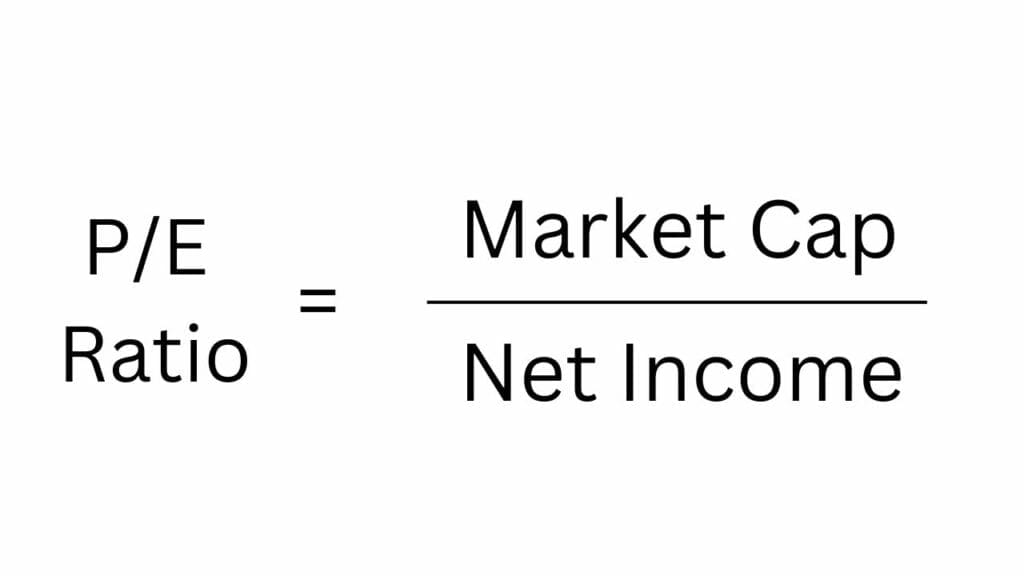

The first method is to take a company’s market cap and divide it by its trailing twelve-month net income:

The second method is to take a stock’s price and divide it by its earnings per share (EPS). These equations will produce the same answer no matter what stock you are looking at. Why? Because they are the same equation hiding in plain sight.

If you take the first equation and divide the numerator and denominator by a stock’s total shares outstanding, you get a numerator that is a stock price and an EPS denominator. Hence, why the two different-looking equations produce the same result – the P/E – for every stock in the world.

If that feels like too much of a math lesson, all you need to understand is that the P/E ratio tells an investor the multiple a stock is trading at vs. its trailing earnings power. This is why investors will use it as a shortcut for stock valuation.

A stock trading at a P/E of 10 will take 10 years at its current earnings power to generate its entire market cap in net income. At a P/E of 20, it will take 20 years. All else equal, investors want to buy the same company at a cheaper P/E, as it will take fewer years (theoretically) to recoup your investment in cash earnings.

In practice, valuing stocks comes with a lot more nuance.

The Limitations of the P/E ratio

As I mentioned in the opening section, a P/E ratio is a snapshot of a company’s earnings over the last twelve months. But companies are dynamic entities, not static. This presents an issue for investors: what a company earned last year may not be close to what it will earn next year or five years from now.

A company may have underearned last year vs. its long-run average. It may be investing heavily in marketing and research to grow revenue. It may be about to merge with a competitor, which will completely change its future earnings power. There are a lot of variables – both small and large – that can affect a company’s future profitability. The point is that one year’s earnings may not tell the whole story.

Let’s use an example to illustrate why you can’t use a P/E ratio in isolation. Technology giant Amazon has consistently traded at a P/E ratio well above the market average. Returning to the mid-2000s, it traded at a P/E of 50 – 100 every year, sometimes higher. Even today, it has a trailing P/E ratio of 80 (as of this writing).

All along the way, investors have argued that Amazon stock is overvalued. And yet, shares are up 20,000% since 2001, well outpacing the 474% return for the S&P 500.

If you just looked at the P/E ratio in isolation, you would have thought Amazon stock was overvalued. But if you understood how much it was reinvesting into its two business pillars – e-commerce and cloud computing – and how much of a runway it had left to grow, you would understand it was smart for Amazon to keep its foot pressed so hard on the gas pedal. Having this conviction made a lot of money for long-term shareholders.

Conversely, a low P/E ratio does not mean a stock is cheap. For example, many coal mining stocks have P/E ratios below 10. But that does not mean they are a good buy. Coal mining is a tough industry in terminal decline with regular threats of federal bans, at least in the United States.

There is a reason investors value coal stocks at low P/E ratios: there is a risk coal companies will have significantly lower earnings in a few years or perhaps no earnings at all. On the other hand, Amazon consistently grows its revenue, showing it deserves a high multiple of its trailing earnings. Even though Amazon stock had an optically high P/E ratio in the mid-2000s, it was undervalued, evidenced by its phenomenal stock price gains and current earnings power.

Why Comparing P/E Ratios is Futile

You’ll see a lot of novice investors compare P/E ratios between two companies. They’ll look at two stocks – perhaps in a similar sector – and say the one with the cheaper P/E ratio is a buy while the other is a sell.

This is misguided for many reasons. Let’s use an extreme example to hammer home the point. Hermès International is one of the world’s premier handbag and leather goods luxury companies. With centuries of brand building and a loyal following, it trades at a P/E ratio of 53.

Crocs Inc. is a footwear brand with unique (can we say ugly?) plastic shoes with holes. It has a history of going through consumer demand boom and bust cycles, making its future earnings power highly unpredictable. It currently trades at a P/E of 9.3.

If you only cared about the P/E ratios and nothing else, you might say Crocs is a buy, and Hermès is a sell. One trades well below the market average, while the other trades at close to double the P/E of the S&P 500 (the S&P 500 trades at a P/E of close to 27 at the moment). But Hermès is the better business with a more predictable earnings stream, which should matter to investors.

That doesn’t mean Crocs stock will do badly. It could be a good investment in the future. But it does mean that the stock isn’t a buy simply because the P/E is below 10. If it were that easy, everyone would get rich investing in stocks.

At the end of the day, investors need to remember that every company is unique. Even ones in the same industry with similar business models. One stock might have a high P/E but an incredible competitive advantage and a huge runway for expansion. Another might have a low P/E but a management team with a bad track record operating in an industry in secular decline.

Saying the second example is a cheap stock because it has a low P/E is lazy thinking and not looking at the whole story. What matters is future cash flow generation, not what the company earned over the previous 12 months.

Speaking of which…

A Better Way to Value Stocks

There is a dirty little secret in investing: the historical numbers do not matter. All the value you accrue as a shareholder will be due to the company’s future profits. It has nothing to do with the past.

Let’s hammer home this point. As a stock investor, you generate returns in two ways:

- Selling at a higher price than you bought the stock for

- Getting cash paid out to you in dividends

That’s it. Either you find someone willing to buy your shares at a higher price, or the company pays out its profits directly back to you. The trailing P/E has nothing to do with this and is overemphasized by many novice investors. It is all about what a stock will be valued at 3, 5, 7, or 10 years from now and how much cash management will return to you over these time horizons (or even longer periods in some cases).

For example, many people focus on Amazon’s trailing net income of $20 billion compared to its current market cap of $1.6 trillion. This gives the company a trailing P/E of 80. Those same folks will argue this means Amazon stock is overvalued. But remember, the trailing P/E has no bearing on how much a company will earn.

Anyone who purchased Amazon stock at the end of 2023 won’t profit from the company’s earnings. But they will make money based on the company’s earnings from 2024 – 2030 (and eventually beyond). With the company rapidly expanding its profit margins while still growing revenue at a double-digit rate, it looks like Amazon will earn many profits in the coming years.

Don’t believe me? Listen to legendary investor and billionaire Stan Druckenmiller, who crushed the market for decades. He put up 30% annual returns for 30 straight years in his hedge fund and never had a down year. That is unheard of in professional money management.

Here is what he has to say about stock valuation:

“You have to visualize the situation 18 months from now, and whatever that is, that’s where the price will be, not where it is today.”

“Never, ever invest in the present. It doesn’t matter what a company is earning, or what they have earned.”

Shifting your attention from trailing metrics to estimating future earnings power will help you improve as an investor. Better yet, you should focus on generating free cash flow, not net income.

Free cash flow measures the actual dollar value accruing on a company’s balance sheet over a certain period – cash flow that can eventually be paid out as dividends to you. Net income is not equivalent to cash flow, as it generally has non-cash expenses such as depreciation.

Connecting all the dots, a smart investor will analyze a company’s prospects, predict its future cash flow generation, and then discount it to today. This is known as a discounted cash flow model, a tool professional investors use to value stocks.

There are many ways to skin the discounted cash flow cat. Some investors will use dozens of variables and get precise outputs in their models. Others – such as Warren Buffett – like to keep things simple. We are all different, so find whatever method works best for you. As for the exact specifics, that is a lesson for another day.

Forget the trailing P/E ratio. Spend your time estimating future cash flow instead.

Brett Schafer

Brett Schafer is an investor, host of the Chit Chat Stocks Podcast, and writer at the Motley Fool.

Related posts:

- Your Essential Beginner’s Guide to the Forward Price to Earnings (P/E) Ratio Forward Price to Earnings, or Forward P/E, is an easy ratio for estimating how expensive a stock is compared to its projected (“forward”) earnings. Similar...

- Why Liquidity Ratios Are Important, With Examples Using Real Companies In times of financial uncertainty, finding companies with a good amount of liquidity provides a margin of safety. Companies in good shape regarding liquidity can...

- Beginner’s Guide to the Price to Book Ratio “Price is what you pay. Value is what you get.” –Warren Buffett The price-to-book ratio remains a top valuation metric for certain companies like banks,...

- The Price to Sales (P/S) Ratio Formula Explained Price to Sales (“P/S”) is one of the more common and simple relative valuation ratios used to generally compare how expensive or cheap a stock...