Price to Sales (“P/S”) is one of the more common and simple relative valuation ratios used to generally compare how expensive or cheap a stock is compared to its peers.

The price to sales ratio formula itself is simple, it is Price (Market Cap) divided by Sales (Revenue). The reason we use Market Capitalization for Price is that Sales is a company-wide metric, and not a per-share metric (like Share Price, or Earnings Per Share).

Price to Sales formula

= Price / Sales

= Market Capitalization / Revenue

Or,

= Price / Sales

= Share price / Revenue per share

The Price to Sales formula is a great tool for investors to quickly measure how expensive a stock is trading in the market; generally the higher the P/S, the more expensive the stock, but this also greatly depends on a company’s expected growth and profit margins.

In this guide to everything you need to know about P/S, we will discuss:

- Why does Price to Sales matter?

- What is the Price to Sales ratio good for?

- Calculating the Price to Sales Formula with an Easy Example

- How to use the Price to Sales ratio properly

- What is the Price to Sales ratio NOT good for?

- What is a good Price to Sales ratio?

- What is a good Price to Sales ratio for a growth company?

First, let’s review why investors will sometimes prefer P/S to other metrics like P/E or P/B (Price to Book).

Why does Price to Sales matter?

Sales is the first building block for a business. Without sales, or revenues, a company cannot make a profit. Period.

There needs to be a stream of revenues before a stream of profits and cash flows can ever be created, and so investors should not forget to look at this part of a company’s financials [also called the “top line”, since it is the first line on the top of an income statement (or “P&L”)].

Sales are also important because you need sales growth to make sustainable growth.

Without sales growth, a company’s growth potential is capped. As a business, you can’t cut costs forever. At a certain point, cutting costs has a diminishing effect on profit growth (cutting all costs from 2% of sales to 1% of sales only adds 1% profit growth).

One of the most significant drivers of long term growth for companies in the stock market historically has been revenue growth, so it pays to pay attention to sales.

What is the Price to Sales ratio good for?

By comparing one company’s P/S to another’s, you can see how optimistic investors are about a company regardless of size.

Like other relative valuation metrics (P/E, P/B, etc), the Price to Sales formula gives you an apples-to-apples measuring stick on a company’s price and size.

Whether a company has $1 million in sales or $10 billion, I can use the P/S to compare how expensive that stock is compared to those sales. For example, the company with a $10 million market cap and a P/S of 10 may actually be more expensive than the $20 billion market cap company with a P/S of only 2.

Price to Sales helps investors see that quickly.

Investors can use the Price to Sales ratio to compare fast growing companies to each other since many of these won’t have earnings (and so you can’t use the Price to Earnings ratio on them).

Price to sales can also be great for evaluating companies with wildly fluctuating profit margins, such as super cyclicals.

Since revenues are generally more stable than earnings, using the Price to Sales Ratio formula to examine a company’s revenues can generally be more reliable than solely using an earnings based (P/E) ratio.

However, some of the most cyclical companies can see both revenues and profits fluctuate wildly depending on where in the cycle a company is in (think commodity companies), and so you can’t just blindly use Price to Sales on any type of company and expect it to be more reliable.

Calculating the Price to Sales Formula with an Easy Example

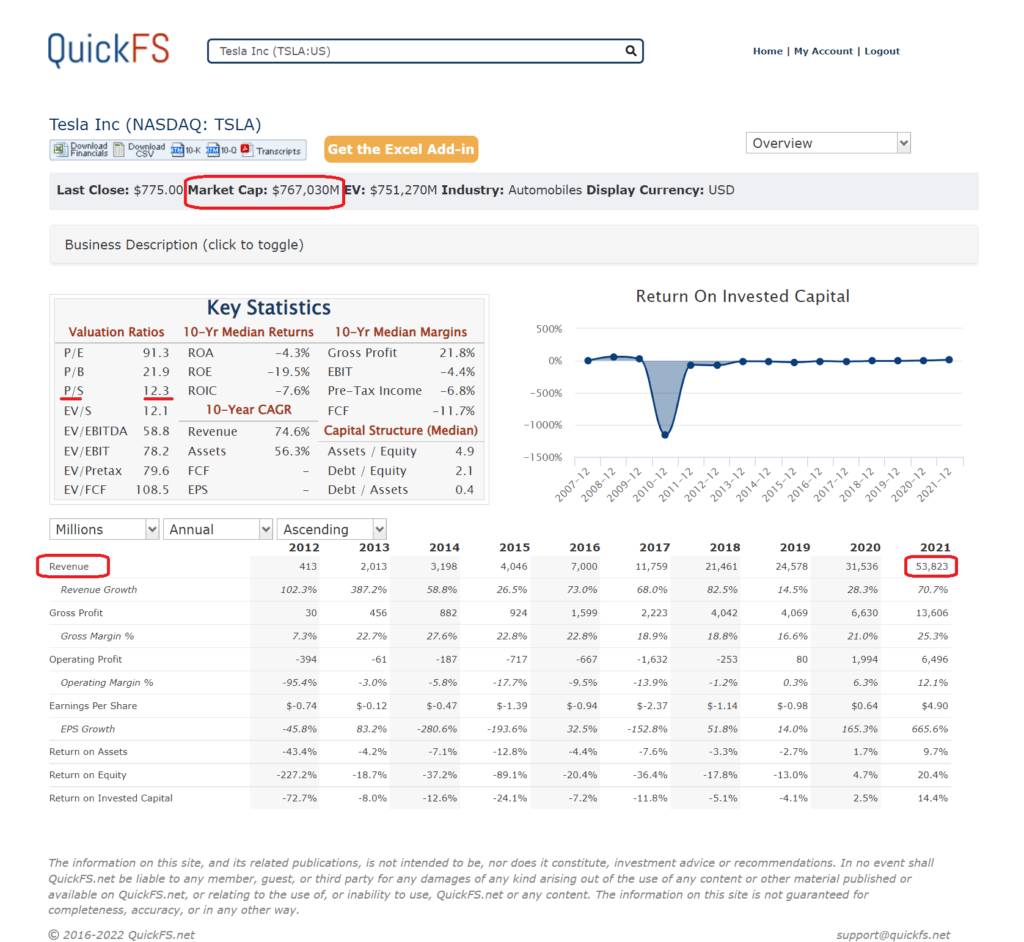

Let’s take a popular stock in the market today, Tesla (ticker: TSLA), to show how quickly and easily we can calculate P/S for ourselves.

Using a free website for investors called quickFS, type TSLA into the search bar to get this screen:

Here we can see the key financial information we need to calculate Price to Sales.

Taking the market capitalization displayed in the top row, and the latest Revenue for 2021, we can calculate the following Price to Sales ratio for Tesla:

TSLA P/S (2021)

= Market capitalization / Revenue

= $767,030 / $53,823

= 14.3

We can also calculate the company’s TTM (Trailing Twelve Months) P/S ratio by taking their TTM revenues:

TSLA P/S (TTM)

= Market capitalization / Revenue

= $767,030 / $62,190

= 12.3

How to use the Price to Sales ratio properly

Investors should know that a stock’s P/S will vary greatly across industries and expected growth prospects.

- It is better to compare a stock’s P/S with other stocks in its industry than with the market.

- It is better to compare a stock’s P/S with other stocks with similar profitability (profit margins).

- It is better to compare a stock’s P/S with other stocks with the same expected future growth rate.

As I will state again later, stock market valuations tend to follow earnings growth (EPS) over the long term, not sales growth.

So anything that affects earnings growth outside of sales growth will impact a stock’s valuation regardless of its Price to Sales.

Take these rules of thumb to heart:

- Technology stocks tend to have higher P/S ratios

- Financial services stocks tend to have lower P/S ratios

- Capital-light companies tend to have higher P/S ratios

- Capital intensive companies tend to have lower P/S ratios

- Fast growing companies tend to have higher P/S ratios

- Lower growth companies tend to have lower P/S ratios

- High margins companies tend to have higher P/S ratios

- Lower margins companies tend to have lower P/S ratios

What is the Price to Sales ratio NOT good for?

Though P/S is good for making those shortcut judgments on a stock’s price, it actually should not be used on an island like that.

In other words, without context the P/S is not very useful.

Companies with widely different profit margins are perfect examples of this. Take the example of a company like Apple (with a Net Profit Margin of 25.9% in 2021) and Amazon (with a Net Profit Margin of 7% in 2021).

Amazon trades at a P/S of 2.6 (as of the time I’m writing this), while Apple’s P/S is 6.2.

It may sound like Apple is way more expensive than Amazon, with a P/S that is more than double. But, if you look at Price to Earnings ratios (P/E), the picture is much different:

- Apple P/E = 27.0

- Amazon P/E = 38.73

You can see that from a P/E perspective, now Amazon looks way more expensive than Apple.

What’s going on here?

Well because of the way that profit margins and sales are inevitably linked, companies with higher profit margins will naturally have higher P/S ratios.

Using a P/S to compare one company to another does not work well if the companies’ margins are wildly different, simply because of the math that’s tied to sales, profits, margins, and P/E and P/S.

Take this example I’ve used on the blog before:

Say you have two companies in the same industry, we’ll call them:

- Efficient Eagle Corp

- Earnings = $100

- Net margin = 20%, Net Sales = $500

- To verify: ($500 * 0.2) = $100

- Spendy Sales Inc

- Earnings = $100

- Net margin = 10%, Net Sales = $1,000

- To verify: ($1,000 * 0.1) = $100

Since these businesses are in the same industry, we can reasonably assume that their P/E ratios would be pretty close (if they’re growing earnings at roughly the same rate). We’ll assume that both have the same P/E ratio—at 15 P/E.

So, both companies would have a market cap of $1,500 ($100 * 15).

What’s the Price to Sales ratio for each company?

- Efficient Eagle Corp

- Market cap = $1,500

- Net Sales = $500

- P/S ratio = 3

- Spendy Sales Inc

- Market cap = $1,500

- Net Sales = $1,000

- P/S ratio = 1.5

You can see that we have two different businesses with wildly different operating strategies—EE Corp is great at keeping costs down and so it needs less sales to make the same earnings as Spendy Sales Inc.

But based on a Price to Sales ratio, Spendy Sales seems like the better value (1.5 vs 3), and it’s a direct result of the fact that the company doesn’t manage its costs well, resulting in a lower net margin.

Looping this back to Amazon and Apple, Apple naturally has a higher P/S than Amazon directly because it is more profitable (has higher margins).

Since over the long term, stocks are priced based on the long-term growth of their earnings (EPS), the long term valuations will tend to revolve around this growth. As this valuation revolves, and it more closely follows EPS, then increases in valuation will follow increases in EPS.

And if the EPS growth is due to margins expansion rather than sales growth, the P/S for a stock will naturally go higher (like in Apple’s case) as the valuation follows earnings, not sales.

You can’t have it both ways.

You can’t have high margins and a low P/S and a low P/E. One of those has to give simply because of the math.

That’s where Price to Sales isn’t very helpful and should be used with a grain of salt.

What is a good Price to Sales ratio?

Going back to good rules of thumb for Price to Sales, a good Price to Sales ratio is only as good as the context you are using it in.

Amazon’s Price to Sales of 2.6 looks cheap even compared to the market until you compare them to other retailers such as Target (P/S of 0.7) or Walmart (P/S of 0.6). And though Walmart’s P/S of 0.6 looks the cheapest compared to this peer group of 3, the stock may still be more expensive if its earnings don’t grow as much as Amazon’s or Target’s.

It’s all relative, which makes understanding if a company is truly “cheap” or “expensive” difficult.

To do that, you need an absolute valuation metric, such as the DCF (Discounted Cash Flow) model. A good DCF will take growth, opportunity cost, risk, and profitability all into account, which takes away much of the inherent weakness of relative valuation ratios.

According to multpl, the current S&P 500 Price to Sales is 2.6, with a long term mean (average) of 1.6 and median of 1.5.

But remember that even history is relative; companies are more profitable today than they were throughout history, interest rates are (still) lower today than historical averages, and companies buy back way more stock today than historically (which boosts EPS growth).

What is a good Price to Sales ratio for a growth company?

It really depends.

A Price to Sales of 10 might not be that expensive if a company can grow its Operating Margins from 2% to 20%, while a Price to Sales of 4 might actually be expensive if a company’s growth and margins will pretty much mature from here out.

That’s what makes evaluating a growth company so hard—you have to be correct about a company’s future revenue growth and profit margins, and whether they have the competitive advantage to ward future competitors in a (usually) unstable industry, and still pay a valuation that creates attractive returns if those assumptions do play out.

Playing the greater fool game, that someone will pay a higher price than you in the future, is a game that ends eventually, usually at the end of a bull market.

Over the long term, stocks are priced based on fundamentals, which means that long term growth in EPS.

Even the best performing companies with expanding margins and high revenue growth can be purchased at too high a price (and thus P/S).

I’d recommend reading Dave’s post about how to value a young company for a better idea on a good valuation estimate on a growth company, rather than giving you a blanket statement on what’s a “good” Price to Sales.

Related posts:

- The Basics Behind Using the Price to Earnings Valuation Method on a Stock The price to earnings valuation method is a simple and quick way to get an idea about how cheap or expensive a stock generally is....

- What’s the PEG Ratio in Finance – Does it Work on Large Companies? Price-to-earnings, or P/E ratio as it is also known, is probably the most recognizable metric used to value stocks. Are they the most useful? Well,...

- What is a Good PEG Ratio? Updated: 4/6/2023 The PEG ratio was one popularized by the famed fund manager Peter Lynch, who went on to post one of the best mutual...

- Your Essential Beginner’s Guide to the Forward Price to Earnings (P/E) Ratio Forward Price to Earnings, or Forward P/E, is an easy ratio for estimating how expensive a stock is compared to its projected (“forward”) earnings. Similar...