One of the most important metrics for a Software as a Service (SaaS) company is their lifetime value (LTV). This is such an important metric because the concept of Software as a Service is great in theory, but you’re banking on those customers to continually come back and keep renewing their service. So, how do we calculate LTV for SaaS companies? Let me show you!

First, I want to talk a little more about LTV and SaaS. As I mentioned, LTV is the lifetime value of a customer over the entire time that they’re purchasing from a company.

I frequently will hear this concept discussed on Shark Tank when you hear questions asking the reorder rate is or how many months a customer might be subscribed to a certain service.

The Sharks are trying to find out how much revenue will be generated from that single user over the course of their relationship with that specific company or product, or, the lifetime value of that customer.

LTV for SaaS Companies

As I mentioned, SaaS stands for “Software as a Service”, meaning that it’s basically an on-demand type of service where you will pay on a subscription model.

Instead of people downloading a program to their computer, they will access the application via a web browser which can save a lot of time and headaches for them with maintenance costs. Additionally, the upfront costs that a customer of a SaaS application are likely much lower.

You typically will see cloud companies be those that utilize a SaaS methodology to sell to their customers.

The reason that LTV is so important for companies that are offering SaaS, or really any subscription model, is because customers will frequently download or use a program for a free trial period and then cancel.

Personally, I do that all the time. In fact, I know someone from college that used to use their email for Netflix and then just change the location of the period in their email. That would register a new email to Netflix so they could get a new, free trial period, and Gmail could still send any pertinent info to the correct email (not sure how, I’m not a tech guy lol).

So, they’d go from [email protected] to [email protected] just to save a few bucks each month.

ARPU for SaaS Companies

If Netflix counted each of these users as a “new customer” then it would be a very misleading metric, so, these subscription models use a metric called ARPU, or Average Revenue Per User.

ARPU is exactly what it sounds like – you’re trying to find out how much revenue is generated by a single user. In this case, all of these fake emails that are being generated by Mike Smith would be $0. Now, if Mike was going to decide to sign up for 3 months at $15/month, then the ARPU for Mike would be $45.

Pretty simple formula, right? It is, and it’s one that’s extremely to understand if you’re wanting to invest in any of these subscription type models, which truthfully seem to be taking over the world…

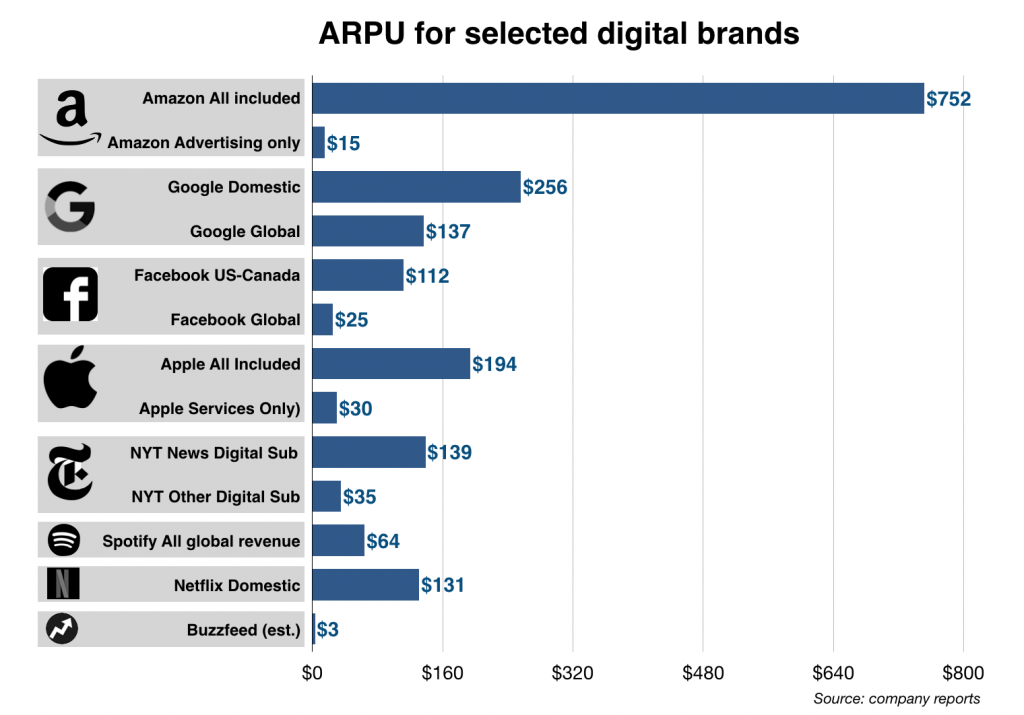

But ARPU also applies to many other major brands – take a look below at the ARPU of some of the major brands, compliments of Monday Note:

The one that surprised me was Apple and that it wasn’t higher, truthfully. Nonetheless, very interesting stuff!

So, ARPU, that’s the first half of the equation – the next part is finding out what the average number of transactions are and then multiplying the entire thing by the time that the customer typically stays just that – a customer!

CLV Formula

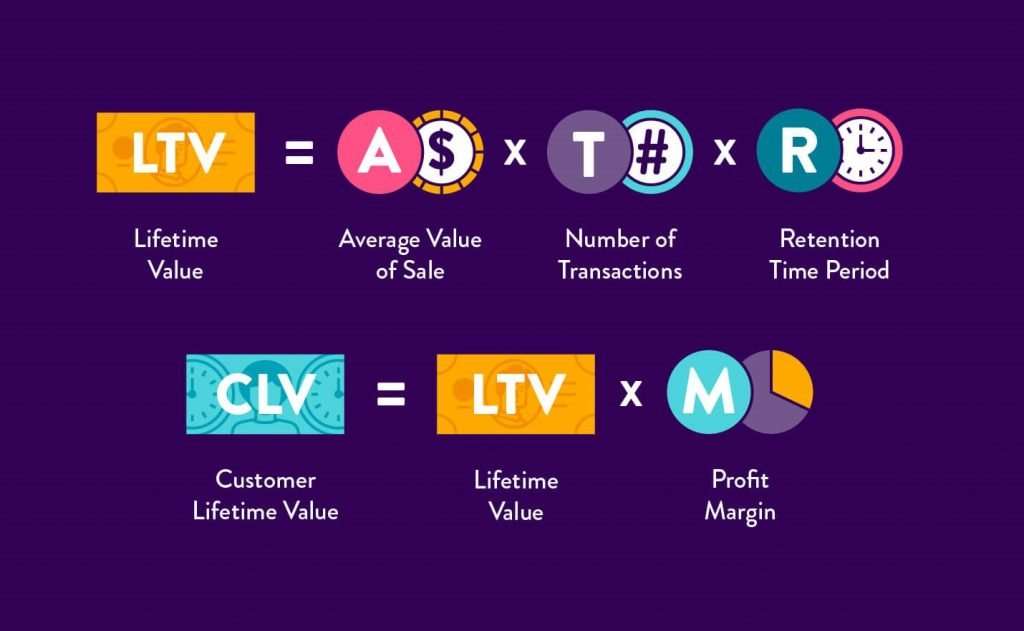

So, your final formula is going to look like this, per Clever Tap:

I really like this infographic because it shows the difference of LTV and CLV (Customer Lifetime Value), which is really just differentiating the ARPU and then the AMPU (Average Margin Per User).

Now, finally, to even take this another step is to compare the LTV/CAC ratio, or, the Lifetime Value/Customer Acquisition Cost.

It might seem like I am getting so far in the weeds, so let’s just take a step back and talk about what I am really trying to accomplish before we go too much farther.

- The reason that I want to know the LTV of a company is because it tells me how much revenue is coming in for the average user

- The Customer Lifetime Value will then apply that to a specific margin, meaning that if I make $100 in ARPU, I might only have $25 in AMPU. That’s great, right? Well, it depends!

- The reason that we now have to compare this to the Customer Acquisition Cost is because I am trying to compare the ratio between how much revenue a user brings in and then the cost to acquire that customer. If my CAC is $75 and the ARPU is $100, that’s only $25 in profit BEFORE any sort of other expenses that you might incur.

Since I started out this post talking about LTV and how it applies to SaaS companies, let’s really get into the weeds with a real example – Netflix!

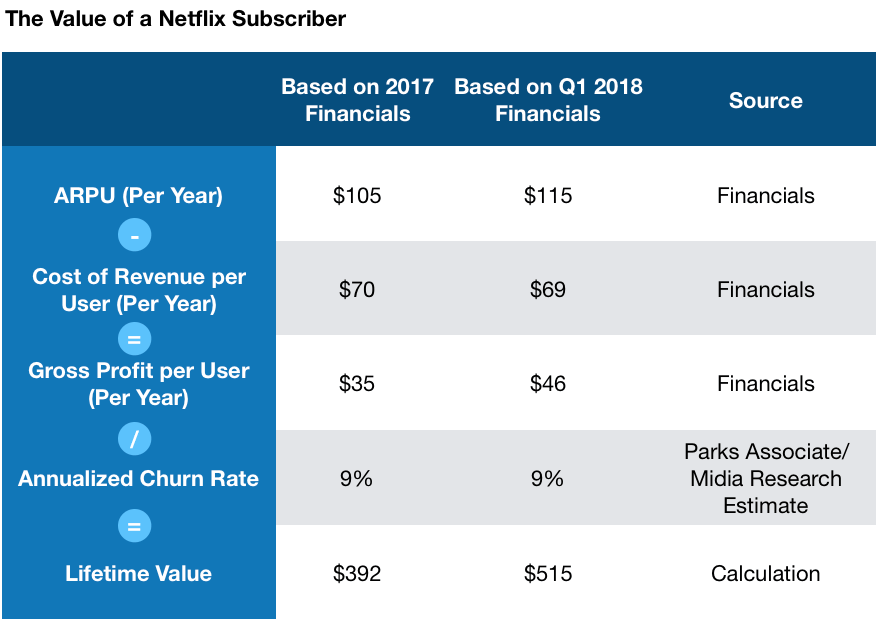

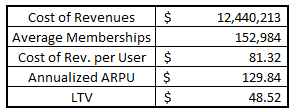

Tanay Jaipuria completed a really nice breakdown for the value of a Netflix subscriber on Medium.com as shown below:

As I mentioned above, you can see how he’s calculating the AMPU using the ARPU and the costs, then dividing that by the Churn Rate, also known as the Customer Acquisition Cost, to get the Lifetime Value of the customer.

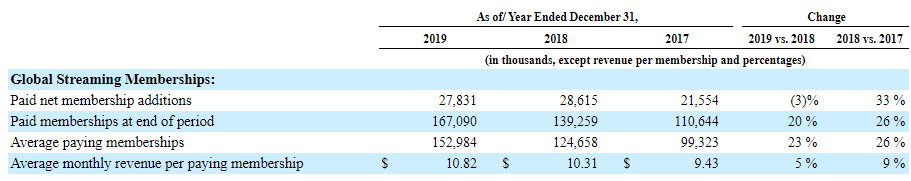

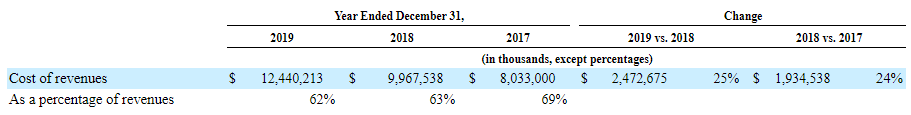

You can find the ARPU and the Cost of Revenue per User in the 10K by going to SEC.gov as I have shown below:

In this case, I would simply take the ARPU ($10.82) and multiply that by 12 to annualize it, meaning you have a total of $129.84.

Then subtract out the Average Cost of Revenue per User. Since that value isn’t shown, you take the cost of revenues ($12,440,213,000)/Average Paying Memberships (152,984,000).

When you do that, your amount is $81.32. The last step is to subtract this from your annualized ARPU – shown below:

Now, the major assumption here is that the average membership length is 1 year. While that certainly might be aggressive, I can say that I’ve had my account for like 8 years and counting now. You can say that Netflix is certainly making some money off of me…

But, can you make some money back from investing in Netflix? I’m not sure, but starting with a stock buying checklist is a great first step in analyzing a SaaS company like them!

Related posts:

- What is ARPU and How Does it Affect My Investments? ARPU is a term that a lot of companies use nowadays to try to breakdown some of their financial reporting ratios on a per user...

- “Knowing Your Numbers” Like the Sharks = Understanding Unit Economics Unit economics – what a boring topic amiright? No – I am not right. And chances are, you also agree that unit economics aren’t boring...

- How 13F Filings Can Help Investors Evaluate Insurance Stocks How do insurance companies make money? We all think the monthly premiums we pay lead to how most insurance companies make money. Insurance companies make...

- Why Do Companies Repurchase Shares? To Create Value. Some of the greatest CEOs of all-time used lots of share buybacks to create outstanding returns. In many cases, these share repurchases can be fantastic...