Saving money might seem like an impossible task, but I promise you, it’s not. Anyone can do it with a solid plan and the correct systems in place. I am here to show you the way – let’s learn how to save $5,000 in a year!

Click to skip to a section:

- What Does $5,000/year Get You?

- Step 1: Cut All “Non-Value” Expenses

- Step 2 – Squeeze Out That Extra Little Bit of Income

- Summary

What Does $5,000/year Get You?

According to PayScale, the average person works 13 years and 2 months of their life. Isn’t that nuts?? That seems like so much of your life is spent at work and guess what – it is!

But let’s do a little bit of a calculation, and please understand that I am making some pretty major assumptions here:

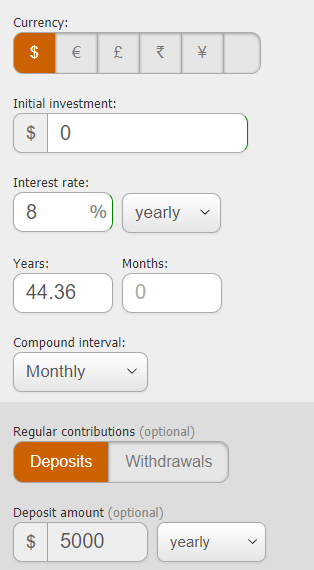

- If you work 13 years and 2 months, that means that you worked a total of 115,341 hours (13 years and 2 months = 158 months. 158 months * 30.417 days/month = 115,341).

- Chances are, most people do not actually work only 40 hours/week. I know I don’t, and I know many others don’t either. So I am going to assume the average work week is 50 hours/week. This means that you will work about 2600 hours/year.

- 115,341 total hours/2600 hours = 44.36 years that you will work at that rate of 50 hours/week.

If you save $5,000/year for 44.36 years, you will have $221,800!

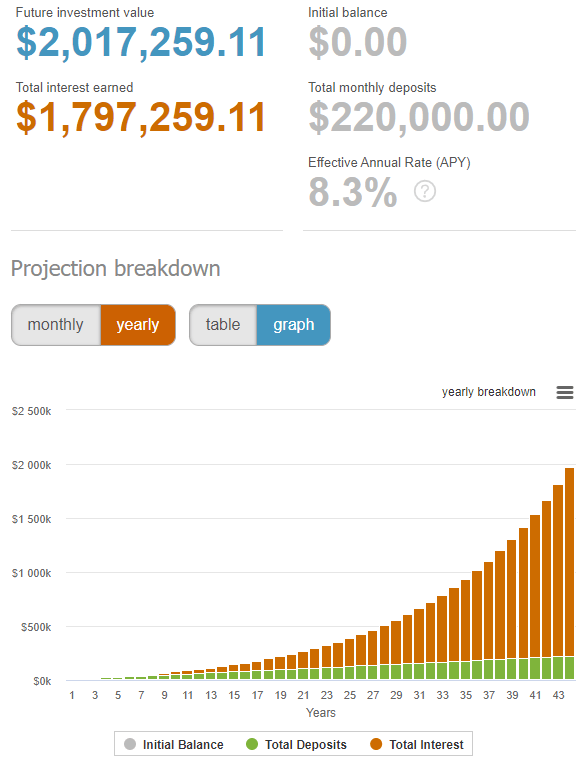

BUT! If you had invested that money instead at an average annual return of 8% (the S&P 500 is above 10%), you would have much more than that…

Like $2 million!

Let’s see how we got there:

All that I did was go to The Calculator Site and put in those same assumptions that I noted previously:

It is incredible that $5,000/year can get you those insane returns, right? I mean, for a large majority of people, that is plenty to be able to retire on. And if you have a spouse or a partner, they can certainly do this as well – nothing is holding them back, either!

But the reason that you’re all here is that you’re looking for some real help to get you to be able to save $5,000/year. So, let me get started with some tangible methods to accomplish this!

Step 1 – Cut All “Non-Value” Expenses

This is a big one for me, and it’s one that you can literally see immediate results with. It’s so simple to do, yet so many people won’t because they don’t understand the true impact of their decisions.

When I say that you should cut all “non-value” expenses, I mean to eliminate all the mindless spending you don’t care about. One of my favorite quotes is:

“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

Ramit Sethi

What that means is that if you absolutely LOVE getting your $3 Starbucks coffee every day and can afford it, why would you cut that out? But if you don’t really care that much about it, don’t spend that much money on something that doesn’t bring you joy. Those funds could be better used somewhere else.

Packing a Lunch

Or, with my personal favorite example, packing a lunch. I’ve lived in a few different cities ranging from a town with 40,000 people to downtown Chicago. If I had to put an “average” price on lunch, I would say it’s around $10. Now, that’s just a plain lunch without a drink, and not including a tip.

Honestly, if you went to a place like Panera Bread (as I did this past weekend), you’ll be spending $15 if you wanted a salad and a cup of soup.

So, let’s say that the average lunch will cost you $10, and I think that’s extremely conservative. If you go out to eat for lunch every day, you will be spending $50 just on lunch when instead, you could pack your lunch for $3 and save that extra $7.

Sure, you might miss out on the camaraderie, but why can’t you pack your lunch and still eat with people? I will frequently pack my lunch, have coworkers order a lunch to-go, and then meet somewhere outside to eat.

Win-win.

Saving that $7/day might not seem like a lot, but it adds up. If you went from eating out every day down to only once a week, you’re going to save $28/week, or $1,400/year, assuming you work 50 weeks!

Total Annual Savings: $1,400

We’re already ¼ of the way to $5,000, and all you’re doing is packing your lunch…

Going Out on Weekends

So, what else can you do when you’re cutting out your massive expenses? The next major one that I see that people do is blow their money going out on the weekends. I know that I absolutely was this person when I lived in Chicago. We would spend hundreds of dollars every weekend on random food and drinks with nothing to show for it.

Sure, it was very fun, but it was very, very expensive. I was able to combine the fun of going out with a couple of budget apps, Yelp and Seated, that would then allow me to save over $150!

Now, that was $150 among a group of 6 people, but going out to eat with 6 people is not something that is unheard of.

I went in-depth previously, but long story short you can find a really cool place to eat, find some promotions that are being offered on various apps (it doesn’t have to be Yelp and Seated), and then you literally get cash back.

Offer to pay for the group and have them all Venmo you, and then you can reap the rewards. Now, I typically would treat the group to a round of drinks or something in fairness to them. Even if that round of drinks is $25, you’re now saving $125 in total, all for 2 minutes of looking at an app!

Truthfully, we would do this every other week during football season, but I am going to assume you do this monthly, meaning a total of $1,500 in savings.

Total Annual Savings: $2,900

Have a Cheap Week

The next thing that you can do is one of my personal favorites – challenge yourself to a cheap week.

Challenges are a great way to push yourself. If you tried to be extremely cheap every single week, you would quickly burn out. But by only being extremely cheap for one week per month, you can see it as a challenge you want to overcome.

My wife and I will do this once a month typically, where we try to see how low we can get our food budget. We won’t sacrifice the quality of our food, but we will do everything we can to drop our budget as low as possible.

Shop all the specials, use all the coupon apps, and be very creative with any food that is typically cheaper. It’s a fun way for us to challenge each other, and we can usually cut our $150 budget down to $75 – $100. Assuming we save at least $50, that’s an annual savings of $600!

Total Annual Savings: $3,500

Step 2 – Squeeze Out That Extra Little Bit of Income

As I mentioned, I firmly believe that cutting costs is the best way to start your journey to financial independence because anyone can do it. However, eventually, you just can’t cut anymore. You will get down to a bare-bones budget where you only buy the necessities. Well done!

But if you’re still unable to reach your savings/investing goals, you need to find a way to make some more moolah!

Getting a raise at work is commonly recommended, but that doesn’t work for everyone.

I work in a company where we get annual raises that are typically right in line with inflation and if you were to ask for something more, you would be laughed at. I know that Ramit Sethi has ways to combat these issues, but I am just not on board with it. Instead, I think a side hustle is a great way to go!

Start a Side Hustle

I define a “side hustle” as any way you can increase your income that is not something that you would normally do.

While that includes some of the obvious side hustles like Uber, Grubhub, mowing yards, etc., there are some other off-the-wall things that you can do as well.

My favorite of which is that if you have a job where you get paid to work extra, do that. If your job has shifts, why not just try to pick up one shift/week that piggybacks on a shift you already had? If you pick up a 5-hour shift one day/week, 50 weeks out of the year, and you’re making $12/hour – that’s $3K right there!

You spent no extra time driving to work; no extra time getting ready. You just worked 5 more hours and now are 60% of your way to this $5,000 goal!

I recognize that not all of us are in this situation, so why don’t we think a little more outside the box? You can even do one-off things like having a garage sale.

My mom used to have garage sales every year, and she would bring in $700-$1,000. Now, on the flip side, that means she was buying a lot of crap, but at least she could get something back for it!

I recently wrote all about my top ways to increase income. I think that you can realistically get $15/hour driving for Uber, especially if you’re willing to time it right and drive during busy times. I don’t think that it will take you a ton of time and effort, but by simply dedicating 4 hours/week, you will be looking at $60 for that week.

After you take out your gas and taxes, you’re conservatively sitting at $30 in that week from 4 hours of driving. That means that you’re bringing home $1,560 each year by simply dedicating those four hours.

Total Annual Savings: $5,000

One time I rode with a driver who would only drive Uber when he had to go somewhere. For instance, his hour-long commute into the city of Chicago each day. He said that on rainy days he would wake up an hour early and pick up commuters that were also heading into the city.

Because of the rain, they didn’t want to use public transportation and get wet. They would choose to take an Uber, and because so many others did this same thing the rates were always high. He was already going into the city, so he didn’t lose much at all and instead was paid a pretty significant chunk of change to take 30 extra minutes.

It’s just that type of creative thinking that you can employ to really max your income!

Summary

So, did we hit our goal of saving $5,000 in a year? Let’s check:

- Packing Lunch – saved $1,400/year

- SMART Eating Out – saved $1,500/year

- Cheap Week – Saved $600/year

- Uber/Lyft – Increased Income by $1,500/year

We’re at a grand total of $5,000 on the nose! Not too shabby, right? Especially when you consider that all these things are very, very simple to do. I mean, you can literally download any of these apps and start saving right now and be driving Uber/Lyft within a couple days!

You might be the type that already does pack their lunch, doesn’t go out, drives Uber, etc. – that’s great! But there are other things that I guarantee you’re missing out on – these were just the low-hanging fruit that I feel a lot of people have opportunities to maximize.

If none of these are really hitting home to you, I recommend focusing on living a minimalistic life first and then moving to an increased income later.

Once that spending is under control, then you can move on to bigger and better things, and that’s where Doctor Budget comes in!

Related posts:

- Easy Ways to Save Money on a Tight Budget If you find yourself scrambling for money each month, try these easy ways to save money on a tight budget. You’ll learn some good habits...

- How to Use the Doctor Budget Tool to Set Your Finances Straight Recently, I was fortunate to be invited on the Investing for Beginners Podcast and talk about my personal finance experiences and introduce Doctor Budget to...

- Useful Tricks to Form Good Money Habits into Natural Decisions One thing is for certain, there are good money habits and there are bad. It seems like everyone has at least one bad habit (me...

- Hey Andy – How Much Should I Save a Month? Spend less than you earn. Simple words to live by but not really anything that’s truly that helpful, you know? Any person getting started on their...