Updated 1/5/2024

A company’s capital structure and credit health can drive the company forward regarding revenues, earnings, and cash flows. How the company funds growth goes a long way toward ultimate success.

When investors search for investment quality, starting with the story, a balance sheet tells investors about the capital structure and how the company funds its growth.

Analyzing the balance sheet and determining the credit health of a company helps define a strong investment and a company going on the right path.

In today’s post, we will learn:

- What is Capital Structure (Terminology)?

- What Are the Three Types of Capital Structure?

- What Is A Healthy Capital Structure

- What Role Does Credit Health Play in Capital Structure?

Okay, let’s dive in and learn more about credit health and capital structure.

What is Capital Structure (Terminology)?

Capital structure describes a company’s mix of debt and equity to finance operations and growth.

Debt refers to bond issues or loans, and equity describes capital raised from selling shares of common stock, preferred stock, or retained earnings.

A company’s wise use of debt and equity indicates a strong balance sheet. A healthy capital structure reflects low debt levels and high equity, which equals an excellent company.

If you are an investor who likes fundamentals, like we do, finding companies with strong balance sheets helps investors invest with a margin of safety.

Okay, let’s define some terms to better understand the capital structure and credit health.

Capital Structure

Visa’s capital structure describes its long-term debt and equity capital. Visa’s capital structure starts as permanent support funding for operations and growth.

We can express Visa’s capital structure as a formula:

Captial Structure = DO + TSE

Where:

DO = debt obligations

TSE = total shareholders’ equity

Many investors refer to the capital structure as capitalization or capitalization structure.

A great way to think about capital structure creating value with the best optimal proportion of debt and equity remains by utilizing the above formula to find the best mixture.

Equity

The company’s equity is the easiest component of the capital structure to measure. The company’s equity contains a mixture of common and preferred stock plus retained earnings.

The above mix encompasses the company’s invested capital, and the numbers appear in the shareholders’ equity section of the balance sheet.

The capital structure equals the invested capital plus any debt. For example, Visa has total debt of $20.9 billion and shareholders’ equity of $37.9 billion, giving the company a capital structure of $58.8 billion.

Debt

The dialogue surrounding debt tends towards a little less clear talk. Much of the finance literature discusses company debt as part of the company’s liabilities. We ignore the divide between operational and debt liabilities by categorizing everything as a debt. The debt liabilities form the basis of the debt component of Visa’s capital structure.

Many investors and analysts focus on the long-term debt components as the entirety of the company’s debt. But this meaning doesn’t account for short-term debt, operating leases, or other debt obligations. Focusing on the long-term debt equates to a short-term answer or a quick fix, but using the whole gamut of debt gives us a better insight.

The main component of a company’s debt refers to bonds a company uses to raise funds for various projects. Companies use their credit ratings to get favorable rates to offer investors in exchange for their investments.

The better a company’s credit rating, the lower the interest rate the company can offer, which might seem counterintuitive, but the higher credit rating also indicates financial strength and the likelihood of repayment. We will discuss this more in-depth in a moment.

Another option for companies wishing to raise funds is long-term debt via bonds from short-term commercial paper.

Short-term commercial paper represents loans companies can use for day-to-day working capital needs, for example, payroll or utility bills.

What Are the Three Types of Capital Structure?

The three main types of capital a company might use to finance projects:

- Debt Capital

- Equity Capital

- Working Capital

Okay, let’s explore these three types of capital to understand better how a company might structure its capital.

Debt Capital

Any company can acquire capital via borrowing. Companies can obtain debt capital through private or government sources.

The most common avenue for established companies comes from issuing bonds or borrowing from financial institutions. Companies also use banks for capital borrowing as well.

The most common funding sources for smaller companies or startups remain friends, family, credit cards, and online lenders.

However, companies rely on good credit scores to obtain debt capital like individuals. To obtain favorable credit means paying their bills on time, in this case, interest payments on any debt the company acquires.

The interest rates will vary depending on the company’s credit rating—the better the rating, the lower the rates.

For example, companies with a credit rating of AA (Moody’s scale) can obtain better financing at lower rates than those with a credit rating of BB, the same agency.

As individuals, we might see debt as a burden to overcome. But companies see the debt capital as an opportunity. Many companies use debt to help finance growth. For example, Roper Technologies, a serial tech acquirer, uses debt capital to help them acquire small tech companies to boost growth.

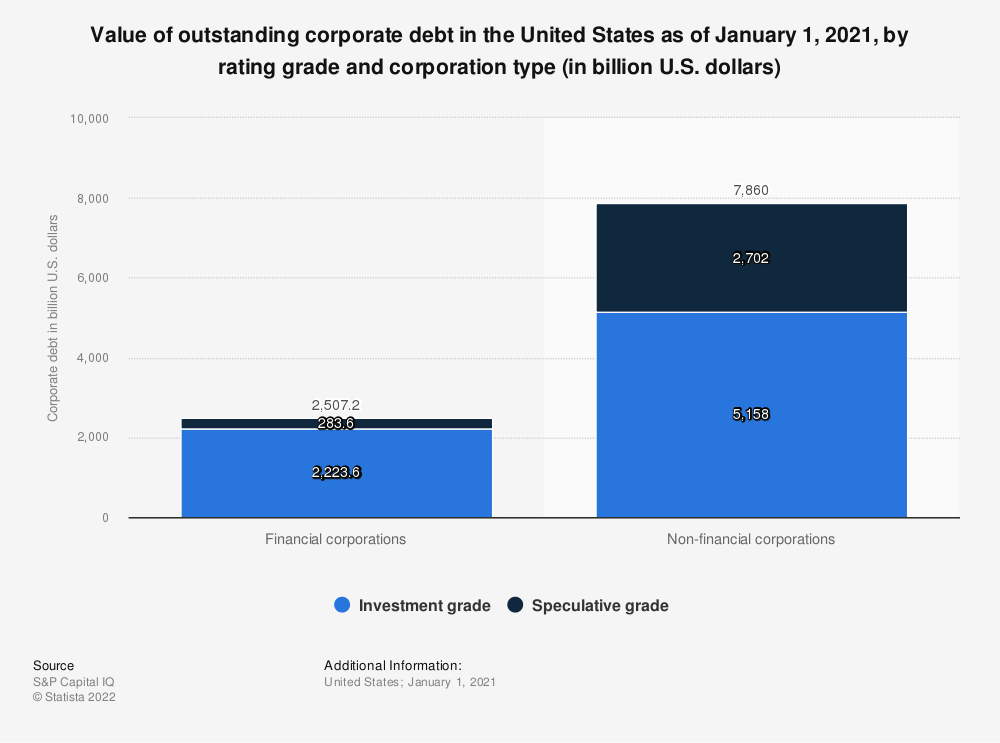

In times of low rates, between 2009 and 2022, issuing bonds was a favorite way for companies to raise debt capital.

According to Moody’s Analytics, one of the leading bond rating agencies, corporate bond offerings grew 70% in 2020 compared to 2019. As the amount of debt issued grew, the rates charged for the debt fell to a multi-year low of 2.3%.

Equity Capital

Equity capital is the easiest to define and comes in several forms—the most common forms of equity are private, public, and real estate equity.

Private and common equity comes in the form of shares of stock with the company.

The big change between the two comes from the source of equity. Public equity stems from raising funds from listing shares on a stock exchange, like the Dow Jones. Private equity raises funds from a close group of investors, offering cash in exchange for shares in the private company.

When investors buy shares of Visa, they provide Visa with equity capital in the form of their cash investment.

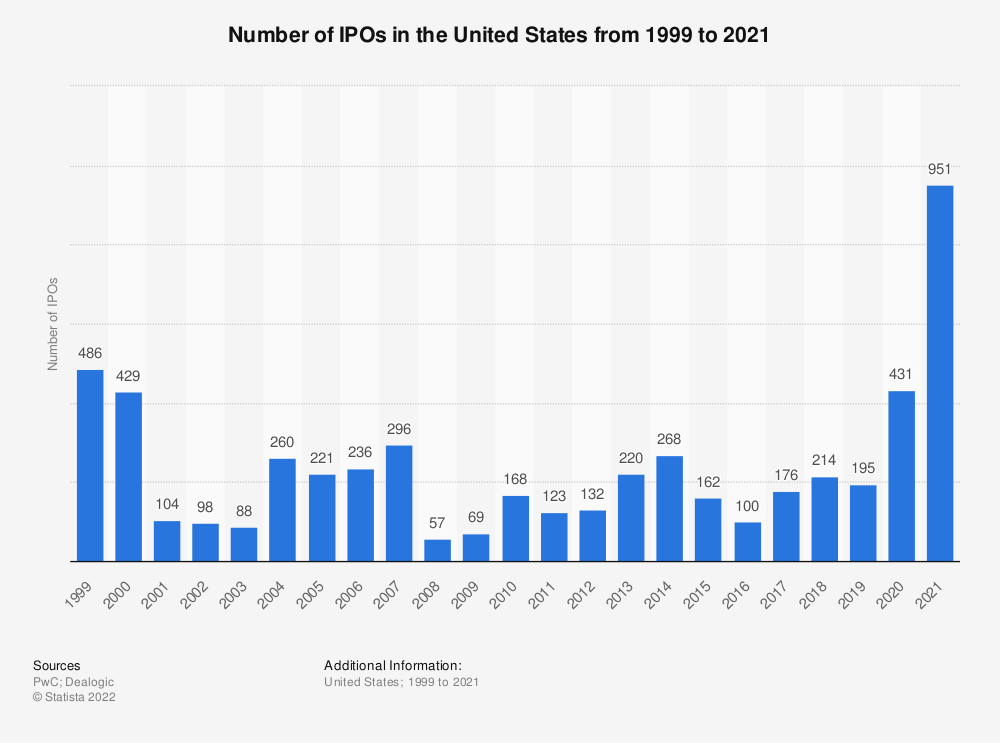

The biggest influx of equity capital comes when a company issues an IPO (initial public offering). 2021 saw the largest IPOs in history, raising $286 billion from IPOs and SPACs.

Credit ratings also impact equity financing by influencing whether a company can raise capital via debt or equity by the cheapest means possible.

For example, if a company with a good credit rating can raise capital via debt versus equity at a cheaper rate, it makes more sense to use the cheaper source of financing to grow.

Typically, debt financing remains a cheaper source of capital than equity financing, but much depends on the company’s credit rating and p in the market.

Working Capital

Visa’s working capital equals the liquid capital assets available to Visa’s management to operate the company daily.

We can calculate the working capital through two methods:

- The current ratio, which equals current assets relative to the current liabilities

- Working capital equals accounts receivable plus inventory minus any accounts payable.

Working capital measures Visa’s short-term cash, focusing on the company’s ability to cover the debt, accounts payable, and any other obligations due within a year.

The current ratio remains the most common form in finance for measuring working capital. It can tell an investor whether a company has the cash to cover its operating costs in the short term.

What is a Healthy Capital Structure?

There remains no magic bullet telling investors or management what ratio between debt and equity a company should use as guidance.

The definition of the healthy blend between debt and equity depends on the industry, type of business, and where the company sits in its life cycle.

For example, a company in the utility industry relies heavily on debt to finance its growth, as does the real estate industry. However, REITs also utilize a heavy mixture of equity cash to generate growth.

Young companies without a ton of credit history might have a larger adoption of equity than debt. In contrast, an established company with a single A rating from Moody’s might choose debt.

Then, you have extreme examples like Constellation Software, which uses working capital or free cash flow to generate growth. As a company relying on a great deal of M & M&A (mergers and acquisition) activity to drive growth, it chooses to finance the growth via its operations and integrate those acquisitions seamlessly.

Unfortunately, as investors, nothing characterizes the ideal mix; instead, we must rely on our experience, other analysts’ views, and several ratios.

For example, the ratio most often cited as a good metric to measure the ideal mix remains debt-to-equity, but it contains challenges with any metric.

The debt-to-equity comes with the issue of representing too large of scope and including operational liabilities.

The debt-to-asset ratio carries the same issue: too broad of a scope.

Two ratios I like to use:

- Capitalization ratio – divides long-term debt by long-term debt plus shareholders’ equity. This ratio helps give key insight into Microsoft’s capital position

- Cost of capital – a little more inside baseball kind of metric, which gives insight into the cost of debt and cost of equity and then weighs them compared to the company’s market cap. This ratio gives great insight into the costs associated with financing, which drives which projects management chooses and how to finance them.

We can also use the Dupont model or analysis to understand the capital structure better.

For example, Texas Instruments can borrow money at 5% for 30 years, the inflation rate sits at 3%, and the company can reinvest the money in core operations, generating a 20% return.

In the above scenario, it makes sense for Texas Instruments to go into debt.

It would make sense for Texas Instruments to carry at least 40 to 50% of debt capital, especially if their sales and costs remain stable.

But many of those decisions rely on management experience, operational efficiency, and the type of industry the company operates.

What Role Does Credit Health Play in Capital Structure?

To help investors understand the strength of a company’s balance sheet, we can use the credit rating agencies whose primary job focuses on risk assessment.

The big three credit rating agencies conduct a risk assessment of publicly traded companies:

- Moody’s (MCO)

- S&P Global (SPGI)

- Fitch

These companies evaluate whether a company can repay principal and interest on any debt, primarily bonds and commercial paper.

These companies use a letter grading system to give each company a score based on the company’s financial strength.

For example, AAA remains the top rating for Moody’s, of which only three companies carry the top rating; the top companies:

- Microsoft (MSFT)

- Johnson & Johnson (JNJ)

- Apple (AAPL)

The credit rating agencies split the public companies into investment and non-investment grades. These ratings give a lot of insight into the financial strength of the particular companies, along with the possible interest rates offered on bonds.

Generally, companies with investment grades carry lower interest rate debt, corresponding to more cash flow. And likewise, non-investment grades lead to higher interest rates and poorer free cash flow.

The credit ratings agencies have access to information unavailable to the general public. For example, they can access business plans, capital expenditures, and future dividend plans.

All the extra information helps the big three determine the company’s credit rating.

Many studies reveal companies’ CFOs consider credit ratings highly relevant. And use the information as part of their decision-making process. They also watch any changes in credit ratings and companies under watch by rating agencies.

Companies with higher credit ratings tend towards lower capital costs and higher leverage levels to generate growth. In comparison, companies in the non-investment grade carry higher debt costs and lower levels of leverage or debt.

We can use credit ratings as a proxy for balance sheet strength. Companies with higher ratings tend to have stronger financials and lower capital costs.

When analyzing a company, a great practice remains to look up the company’s credit ratings at one of the big three. I use Moody’s as my main choice but have accounts with all three as they remain free.

Investor Takeaway

Visa’s capital structure contains a mixture of debt and equity on its balance sheet. Though no ideal mix remains for a healthy company, generally accepted rules include lower debt and higher equity levels.

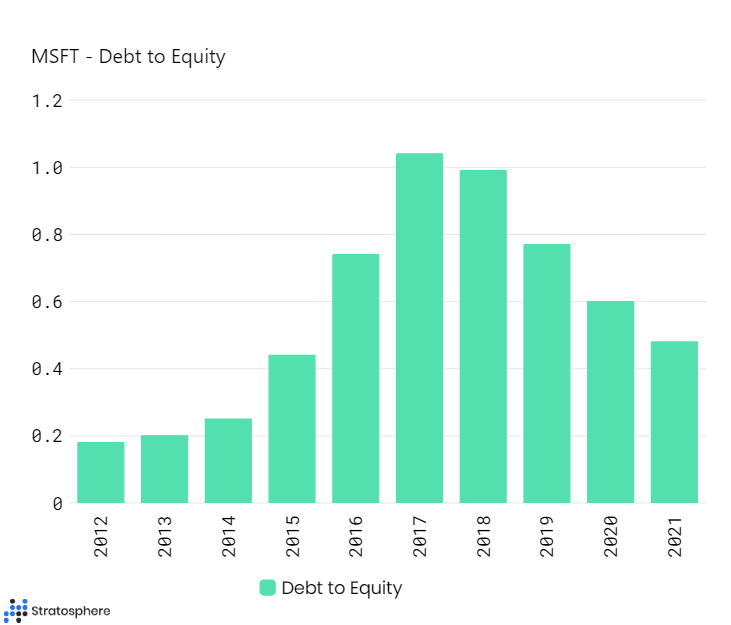

We can use various ratios, such as debt-to-equity and capitalization ratios, to help us analyze a company’s capital structure. We can compare those results to peers and historical numbers for past performance.

Combining those ratios with the ratings from Moody’s, for example, helps give us good insight into the capital mix the company chooses to utilize.

Using our tools to analyze a company’s capital structure and the insights from the rating agencies will help investors find strong companies. These tools also give us insight into management’s decisions to grow the business.

Capital allocation remains the top job for the CEO and management. Companies that make poor capital allocation will probably struggle in the markets. A good study of the capital allocation skills of CEOs such as Warren Buffett, Jeff Bezos, Mark Leonard, and others would offer great insights into what to look for in a leader.

And with that, we will wrap up our discussion on credit health and capital structure.

Thanks for reading today’s post, and I hope you find something of value today. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and stay safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- How the Working Capital Turnover Ratio Can Help You Decide on a Worthy Investment “Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business...

- What’s a Good Debt to Equity Ratio? The Ultimate Guide for Beginners The debt to equity ratio is a great formula for investors to use as a rule of thumb for determining the riskiness of a stock,...

- What is Return on Equity and How Do I Calculate it? Updated 1/5/2024 “Focus on return on equity, not earnings per share.” Warren Buffett In the investing world, there always seems to be a big divide...

- Balance Sheet Analysis: 5 Important Ratios for Measuring Company Health A good deal about the health of a company can be learned from conducting balance sheet analysis and this article will go in depth on...