“Micro Cap stocks? I thought it was only large cap and small cap!”

Nope. You’re wrong.

Remember how I used a comparison of Brock Lesnar and Connor McGregor for a depiction of large cap stocks vs. small caps? Well, micro cap stocks are those stocks that are smaller than small…think, like a fly…they’re so stinking small that they’re basically not even there!

Or are they?

A micro cap stock is one that has a market cap of $50 – $300 million, so much smaller than the max for a small cap of $2 billion. Typically, these stocks are much more volatile because they’re likely in their infancy of life in the stock market or maybe they’re on their last leg, hoping to really have things click before running out of cash.

As you can likely imagine, many of these micro cap stocks are extremely risky. Simply due to the nature of having such a small market cap, they’re going to be more at risk when something bad occurs but also can experience major jumps in share price off a simple piece of information that’s perceived as optimistic.

Personally, I like to completely stay away from micro cap stocks for a few reasons:

1 – I don’t know enough about them

I have tried to learn about these companies but at the end of the day, I just always find myself not feeling comfortable. I think it’s just some sort of eerie feeling that I have when I am researching them but I am just always fearful that the company might be part of a pump and dump scheme that you would see in The Wolf of Wall Street.

The simple answer is that I could simply devote more time to continue to learn more about them, and you’re right, but are the potential returns actually worth the time that I would need to not only initially learn about them but also to stay up to date on them? We shall see!

The issue is that these companies are just simply not within my circle of competence so I choose to avoid them.

2 – There’s too much uncertainty and risk

I love taking risk. Like LOVE it. But I need to fully understand the risk that I am taking because if I don’t, then I will make a bad decision and sell at the low point of the stock just to watch it rebound a bit.

At one point I tried to invest in a micro cap stock in the biotech industry from a purely speculative investment, for maybe 2% of my total portfolio, and I have never been more stressed in my life.

Why was I doing this? There was so much uncertainty and risk that it was driving me nuts and literally keeping me from sleeping at night for 2% of my portfolio. It just flat out wasn’t worth it.

3 – there’s too many other great options that are at least a small cap stock

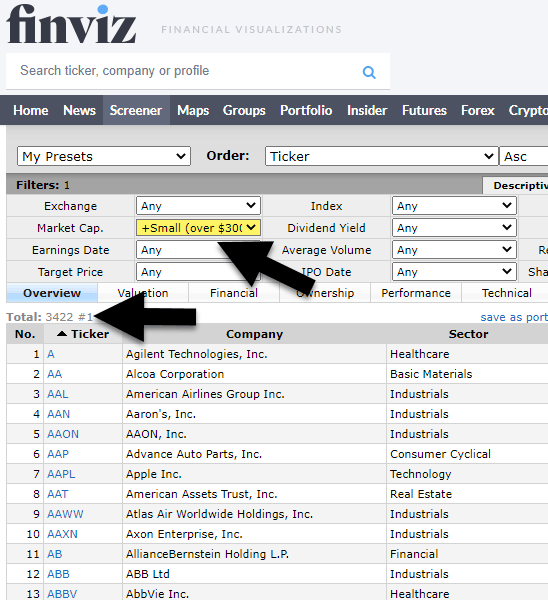

There are SO many other great companies that you can invest in. I mean, I just ran a stock screener that showed there were 3,422 companies that are bigger than these micro cap companies:

Why would I even waste time trying to learn about one of these super small companies that are going to stress me out beyond all belief?

So, now we’re at the point in my high-level “initial” investing, where I am simply doing some information gathering and trying to educate myself, where I would really consider an ETF if I was sold on a micro cap stock. I have decided, after research and some actual efforts on my part, that I simply do not have the stomach to invest in these micro cap stocks, so maybe an ETF is a good play.

One of the most common micro cap stocks is the First Trust Dow Jones Select MicroCap Index Fund, or FDM.

My typical research is to look at the stock on ETF.com and look at a few key aspects of the ETF.

The expense ratio is .6% which is high but not unheard of for a niche ETF like this.

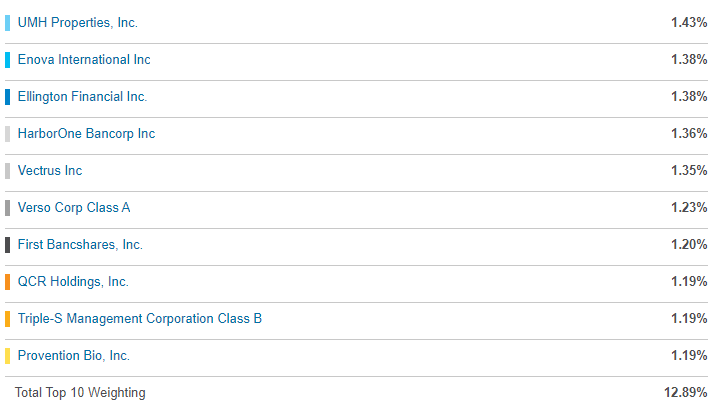

The next thing that I like to look at is the Top 10 Holdings to get a general idea of the companies that are held in the ETF:

Ah, yes, Triple-S Management Corporation and Ellington Financial. Now I am super comfortable with this ETF…

Kidding. I have never heard of any of these companies. Now, again, I am admitting that this is not my strong place or my circle of competence, so for me personally, it makes no sense for me to invest.

But, does it make sense for anyone to invest in this ETF?

Well, not in the last decade or so.

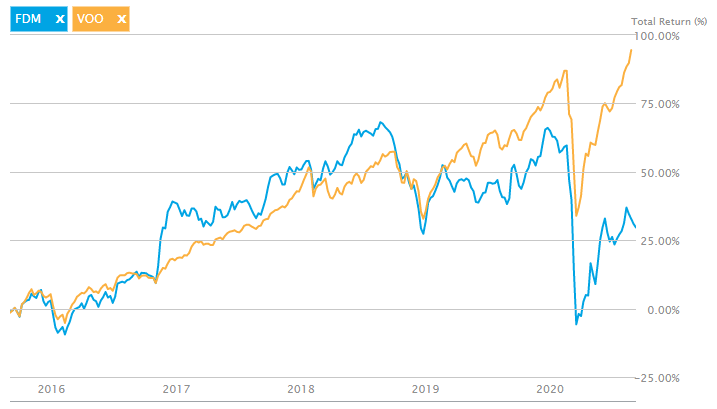

One of my favorite things about ETF.com is you can select a different ETF to compare it to as a benchmark. I know that typically when you’re looking at a small cap stock that you should compare it against other small caps but guess what – no.

I view my alternative as investing in the S&P 500. I view that as the best representation of the total stock market so I always want to make sure that my investment choices, whether it’s stocks or ETFs, are at least matching that performance.

As you can see, VOO absolutely crushes FDM over the last 5 years. The results aren’t much diffferent in a 10-year period either but since VOO hasn’t been around for 10 years, the results look flawed.

The thing that this tells me thugh is that in the last 5 years of great growth for the total stock market, micro caps have been giving you MICRO RETURNS!

So, am I going to invest in companies that are much riskier than others, that I know way less about, produce much worse returns, all while I have literally thousands of other options?

No. No I am not. And neither should you.

Do me a favor and just forget about micro cap stocks completely and move your focus to stocks that you are comfortable with. My advice would be to start with looking at this comparison of large cap vs small cap and then move forward from there!

If you’re absolutely dying to learn more about micro cap stocks though, you can check out this video guide:

Related posts:

- Where to Put Your Money? Large Cap vs. Small Cap Stocks! Where to Put Your Money? Large Cap vs. Small Cap Stocks! I love listening/watching CNBC whenever I have free time, solely for the entertainment factor,...

- A Few Reasons why Investing in eSports Could Result in Massive Gains Have you ever considered investing in eSports? If not, you could really be missing out on some major potential gains. In a recent Investing for...

- Do you Trade Volatile Penny Stocks? A common pitfall that I often see new investors fall into is that they get sucked into the “get rich quick” mantra that they think...

- Does Good Earnings Guidance Lead to High Returns [Real-Life Case Studies] If you’re addicted to checking your portfolio multiple times a day, and I personally don’t think that’s a bad thing as long as you have...