“Businesses that earn a high return on capital are better than businesses that earn a low return on capital.”

In his seminal book “The Little Book that Beats the Market,” Joel Greenblatt laid out his now-famous “Magic Formula,” included in the formula is his version of return on capital. It is the formula I would like to explore today.

Return on capital, return on invested capital, and return on capital employed are all sides of the same coin, but each with a different twist on the formula.

We will explore the differences between the formulas and dive into why Greenblatt chose this variation on return on capital instead of the more expected return on equity or assets.

Buffett talks extensively in his letters to shareholders about return on capital and how he looks for companies producing high returns on capital and reinvesting at those same rates into the future.

In today’s post, we will discuss the following:

- Definition of Return on Capital

- Importance of Return on Capital

- How to Calculate Return on Capital

- Examples of Return on Capital with Real Companies

Definition of Return on Capital

Joel Greenblatt defines return on capital as net working capital plus net fixed assets (PP&E) minus excess cash. In English, that means he uses total assets minus non-interest-bearing current liabilities; he subtracts goodwill and intangibles and any excess cash.

Greenblatt’s objective is to identify a business’s tangible capital to operate. Companies need to pay money for items such as inventories, equipment to produce goods, buildings to produce those goods and house employees, etc. But it doesn’t shell out money for items such as goodwill, intangibles, and accounts payable. Also removed is any excess cash, as it isn’t necessary to operate the business either.

Greenblatt also uses operating income or EBIT (earnings before interest and taxes) in the numerator, as opposed to the net income, as is normal for return on assets or equity. The use of operating income allows for better apples-to-apples comparisons of companies. The use of operating income excludes items such as interest expenses, which depending on the debt load for any company, can be higher or lower for said company.

Greenblatt focuses on determining and comparing the basic earnings power of any business; therefore, he didn’t want the results skewed by the effect of leverage and income taxes. Therefore he uses operating income as opposed to net income, which does account for both of those line items.

As a reference, Greenblatt states in his book that he looks for companies that produce 50% or better returns on capital.

Now that we understand what return on capital is, let’s dive in and discuss the importance of this metric.

Importance of Return on Capital

Return on capital offers us a concept that all investors should understand. Some investors, primarily value investors, prefer to buy cheap assets, net-nets, or Graham cigar butts, but even in these cheap businesses, return on capital remains important. We need to understand it will impact your margin of safety.

Cheap asset investments can work over time, sometimes wonderfully, as simple investments. But the holy grail gives us growing businesses that produce high returns on capital at those same low prices.

With his “magic formula,” that is what Greenblatt is attempting to do, having his cake and eating it too.

The broad measure we mentioned earlier shows our return on capital remains the same flavor as return on invested capital or return on capital employed. They can all have slightly different variations. But the main objective with all formulas is to determine how well a good business uses its capital return to generate and grow earnings, regardless of the nuances of calculating the return.

As investors, and part owners of the business, we are interested to know a few things, including the basics of return on capital:

- How much capital has the business invested to generate its earnings?

- What kind of rates has the company historically returned on those investments?

- How much capital will it need to invest going forward, and what kind of returns can we expect to earn on those investments?

The first two items are easy to determine by looking at the current financial statements (income statement and balance sheet) and past financial statements.

The third item is the most important thing; we want to know how much money we can earn in the future and how the company will need to invest to achieve those earnings.

The ultimate goal is to find a company that can produce those high capital returns and reinvest at those high rates into the future.

Ok, now let’s move on to calculating return on capital.

How Do You Calculate Return on Capital?

Greenblatt spells out his formula for return on capital as:

Return on Capital = Operating Income (EBIT)/( Net Fixed Assets + Working Capital)

Where operating income equals earnings before interest and taxes, which most companies list on their income statement as operating income; however, there will be times when you will have to calculate the operating income yourself.

Working capital comprises total assets minus non-interest-bearing current liabilities, plus subtracting items such as goodwill, intangible assets, and excess cash.

The easier method is to list the items we need to locate on the balance sheet.

- Accounts receivable

- Total inventories

- Other current assets

- Accounts payable

- Accrued expenses

- Deferred revenue

- Other current liabilities

And the net fixed assets are also known as non-current assets, and for our purposes, here include property, plant, and equipment listed on the balance sheet.

To find the data, we need to calculate the formula; for all of it we will find on the income statement and the balance sheet.

We exclude the debt from the formula because the other half of the magic formula includes enterprise value, long-term and short-term debt, and any interest paid or accrued due to the leverage. To count any of the debt in this equation would be to double-count the leverage.

Ok, let’s dive in and discover how to calculate return on capital for a couple of companies.

Examples of Return on Capital with Real Companies

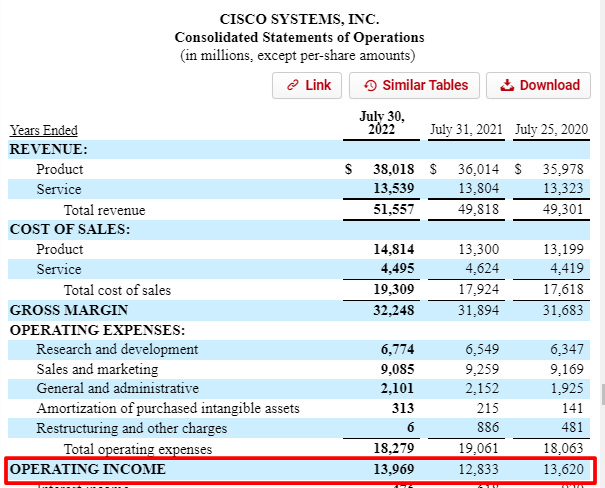

The first company I would like to analyze is Cisco (CSCO), which trades at $39.58 and has a market cap of $155.1 billion.

First, I will look up the annual report or 10-k for Cisco and highlight all the data we need to calculate our formula. All numbers will be listed in the millions unless otherwise stated.

And now the balance sheet:

Ok, let’s pull the highlighted data from the line items.

Cisco’s return on capital calculations follow:

- Operating income – $14,025 million

- Fixed Net Assets

- Property, Plant & Equipment – $3,000 million

- Working Capital

- Accounts receivable – $10,527 million

- Inventories – $2,568 million

- Other current assets – $4,355 million

- Accounts Payable – $2,594 million

- Income Taxes Payable – $961 million

- Accrued Compensation – $3,316 million

- Deferred Revenue – $12,784 million

- Other current liabilities – $4,564 million

Now let’s start plugging in our numbers.

Return on Capital = Operating Income / ( Net Fixed Assets + Net Working Capital )

Let’s put together the numbers for net working capital:

Net Working Capital = ( Accounts receivable + Inventories + Other current assets ) – ( Accounts Payable + Income Taxes payable + Accrued Compensation + Deferred Revenue + Other Current Liabilities)

Net Working Capital = ( 10,527 + 2,568 + 4,355 ) – ( 2,549 + 961 + 3,316 + 12,784 + 4,564 )

Net Working Capital = 17,450 – 24,174

Net Working Capital = -6,724 million

Plugging in the net working capital:

Return on Capital = 14,205 / ( 3,000 + max(-6,724,0)

Return on Capital = 14,205 / 3,000

Return on Capital = 4.74

To convert the number into a percentage, we will multiply it by 100% and get a number of 474% as a return on capital for Cisco.

That number seems high, but the return on capital percentages tend to be higher, especially if the company has a lower PP&E and higher current liabilities. The formula excludes leverage and cash on hand, which some companies use to generate returns, and Greenblatt is looking for companies that generate returns based on “in-house capital.”

Let’s look at another company, shall we? Next, I would look at Intel (INTC), which has a market price of $25.04 and a market cap of $110.4 billion.

Again we will go back to the financial reports to find our numbers to calculate the return on capital for Intel.

Now extracting the items, we can plug our numbers into the return on capital formula.

- Operating Income – $22,082 million

- Net Fixed Assets

- Property, Plant, and Equipment – $63,794 million

- Working Capital

- Accounts Payable – $5,747 million

- Accrued Compensation and benefits – $14,324 million

- Other accrued liabilities – $7,257 million

- Accounts Receivable – $9,457 million

- Inventories – $10,776 million

- Other current assets – $8,897 million

We can plug all the numbers into working capital and go from there.

Working Capital = ( 9,457 + 10,776 + 8,897 ) – ( 5,747 + 14,324 + 7,257 )

Working Capital = 29,130 – 27,328

Working Capital = $1,802 million

Now that we have calculated our working capital let’s put the whole formula together.

Return on Capital = 22,082 / ( 63,794 + max(1802,0)

Return on Capital = 22,082 / 65,596

Return on Capital = (.3366) * 100%

Return on Capital = 33.66%

As we can see, Intel has a significantly lower return on capital than Cisco as they have a larger property, plant, and equipment line requirement to produce capital returns than Cisco.

Let’s do one more for giggles.

The next one I would like to dig into is AbbVie (ABBV), which is currently trading at $93.6 with a market cap of $164.96B.

I will first access the financial reports for AbbVie and then pull our numbers for the ratio.

- Operating income – $19,529

- Net Fixed Assets

- Property, Plant, and Equipment – $5,872

- Working Capital

- Accounts receivable – $9,977

- Inventories – $3,128

- Prepaid Expenses and Other – $4,767

- Accounts Payable and accrued liabilities – $22,514

Now that we have all our numbers, let’s calculate the net working capital.

Net Working Capital = ( 9,977 + 3,128 + 4,767 ) – ( 22,514 )

Net Working Capital = 17,872 – 22,154

Net Working Capital = -4,282

Now that we have working capital calculated let’s figure out our return on capital for AbbVie.

Return on Capital = 19,529 / ( 5,872 + max(-4,282,0))

Return on Capital = 19,529 / 5,872

Return on Capital = 3.326 * 100%

Return on Capital = 332.6%

Ok, that rounds out our calculations for return on capital.

I am going to calculate return on capital for some of the more popular companies to give us some context.

- Facebook (FB) – 56.16%

- Apple (AAPL) – 305.86%

- Amazon (AMZN) – 6.37%

- Netflix (NFLX) – 512.57%

- Google (GOOG) – 18.85%

- Qualcomm (QCOM) – 293.92%

- IBM (IBM) – 56.02%

- Disney (DIS) – 20.21%

- Walmart (WMT) – 18.14%

- Target (TGT) – 18.85%

- Costco – (COST) – 29.76%

Now, that was interesting. Amazon of the FAANG stocks was the lowest, and Target was the lowest for retailers.

Final Thoughts

Calculating the return on capital is fairly easy; the hardest issue is locating the data we need for our formula. Analyzing the balance sheet and finding the working capital helps identify companies creating excessive returns on capital without leverage.

Greenblatt used return on capital to find companies generating high returns on capital; as part of the magic formula. Consider the return on the capital part of the equation as the quality check on a company. Any company with outsized capital returns will grow its earnings over time and increase its value.

As Charlie Munger states in his seminal Art of Stock Picking:

“Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.”

Charlie states the importance of finding companies that generate high returns on capital.

Regardless of which formula you choose to use to track returns, whether it is returns on capital, return on invested capital, or return on capital employed, screening with these metrics will help you find companies that are likely to generate long-term success for you.

Additionally, this metric ties loosely to finding great managers or CEOs because capital allocation skill is arguably the most important duty any of them will fill. Buffett’s genius over the years, besides his skill in stock-picking, has been his capital allocation abilities. One of the many reasons Berkshire has returned such fabulous wealth to its shareholders.

Using the return on capital should be part of your stock screening process and a small part of your evaluation of any company you are considering buying. I have added all the capital metrics to my checklist to determine great capital allocators.

Another note about the return on capital formula, it is not compatible with financials such as banks or insurance companies. Rather for those companies, we will need to stick to return on equity and return on assets.

That is going to wrap up our discussion on return on capital today. As always, thank you for taking the time to read this article, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time.

Take care, and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Invested Capital Formula: The Exact Balance Sheet Line Items to Use Updated: 5/22/2023 Invested capital is one of the main components of the popular Return on Invested Capital, or ROIC, metric. There are two main ways...

- Return on Capital Employed: Ratio for Profitability and Capital Efficiency Updated 2/7/2024 One of Terry Smith’s investing foundations’ main pillars is investing in good companies, which he defines as companies with high returns on capital...

- Cash Return On Invested Capital: “Insider” Formula for Earnings Cash is king, and finding companies that are superior reinvestors of that cash is one of the trifectas of winning in investing. One of the...

- ROIC vs ROCE: When to Use One Over the Other [Pros & Cons] Updated 8/25/2023 ROIC (Return on Invested Capital) and ROCE (Return on Capital Employed) are formulas describing how efficiently a company invests its capital. The difference...