On Episode 156 of the Investing for Beginners Podcast Andrew and Dave did another one of my favorite episodes of listener question and a great topic came up. Someone had 15 years to retirement and they were wondering what if they should DRIP their investments or if they were too late to the party.

I wanted to focus a bit on that but also just to show what I would do if I was approaching retirement age, and maybe show you the age that you actually will be able to retire if you’re not there yet!

If you’re asking the question of “how should my investing strategy change as I approach retirement” then I first want to congratulate you on getting close to retirement! Years of hard work and saving have allowed you to get to this point and now you can take some time and relax and do whatever the heck you want!

So, what should your portfolio actually look like? It’s pretty common knowledge that you should make it more balanced with some safe investments like bonds or CDs, potentially in a 50/50 allocation with bonds or CDs and then stocks being the other 50%, but is that actually the appropriate strategy?

Sure, bonds are safe, but that also means that the upside is limited. On the other hand, you have stocks, which can easily lose 30% in a month like we just saw with the coronavirus, but then you can also see insane gains as well. Essentially, you’re trying to protect yourself from the extreme volatility that we have seen in the stock market for the past…. well…. literally forever!

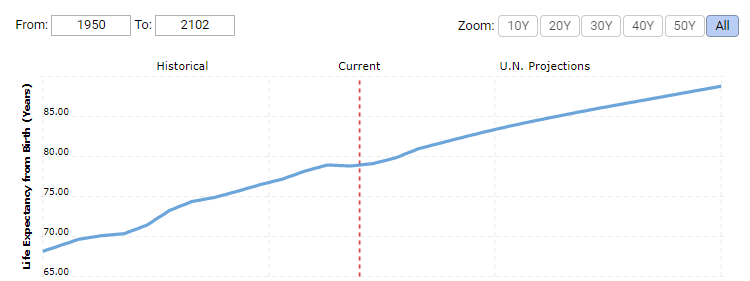

The thing is, though, is that maybe retirement age isn’t’ the time to make this drastic shift to super conservative investments. The average age, per MacroTrends, has been steadily increasing throughout time and that trend is very likely to continue!

For instance, when I turn 65, the average life expectance will by 84! That’s a huge climb even from the expected life expectancy of 78 currently. But the thing is, that’s just the average – you could live many, many years beyond that! So, shifting my portfolio to a lot of safe investments when I’m say 50-55 is wayyy too early! In fact, you can even make the debate that the 19 years from 65-84 is way too early.

It might seem ridiculous that I’m saying that, but trust me, it’s not.

Look at the History of the Stock Market

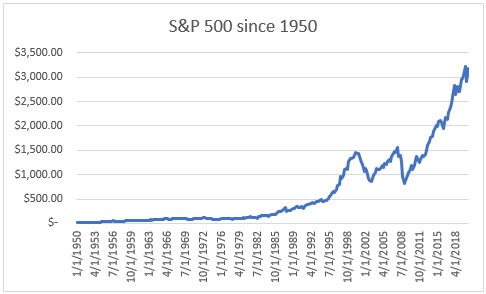

If you look at the major stock market crashes that we have had in the recent years then you’ll see that those occurred in 2000 and then again in 2008. The stock market crash in 2000 had completely rebounded back by 2007 and then the stock market crash in 2008 had completely rebounded by 2013. Check it out:

Even if you combined these two crashes, which is likely how I would look at it, you’re still looking at a total window of 13 years from when the peak in 2000 to get back to that same market price in 2013. 16 years after the peak in 2000, the S&P was up about 50%, and that included two market crashes! That still will outpace inflation more often than not and be way better than a safe investment and you had TWO MARKET CRASHES in just 16 years!

So, if you’re 50 years old and you have 15 year to retirement – what do you do? Well, to me, data shows a couple things:

- The market is going to rebound as long as you give it time

- Moving into a conservative investment too early is actually too risky

I think I’ve hit on the first point pretty hard, but what do I mean when I say that being in conservative investments can be risky? Well, if you move into a conservative investment really early on then you’re going to miss out on a ton of potential gains!

You see that little blue line that I showed in the graph above? What if only half of your investments were in the market and the other half was getting 2% from a bond? It wouldn’t be good!

The Problem with the 4% Rule

I am a really big fan of the 4% rule but I think a lot of people take it to heart and take it as gospel when in all actuality, it is not a fool proof guarantee.

Essentially what the 4% rule says is that if you were to retire with $1 million, you could take out 4% of your nest egg, or $40,000, each and every year. Note that you would always take that 4% out but you would actually adjust it for inflation, which has been around 2-3% throughout recent history.

So, it would be $40,000 in year 1, $41,000 in year 2 assuming a 2.5% inflation rate, and so on. Doing this, you would essentially never run out of money. I went really in depth and back tested this theory using a 100% stock portfolio and then also a balance portfolio of stocks and bonds and for the most part, things actually checked out!

You really, for the most part, would actually be able to make this work throughout time. There of course are always exceptions to the rule, so banking on this could be a huge issue because while history is a great indicator of the future, it is absolutely never a guarantee.

If it was me, and I was debating how close I was to being able to retire, I would simply prepare for the worst. Of course, the 4% rule tells me that I should be good forever, especially if I can take a lower amount of money like 3% or 3.5%, but that is not a guarantee like I mentioned.

What’s the Worst Case Scenario?

The worst thing would be to retire at 50 and then realize at 60 or 65 that you’re going to run out of money in the near future – what do you do then? You’re in deep, deep trouble at that point. You can’t just go pick up your old job and keep on going.

Nobody is going to hire someone that’s 5 years away from retiring again and someone that hasn’t done anything for the last 10-15 years!

You’re going to be a greeter at Walmart. Not that I’m talking down on that job, but if you’re used to a higher income then you’re absolutely not going to be able to get that same income, meaning you’re going to have to work way more hours just to make up for that lost time.

I’ve heard a lot of people in the Financial Independence Retire Early (FIRE) community say that if they retire early, the worst-case scenario is that they have to go back and get a job which is everyone else’s everyday life. Well, honestly, I think that’s complete crap.

It’s not like you can just get right back in and get a job instantly. You have missed a ton of time! Not only is it going to be hard for you to actually figure out the process to even start looking for a job, but you will have missed out on so many years of business changing.

Let’s pretend that someone tried to retire at 40 and at 50 they chose to come back and work – would you hire that person? I would want to understand why they took a 10-year period of doing absolutely nothing. I also would want to know why things have changed, or in other words, is that potential employee just going to work for a few years and then just retire again? Is that a risk that an employer is even willing to take?

If it was me, I wouldn’t even bring that person in for an interview. If I had a couple potential candidates and one had a steady work history while the other was off work for 10 years because they retired…I mean, come on…is that even a question?

But imagine if you were in this situation and you got brought in – what would you tell them is the reason that you retired?

“Yeah, I wanted to retire early so I decided to save the bare minimum to try to coast the rest of my life and turns out, I was wrong…so, did I get the job??”

Work Longer or Retire Early?

I want to clarify here that I am all for FIRE, and I mean like 100% all in. I absolutely push everyone to try to be financially independent and then have the option to retire early. But if I thought I was 15 years away from retirement, why not just push it to 20 and make sure that you actually can live the life that you want after working?

I don’t want to be a huge naysayer and rain on your parade, but I would rather work an extra year than retire one year too early. Hell, I’d rather work two extra years than retire 1 year too early.

Just real high-level stuff here, but if you saved $1 million and plan to use $40,000 by using the 4% rule, and you retired 1 year early, then you’re going to need to make up that $40K somewhere along the way, right?

Maybe that’s only spending $30K over 4 years or spending $35K over 8 years. That might not seem too bad, but you just hindered the retirement lifestyle that you wanted for 4-8 years just to retire one year early. To me, that’s not worth it.

But the thing is, even after you retire, you have TONS of time that your money absolutely needs to be in the market if you want to have any chance at making your money last.

If inflation was 2% and your bonds were getting you 2%, and you took out 4% each year, then you’re going to run out of money just a short 25 years in! That’s going to be an awful situation as I mentioned above….in depth.

But, if instead you invested some of that in the stock market, even at a very conservative rate, your money could end up lasting forever.

You see, even with the insane volatility in the market, the long term still crushes the short-term, so if you just hold onto your money then you’re going to be just fine. You only lose money if you sell, so just don’t sell. I oftentimes talk about people that I know personally that sold in 2008 and locked in 50% losses from their highs while if they had just held on, they’d now be sitting with a number that is double the highs!

Which means it was FOUR TIMES the low price that they sold at.

They sold because they were focused on the short-term. Focus on the long-term and trust that the market has a 100% success rate of always going higher. Even if you retire at 65, you likely will live another 15, 20 or even 30 years! Maybe even longer!

I guarantee that you’re going to regret it majorly if you pull your money from the market too early. Instead, stick with these three rules:

- DO NOT pull your money from the market too early. You can get conservative, but it should be once you’re well into your retirement

- Make sure that you know your retirement number

- When all else fails, work that extra year, two years, or longer. You might regret working longer than you needed, but it’s way better than working less than you needed

Step 1 for those of you planning out your retirement is to try to figure out what your retirement number is. So, do you know? It’s ok if not – the 4% rule can be a great rule of thumb, but it’s nothing more than that. Instead, take the time to really think about your future expenses and all of the things that you might want (or need, like major healthcare) in the future, and be sure that you hit that retirement number…and then maybe add some extra on top for cushion ?

Seem hard? It’s not – just follow my advice!

Related posts:

- Calculating Your Retirement Number Goal Based on Your Retirement Plan What’s your retirement number? Everyone has different needs, desires, and goals for retirement. Let’s unpack each of those so you can calculate your own retirement...

- What’s the Tax Rate on my Bonus if I Invest it in the Stock Market? So, you’ve just received a big bonus at work and you’re wondering what you should be doing with it, any quite frankly, you’re worried about...

- The Key to Using the Rule of 25 to Plan Your Retirement Properly As a young teenager, all you can think about is moving out of your parent’s house. Then as you hit your early twenties, it turns...

- What’s a Reasonable Goal for an Average Retirement? Many of us wonder how we are doing when it comes to retirement savings. It can make us money hungry, not because we are greedy...