If you’re asking me, “should dividends be reinvested?” I am telling you that the answer is always a resounding YES!

Now, if you’re asking me if those dividends should be reinvested back into the same stock that earned those dividends, that is a much different question! But don’t worry, I’m here to help cut through some of the nonsense and get you an answer that will help you properly invest your dividend income!

Click to jump to a section:

- Don’t dollar-cost average

- Is DRIP still relevant?

- No longer applicable pros to using DRIP:

- DRIP opportunity cost

- Summary

Don’t Dollar-Cost Average

Have you ever heard that “time in the market beats timing the market”? Well, it’s 100% true, and the numbers show it. Statistically speaking, when you have money that you want to invest, you should try to get that money into the market as fast as you can!

I’m telling you right now that you should NEVER dollar-cost average if you’re seeking maximum returns. I know that might seem like a hot take, but it’s true. Let me explain.

Think about it – the stock market has historically gone up over time on a fairly reliable basis, so wouldn’t it make sense to put your money in as fast as possible?

Of course, sometimes it will backfire, but the odds say that if you put your money in today, it’ll be at a lower price than what it would be if you invested tomorrow.

When comparing lump sum investing vs. dollar cost averaging you can see that it’s a no brainer that you should get your money into the market as soon as you possibly can, and the same remains true for dividends.

So, as soon as you get those dividend payments, put those funds back into the market so you can continue to capitalize on compound interest!

Is the DRIP Program Still Relevant?

Now, chances are that you are asking this question because you have heard about DRIP, or Dividend Reinvestment Plan, and you’re wondering if this is applicable to you. Well, to be totally honest, I don’t know if DRIP really is that applicable anymore…

DRIP, essentially, is when you earn a dividend, that money then is automatically invested right back into that same company that paid you the dividend in the first place. So, let’s imagine this scenario:

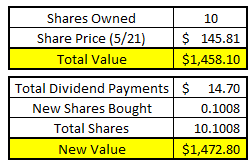

You’re invested in one of the greatest dividend kings of all time in 3M (MMM), and you own 10 shares of that company. On 5/21/20, MMM paid its quarterly dividend of $1.47/share, and since you own 10 shares, you received a total payment of $14.70.

You can either receive this as just cash in your account, or you can enroll in DRIP, meaning that you will instantly get more shares of MMM for the equivalent of that dividend payment.

As you can see, that $14.70 in dividend payments is enough to get you .1008, or just over 10% of 1 more share. You now own 10.1008 shares instead of the original 10, meaning that the total value of your stock is at $1,472.80, or $14.70 over the amount of your initial investment (which is the same as the dividend that you received).

The beauty is that you could keep this going, quarter after quarter. Since 3M has one of the most sustainable track records of growing its dividend over time, you don’t have to worry about it cutting its dividend. But is this actually the best strategy for you?

DRIP really provided (note that this is past tense) three main benefits to the common investor:

1. You don’t pay a commission on that transaction

This is a huge advantage! Or, maybe I should say that it USED TO BE a huge advantage. You see, commission on a transaction of stock used to be $5+ every single time that you bought and sold stock.

So, if you weren’t enrolled in DRIP and wanted to invest your $14.70 into MMM, you would pay a $5 fee. That’s effectively a 34% fee right off the bat since you’re investing such a little amount.

By avoiding this fee, you had a huge leg up to keep your money in the market and let it keep on compounding.

But times have changed – a few years ago, many brokerage firms decided that they were going to drop ALL commissions on transactions, both on shares being bought and sold. This didn’t include all brokerage firms, but it did include many such as Fidelity, Ally, E-Trade, TD Ameritrade, and many others!

I think this can be attributed to Robinhood gaining traction with the younger investor as they pioneered free trades. However, now that almost all brokerages offer it, you might want to switch your brokerage firm to a brokerage you prefer.

As long as you’re invested with one of these brokerage firms that offer free trades, then 1/3 of the major benefits of DRIP are gone. But let’s pretend that you’re invested with a brokerage firm that doesn’t offer free trades, and for whatever reason, you can’t switch to a new brokerage (I have no idea what this would be), at least you can reap the rewards of this next major advantage, right?

2. You can buy partial shares

Just as with the example that I provided above, when you opt-in to DRIP, you have the ability to buy partial shares! This can be a huge advantage to any investor trying to keep as much of their money invested in the market.

Using the same example above, you wouldn’t have been able to buy another share of MMM because you didn’t have enough from your dividend payment. You’d either have to get more cash by selling a different stock, depositing more money into your account, or just letting your money sit there uninvested.

Pretty big advantage, right?

Well…it used to be.

Now, most brokerage firms allow for purchases of partial shares. You don’t have to be partaking in DRIP to take advantage of this. You can purchase partial shares with any deposited funds.

For instance, I invest with Fidelity, who now offers partial shares. Regardless of how much money I have available to invest, I can use it.

When I was first starting investing, partial shares were a major benefit and a huge reason that I chose to DRIP my investments. It allowed me to keep 100% of my money invested 100% of the time. But now that advantage is essentially gone as long as you’re invested in a brokerage that offers the ability to buy partial shares.

So, now we’re down to only 1 of the three major benefits of DRIP being left…. but is it still left?

3. Instant Hands-Off Investing

This is another fantastic thing that DRIP provides for you and it gives you the ability to miss 0 seconds of time in the market which obviously is a win-win. But there might be a little “hiccup” along the way.

What happens if that stock made a huge run and now it’s overvalued? You could theoretically view this as a way of just continuing to gain more exposure to the stock. Or, if the stock took a big hit, then you’re just lowering your average cost of ownership of the stock. But at the end of the day, you’re buying shares of a company without knowing what price you’re buying at.

While I loved this as a newer investor because it kept me from getting overwhelmed at the frequency that I needed to make a decision to buy stock, the more comfortable that I get in my investing journey, the less that I felt like this was a benefit.

Opportunity Cost on Reinvesting Dividends

I recently talked about how I just started to take control of investing in my 401K vs. having Fidelity manage it because I’ve gained confidence throughout my investing career. That confidence is also the same confidence that has made me think that automatically putting dividends into a company without me actually doing it may not be the best idea.

We’re living in a super volatile world with COVID-19 and supply chain issues impacting production. I mean, the stock market is volatile enough as is, but this is far more than usual. If I have two stocks that both gave me a dividend, and one has drastically increased in price, and the other has drastically decreased, but the actual business hasn’t changed, and I still trust both companies, then wouldn’t I want to buy more of the company that has dropped in price?

Of course! I will get more bang for my buck.

If I had opted into DRIP then I would never even have had this opportunity. The dividends would be automatically invested before I even had the chance to decide.

For me, this is not ideal, but if you want to be hands-off and not have to log in to your brokerage every few months (at least), then maybe DRIP is for you!

Personally, I love getting into the numbers and evaluating stocks. Like, I legit love it. It’s not something that everyone loves, and I get that. But I thoroughly enjoy evaluating my investments and ensuring that I invest in a stock with the most growth potential and the biggest discount on its intrinsic value.

That might sound overwhelming, and if it is, I totally understand, but take it in baby steps. Learn the basics of the market, some introductory valuation ratios, and look at the Value Trap Indicator, which I think is the best way to find a company that is undervalued vs. their intrinsic value (aka a great buying opportunity).

If you want a defined step-by-step process to get started in the market, check out this downloadable checklist for beginner investors.

Summary

In summary, I still want to say that DRIP is a great tool. Some brokerage firms do not offer free trades, some do not offer partial shares, and some investors love certain companies and want to pick that stock and forget it, which is completely fine! DRIP would be the best option for any of these investors.

If you’re the type of person that likes to do your own analysis and run the numbers on your own, then maybe DRIP isn’t the best bet for you, but I know that many people will prefer to automate things if they can.

If you’re someone that’s enrolled in DRIP solely because you have a brokerage firm that doesn’t offer free trades or partial shares, then my biggest piece of advice is to select a new brokerage. Sure, DRIP might work for you on dividends, but what about when you put $100 in, and the share price is literally anything except $100? Or, what about when you put $100 in each week, and you’re paying $5 right off the bat?

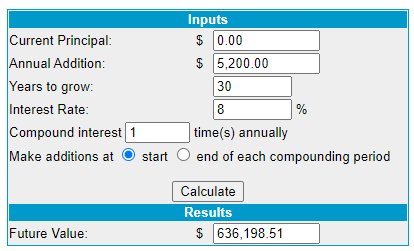

$5 might not seem like a ton of money, but its effects compound. If you invested that entire $100 every week for 30 years, you would have $636K at the end:

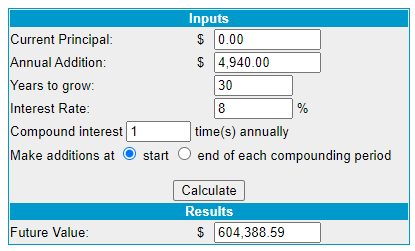

If you had to pay $5 each time then you’d only have $604K at the end of the 30 years:

When you’re talking about hundreds of thousands of dollars, $32K might not seem like a jaw dropping amount, but you’re doing LITERALLY NOTHING different…you’re just using a better broker that doesn’t charge you fees!

So, at the end of the day, should dividends be reinvested? YES! But only in the way that makes the most sense for you!

Related posts:

- The Big Guide to Little Dividends Dividends are one of the best ways companies can return value to shareholders. Share buybacks have become all the rage in the investing world, pushing...

- Tesla and Apple Did It – Is it Time for a Google Stock Split? Stock splits are a really unique thing nowadays and with so many companies doing it lately, it makes me wonder if it’s also time for...

- Robinhood DRIP Problems and What Dividend Investors Should Do One of the drawbacks to investing with Robinhood for the dividend investor is that they currently (as of Sept 2018) don’t offer automatic DRIP with...

- Dividend Reinvestment Plan Example — When Total Return Multiplies The compounding from dividends can be an incredible force. I have a dividend stock I’ve held and reinvested dividends in for over 5 years. I...