Sometimes investing in the stock market can feel a little bit, “frothy”, per se, and when that occurs it’s nice to have something to fall back on. Every time I turn on CNBC or listen to a podcast, people are always talking about how overvalued the market is and it’s quite honestly terrifying.

If you’re looking for protection in these times, you should really consider all of the pros and cons for a stop loss vs. stop limit.

Let me paint a picture of where we stand in January of 2021…

We’re in one of the strangest times that I can personally ever remember, just in general – not even investing related. The U.S. seems to be a very divided country and you can see it in people’s actions all the way from the news to just scrolling your own personal Facebook, Twitter or Instagram.

And that’s why I basically only use social media for investing related topics rather than anything else, and it can be a great resource when you use it that way!

We’re in this weird world where the earnings of many companies have been absolutely abysmal because of COVID-19, but the prices of these companies are just soaring through the roof!

It’s insane and truthfully, it’s extremely scary. You know how the typical “value” stocks will carry a low P/E in the 15-20 range? Well, I always think of banks as being value stocks – the P/E of Wells Fargo is 87!

I pulled up a Value ETF that listed Disney in it…Disney doesn’t even have a P/E because they have negative earnings! Things are just bonkers right now and the word that I hear everyone use to explain it is “frothy”.

You can find a thousand people talking about how we’re in a bubble because earnings are so low and valuations are so high and it’s extremely scary. I tell myself that this time is different because we’re in a pandemic and we’ve been propped up with a ton of stimulus.

The stimulus is showing no end in sight but that’s going to potentially keep the market going higher, and with anticipations that an effective vaccine is going to be quickly distributed, there’s hope that earnings will return back to normal as the world opens back up.

But are things actually different? I feel like “this time is different” is what people always say right when they’re actually more of the same, so maybe that means that we are actually in for a very rough pullback in the market.

Anytime that I frequently hear people talking about the market being frothy or overvalued, I like to grab the phone and give my old buddy Robert Shiller a phone call. I don’t actually do this, but Shiller created the Shiller PE or Cyclically Adjusted P/E Ratio (CAPE) that will basically normalize the P/E of the market and adjust it for inflation, spread amongst the last 10 years.

The reason that he does this is because it takes out some of the major fluctuations that you see in the market and adjust for inflation to get a true picture of the market. If inflation is 8% and the market goes up 6%, then really the market is down 2% on a real basis – very important context.

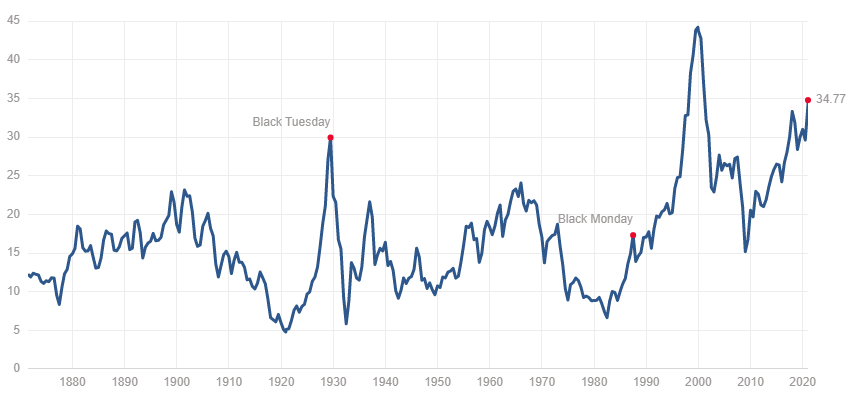

Take a look at the graph below that shows the Shiller P/E per multpl.com:

Anything in particular that you notice? I mean, it’s pretty obvious… the Shiller P/E is showing that it’s at the second highest EVER!

Yeah, I mean that is a little bit scary.

Take a look at some of the other peaks that you see such as Black Tuesday and Black Monday. The largest peak isn’t marked but do you know what that is? The tech bubble of 2000. Also, look what happens during the housing market in 2008!

Starting to notice a trend? A lot of these peaks occur before a very, very large market crash, and some of them are so big that they are ones that we never forget!

The average Shiller P/E is 16-17 throughout time…we’re nearly at 35 right now lol.

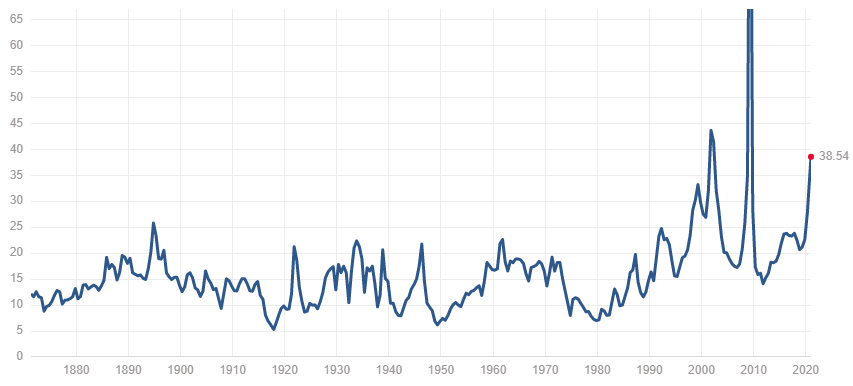

Looking at it from just a P/E ratio and not the Shiller method, you can see that the story is really not that much different:

In general, there is a slight upwards trendline over time, but the fact of the matter is that we’re so far above most other periods in time.

Personally, it does cause a little bit of concern in my eyes. I started my investing journey being 100% a value investor but have changed my strategy to about 50% growth and 50% value over time (it’s up to your call to decide which is best but I have my own personal feelings).

Now just because the market might seem a bit uneasy definitely doesn’t mean that you need to start to be thinking about an exit strategy, but I could see why you might be inclined to just be a little bit less risky.

We’re somewhat in this situation where you’re flirting with timing the market but also just trying to build in some protection for yourself.

Personally, I am a huge fan of investing with margin but that’s because of two major reasons:

1 – I trust that over time the market is going to always go up

As long as I am fine holding onto my stocks for the long run, which I always recommend, then everything should play out where I should get some great gains above the interest that is always accumulating.

Now, there is a major risk with margin, and that’s if you get a margin call placed on you. To protect myself from that, I have a rainy day fund:

2 – You have to be protected from margin calls

I won’t go too far in depth about margin calls as I have done that previously in a different post, but if a margin call is placed on your account, you either have to add money to your account or sell some stocks to generate cash.

Selling stocks is the easy option, but the only reason a margin call is being placed on your account is because your holdings have dropped in value, meaning you bought high and sold low.

If you can add money, you can avoid having to sell your stocks low and in turn ride them through this downturn. A perfect example is in 2020 during COVID when we saw the entire market drop 30% but then finish the year up 16%!

If you had sold, you’d miss all those gains. That’s why I always have a rainy day fund which is nothing more than just a little cash sitting on the side to protect me when the rain starts to come down.

Note that this is not an emergency fund. Rain doesn’t cause an emergency. Hurricanes do.

- Rainy Day Fund = Opportunities

- Emergency Fund = Hurricanes…aka real emergencies.

Don’t get them mixed up!

The thing with margin though is that it’s not actually my money and that I am just borrowing to try to make some higher gains. That does make me fearful when I see that the market is at record highs, especially in some of my top performing stocks that have just had monster years in 2020 such as one of my favorite speculative investments, ROKU.

So, how do I protect myself? That’s really the entire question, right?

Well, I like to setup a little bit of protection for my stocks that I am using margin for just in case things pull back a little bit. Not that I don’t trust them, but they can fall just as quickly as they went up, so I’d prefer to have stocks that I own with my own cash drop in value rather than those held in margin.

The question is – how do I set this protection up? Well, the two main options that I see people using are the stop loss and the stop limit.

Investopedia defines a stop loss as:

“a stop-loss order is an order placed with a broker to buy or sell a specific stock once the stock reaches a certain price” while a stop limit is “a stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk.”

In layman’s terms – when you place a stop loss order, you’re placing an order to sell a certain number of shares when the stock hits X price. Note that I didn’t say you’re going to sell at that price but rather sell when the share price is at that price OR below.

Normally, this is not an issue at all, but let’s apply it to my example with myself holding ROKU. ROKU is a very volatile stock and you can easily see swings of 6%+ in a day, let alone a day during earnings.

ROKU is currently right around $400/share, so let’s say that I want to protect myself and sell if it dips below $375. So, I set a stop loss at $375 – not a bad strategy, right?

But, then ROKU misses on their earnings report which in the grand scheme of things really doesn’t mean anything, the stock drops 20% from $400 down to $320.

Good thing I sold at $375, right? WRONG! If they reported after hours as many companies do, meaning the market is closed, my order won’t actually get placed. Instead, when the stock market opens the next day, my order will be placed at the first available price since it’s below my stop loss. AKA, I just sold at $320 – OUCH!

Not at all what I wanted to happen…

Now, this isn’t a very common situation, but it 100% can happen. Maybe the stock will open at $320 and go to $300. Maybe at $320 I don’t want to sell anymore and would prefer to add more. It just depends, but it is absolutely a real possibility.

On the other hand, we have the stop limit. The stop limit is similar to the stop loss but instead of selling at the first price under that $375 price, it will sell only at $375 and no lower.

So, this does help me a lot if I didn’t want to sell when the market opened at $320 (using the same example). But what if there’s just some bad news that people are switching back to cable and maybe the stock drops 8% overnight. That means that it’s now at $368 when it opens.

And then it drops 2% in a day; then 4%; then 7%; so, on and so on, all the way down to $300. You’re still holding shares that if you had placed a stop loss for, you would’ve sold at $368. Instead, you lost another $68/share because you didn’t place the order you should’ve.

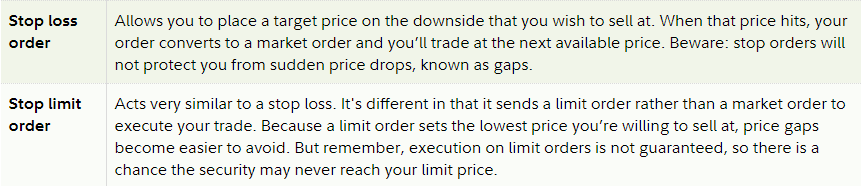

Fidelity explains the difference in these two “protection” options a little bit more, below:

At the end of the day, which one is better? Well, as with basically everything in personal finance, it 100% depends.

If you still like the stock a lot for the long-term but you’re just wanting to be safe and maybe reduce your investment a bit, maybe the stop limit makes more sense for you. This way, if the stock crashes, you won’t have essentially “panic sold” like a stop loss would do.

Maybe I want to sell at $368 but I would buy back at $320. Just something to think about!

A stop loss could come in handy if you’re just wanting to get out of the stock at all costs, no matter what, if a massive drop happens. Maybe you’re investing in a super speculative biotech stock that will crater if their drug results come back negative, which had risen drastically on optimism of great results, and you just want to cut bait no matter what.

At the end of the day, it really just depends on your view of the stock and to make sure that you’re prepared for the worst case in either outcome.

Like I mentioned, I really only use these with speculative investments, because let’s be honest – investing for the long-term is FOR SURE the right move!

Related posts:

- Explaining the Trailing Stop Limit and a Better Alternative Updated 9/25/2023 A trailing stop limit is an order you place with your broker. It places a limit on your loss so that you don’t...

- Planning to Tax Loss Harvest? BEWARE of the Wash Sale Tax! Updated 3/20/2024 One thing that many investors will realize throughout their investing journey is that trading in and out of stocks can be extremely expensive...

- Portfolio Risk Management: 6 Strategies for the Retail Investor Risk management is an important element to achieving long-term investment results but it often gets overlooked by investors as generating returns takes center stage. Due...

- How Do You Know When To Sell a Stock? Updated: 6/16/2023 A question as old as time in the stock market. How do you know when to sell a stock? If you ask an...