Oh boy – the panic sell. It’s an age-old mishap that so many investors will find themselves susceptible to and one that literally takes years and years of practice to be able to successfully master.

What even is a panic sell, thought?

A panic sell is when you see your stocks dropping like a rock and you can’t help yourself. You see the stock down 5%. Then down 8%. 10%. Down 12%.

Ok – you can’t take it. You log into your account and hit the “sell all” button and boom, there goes your ownership in that company.

Now what happens?

Well, other than the stock immediately going back up because that’s how it always seems to happen, you almost have this sick feeling in your stomach regardless of what happens. You just lost 12% and then you sold – doesn’t that somewhat sound like you just sold low, the definition of what we try to avoid as investors?

Unfortunately, this is something that is just way too common with investing. It’s extremely mental and emotional and people just get in their way often.

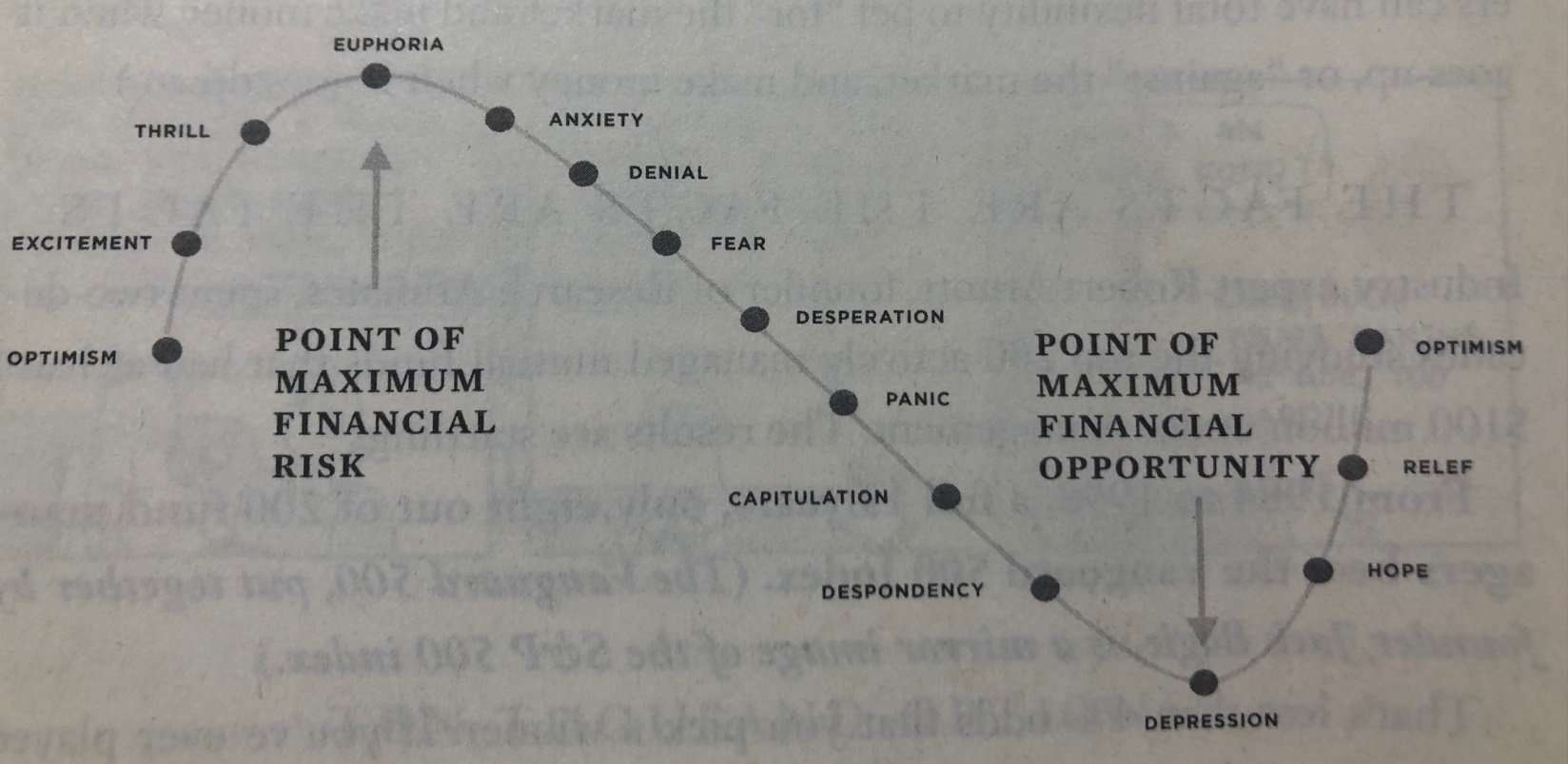

I have currently been reading ‘Money Master the Game’ by Tony Robbins and in his 9 Investing Myths section he talks about how mental investing is and how your emotions can easily get the best of you. Have you ever been on this rollercoaster that he mentions?

I know that I have! In fact, I feel like I can get on that rollercoaster quite frequently, but that’s also because I am a proponent of checking my portfolio daily. It might sound ridiculous given that I just said I can be on an emotional rollercoaster at times, but the thing is I am only 30, and I would much rather make mistakes early in life than I would when I really need the money in retirement, so I still have a ton of conviction in my process!

The difference now is that when I ride this emotional rollercoaster, I don’t panic sell. Sure, I might not make the best decisions 100% of the time, but I make it a point not to panic sell just because my stocks are getting crushed.

In fact, when COVID really hit in March of 2020, I was able to liquidate my rainy-day fund and invest it into the market to capitalize on the massive market selloff that we were experiencing. Was I freaking out that my investments had all dropped by 30-50%? Heck yes!

But I stayed rational, still had conviction in those companies, and chose to add to them. I know this might seem somewhat like market timing, but I view this as simply being optimistic when an opportunity arises and then pouncing on it!

On the other hand, we have Fidelity. Fidelity used to manage my 401k and they told me that when the crash happened, they had essentially doubled my 401k to bonds from 10% to 20%. They did this after the crash and then inevitably missed the run back up that the market experienced.

Personally, this was all it took for me to yank my 401k back under my control and honestly, I don’t even hate Fidelity for this because they made a call on what the market was doing and hoped it would work out. My issue with it was that it felt like they panic sold rather than trusting the process!

I don’t want to buy more bonds when the market drops – I want to sell the ones that I do have! And truthfully, I don’t want to own any at all since I am only 30.

But this is exactly what I see investors do all the time. They will sell their investments after a drop in price just to buy back in later at an even higher price!

Believe it or not, most of us are awful investors. We all just get in our own way with investing and it really comes back to bite us in the butt.

Now, that doesn’t mean that we shouldn’t invest, because even if you buy high and sell low (the literal opposite of our goal), you can still make a lot of money – and the math proves it!

It just boils down to our emotions. Over the course of time, humans are statistically likely to panic sell at the worst time and inevitably underperform the market or index that they’re investing in.

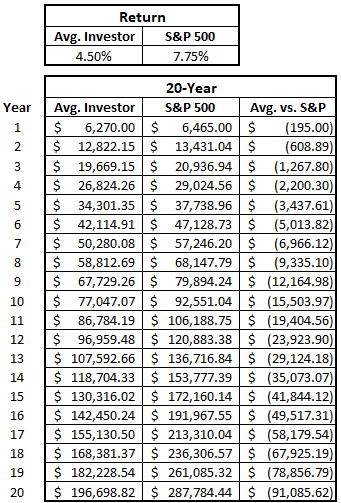

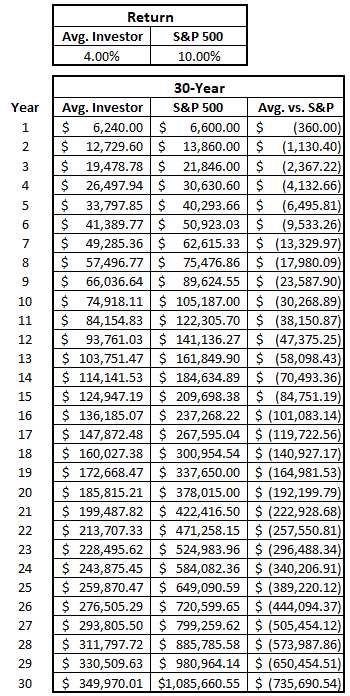

If you invest in a total stock market ETF like SPY, you would think that your returns should mimic SPY, then right? Well, they likely will not. Not all Seeking Alpha articles can be trusted (but some really can!) Take a look below from one of our favorite news outlets, Seeking Alpha:

As you can see, the investor return significantly underperforms the S&P 500 regardless of the time period. And I’m not talking about a couple of percent – we’re talking 2.5X when it comes to the 30-year time period! Do you know what kind of effect that can have on your long-term returns?

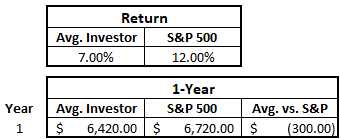

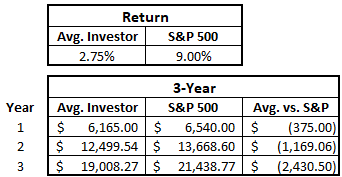

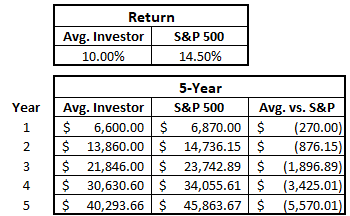

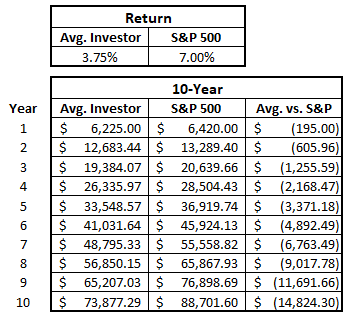

Let’s look at a few different scenarios below, all of which will be if you max out your IRA (I prefer Roth but that’s just me) during the time periods mentioned above. Please note that the chart didn’t give the exact returns, so I tried so somewhat guestimate what they were based on the chart.

As you can see in the 1-year time period, while the outperformance is substantial at 5%, the overall difference is only $300. Truthfully, I think this is a picture-perfect example of why the most important part of compound interest is time, and why I recommend starting as early as you can (and even starting investing for your kids!), even if it’s with a very little amount.

You can see here that the S&P 500 returns are over 3x what the Avg. Investor is getting, and the variance is reflective. Remember, you’ve only invested $18K in total over these three years ($6K/year * 3 year = $18K) and yet you’re $2400 below a simple SPY ETF…ouch!

Note here that while the S&P 500 outperformance is coming in a bit as it’s only at 4.5% over the Avg. Investor, the variance is really picking up steam as it’s nearly $5600 after 5 years! Refer again back to my comment about time and getting started early!

This chart is important to me because when I buy stocks, for the most part, I always think about them in the mindset that I should plan on holding them for at least a decade. Warren Buffett stole my investing philosophy (obviously) by saying “If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.”

That’s why I focus in on this chart a lot because it’s very representative of the timeframe when I am evaluating investments.

Holy crap! Look how much the 20-year changed from the 10-year! It went up 515%! Now we’re really, really starting to see some massive outperformance.

And remember, over these 20 years, you’ve only invested a total of $120K, but by trying to time the market you’ve lost over $91K vs. if you had just let it sit there…no bueno, my friend!

Are you as excited as I am for the 30-year? Cause I am PUMPED!

Wow – speechless. Over $735K.

Is there really anything more that needs to be said about not tinkering with your portfolio by market timing? Just let the dang thing sit once you’ve invested! I mean that’s the difference of being a millionaire and being 1/3 of the way to it…

Point and case.

Easy enough, right? Just let it sit! Soooo easy.

Not.

It’s not easy at all. You see, we all have various financial biases and tendencies that get in the way and make us bad investors. It’s natural. Personally, I think that a panic sell can really be attributed down to two different financial biases/tendencies:

1 – Loss Aversion

Loss Aversion is when you feel the pain of your losses much more than you feel that good feeling on the gains. A 10% loss feels so much worse than a 10% gain makes you feel happy. Honestly, I completely agree with this thesis.

Sure, we all do invest to make money, but the last thing that we want to do is lose money. I think that loss aversion can have such an impact on people because so many people are focused on the short-term and they might invest for the wrong reasons.

Investing is a long-term game and investing for the short-term is nothing short of gambling. If you’re investing for an expense in a year or two like a down payment on a house – stop. The second that your portfolio drops 10%, you’re going to sell it all and lock in those losses, just to potentially miss the runup back up.

Loss aversion is a very real thing and I’m sure that you have had some situations like this where you’ve sold because the pain of those losses is just so strong.

2 – Herding + Feedback Trading = Overreaction

This is more of a financial tendency “formula” as it’s a couple different factors that feed into overreaction.

Herding is essentially those that are bandwagon traders (cough cough Tesla, Virgin Galactic, “stay-at-home stocks”, etc.) that just don’t want to miss the boat.

Feedback trading is those that simply will trade based off the news that comes out. Good news means buy, and bad news means sell.

Overreaction is generally caused by the previous two because so many people have either piled into a stock or sold out of it, causing it to be way overvalued or undervalued, even for momentum investing.

To me, I almost call this CNBC trading. People will hear about a hot, new “stock tip” that is going to make them rich and it just seems way too good to be true. Well, not only is it likely too good to be true, it’s likely extremely false.

People are just so infatuated with investing as a get rich, quick scheme but in all reality, you can get rich but it’s going to take some time!

The issue with herding and feedback trading is that it’s all sunshine and rainbows when things are good, but the second that it turns bad, you’re going to sell out, and the reason is simple – you have literally zero reason for owning the stock in the first place. Does this sound like anyone you may know?

Hand up – this was me at one point.

I used to listen to CNBC (well, I still do) and just get the trader’s favorite stocks and then buy them. I was literally just buying companies because of what they said, and I didn’t even know what the company did. It was an awful, awful thing, but I learned a lot. Now, when I watch CNBC, it’s purely for fun and never for any sort of real investing decision.

I cannot stress enough how important it is to have some sort of investing checklist or process so that when you make a decision to invest in a certain stock, you know exactly why and you can fall back on this thesis when the going gets tough.

It’s inevitable that you’re going to eventually fall on some tough investing times and if you don’t have that thesis, you’re going to panic sell your way into some massive losses. Instead, take the time on the frontend to develop some conviction in your investments – it’s going to save an absolute ton of money for you in the long-run.

The cool thing about avoiding a panic sell is that you’re obviously going to stay invested and likely not underperform the holdings that you own, unlike the “average investor” as I have already shown.

Something that’s even cooler is that you can invest in a way that preys on other people making these investing mistakes of panic selling and instead capitalize on their losses. Sure, I don’t want people to lose money, but if they’re going to do it anyways then I might as well take advantage, right?

Welcome to Momentum Investing!

Related posts:

- How To Best Reduce Investment Risk – A Comprehensive Framework Updated 4/21/2023 After much effort, you have finally mastered value investing. You now know how to identify good companies and value them. You also only...

- Planning to Tax Loss Harvest? BEWARE of the Wash Sale Tax! Updated 3/20/2024 One thing that many investors will realize throughout their investing journey is that trading in and out of stocks can be extremely expensive...

- How Do You Know When To Sell a Stock? Updated: 6/16/2023 A question as old as time in the stock market. How do you know when to sell a stock? If you ask an...

- What is a Good Number of Stocks to Own? The number of stocks in a portfolio can have a major influence on your ultimate results as an investor. Because of this, every investor must...